If QuickBooks Desktop is your accounting software of choice and you pay your employees commission, then knowing how QuickBooks Desktop commission tracking works is a must.

However, if your QuickBooks commission process isn’t concrete, tracking commissions can be challenging. The good news is that there are ways to improve your QuickBooks commission workflow to ensure accuracy and transparency.

In this article, you’ll learn how to track sales commission in QuickBooks Desktop to make QuickBooks payroll much simpler. Plus, you’ll get a glimpse at how sales commission tracking software automates your commission process to drive efficiency.

Does QuickBooks Desktop track sales commissions?

Before learning how to track commission in QuickBooks Desktop, we need to clarify whether QuickBooks Desktop tracks commission at all.

Unfortunately, QuickBooks does not currently offer a commission tracker. For the most part, QuickBooks commission tracking is a manual process.

That said, there are ways to get around this limitation and set up your QuickBooks Desktop commission in a way that makes tracking easier.

Let’s dive deeper into how to track sales commission in QuickBooks Desktop.

Can you track and record sales commissions in QuickBooks Online?

While QuickBooks Online lets you record commission payments, it doesn’t offer commission tracking features.

Luckily, QuickBooks integrations like Method help you accurately track and calculate commissions automatically. With Method, you can create a fully customized commission tracker to automate your specific sales process.

How to track sales commission in QuickBooks Desktop

While you can’t track commission in QuickBooks Desktop, you can set up commission items. This allows you to manually track employee commission.

Learning how to track sales commission in QuickBooks Desktop is a two-step process.

- Set up a commission pay item.

- Add the pay item to your commissioned employee’s profile.

Let’s break down each of these steps outlining how to track commission in QuickBooks Desktop.

Step 1: Set up a commission pay item

The first step in learning how to track sales commission in Quickbooks Desktop is to set up a commission pay item. Here’s a step-by-step guide on how to do this:

- In “Lists,” select “Payroll Item List.”

- Under the “Payroll Item” drop-down menu, click “New.”

- Select “Custom Setup,” then click “Next.”

- Select “Wage,” then click “Next.”

- Select “Commission,” then click “Next,”

- Enter the name of the item, then click “Next.”

- Select the appropriate Expense account for the item, then click “Next” and “Finish.”

From this point, you must add your pay item to the right employee’s profile.

Step 2: Add pay item to commissioned employee’s profile

Before starting this part of the QuickBooks Desktop commission tracking process, make sure that you already have your employee set up in your account. From there, it just takes a few more steps:

- Under “Employees,” select “Employee Center.”

- Click on the appropriate employee.

- Select “Payroll Info.”

- In “Earnings,” add the payroll item that you created in Step 1, then click “OK.”

As you can see, the process is a bit lengthy, especially considering that you still have to manually track commission.

Looking for an easier way to manage QuickBooks Desktop commission tracking? Automation’s the solution for you.

Why you need to automate commission tracking in QuickBooks Desktop

Dealing with commission in QuickBooks requires lots of manual entry to ensure accurate accounting and timely pay for your sales reps. This ends up costing you time and resources that are better spent on other tasks.

So when you consider how to track commission in QuickBooks Desktop, automation should be top of mind.

Automation tools such as commission tracking software allow for accurate commission tracking in QuickBooks without the need for constant manual data entry.

As a result, you reap benefits like:

- Increased efficiency for your team.

- Transparency for your sales reps.

- Accurate accounting with less mistakes.

There’s one commission tracking solution that delivers all of these benefits to QuickBooks users.

QuickBooks Desktop commission tracking solution — Method

If the question is “how to track sales commission in QuickBooks Desktop,” the answer is Method.

Method is the best automation tool for QuickBooks Desktop commission tracking thanks to several unique features.

Firstly, every business has a different commission structure, meaning software that’s fit for one business may not be right for another. What’s the solution? Customization.

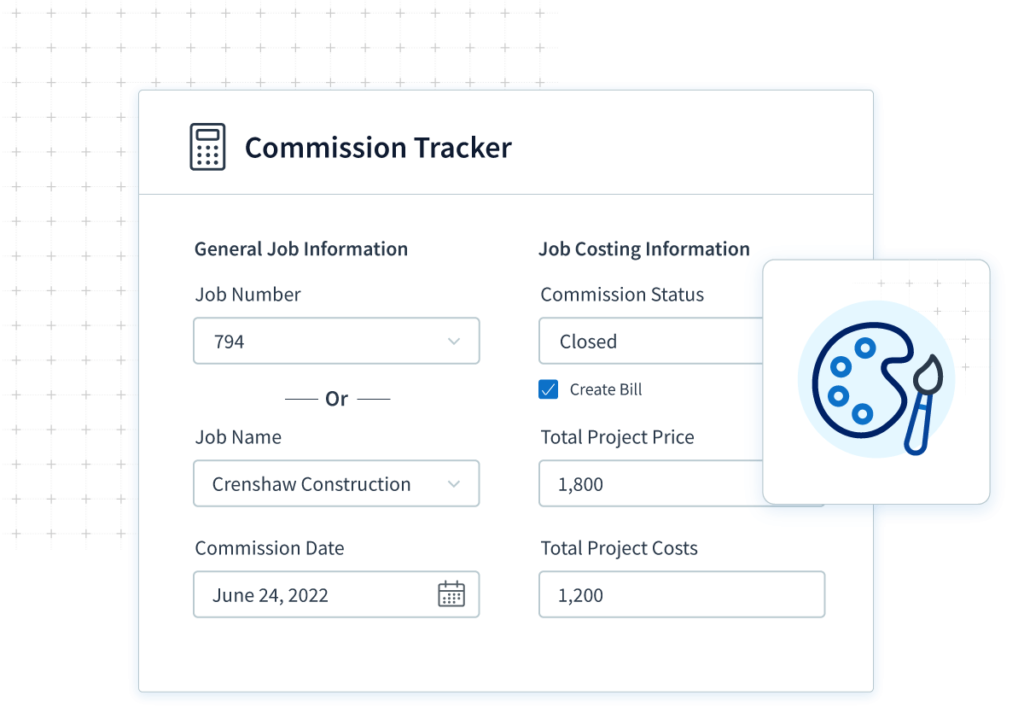

Method is a fully customizable software solution, meaning that you can build a personalized commission tracker tailored to your business. Method’s platform enables you to customize it yourself, but you can also enlist the help of Method’s customization experts.

Next, if you already have your employee records set up in QuickBooks Desktop, you don’t want to have to duplicate your data in a separate sales commission software. With Method, you don’t need to worry about entering the same information twice.

Method’s two-way QuickBooks sync means that when you update information in Method, it automatically syncs to QuickBooks, and vice-versa.

This means that your employee data will sync to Method, which calculates commissions for you. From there, that commission syncs to QuickBooks and is ready for payroll. This process eliminates the risk of double data entry and ensures accurate payroll.

Other key features in Method include:

- Categorizing your sales and employees for better insights.

- Custom sales rep commission reports.

- Several third-party integrations for an all-in-one solution.

Better yet, Method also works for QuickBooks Online. So if you’re also wondering how to set up commission in QuickBooks Online, look no further for a comprehensive solution.

Final thoughts: QuickBooks Desktop commission tracking

Calculating and recording commission is crucial in ensuring that your payroll is accurate and that your employees stay happy. That’s why learning how to track commission in QuickBooks Desktop should be your top priority.

A commission tracker is the best way to keep on top of your commission processing and ensure that nothing slips through the cracks.

If you’re looking for a tool to strengthen your QuickBooks Desktop commission tracking and overall workflow, look no further than Method.

QuickBooks Desktop commission tracking FAQs

How do I record commissions in QuickBooks Desktop?

To record commissions in QuickBooks Desktop, you must first set up a commission pay item. Once you do that you can add the pay item to the select employee’s profile.

What type of account are commissions?

For a business, commissions are an expense as they are part of payroll. The sales form that commission is calculated from is considered revenue.

It’s important to keep this in mind when recording commission in QuickBooks payroll to ensure accurate accounting.

How do you categorize commission paid?

The way you categorize commission paid depends on how your business structures commission.

When you pull up your commission reports in QuickBooks, you can categorize commission by:

- Sales rep.

- Amount.

- Date.

With Method, you can generate custom reports for commission and other business data to provide you with data-driven insights.

Start your free trial of Method today!

Image credit: Rene Asmussen via Pexels