Using QuickBooks makes it easy to stay on top of your business operations, but when it comes time to sign documents, manual workflows can really stall the process.

E-signature software helps cut down on manual back-and-forth, eliminating the need to deal with physical paperwork. Docusign is one of the most trusted names in the space, and when paired with QuickBooks Online Advanced, you’ve got tighter workflows that prevent duplicate work and speed up transactions without the need for constant check-ins.

That said, depending on your business setup, it might not check every box. If Docusign doesn’t quite meet your needs, we’ll also look into Method, a feature-filled CRM with e-signature functionality, built to work closely with QuickBooks.

Let’s walk through how e-signature software works and what you should know about the Docusign QuickBooks integration, along with an alternative worth considering.

The value of e-signature capture

According to Adobe, it can take around eight days to get a physical signature, but only three hours, on average, to get an e-signature. That’s much more efficient!

An e-signature is a legally binding way to sign documents digitally, as long as you’re using software that meets legal and security standards.

Here’s what small businesses gain from shifting from physical to digital signatures.

1. Higher efficiency

Physical paperwork can bog you down. With an e-signature tool, you can send your documents off for approval with one click. No printing, scanning, or chasing people down. It’s a win for customer satisfaction, and you’ll come across as professional, too.

2. Enhanced security

Electronic signatures are often encrypted, time-stamped, and stored in a secure system. This makes them a lot more reliable than wet signatures. They are much more difficult to forge or copy in the way you can with pen and paper. This means that your contracts and client data stay private, and every agreement that’s signed is legally trackable.

Whether you’re handling a sales receipt or a purchase order, your documents are always locked down.

3. Improved organization

When everything’s signed and stored digitally, you don’t have to dig through filing cabinets or shared drives to find a signed contract. Digital storage makes it easier to keep your business processes in order.

Because you’ve been able to streamline the signing process, all your documents stay in one place. Being organized means avoiding costly mistakes like mishandling client information and missing critical deadlines. This simplifies compliance and record-keeping.

4. Faster turnaround

Sending documents through the mail is much less efficient than using software that automates them. With trusted software, document turnaround is quicker.

You can create reusable templates, so you’re not writing every document from scratch. Then, signers can use any device to access the mobile app and sign from anywhere. This way, you get to enjoy a shorter quote-to-cash cycle.

Speed matters when you’re managing multiple clients. Digital signing can get tasks done in hours, rather than days.

5. Cost-effective

The costs of printing your contracts, estimates, and other business paperwork, on top of shipping them, add up faster than you’d think. Printing a few documents won’t drain your budget, but over time, all those prints make a dent. In fact, an average employee’s printing habits can cost a company $725 a year.

E-signature software helps reduce those expenses by eliminating the need for paper and ink. Going digital keeps your office lean and frees up precious storage space, which is a clear win for small businesses watching their margins.

6. User-friendly

Making customers scan and manually send documents can be frustrating and time-consuming, often leading to drop-offs or delayed responses. With an intuitive e-signature tool, clients enjoy a smoother signing process.

For example, a contractor can sign off on a job estimate from their phone while on-site instead of waiting to get back to their desk. This level of convenience leads to faster approvals and a better overall customer experience.

7. Better tracking

A trusted e-signature software gives you real visibility into where every document stands. Who’s signed and who hasn’t? You can see them all in real-time. You’ll always know what needs attention and what’s already done.

When integrated into your accounting software, your e-signature tool will complement your finances and daily operations. This keeps your team organized, reduces delays, and makes your business processes more predictable and less stressful.

Benefits of integrating e-signature software with QuickBooks

QuickBooks doesn’t have its own remote e-signature capture feature, which is why you’ll need a third-party app to close the loop. Once you’ve integrated one, it’s well worth it.

Here are some advantages you gain from combining e-signature software with your QuickBooks account:

- Get estimates and invoices signed in hours (not days).

- Eliminate the need to email or re-upload signed documents.

- Keep all your signatures, approvals, and financial records centralized.

- Improve your work accuracy by reducing the need for manual data entry.

- Maintain better data integrity and audit trails.

What is Docusign QuickBooks integration?

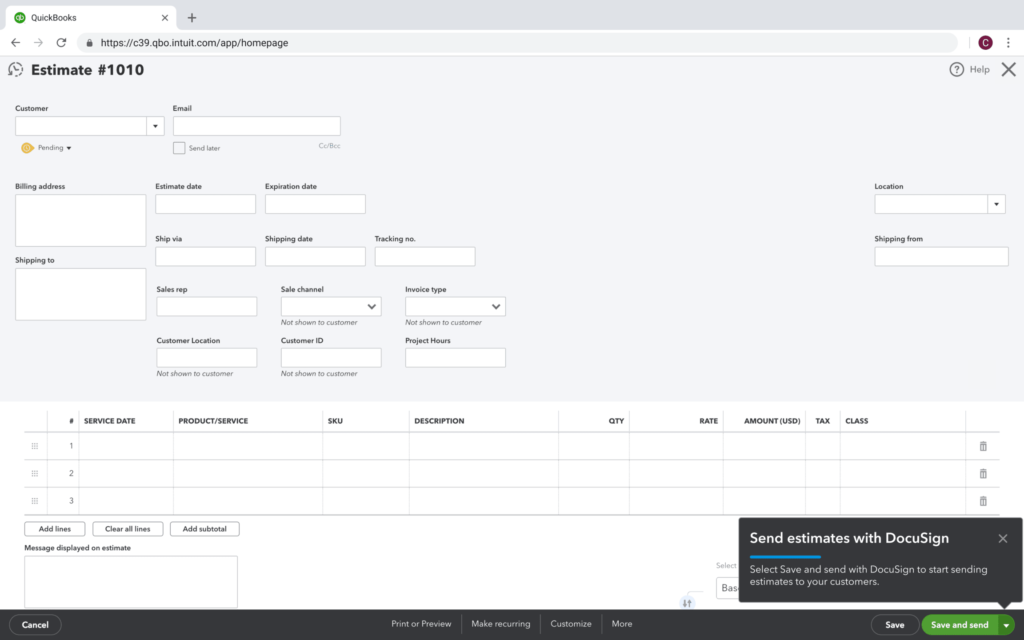

Image credit: Intuit

The Docusign QuickBooks integration connects your QuickBooks Online Advanced (QBO) account with Docusign’s e-signature features. It allows you to send invoices, estimates, and other customer documents for electronic signature without leaving QuickBooks. This streamlines your approval process and helps eliminate delays in getting client sign-off.

Note: You currently need QBO to connect directly with the Docusign app. This integration isn’t available for QuickBooks Simple Start, Essentials, or Plus plans.

How does the QuickBooks and Docusign integration work?

You can connect your QuickBooks via the Docusign eSignature Connector from the Intuit App Store. This integration lets you send documents directly from QuickBooks for digital signing.

Your customers will receive a secure link to review and sign documents on their own time. They can then access the link from any device.

Key features

Connecting your Docusign account with QuickBooks gives you:

- Access to unlimited templates for frequently sent documents.

- Drag-and-drop fields like date, signature, or initials.

- Custom signing order for multiple signers.

- Built-in document tracking with audit logs and a transaction history report.

- The ability to tag documents for payment processing.

This helps you automate workflows, reduce manual effort, and streamline your invoicing processes. It’s especially useful for teams that send out large volumes of estimates and need everything signed fast and securely.

Limitations

Let’s also consider that this integration has some trade-offs:

- The native Docusign integration only works with QuickBooks Online Advanced.

- Docusign’s default plans come with envelope limits (for example, even the Business Pro plan, which costs $40 per user monthly, only allows you to send up to 100 envelopes each year for signature).

- Lacks native support for QuickBooks Desktop users.

If you’re a smaller team or aren’t using QBO, this might feel like more than you need. In that case, it’s worth exploring other worthy options that offer similar functions, simpler setup, or more flexible pricing.

Method: The better QuickBooks and Docusign alternative

Do you use QuickBooks but find Docusign too limited or expensive? Method might be the solution you’re looking for.

Method brings digital signatures, CRM tools, and custom workflows together seamlessly.

No document limits, and no extra tools to juggle!

Method is great for…

Method is a top choice for QuickBooks users who want to automate the entire journey from lead to payment. It gives you best-in-class, two-way, real-time sync for both QuickBooks Online and QuickBooks Desktop to keep your data accurate and up to date across platforms at all times—something most QuickBooks apps can’t match.

See how Method works in action:

Method: Key features

With Method, you can expand the possibilities of what you could do beyond collecting e-signatures.

Here are some notable features:

- Unlimited e-signatures with no caps on documents sent or signed.

- Custom templates for estimates, invoices, and approvals.

- Built-in integration with QuickBooks Online, QuickBooks Desktop, and even Xero.

- Two-way sync for accurate data and faster updates.

- Complete transaction history reports and audit trails.

- Add credit card payments to your workflow.

- Trigger notifications or approvals automatically to cut down on repetitive tasks.

- API and Zapier support to connect with the other tools you already use.

- Helpful support team and step-by-step tutorials for setup and use.

How Method works with QuickBooks

First off, Method connects to your QuickBooks account through secure authentication. It pulls in your estimates, customer data, and transactions in real time, so once a document is signed, it syncs right back into QuickBooks.

But because Method is also a full customer relationship management tool, you can control how you handle leads, jobs, and follow-ups right on the platform. You can even set up what happens after a document is sent or signed and automate it, like creating an invoice or triggering team notifications.

Getting started is easy. You can sign up for a free trial to see how Method works for you. We also provide a product tour of our e-signature capabilities.

How to automate e-signature with Method

With Method, sending documents for signature is quick, seamless, and fully connected to your QuickBooks account.

Here’s how you can get started:

- Start your free trial—no credit card or contract required.

- Use secure authentication to link your QuickBooks (Online or Desktop).

- Book a guided walkthrough to explore our e-signature features and custom workflows.

- Set automated triggers for sending, signing, and syncing documents.

Ready to give it a try? Switch to Method and explore its more complete set of features.

Docusign QuickBooks alternative FAQs

Is Docusign a free service?

No, Docusign isn’t free. The Personal plan (for individual use) is $10 per month. For businesses, pricing begins at $25 per user per month for the Standard plan. Meanwhile, the Business Pro plan (which includes automating and optimizing agreements) costs $40 per user per month.

None of Docusign’s default plans offer unlimited e-signatures, and your ability to send documents is capped based on your plan, unless you request a custom option.

How do you connect Docusign and QuickBooks Online?

Docusign QuickBooks integration can be done by installing the eSignature Connector from the Intuit App Store. Once connected, you’ll be able to collect signatures on estimates by selecting “Save and send with Docusign.” Note that this integration only works with the QuickBooks Online Advanced plan

Does Docusign integrate with QuickBooks Desktop?

Unfortunately, there’s currently no native integration between Docusign and QuickBooks Desktop. If you’re using Desktop, you’ll need to manually upload documents for e-signature or look for an alternative.

Method, for instance, connects with both QuickBooks Desktop and Online, so you can send your documents for signature and have them automatically sync back.

What’s a more cost-effective alternative to Docusign?

Method is a better-value alternative to Docusign, especially for QuickBooks users. It offers unlimited e-signatures, has built-in CRM tools, and you can customize workflows without the need for multiple platforms. You also get support for QuickBooks Online and Desktop, a two-way real-time sync, and seamless authentication.

It’s ideal for small businesses looking to simplify their document journey and improve cash flow.