Are you a small business owner feeling caught between the limitations of QuickBooks and the overkill of Oracle NetSuite? You’re not alone. Many growing businesses reach a point where QuickBooks’s basic accounting isn’t enough—you need better inventory tracking, customer management, and automation. NetSuite, a powerful all-in-one ERP, might appear to be the next step, but then you see the price tag (often $10k+ per year just in fees) and the complexity of implementation, and wonder: “Isn’t there a more small-business-friendly option?”

In this guide, we’ll compare NetSuite vs other popular solutions for small businesses. You’ll learn how NetSuite stacks up in terms of features, pricing, and suitability, and get candid insight into which option might be the best fit for your business.

In this article:

- What is NetSuite (and why do you need an alternative)?

- What do small businesses need?

- QuickBooks + Method CRM = Best alternative to NetSuite ERP

- More NetSuite competitors

Let’s dive in and find the right solution for your business.

What is NetSuite ERP and why do small businesses seek alternatives?

NetSuite is a cloud-based enterprise resource planning (ERP) platform that helps businesses streamline and automate their core business operations including:

- Financial management.

- Customer relationship management (CRM).

- E-commerce.

- Procurement.

- Inventory management.

- Supply chain management.

- Human resources.

With NetSuite, users get real-time visibility into key business metrics and they’re able to support multi-subsidiary, multi-currency, and multi-country operations. It’s a scalable solution that allows businesses to optimize productivity, reduce IT complexity, and make data-driven decisions, in a single system.

NetSuite offers an impressive suite of tools, but this can be a challenge for small businesses. The high cost of licensing, complex implementation process, and the platform’s extensive features can be overwhelming. It’s often more than what a lot of small to mid-sized businesses (SMBs) actually need.

Instead of jumping straight to a robust – and expensive – solution like NetSuite, many small businesses take a gradual approach by adding to their existing systems. For example, if you already use QuickBooks for accounting, adding a tool like Method can extend your capabilities significantly. This allows smaller businesses to scale more sustainably, using tools tailored to their actual needs.

What small businesses need from a NetSuite alternative

While every business will have distinct needs, there are some key capabilities small businesses typically require when looking for a CRM or ERP system to replace NetSuite. When looking for an alternative for NetSuite, look for the following:

- Accounting integration: The platform must sync seamlessly with trusted accounting software. Many small businesses already use platforms like QuickBooks, so any solution should either connect to it or replace its capabilities.

- CRM capabilities: A solution should offer built-in CRM tools that help organize and automate essential processes like tracking leads, managing customer relationships, and following up with customers.

- Inventory and operations: Whether you’re selling products or managing projects, small businesses need tools to handle inventory, work orders or service workflows.

- Customization: A good solution should allow for customization of forms, workflows, and reports without needing to enlist a developer or learn to write code.

- Integrations: Connecting your tech stack with your CRM/ERP solution is key to ensuring everything works together seamlessly.

- Customer support: Small businesses need responsive customer service, clear documentation, and onboarding help without having to pay a premium.

- Cost-effectiveness: When looking for a NetSuite alternative, cost matters. The right platform should have clear, tiered pricing with no hidden fees.

- Scalability: The ideal solution should be able to grow with you. It should be able to start with just a few users and scale affordably as the business grows.

Let’s dig into nine of the top NetSuite alternatives.

| Software solution | Best for… |

| QuickBooks + Method | … Businesses running on QuickBooks that need more than just accounting. |

| Microsoft Dynamics 365 Business Central | … Businesses that have outgrown QuickBooks in areas like manufacturing or advanced inventory and have in-house IT. |

| Zoho | .. Brand-new small businesses that haven’t invested in a system and want an inexpensive all-in-one solution. |

| Acumatica | … mid-sized manufacturing, wholesale, or distribution businesses needing advanced inventory/warehouse/production management. |

| Odoo | … Tech-savvy startups or growing businesses that want full control over their systems and have access to developer resources. |

| Epicor | … Larger small and medium-sized enterprises in manufacturing. |

| Sage Intacct | … Growing businesses with a dedicated finance team. |

QuickBooks + Method CRM = The #1 NetSuite alternative for small businesses

Whether Online or Desktop, QuickBooks is considered the gold standard accounting solution for small to medium-sized businesses. Best known for its user-friendly interface and affordable pricing, it makes managing your finances easy. From invoicing and expense tracking to payroll and reporting, QuickBooks handles accounting tasks exceptionally well.

QuickBooks is mainly finance-focused. It offers limited CRM capabilities and minimal workflow automation. For businesses that need to tackle more – like managing leads, tracking work orders, or customizing processes – this creates a gap. That’s where Method comes in.

QuickBooks + Method: The dynamic accounting/sales duo

Method is a customer relationship management and process automation platform purpose built for QuickBook users. Designed to integrate with both QuickBooks Online and Desktop, Method offers real-time, two-way sync. So when you add or update a customer, invoice, or estimate in Method, it’s automatically reflected in QuickBooks and vice versa. This eliminates double data entry, reduces errors, and ensures you’re working from a single source of truth for financial and customer data.

While QuickBooks effortlessly supports your accounting needs, Method steps in to handle your front-office capabilities. With features like contact and lead management, sales opportunity tracking, and even customer portals for online payments and self-service, Method helps small businesses close the loop between sales and finance—all without switching platforms.

Let’s take a deeper look at QuickBooks + Method as an alternative to Netsuite.

Key features

- Real-time, two-way QuickBooks sync keeps customer, invoice, and payment data consistent – eliminating double data entry and reducing errors.

- End-to-end financial management handles invoicing, expenses, reporting, payroll, and taxes through QuickBooks, with full visibility into financials at every stage.

- With complete CRM functionality you can track leads, manage contacts, and organize your pipeline in one place.

- Customize job tacking, scheduling, and work order management to fit your processes – perfect for field services, contractors, and project teams.

- Tailor the system to your business’s needs by building custom workflows, forms, and dashboards without writing code.

- Scale your system without a major platform switch or costly upgrade by simply adding users as needed.

- Get full CRM and automation without the enterprise-level cost or complex set up with an affordable and easy-to-use system.

Pros

- Data is always up-to-date across Method and QuickBooks with real-time sync.

- Customer portal allows clients to view and pay invoices online.

- Affordable and comprehensive platform built for small to mid-sized businesses.

- Method makes QuickBooks work even longer—so there’s no need to outgrow it anytime soon.

Cons

- Small but manageable learning curve when onboarding new users.

- Best for businesses using or planning to use QuickBooks

Comparing costs: QuickBooks + Method vs. NetSuite

It might seem like paying for two separate platforms might not be the more affordable solution, so let’s break down the math.

NetSuite pricing typically starts around $1,000+ per month for a basic license, with additional fees for each module and user you add. Most plans require an annual contract and professional implementation, which can add thousands more in upfront costs – not to mention the set up time.

On the other hand, QuickBooks Online Advanced – the highest-tier plan – costs approximately $180-$200 per month. And this plan supports many users and advanced financial features. If you’re using QuickBooks Desktop Enterprise, pricing starts around $5,000 per year for larger teams. With Method, you gain full CRM and workflow functionality and only add $25-$49 per user per month to your costs.

For example, imagine you’re using QuickBooks Online Plus ($80/month) with 5 Method users at $44/month. You’d be paying roughly $300/month total. That’s less than one-third the cost of a typical NetSuite setup, and that’s before factoring in NetSuite’s implementation fees.

When to consider Method

Use Method when your business runs on QuickBooks but needs more than accounting – like tracking leads, managing sales, or customizing workflows. It’s ideal for small to mid-sized businesses that want to connect their front-office with their back-office without switching platforms.

6 more NetSuite competitors for small businesses

Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is Microsoft’s cloud-based ERP software for small to mid-sized businesses. It combines accounting, sales, inventory, purchasing, and project management in an all-in-one platform with robust integration across Microsoft 365 tools like Outlook, Excel, and Teams.

Key features

- Automate approvals, notifications, and business processes with customizable workflows.

- Supports multiple entities, currencies, and locations for streamlined global operations.

- An ERP that brings financials, sales, purchasing, and more in one unified system.

- Flexible cloud deployment with the ability to scale up as your business grows.

Pros

- Adapts to complex workflows via Microsoft’s Power Platform and third-party apps.

- Has a 30-day free trial to allow you to test the platform for your business needs.

- Backed by Microsoft’s security, infrastructure, and partner network.

Cons

- Setup and training can be time-consuming for smaller teams.

- May be too complex or feature-heavy for basic use cases.

- Les compatible with Google Workspace.

Pricing

Microsoft Dynamics 365 Business Central offers the following pricing plans:

- Essentials: $70.00 per user per month.

- Premium: $100.00 per user per month.

- Team Members: $8.00 per user per month (this plan provides limited access to users).

Typically, it requires a partner or consultant to implement the system, adding to startup cost.

When to consider Microsoft Dynamics 365

A strong fit for small businesses that have outgrown QuickBooks in areas like manufacturing or advanced inventory—and have the IT resources to support a more complex system.

Zoho One

Zoho One is a bundle of 40+ integrated apps including Zoho Books (accounting), Zoho CRM, Zoho Inventory, and more. Designed for small to mid-sized businesses, it aims to provide a single, unified platform at a highly competitive price.

Key features

- All-in-one app suite that covers CRM, accounting, email, project management, and more.

- CRM and sales tools to provide centralized management across all apps.

- Automate workflows with Zoho Flow and gain insights using Zoho’s AI assistant.

- Most Zoho apps are fully accessible via mobile.

Pros

- Pricing per user is low for the product.

- Fully cloud-based, and you get a bit of everything.

- A strong ecosystem for smoother cross-functional workflows

Cons

- Accounting in Zoho is not as widely used or robust as QuickBooks.

- Not all areas are equally robust (e.g. Zoho CRM versus Zoho Inventory).

- Integration gaps between modules or limits unless on higher tiers.

When to consider Zoho One

If a brand-new small business hasn’t invested in any system yet and wants an inexpensive all-in-one, Zoho One is attractive. But for those established on QuickBooks, Zoho might not be worth the switch.

Pricing

Zoho One offers the following pricing plans:

- All Employee: $50 per user per month (must purchase licenses for all employees on payroll).

- Flexible User: $115 per user per month.

Acumatica

Acumatica is a modern, cloud-based ERP platform designed for mid-sized businesses. With strong modules for finance, distribution, and manufacturing, Acumatica is often viewed as an SMB-friendly alternative to larger ERPs like NetSuite.

Key features

- Comprehensive accounting, budgeting, and financial reporting tools.

- Supports complex warehouse management, order processing, and supply chain operations.

- Modules for production planning, scheduling, and shop floor control.

- Cloud-native platform that can be accessed anywhere.

Pros

- Implement only the modules you need, then scale up as your business grows.

- User-friendly interface with a modern UI.

- Easily connects with third-party apps and services.

Cons

- Set up can be complex, costly, and require a partner.

- Pricing is relatively high when compared to other systems.

- May be overpowered for very small businesses.

When to consider Acumatica

Choose Acumatica if your small or mid-sized manufacturing, wholesale, or distribution business is outgrowing basic tools like QuickBooks and needs advanced inventory, warehouse, or production management.

Pricing

Acumatica offers flexible, resource-based pricing which is custom for each business.

Odoo

Odoo is an open-source business management suite with a wide range of ERP and CRM applications. As a modular solution, Odoo lets businesses choose from apps for accounting, sales, inventory, HR, and more.

Key features

- Full access to open source code allows deep customization.

- Build customized workflows tailored to business processes using custom code.

- Globalization tools offer multi-language, multi-currency, and tax localization support.

- Modular ecosystem has over 40 integrated apps.

Pros

- Free to use if self-hosted; paid version is still lower cost than many full ERPs.

- Scalable as you add functionality as your business grows.

- Large developer community with integrations, third-party apps, and community resources.

Cons

- Requires technical expertise.

- Accounting module may not meet U.S. standards.

- Implementation can be time-consuming without a skilled partner.

When to consider Odoo

Odoo is a strong choice for tech-savvy startups or growing businesses that want full control over their systems and have access to developer resources. Small businesses without technical support may find it harder to manage than plug-and-play alternatives.

Pricing

Odoo offers the following pricing plans:

- One App Free: $0 unlimited users.

- Standard: $24.90 per user per month.

- Custom: $37.40 per user per month.

Epicor

Epicor is a comprehensive ERP known for its deep expertise in manufacturing, distribution, and automotive industries. It is designed for complex, process-heavy businesses that need robust operations and supply chain capabilities.

Key features

- Supports production planning, MES, shop floor control, and quality management.

- Real-time visibility and control over warehouse and logistics operations.

- Multi-site, multi-currency, and regulatory compliance features.

- Industry-specific solutions for manufacturing, distribution, retail, and automotive.

Pros

- Highly configurable and scalable.

- Strong industry track record with decades of development.

- Modern interface and an excellent user experience.

Cons

- Software, implementation, and support are all premium-priced.

- Requires IT support for configuration and maintenance.

- Historically on-premise; cloud version is newer and still maturing

When to consider Epicor

Epicor is another high-end ERP often mentioned, but it’s generally used by larger SMEs in manufacturing and would be overkill for a typical small business looking to replace NetSuite.

Pricing

Epicor’s pricing model is tailored to the specific needs and size of each business and available upon request.

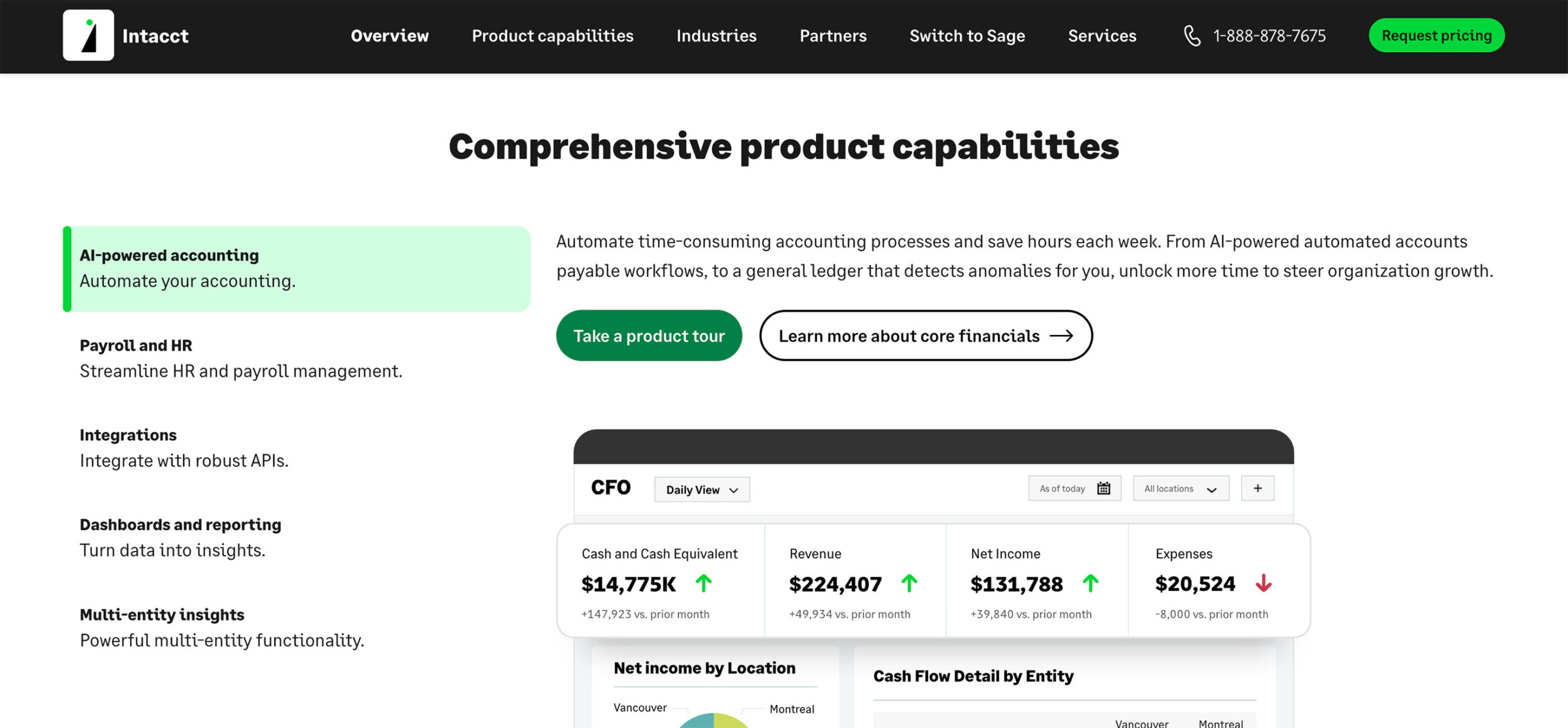

Sage Intacct

Sage Intacct is a cloud-based financial management solution designed for growing companies that need advanced accounting functionality. It’s especially popular with finance teams seeking strong reporting, multi-entity management, and GAAP-compliant processes.

Key features

- Strong core financials including general ledger, accounts payable/receivable, and cash management.

- Handle accounting across multiple businesses and currencies.

- Real-time financial insights tailored for CFOs and finance teams.

- Connects with CRMs like Salesforce and other tools.

Pros

- Excellent for complex accounting needs and GAAP compliance.

- Robust reporting and customizable dashboards

- Strong security, audit trails, and compliance features.

Cons

- Accounting-only platform.

- Higher cost than typical SMB solutions.

- Implementation is complex and usually requires a Sage partner.

When to consider

Sage Intacct is best suited for growing businesses with a dedicated finance team, especially those needing advanced reporting, multi-entity consolidation, or project-based accounting. If your business has outgrown QuickBooks but doesn’t need a full ERP suite, Intacct is a strong next step.

Pricing

Sage Intacct pricing is available upon request.

Choosing the Right Solution for Your Small Business

There’s no one-size-fits-all ERP or CRM solution. The right choice depends on your business’s size, industry, budget, and how fast you’re growing. While NetSuite offers a powerful all-in-one ERP for those who need it, many small businesses are better served by more focused, cost-effective options.

For many small businesses, especially those already using QuickBooks, there’s a smarter first step. QuickBooks combined with Method adds the customer management, automation, and customization you need – without the steep price tag or long implementation cycle. Method+QuickBooks fills the CRM and workflow gaps, helping you scale efficiently while keeping things simple.

If your business grows to include multiple entities, global operations, or highly specialized workflows, it might be time to consider a full ERP like NetSuite. But until then, there are more affordable and functional solutions for your business needs.

Before taking the plunge into enterprise systems, consider test-driving Method with your QuickBooks data – you might find it delivers everything you need, without the enterprise overhead.

Start your test drive today with Method’s free 14-day trial.