If you manage tax-heavy work, Canopy may seem like your perfect match. ❤️ It’s an all-in-one accounting practice management software with built-in document management, client portal, time tracking, and invoicing tools. For accounting firms focused on tax resolution, it checks a lot of boxes. ✅

But here’s the catch: Canopy leans hard into tax. This may leave gaps, especially if you offer a broader range of services. Another major limitation is that Canopy offers a limited QuickBooks integration. For businesses deeply tied to QuickBooks, this can lead to duplicate work and outdated data. 📊

Here at Method CRM, we’ve been supporting QuickBooks-based businesses since 2010. Method is loved by business owners in the finance industry and beyond, for its real-time, two-way QuickBooks sync, no-code customization, and end-to-end workflow automation. In this guide, we’ll cover which features to look for in a Canopy alternative and discuss how Method can be an asset to your growing business. 📈💡🌱

Table of Contents

- Must-have criteria before you choose

- CASE STUDY: How Tax Office SF ditched paper for 10x faster billing 🚀

- Why firms outgrow Canopy

- The field at a glance 👀

- Canopy alternatives: The top contenders

- 1. Method CRM: QuickBooks-integrated CRM with customizable workflows

- 2. TaxDome: All-in-one tool with a powerful portal

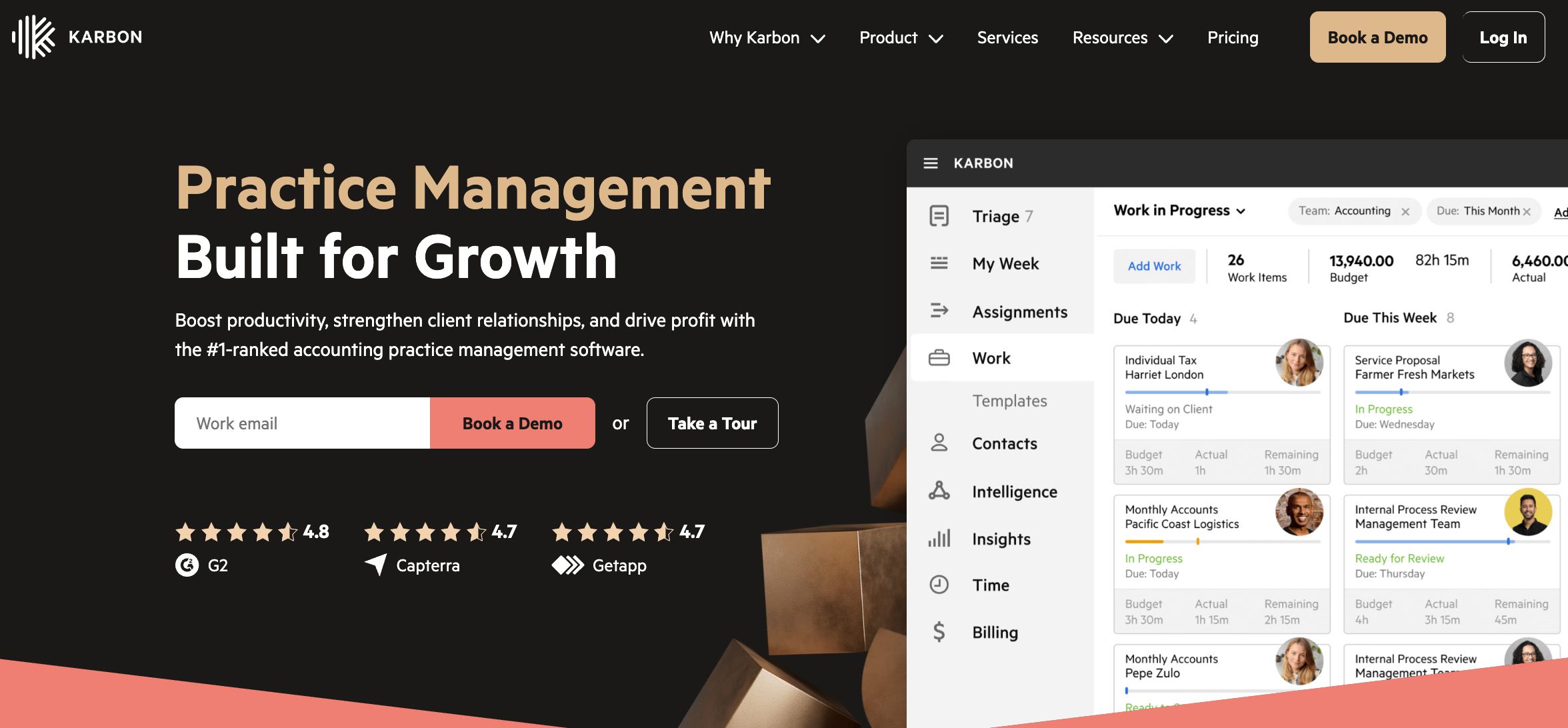

- 3. Karbon: Email-first collaboration for larger teams

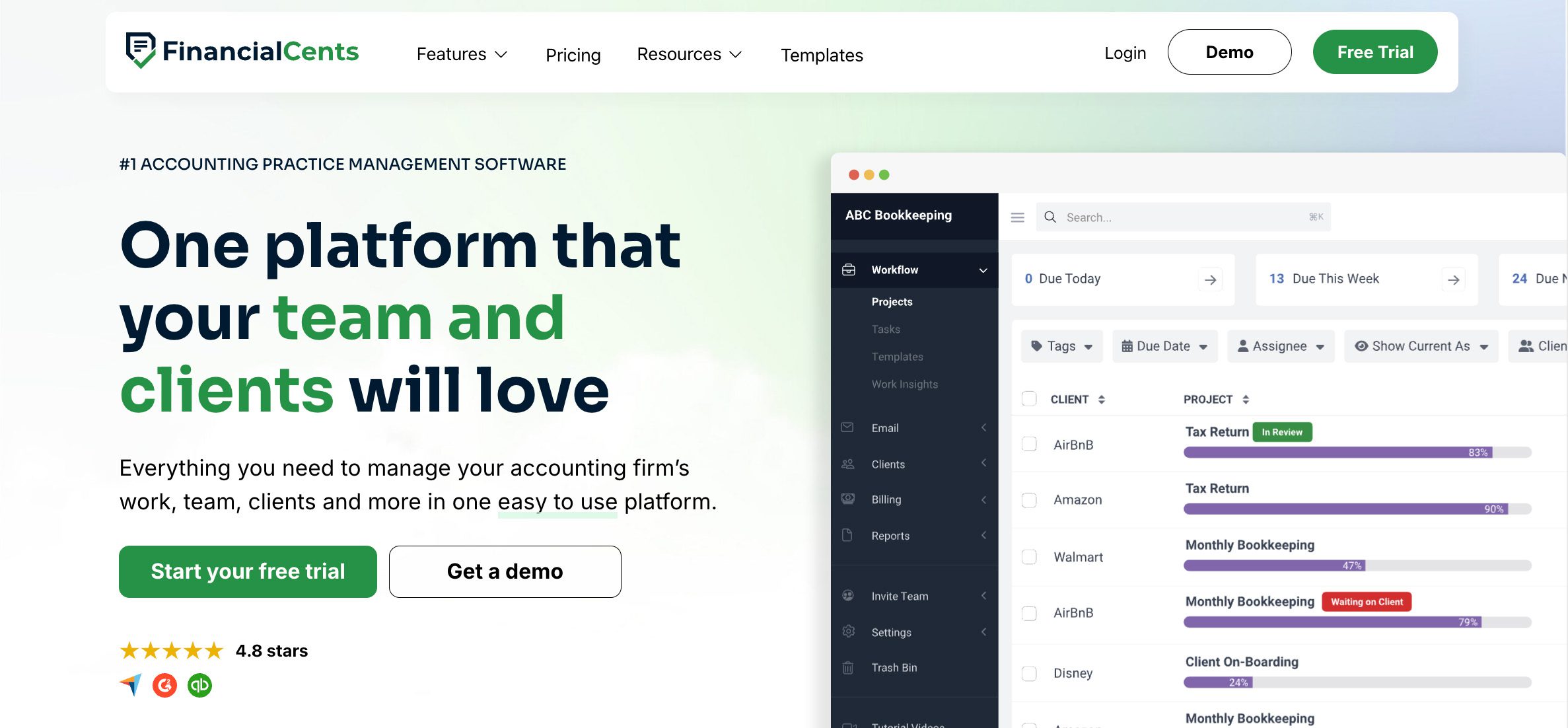

- 4. Financial Cents: Flat-rate pricing for small firms

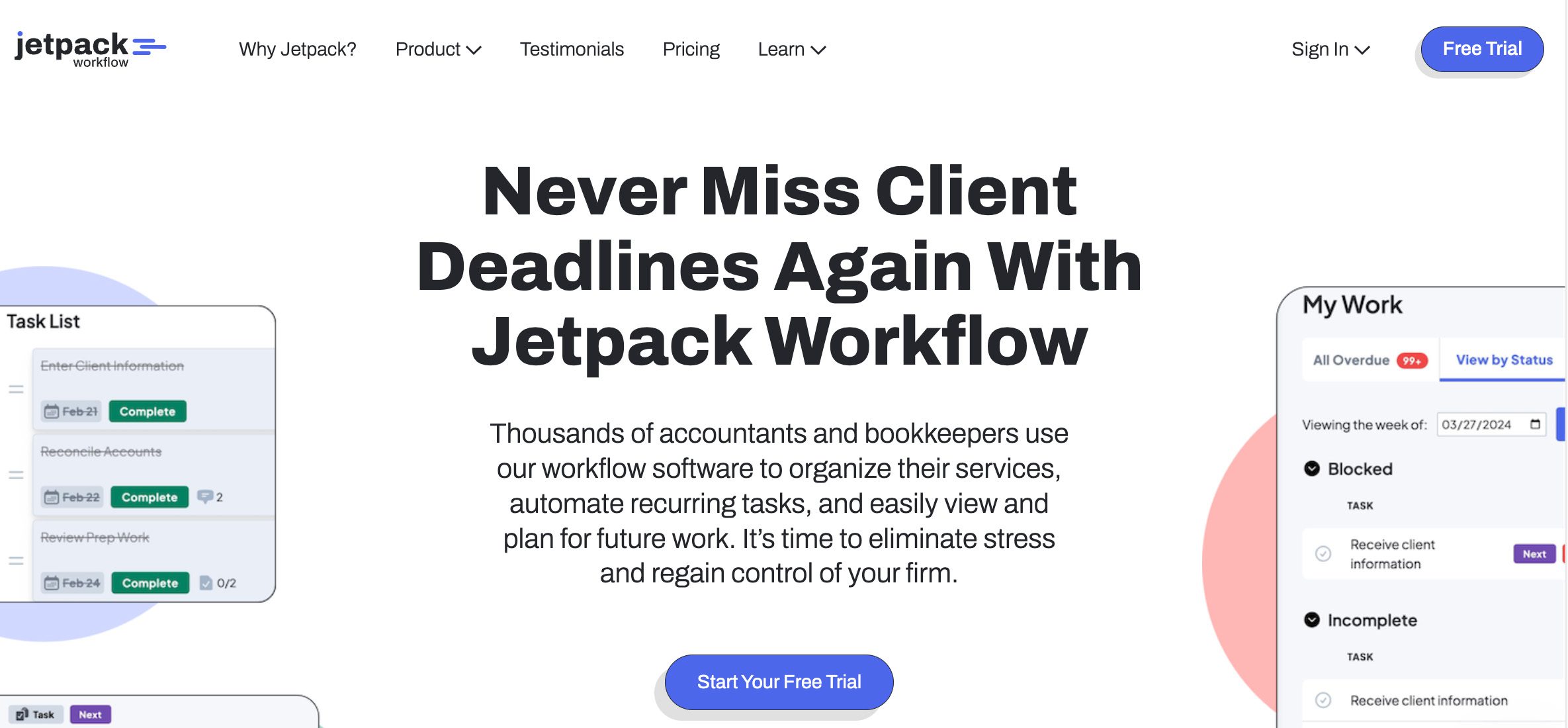

- 5. Jetpack Workflow: Simple recurring task engine

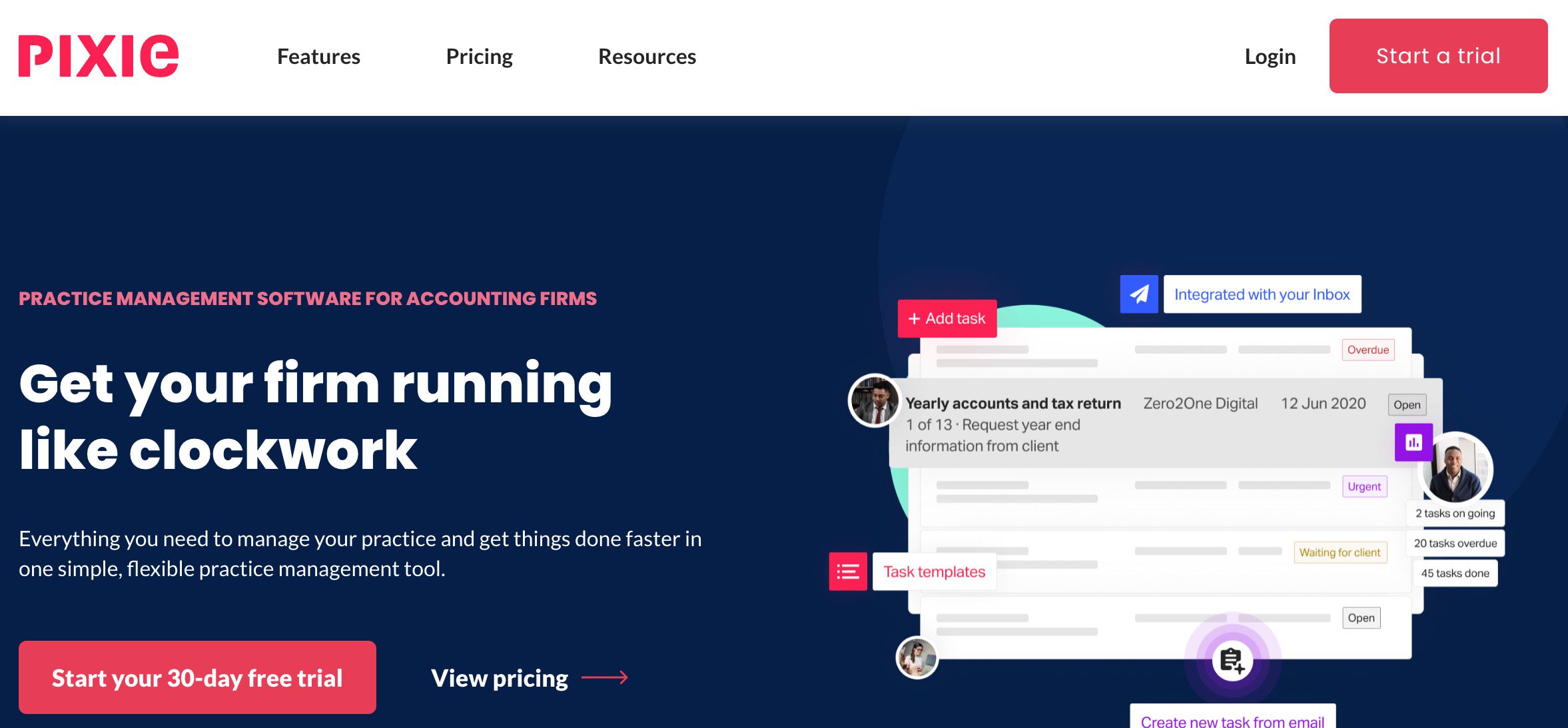

- 6. Pixie: Budget pick with ease of use

- 7. Copilot: White-labeled client portal + payments

Must-have criteria before you choose

Choosing CRM software isn’t something you do on a whim. There’s a lot to consider. A CRM (Customer Relationship Management) system helps you manage clients, organize documents, assign tasks, and centralize everything from leads to payments.

For accounting teams juggling tax prep, bookkeeping, advisory, and admin work, the right CRM also serves as a practice management solution. This keeps client services and operations in one place.

Here’s what to look for before committing to a platform.

Secure, branded client portal 🛡️

A client portal is where your clients upload files, sign documents, and view updates, but not all portals are created equal.

These are the core functions that need to be in a client portal:

- Security: End-to-end encryption and strict access controls.

- Ease of use: User-friendly interface with no sign-in headaches.

- Branding: Includes your logo, domain, and reflects your firm’s identity.

- Centralized communication: Cuts down back-and-forth emails and keeps all the data organized.

On top of this, some platforms offer a customer self-service portal that gives clients the ability to find answers, submit requests, and access resources on their own time. When paired with a dedicated client portal, you create a smoother overall user experience while taking pressure off your staff.

If the platform doesn’t offer a portal, or it feels clunky, it’s already behind.

True workflow automation and recurring tasks ⚙️

Manual admin work can slow your firm down. You should be able to set up recurring client work, like monthly bookkeeping or quarterly reviews, with automatic task generation and reminders. It’s a bonus if it also supports conditional logic (e.g., “If X happens, assign Y to Z”).

This matters because accounting work is a cycle, not a checkbox. A reliable CRM will automate task creation, send reminders, and make sure nothing gets overlooked.

Two-way QuickBooks Online (QBO) sync 🔄

There’s a big difference between a CRM software that “integrates with QuickBooks” and one that offers a true two-way sync. Many tools pull in some data from QuickBooks but stop there. Canopy offers a limited two-way sync that only applies to clients and service items. This means that when it comes to payments, invoices, and, more, changes made in one system don’t reflect in the other.

A two-way sync keeps all your data across platforms aligned in real time. If you rely on QuickBooks for your financials, this should be a non-negotiable key feature.

Flat or transparent pricing plans 💲

You might have been inclined to purchase a seemingly economical software and suddenly became shocked at how pricey it was upon checkout. Many platforms charge low base rates and lock essential features, like e-signatures, full client portal access, or basic document management, behind higher tiers or separate add-on fees.

Before you choose, review the full pricing breakdown. A flat or transparent pricing plan means that you know exactly what’s included, what’s optional, and what happens as your team or client base grows.

Onboarding speed and learning curve 📚

Your choice of CRM should be easy to set up and quick to learn. This should complement your employee training, an investment that pays off as your workflows expand and adapt. Time spent figuring out software is time not spent serving clients.

Look for tools that offer step-by-step setup, prebuilt templates, and responsive onboarding support. Live chat, walkthroughs, and setup guides ensure smoother adoption.

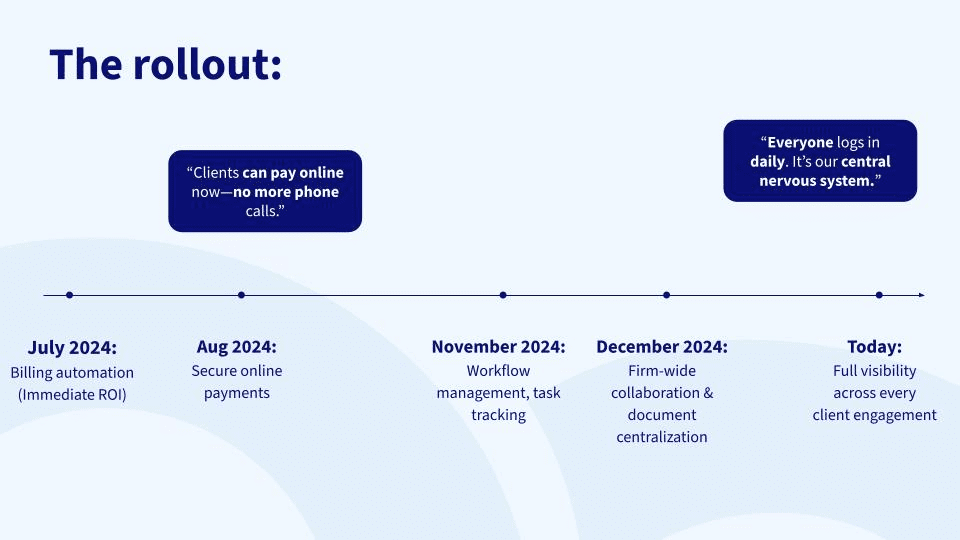

CASE STUDY: How Tax Office SF ditched paper for 10x faster billing 🚀

Tax Office SF, a boutique tax advisory firm, was able to transform paper-heavy legacy workflows into a streamlined, digital-first operation with Method CRM.

Partnering with Method CRM, the firm began by digitizing their most pressing pain point—invoicing. Gradually, they expanded to client onboarding, workflow management, and remote collaboration, all tailored to their specific operations with hands-on support from Method’s team. 🤝

By implementing a fully customized, QuickBooks-integrated CRM, Tax Office SF transformed into a streamlined, cloud-based operation, able to eliminate manual bottlenecks, improve cash flow, and enable real-time collaboration across a now-national team. 🙌

Why firms outgrow Canopy

Canopy, without a doubt, is an asset for tax-focused accounting. However, as your firm starts scaling or adding services, a few pain points may emerge:

- Cost creep and paid modules: Canopy uses a modular pricing model. CRM, workflows, billing, and even transcripts or tax-resolution tools come as separate line items. This makes growing more challenging using the platform, as you’ll need to consider the unpredictable costs when adding services.

- Limited e-signature flexibility: Canopy offers unlimited e‑signatures via its Document Management license, but there’s an asterisk on that. Some IRS-compliant signatures rely on KBA (Knowledge-Based Authentication), and each attempt uses a paid KBA credit ($1.25 per credit). If a client fails the ID check, they’ll need to sign by hand, which can slow things down.

- Dated dashboards/UI: Canopy’s interface looks clean, but it’s not always built for speed. The dashboard can be seen as less customizable than many of Canopy’s competitors.

- Steeper admin setup than peers: Admins often have to customize modules from scratch, with fewer prebuilt templates than other tools. Setting up automations, client roles, and task flows can become a bottleneck without dedicated setup support.

If your firm is growing fast or needs more flexible tools, these Canopy drawbacks are worth weighing. Every platform has trade-offs, so there’s no perfect option. What matters is picking one that won’t slow you down when your needs shift.

The field at a glance 👀

We’ve done the homework. Here’s our lineup of the best Canopy alternatives:

- Method CRM

- TaxDome

- Karbon

- Financial Cents

- Jetpack Workflow

- Pixie

- Copilot

Here’s how they compare side-by-side.

| Platform | Price | Client portal | Document management | QBO sync | Unique angle |

| Canopy | Starts at $45/user/month; Client Engagement Platform at $150/month for unlimited users; plus add-ons | ✅ | ✅ | ⚠️ Invoices, categories, classes, locations, and payments are synced from Canopy to QBO, but not vice versa | Focused on tax-heavy workflows with modular pricing flexibility |

| Method CRM | Starts at $27/user/month for the basic contact management plan; Pro at $44, Enterprise at $74 | ✅ | ✅ | ✅ Offers a real-time, two-way sync | Deep QuickBooks CRM integration with full CRM |

| TaxDome | Essentials plan is at $800/year (1 user only); Pro at $1000/year/seat; Business at $1200 | ✅ | ✅ | ⚠️ Limited auto invoice and payment sync | Tax and CRM software with robust workflow automation |

| Karbon | Team plan is at $59/month/user (up to 3 team members); Business at $89/month/user (up to 10) | ✅ | ✅ | ⚠️ Invoice sync is primarily one-way | Built around seamless team collaboration and visibility in accounting workflows |

| Financial Cents | Solo plan is at $19/month/user; Team at $49; Scale at $69 | ✅ | ✅ | ⚠️ Limited time entry and invoice sync | Affordable work management with streamlined automation |

| Jetpack Workflow | Starter monthly at $45/month/user; Starter yearly at $30/month/user | ❌ | ✅ | ⚠️ QBO sync supported; limitations may require Zapier integration | Focused on workflow and operational clarity with structured support |

| Pixie | Starts at $129/month for less than 250 clients; 251-500 clients at $199/month; 501-1,000 clients at $329/month | ✅ | ✅ | ⚠️Only through Zapier integration | Simple, flat-fee design with embedded training and team-ready automation |

| Copilot | Starter plan at $39/month for 1 user; Professional at $149/month for 3 users; Advanced at $399/month for 5 users; Custom pricing available for unlimited users | ✅ | ✅ | ⚠️ One-way sync focused on exporting data like customers, invoices, and payments | Emphasis on client messaging, portal access, and in-app payments |

Canopy alternatives: The top contenders

Now that you’ve seen the big picture, let’s dig into the top Canopy alternatives.

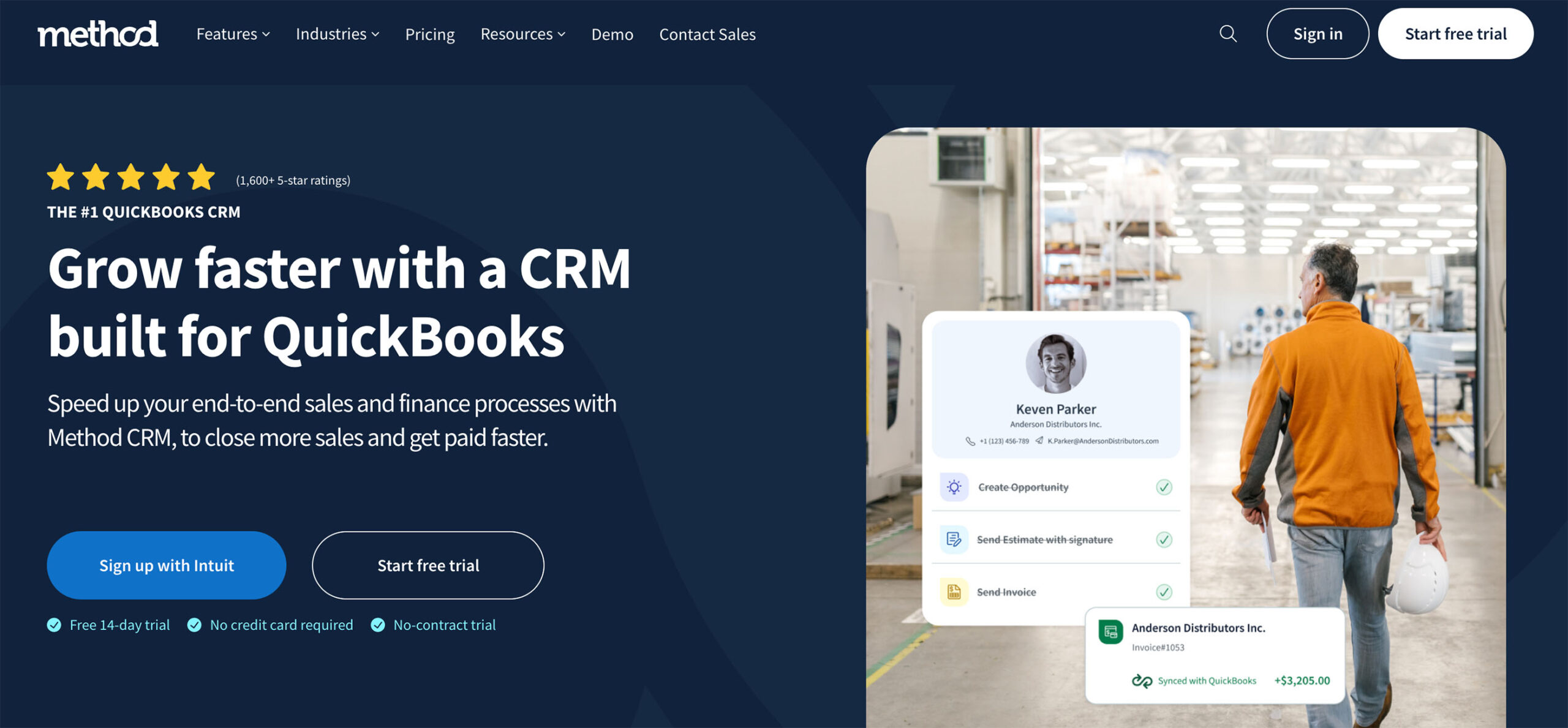

1. Method CRM: QuickBooks-integrated CRM with customizable workflows

Method is a Quickbooks-integrated CRM with deep customization functionality. Its best-in-class, two-way, real-time QuickBooks sync means that your firm’s financials and CRM will always match. Also, Method’s no-code customization allows firms to tailor the software to their unique needs and workflows.

For accounting firms, Method also makes lead generation campaigns far more effective by pairing contact tracking with email marketing tools. You can segment prospects, trigger follow-ups, and measure engagement, all within the same cloud-based workspace. This way, every lead stays connected to your sales and invoicing pipeline.

✅ Pros:

- Industry-leading two-way sync for both QuickBooks Online and Desktop.

- Drag-and-drop workflow builder adapts to your exact client tasks and other internal processes.

- Full CRM capabilities for contact management, sales pipeline tracking, and task assignments.

- Built-in client portal lets accounting professionals collect documents, manage follow-ups, and accept payments online 24/7.

- Native integration with Mailchimp, Gmail, Google Calendar, and Zapier.

❌ Cons:

- Software only available in English

- Only suited for QuickBooks and Xero users.

👍 Ease of use:

- Simple to set up with a clean interface and guided onboarding. Comes with plenty of support resources, including a detailed help center, tutorials, FAQs, and even live assistance.

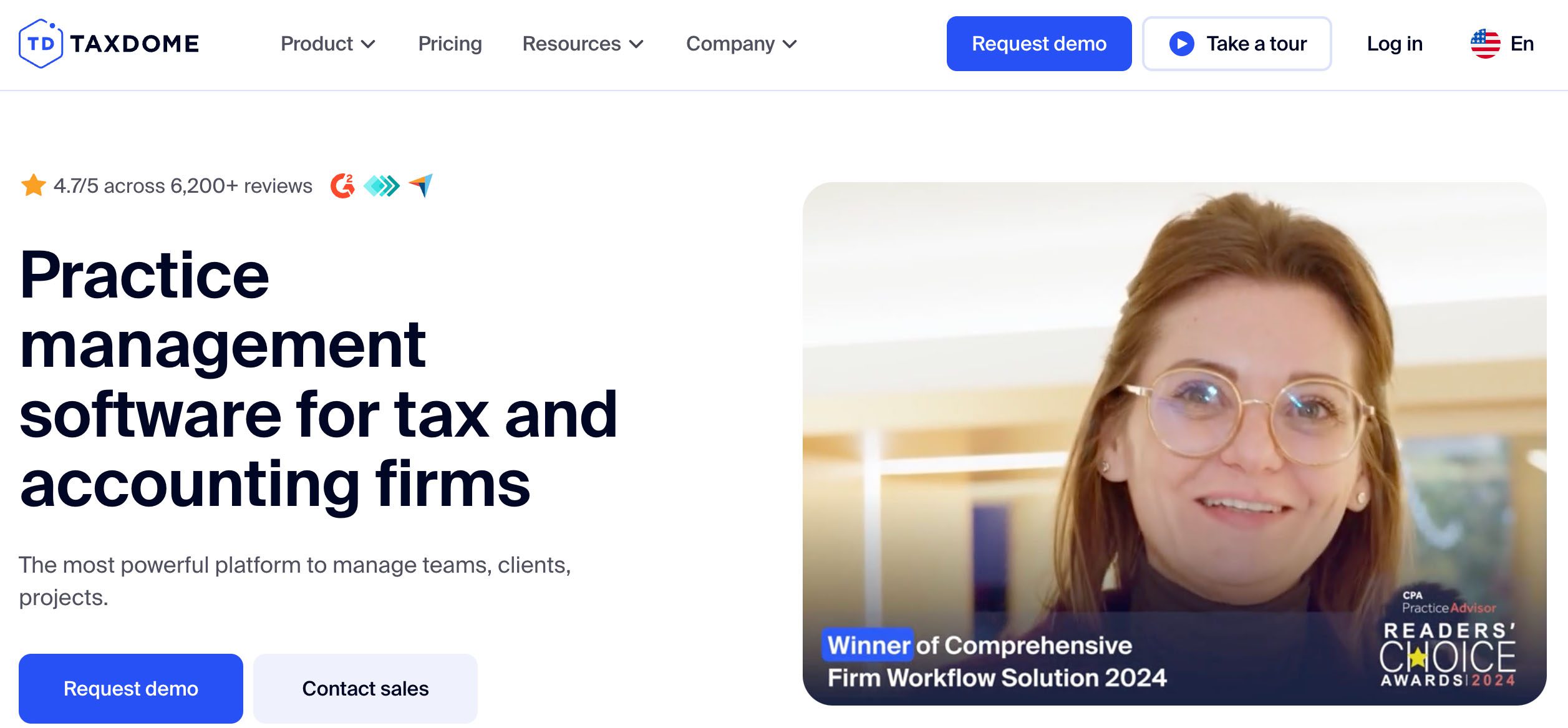

2. TaxDome: All-in-one tool with a powerful portal

TaxDome is a comprehensive practice management system that lets you manage CRM, client portal, e-signatures, and workflow management under one roof.

Its strong mobile app and document tools shine, letting clients upload tax documents by snapping a photo, signing forms with e-signatures, paying invoices, and messaging their team without ever opening a laptop. On your side, you can track messages, approve documents, and trigger workflow automation from your phone.

✅ Pros:

- Highly customizable client portal lets your firm brand the experience and control client access.

- A dedicated client mobile app gives clients access to forms, chats, and payments on the go.

- A built-in PDF editor with unlimited storage makes it simple to annotate, merge, and send returns.

❌ Cons:

- Has a steep learning curve.

- No built-in reporting or analytics, so you’ll need to export the data to review performance.

👍 Ease of use:

- Initial setup can take time, but they offer guided onboarding, tutorials, live webinars, and have an active support community.

3. Karbon: Email-first collaboration for larger teams

For accounting teams that manage most client communication by email, Karbon makes the inbox the core of your practice management system. Its goal is to avoid inbox chaos by blending team collaboration, client communication, and workflow management into one cloud-based hub.

You can expect Karbon to deliver essentially the same core functions as Canopy, but Karbon’s tools come fully integrated rather than split into separate modules that are paid for separately.

✅ Pros:

- AI-powered assistant “Karbon AI” drafts replies, summarizes threads, and flags priorities.

- Built-in workflow automation handles reminders, intake forms, and task queues.

- Includes “Practice Intelligence” with real-time status updates and firm-wide insights.

❌ Cons:

- Requires more setup and onboarding.

- While not cheap, the pricing tiers offer clear value.

👍 Ease of use:

- Karbon delivers robust collaboration, but setting it up takes effort. Implementation requires customizing workflows, clients, and email rules.

4. Financial Cents: Flat-rate pricing for small firms

Financial Cents is a web-based practice management tool built for accounting firms that want a simple way to track deadlines, manage clients, and log time. Its flat-rate pricing makes it cost-effective for smaller teams, and its time tracking integrates directly into projects so billable work isn’t missed.

While it’s lighter on advanced reporting and document tools, its focus on core workflow tracking and accountability increases its value in terms of speed, transparency, and predictable costs.

✅ Pros:

- Flat-rate pricing plans with competitive features, even for the solo plan.

- Built-in time tracking to monitor billable and non-billable hours.

- Strong ratings for intuitiveness and value.

❌ Cons:

- Limited project management views, where tasks can only be managed in a list or calendar format.

- Advanced features like auto-follow-ups and integrations (e.g., Zapier, SmartVault) require upgrading to the Scale plan.

- No mobile app for full functionality.

👍 Ease of use:

- Financial Cents uses a spreadsheet-like interface that accountants can learn quickly. Most features work out of the box without heavy setup.

5. Jetpack Workflow: Simple recurring task engine

If you’re looking for a workflow-leaning tool, then Jetpack Workflow may be the right option for you. As task management is top priority, you get bonus features like time tracking, planning views, and email reminders to support performance that complement your existing accounting stack.

However, as a basic recurring task engine (which it does really well), you won’t get the usual practice management tools like a client portal or invoicing capabilities here.

Pros:

- Choose from 70+ prebuilt workflows or build your own with custom steps.

- The task management dashboard gives a clear, top-level view of all ongoing work.

- Time tracking lets you log hours directly within tasks, view total time per client or project, and export reports for billing or productivity reviews.

❌ Cons:

- There’s no built-in client portal.

- Lacks a built-in email inbox.

👍 Ease of use:

- Accounting professionals can quickly set up recurring tasks using templates, and the dashboard keeps work manageable and visible.

6. Pixie: Budget pick with ease of use

With Pixie, you get workflow templates, solid email integration, a user-friendly interface, and off-the-shelf automation that respects your time. Flat pricing means your whole team works together without unexpected costs.

If you’re a small firm and need a lightweight framework for workflow management, task tracking, and client collaboration, Pixie strikes the perfect balance between power and simplicity.

✅ Pros:

- Template-rich setup consisting of prebuilt workflows for tax, bookkeeping, payroll, and more for small teams to save time.

- Has a built-in client portal to centralize communication.

- Workflow automation handles recurring tasks, auto-reminders, and deadline tracking.

❌ Cons:

- Lacks advanced reporting, capacity planning, or visual dashboards for firm-wide oversight.

- Designed for small to mid-sized firms, and might not meet the complex, specific needs of larger practices.

👍Ease of use:

- Pixie is built for busy accountants who don’t want to struggle with onboarding. Its interface is intuitive, setup is fast, and the template marketplace guarantees that firms hit the ground running quickly.

7. Copilot: White-labeled client portal + payments

Copilot is a top choice for accounting firms that want one professional, branded portal for all client touchpoints. It mixes payment processing, secure messaging, document sharing, intake forms, and tasks into a modular system.

Add the ability to embed apps and use an API to integrate tools like Calendly, Airtable, or Power BI, and you’ve got flexibility. Copilot delivers a polished, centralized hub for client onboarding, billing, and interaction, which is a game-changer for a more presentation-focused approach.

✅ Pros:

- Provides a sleek, fully white-labeled client portal that aligns with your firm’s brand, including domain, styling, and access controls.

- Built-in payment processing supports invoicing, subscriptions, and ACH or credit card payments.

- Includes a notification center so clients and staff stay alert to updates, tasks, and messages within a centralized environment.

❌ Cons:

- Configuring portal apps, branding, and permissions can feel heavy for small teams.

- Doesn’t provide in-depth context for the full scope of a project.

👍 Ease of use:

- While the interface keeps billing, contracts, and messaging just a click away, some users may need time to adjust to navigating multiple tools efficiently.

Features to look for 🛠️

Based on the Canopy alternatives we’ve reviewed, these features stand out as absolute must-haves:

- Client portal and e-signatures: A secure, well-branded client portal allows for file sharing, document requests, and status updates while striking a great impression. Built-in e-signature tools save time by letting clients sign digitally everywhere.

- Workflow automations and templates: A software with automation capabilities is essential for reducing manual, repetitive work. Customizable templates ensure consistency and speed.

- Time tracking, invoicing, and payment processing: Integrated time tracking links billable hours directly to invoices. Combined with payment processing, you can bill clients and receive payments without switching between platforms.

- Dashboards, profitability, and real-time alerts: Visual dashboards help track KPIs like billable hours, overdue tasks, or revenue by client. Profitability reports give insight into which jobs bring the most value, while real-time alerts keep the team aware of urgent deadlines or approvals needed.

- Integrations and open API: A CRM with accounting software integrations eliminates double entry. Open API or Zapier provides endless possibilities, linking to SEO marketing tools, calendar apps, or niche accounting platforms. These let you build a system that fits your exact processes.

Your accounting practice management software has the potential to become your documentation and bookkeeping control center. So choose a platform not only for the price or list of features, but one that can handle your current workload and scale with your firm’s growth.

Pricing breakdown and hidden costs 💰

The last thing you’d want is to be surprised at the costs. Pricing for practice management software can vary widely depending on your firm’s size, workflow demands, and budget.

Here are rough estimates to give you a clearer picture.

| Tier | Price range | Best for | Features to expect |

| Starter | $25–$50/user | Solo or small firms (1–3 users) | Basic CRM, simple task tracking, client portal |

| Growth | $50–$80/user | Growing firms (3–10 users) | Workflow automation, time tracking, richer task templates |

| Enterprise | $80–$150/per user (custom pricing) | Larger firms (10+ users) | Advanced reporting, API or integrations, dedicated onboarding |

No business is the same, and some platforms offer more features than others. Here are some common add-ons to factor into your costs:

- Storage upgrades: Some platforms may limit file storage and charge extra for significant archival volume.

- E-signature credits: There might be a limited monthly quota on signatures and documents, and charges per additional KBA-compliant signature.

- Premium support: Fast-track customer service or dedicated account managers usually fall under higher-tier plans or are pay-per-use.

- Advanced integrations: Basic API access may be included, but niche or industry-specific connections may require add-on fees.

As a general rule, budget an extra 10–20% on top of your base subscription for these extras.

Frequently asked questions

What are the top Canopy alternatives for accounting firms?

Several practice management tools stand out as strong alternatives to Canopy. Popular options include Method CRM for its two-way, real-time QuickBooks sync and customizable workflows, TaxDome, known for its robust client portal, and Karbon, which excels in email-first collaboration and team communication.

What are the hidden costs associated with practice management software?

Many platforms have base pricing but also include add-ons that can increase your total cost. Common extras include expanded storage, premium support, and access to advanced integrations. Firms should thoroughly review the platform’s pricing plans to avoid surprises.

What are the features accountants need to prioritize?

Accounting firms should focus on features that cater to their specific needs. For instance, if you’re workflow-heavy, look for software with extensive automation features and customizable templates. Consider seamless integrations to connect with essential tools like QuickBooks and email platforms.

Final call: Which Canopy alternative best suits you? 👌

- For tax-focused firms wanting a powerful portal and solid workflow automation, TaxDome fits the bill.

- Teams that live in email and need tight collaboration will find Karbon hard to beat.

- Small firms or startups seeking flat-rate pricing and simple time tracking should check out Financial Cents.

- If you want a no-frills, recurring task engine to keep projects on track, Jetpack Workflow delivers.

- Budget-conscious practices craving ease of use can rely on Pixie.

- Firms wanting white-labeled portals and integrated payments might prefer Copilot.

- For accounting teams deeply tied to QuickBooks, Method CRM offers real-time sync and fully customizable workflows tailored to your exact processes.

Curious how Method CRM can streamline your QuickBooks-driven practice?

Schedule a free demo today and get a firsthand look at how Method fits your workflow.