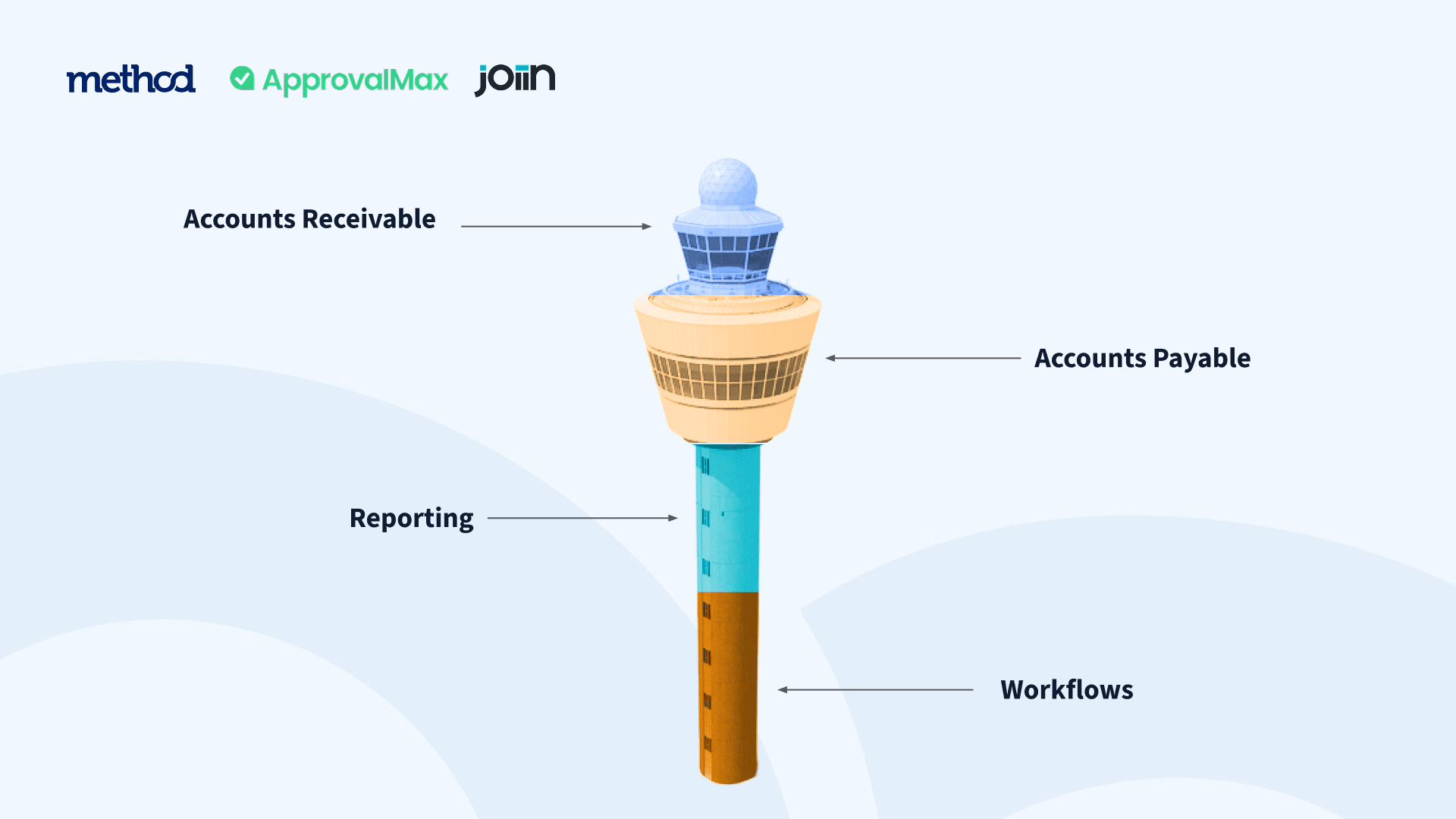

How to Build a Control Tower for Smarter & Faster Business Decisions

As businesses add locations, teams, and entities, and complexity, four systems start creaking: AR, AP, reporting, and the workflows that connect them. This webinar dug into how to build a “control tower” that keeps those parts talking—helping you make faster and smarter decisions.

Speakers

- Helina Patience, CPA, CMA — Head of Accounting @ ApprovalMax; CEO @ Entreflow

- Harry Symons — Head of Customer Success @ Joiin

- Hosted by Matas Pranckevicius — Content Lead @ Method

Does AR take too long?

In a live poll, we asked: “How long does it usually take for your invoices to get paid?”

Most responses landed in 31–60 days, with a healthy chunk around two weeks. We think this can be a lot better, and it’s not that some industries are “irredeemable.”

Things to consider, according to the speakers:

- When invoices are paid late, customers paying are effectively using you like a bank, interest-free.

- You can change behavior. Start by avoiding AR where possible: deposits, auto-pay, and easy payment paths.

- Be politely relentless. People pay the squeaky wheel.

- If you’ve got aging invoices, be friendly but firm: explain the backlog, offer payment plans, and set new rules going forward.

- Rolling changes is fine: start with new customers, then migrate existing ones.

On 💸 checks: Helina’s firm doesn’t let clients accept them. Check fraud is rampant, postal delays make things worse, and “the check is in the mail” is the oldest cash-flow stall in the book. Offer auto-pay; if a customer wants float, trade it for longer terms while keeping control of collection.

Demo: how AR can run without having to constantly chase clients

We walked through a quick demo of how Method handles the front-end of estimates, invoices and cash collection.

Want a full in-depth Method demo and live Q&A with a product expert? ➡️ Register for our 30-minute weekly workshop.

- Create an estimate, email or SMS it, and even require a deposit.

- The customer portal lets clients accept and pay directly (with signature), and everything bi-directionally syncs with QuickBooks (Desktop/Online) and Xero.

- The point isn’t one estimate—it’s standardizing the process across teams so Sales never needs to poke around in the accounting file, and Finance still sees every step.

AP: manual approvals aren’t “safer,” they’re slower (and riskier)

Attendee questions hit the usual headaches: duplicate bills, multi-page invoices, who approves what, and closing delays when suppliers are late.

Helina’s AP guidance (and a story):

- Paper piles lead to batch “rubber-stamp” approvals. That’s not safer.

- Use tools with receipt capture/OCR and duplicate detection (e.g., ApprovalMax’s capture).

- Push approvals through rules instead of inboxes: by location, role, amount thresholds, class/project.

- Add auto-approval for obvious, low-risk items (e.g., small recurring software).

- Include an optional review step before approvals if needed.

- Every action builds a full audit trail, and the documents + audit log flow into QuickBooks/Xero—auditors love this.

Harry’s AP war story: sacks of soggy mail, hand-coding hundreds of invoices, double-counting, and suppliers (like the window cleaner) waiting months. The bigger you get, the less acceptable that becomes.

Cash-flow considerations: Real-time AP avoids “$70,000 surprise due tomorrow.” Early visibility lets you plan, verify vendor performance/rates, and eliminate guesswork.

Reporting: what “control tower” visibility looks like

We should think about “reporting” as everything from basic month-end to multi-entity consolidation.

Harry’s Join walkthrough:

- Build consolidation from multiple companies.

- Flip reporting currency (e.g., to GBP for a lender); the tool handles the translation.

- See company-level breakdowns and toggle eliminations to check intercompany lines before/after.

- Use dashboards for cash and key metrics so you’re not waiting on a quarterly Excel marathon.

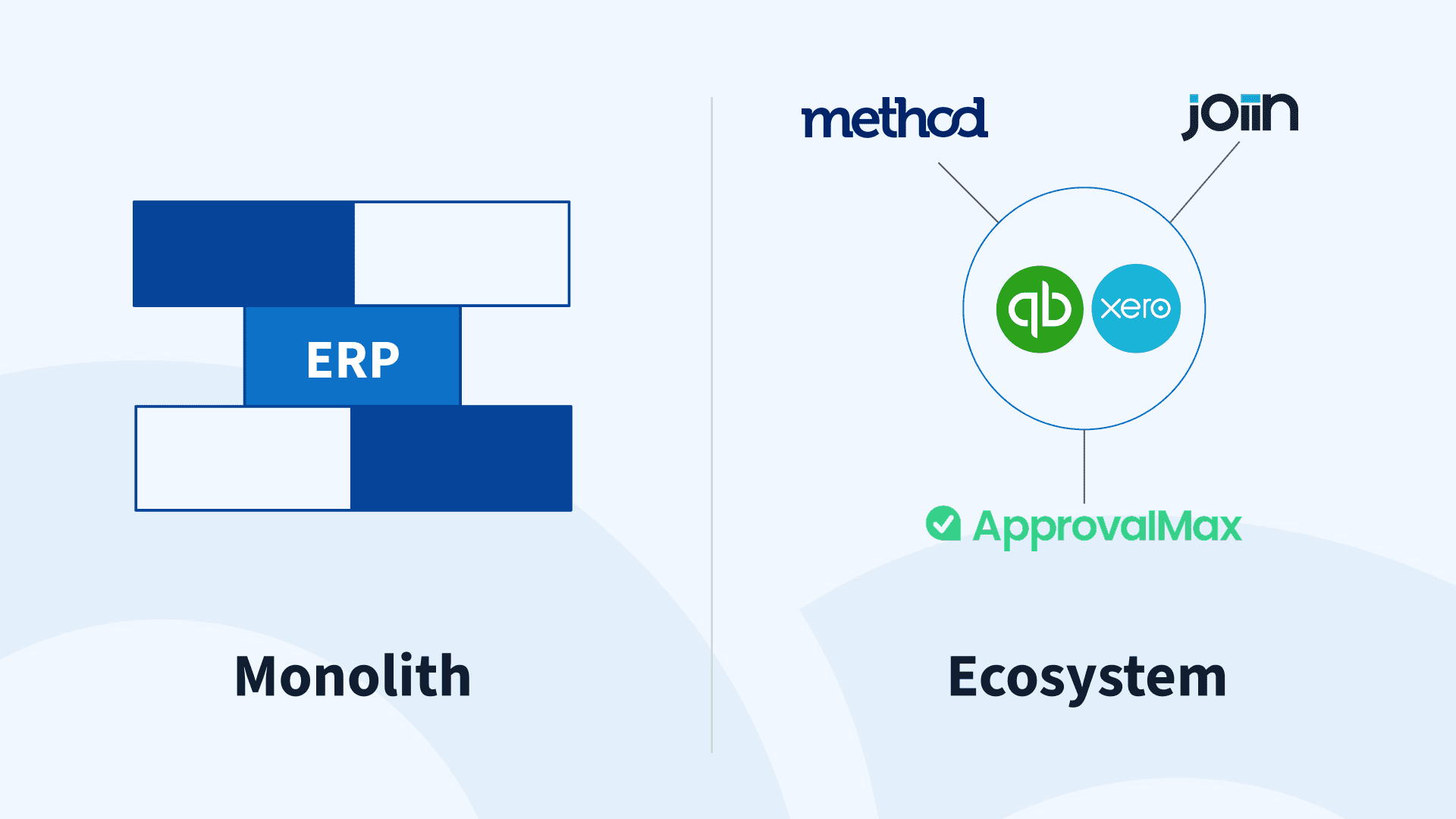

“Ecosystem,” not monolith

Helina’s implementation view:

- Keep QuickBooks/Xero as the core, and plug in robust apps (AR/AP approvals, reporting) as needed.

- These aren’t six-month ERP migrations—many setups take about a day to pilot and prove.

- As the business evolves (inventory needs, new workflows), swap components without ripping out the whole stack.

- Compared to big ERPs she used in industry, today’s app ecosystem is more flexible, faster to adopt, and frankly does more for less.

Q&A highlight: budget vs. actuals (and forecasting)

A closing question nailed a common pain: aligning budget to spend so unapproved or unbudgeted costs don’t slip through.

Helina’s answer:

- In high-growth, forecasting can be more useful than a static budget—review monthly, not quarterly.

- Decision-makers need timely, trustworthy data to steer without guesswork.

- ApprovalMax can do budget checks against QuickBooks budgets by project/class during approvals, so overages are flagged before spend goes out.