How to Build Smarter AR & AP Workflows for Cash Flow Efficiency

You can have record sales and glowing profit margins, but if cash is stuck in limbo, growth grinds to a halt. That’s why we brought together a panel of experts for our recent webinar on how to build smarter AR and AP workflows for cash flow efficiency.

Hosted by Method’s Matas Pranckevicius, the session featured:

- Brad White, CEO of VARC Solutions, a QuickBooks expert and seasoned business consultant

- Jav Kinger, Alliance Manager at Tipalti, a global AP automation platform

Together, we unpacked the everyday bottlenecks businesses face in receivables and payables—and how to fix them.

Why Cash Flow Challenges Hold Businesses Back

From late-paying customers to sluggish approvals, many finance teams feel like their money is “taking a vacation.” Attendees shared real-world frustrations:

- Chasing overdue invoices and unpredictable customer payments

- Juggling supplier deadlines while capital is tied up

- Forecasting cash with little visibility or accuracy

Brad summed it up best: “You can have the best product in the world, but still go out of business because of cash flow.”

The bottom line? Inefficient processes scale with you—small cracks become big problems as your business grows.

Smarter AR: Designing the “Getting Paid” Process

Brad and Matas emphasized that AR isn’t just admin—it’s a process you must intentionally design. That means defining:

- Policies – Clear payment terms and expectations (e.g., net 30 = a call on day 31).

- Payment Methods – Move beyond checks. Card-on-file and ACH payments speed up cash collection dramatically.

- Exceptions – When clients insist on different terms, balance flexibility with protections like retainers or upfront deposits.

With automation layered on top, proactive collections turn into a repeatable system instead of a scramble.

Smarter AP: Streamlining Supplier Payments

Jav pulled back the curtain on AP pain points: manual onboarding, paper invoices, endless reconciliations, and overburdened staff. In fact, 47% of firms report payment error rates of 3% or higher, and it costs an average of $20 just to process a single invoice.

Tipalti’s approach? End-to-end automation across:

- Supplier self-service onboarding (with built-in validation and compliance)

- Smart invoice ingestion and coding

- Streamlined approvals directly from email

- Flexible, on-time global payments

The result: AP teams cut workload by 80%, suppliers get paid faster, and cash flow stays predictable.

Metrics That Matter

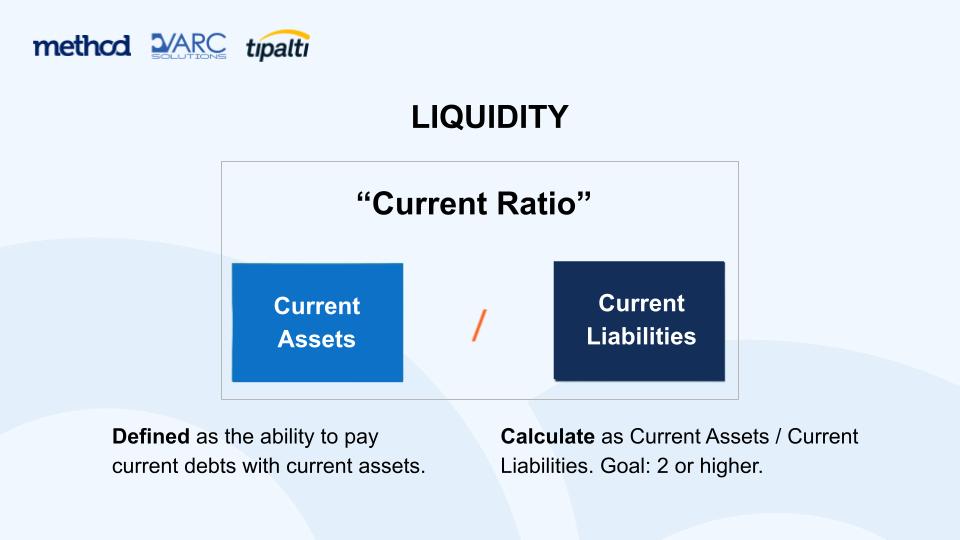

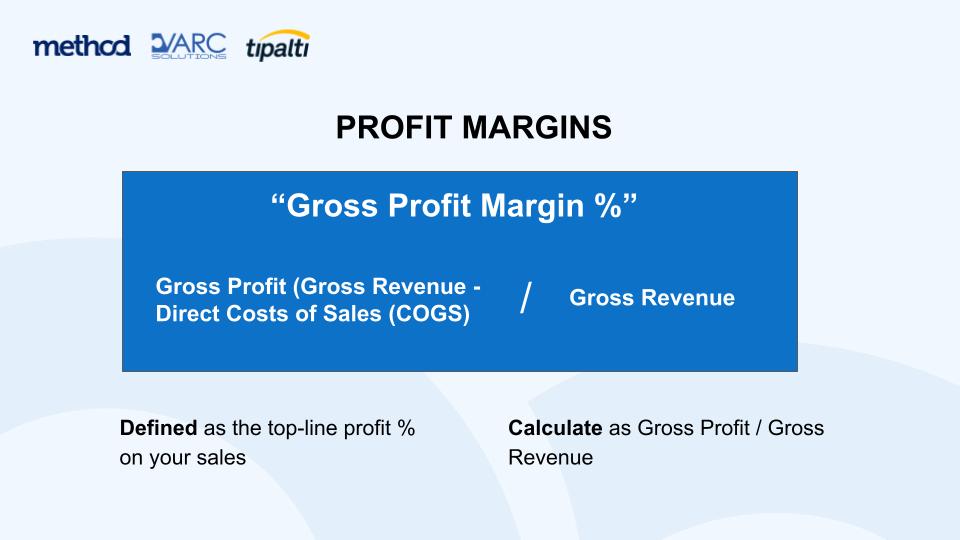

To know if your workflows are working, Brad highlighted two ratios every business should watch:

- Current Ratio: Can your current assets cover your current liabilities? A healthy 2:1 or better keeps the lights on.

- Gross Profit Margin: Strong margins (50%+) give you breathing room. Weak ones leave no cushion for expenses—even if revenue looks good.

Or as Brad put it: “Profit without cash flow is meaningless.”

Real-World Impact

Method customer Topstitch Canvas proved what’s possible. By customizing their AR workflows with Method, they went from day-long admin headaches to invoices being paid instantly through the customer portal. That kind of efficiency doesn’t just save time—it accelerates growth.

Final Takeaway

You can’t cut your way to growth—you need to invest in smarter systems. By redesigning AR and AP workflows with the right policies, automation, and integrations, businesses can free up cash, strengthen supplier relationships, and scale with confidence.

💡 Want to see how Method can streamline your receivables—or how Tipalti can take the pain out of payables? Reach out for a workflow design session and start making your cash work harder for you.