Salesforce is the world’s leading cloud-based CRM platform, but that doesn’t mean it’s a perfect solution for everyone.

If you’ve landed on this blog, you’re likely feeling that Salesforce isn’t quite the right fit — whether it’s the cost, complexity, or something else entirely.

Don’t worry, you’ve got options. In fact, we’re about to walk you through the 12 best Salesforce alternatives for 2025.

What is a CRM?

Before we jump into the best Salesforce alternatives, let’s start with the basics: CRM stands for customer relationship management.

Think of it as the ultimate organizational tool for sales, customer support, and marketing teams. Key functions include:

- Lead and customer management.

- Integrations (email, calendar, accounting software).

- Reporting and analytics.

- Sales pipeline management.

- Administrative and marketing workflow automation.

- Customer service tools.

- Mobile access.

A CRM helps you keep track of everything in one place, automating tasks and freeing up your team to do what they do best.

Salesforce: Why or why not?

Image credit: PCMag

Salesforce is often seen as the giant in the CRM world. But it’s crucial to recognize that it primarily targets large businesses and enterprises, particularly those with over 1,000 employees. So while it’s packed with features, let’s be real: Salesforce is not for everyone — especially small-to-midsized businesses.

Pros of Salesforce:

Salesforce users most appreciate the platform because of its:

- Rich feature set with tools for collaboration, automation, and business management.

- Strong integration potential.

- Diverse industries served, including professional services, manufacturing, and finance.

- Advanced insights through Einstein Analytics.

- Cloud-based for easy access.

- Robust security measures.

Cons of Salesforce:

While Salesforce is great for businesses with the resources to dedicate to its ongoing usage and maintenance, it comes with several downsides:

- High cost.

- Steep learning curve.

- Overcomplicated for smaller businesses.

- Time-consuming implementation.

- Potential feature overload.

- Requires dedicated maintenance team.

- Performance issues in complex setups.

The sheer number of tools can feel overwhelming, and unless you have a team dedicated to mastering the platform, you may end up paying for features you don’t need or know how to use. Plus, Salesforce comes with a hefty price tag, which makes it less appealing for smaller businesses or those just starting out.

Now, if you’re thinking, “That’s not really what I need,” you’re in the right place. Let’s get into the best alternatives to Salesforce.

Best Salesforce alternatives and competitors

1. Method CRM

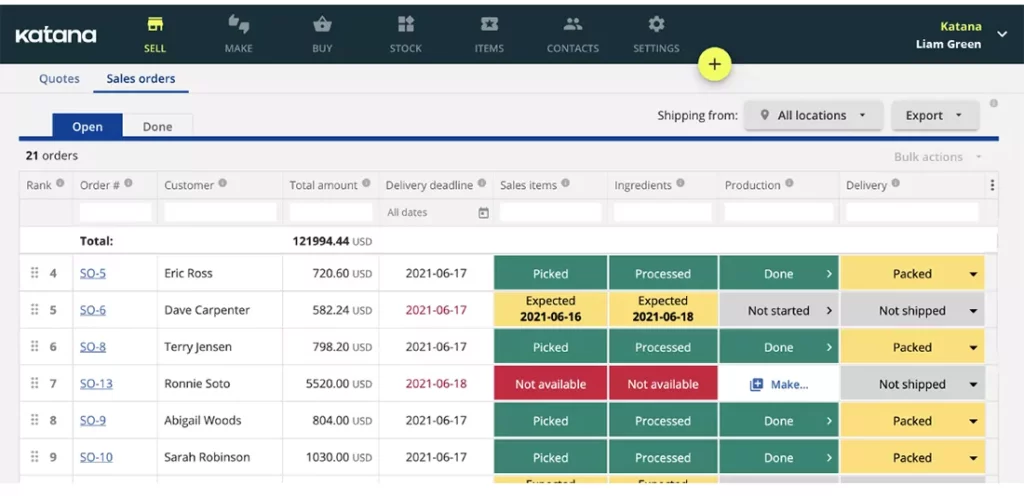

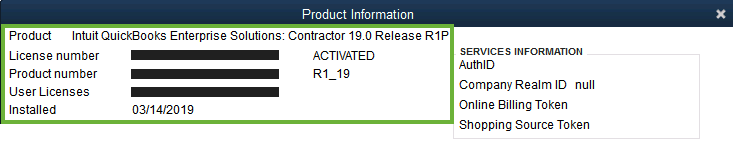

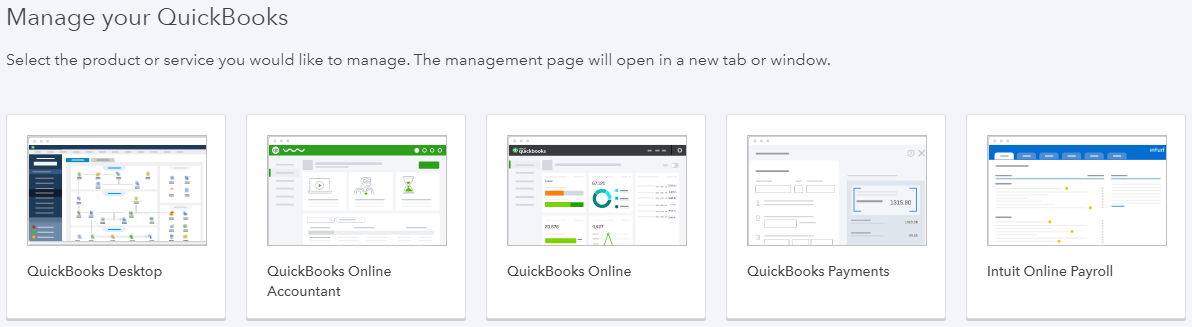

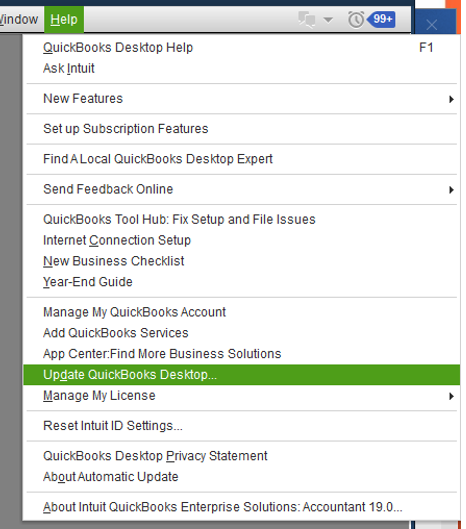

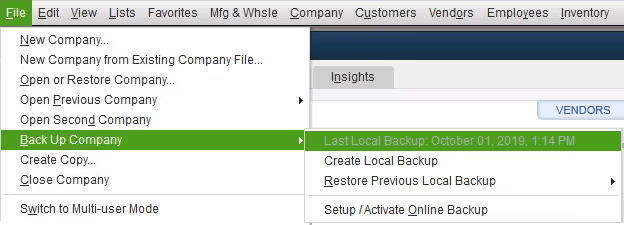

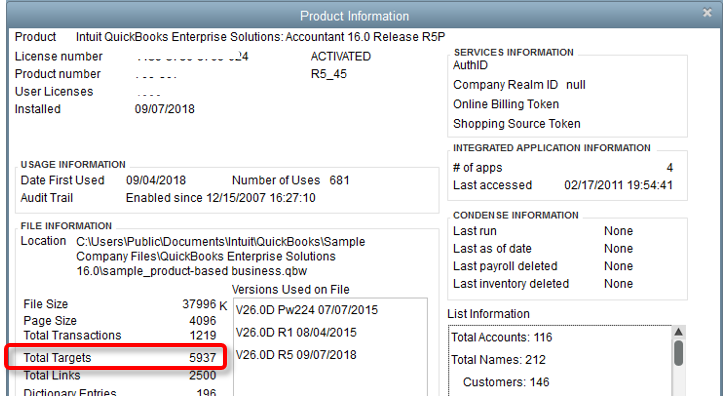

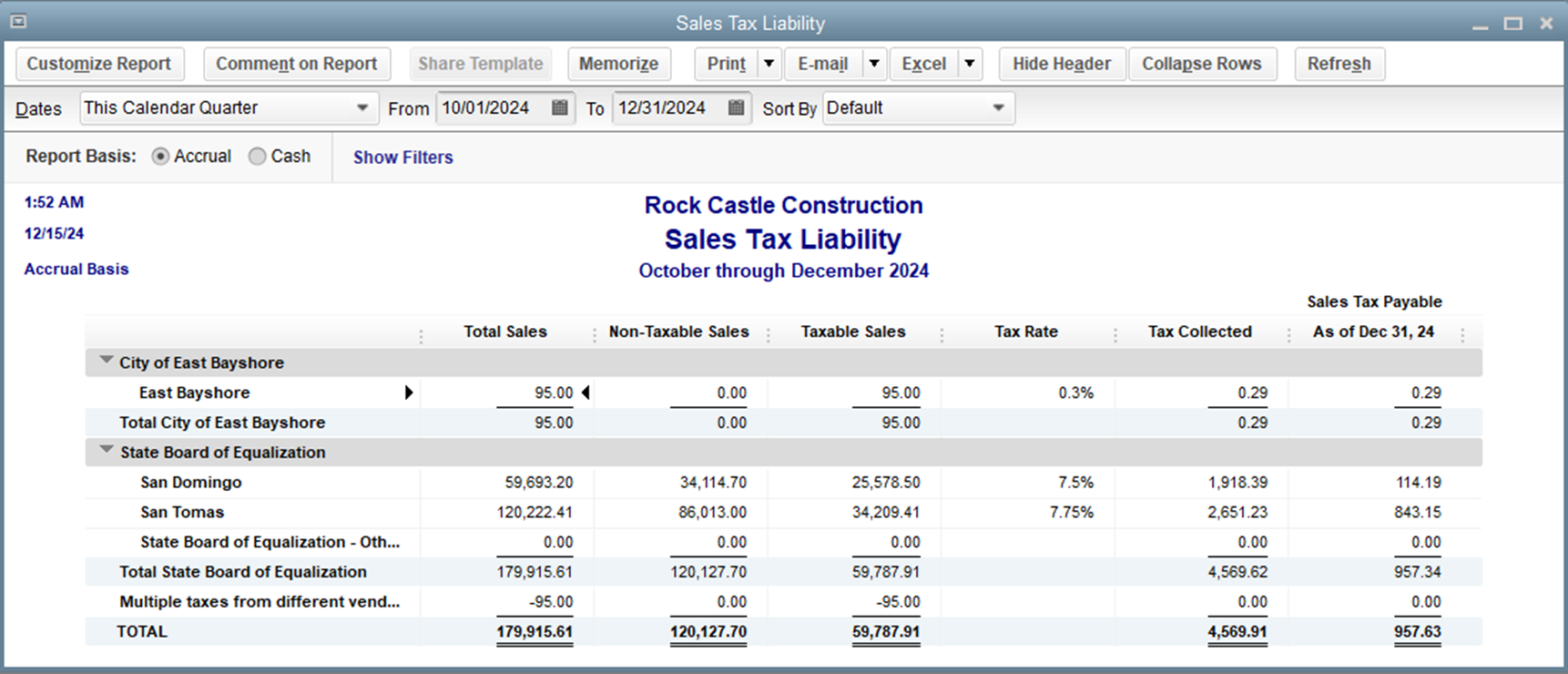

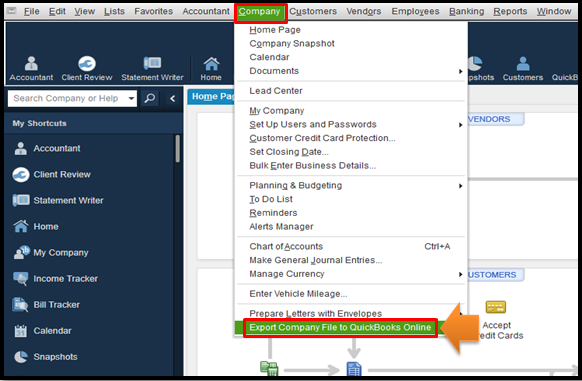

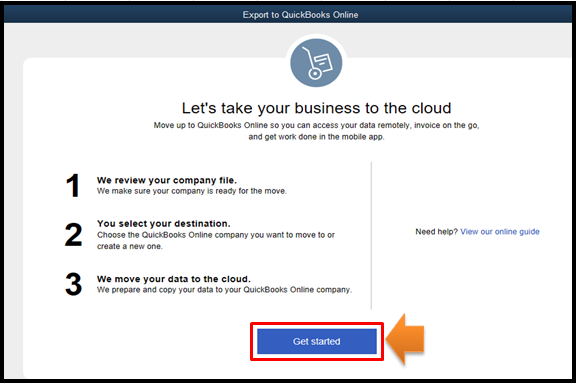

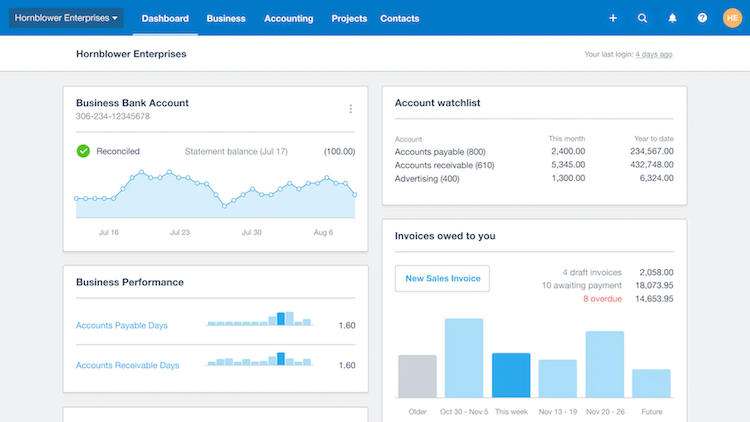

Out of all the best Salesforce alternatives, Method is the #1 CRM for QuickBooks and Xero users. The platform is highly customizable, yet user-friendly, making it the perfect solution for your unique needs and workflows.

Method features

- Automated lead capture using web-to-lead forms.

- Seamless syncing of data to and from QuickBooks or Xero.

- 24/7 customer self-service portals for access to documentation and paying invoices.

- A complete view of each customer, including purchase history and interactions.

- Unlimited customization to mold the platform to your business.

- Drag-and-drop tools for workflow automation.

- Automated follow-ups and reminders to keep everything on track.

Method limitations

- Method works best if you are a QuickBooks or Xero user.

- The platform is currently only available in English.

Method pricing

Method CRM has three pricing plans:

- Contact Management: $25 per user per month.

- CRM Pro: $44 per user per month.

- CRM Enterprise: $74 per user per month.

Method CRM offers a free trial with no credit card required. Get started today!

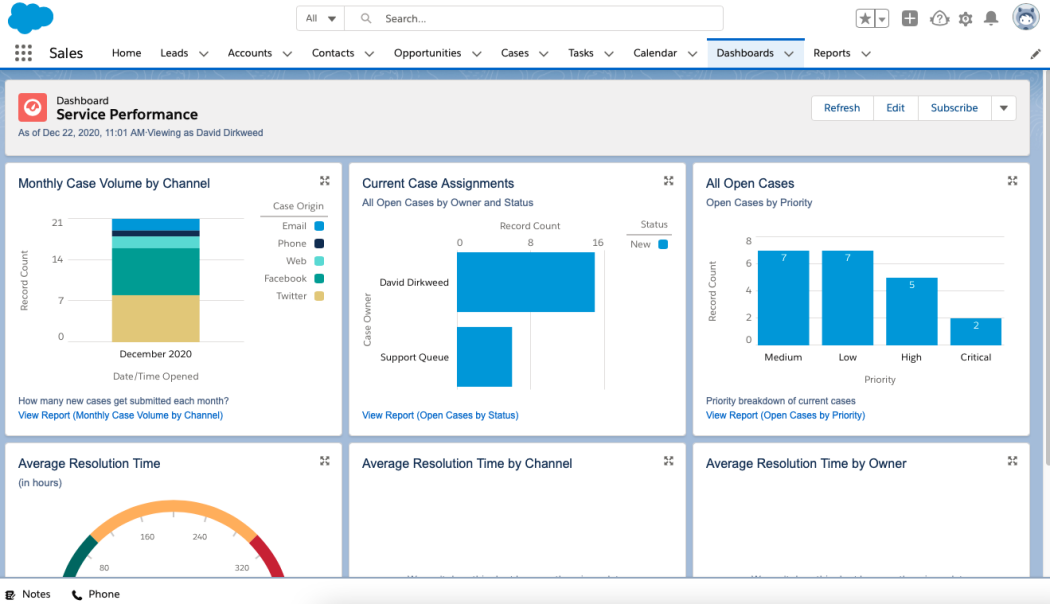

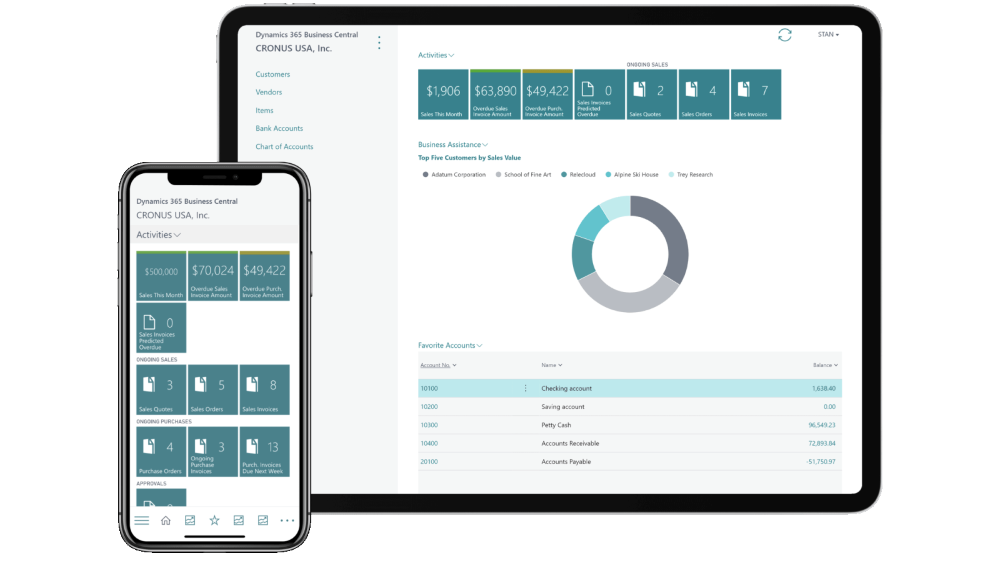

2. Zendesk

Image credit: Mopinion

Primarily recognized for its customer service tools, Zendesk provides a user-friendly platform that focuses on improving support efficiency and customer satisfaction.

Zendesk features

- Powerful service tools like quick and easy support tickets.

- Multi-channel support across email, phone, chat, social media.

- Centralized hub for customer profiles and interaction history.

- Collaboration features between agents and across departments.

- Growing knowledge base for self-service.

- Provides advanced analytics and reporting.

- Integrates with 1,500+ apps through the Zendesk Marketplace.

Zendesk limitations

- Lacks advanced CRM functionalities compared to dedicated CRM platforms.

- Pricing jumps up quickly as you add more features and users.

- May be overkill for very small teams with basic support needs.

- Requires some setup and configuration to unlock full potential.

- AI and automation features are limited on lower-tier plans.

Zendesk pricing

Zendesk offers several pricing plans:

- Build your own: Starts at $19 per month per agent.

- Suite Team: $55 per month per agent.

- Suite Growth: $89 per month per agent.

- Suite Professional: $115 per month per agent.

- Suite Enterprise: Contact their sales team directly.

Zendesk also offers a 14-day free trial.

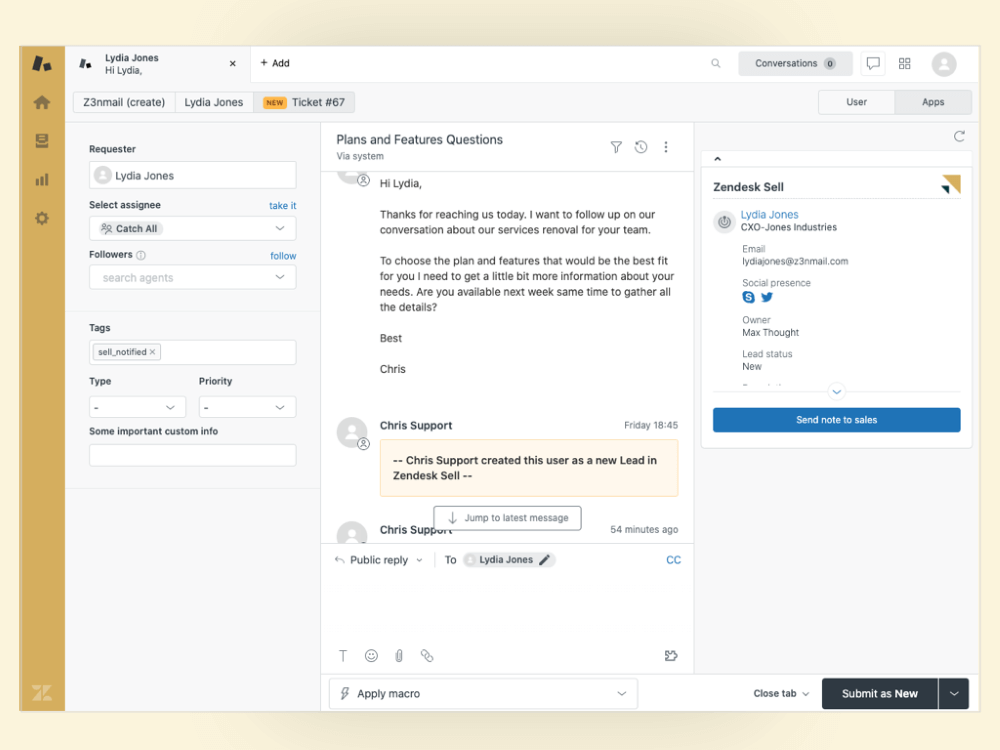

3. Microsoft Dynamics 365 Business Central

Image credit: ADMN

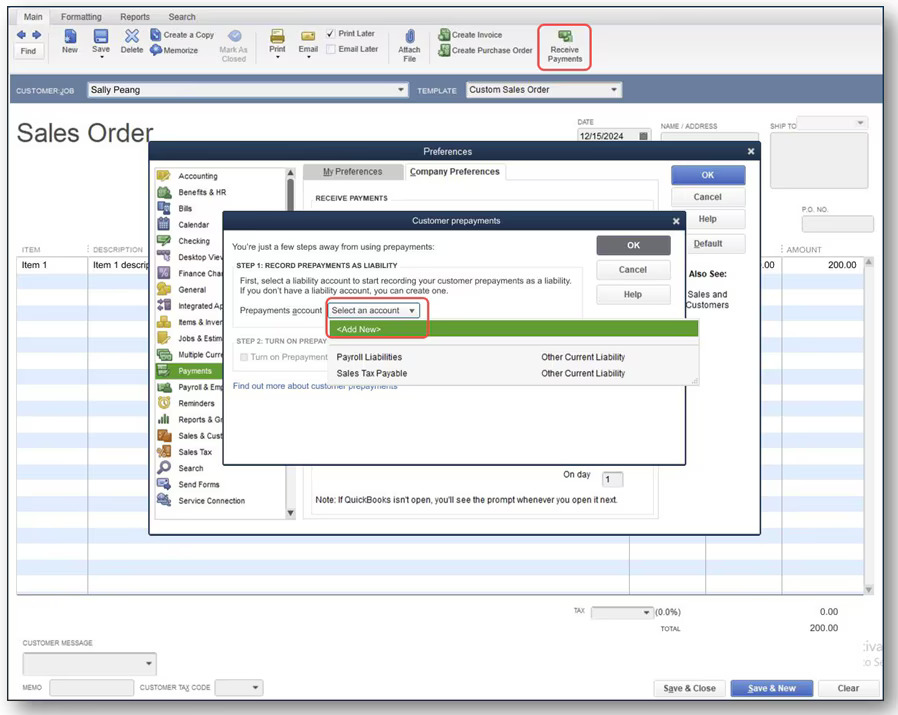

Next up on our list of the best Salesforce alternatives is Microsoft Dynamics 365. This comprehensive CRM and ERP solution provides businesses with sales, marketing, and customer service tools for an all-in-one system.

Microsoft Dynamics features

- Native integrations with other Microsoft products like Office 365 and Teams.

- AI-driven insights for smarter decision-making.

- Robust sales and marketing tools.

- Advanced reporting and analytics capabilities for performance tracking.

- Customizable app modules for a tailored business solution.

- Omnichannel engagement tools to support customer interactions via multiple channels.

- Mobile access enables on-the-go updates and management.

Microsoft Dynamics limitations

- Complex, time-consuming setup process.

- Requires a larger budget than other options on this list.

- Steep learning curve that may require training.

- Reported customization challenges and external integration issues.

- Limited out-of-the-box reporting and analytics.

Microsoft Dynamics pricing

Microsoft Dynamics 365 Business Central offers two core pricing plans:

- Essentials: $70 per user per month.

- Premium: $100 per user per month.

You can also add team members to these packages at $8 per user per month, where they get limited access to read data, make approvals, and create or update select information. The platform also offers a 30-day free trial.

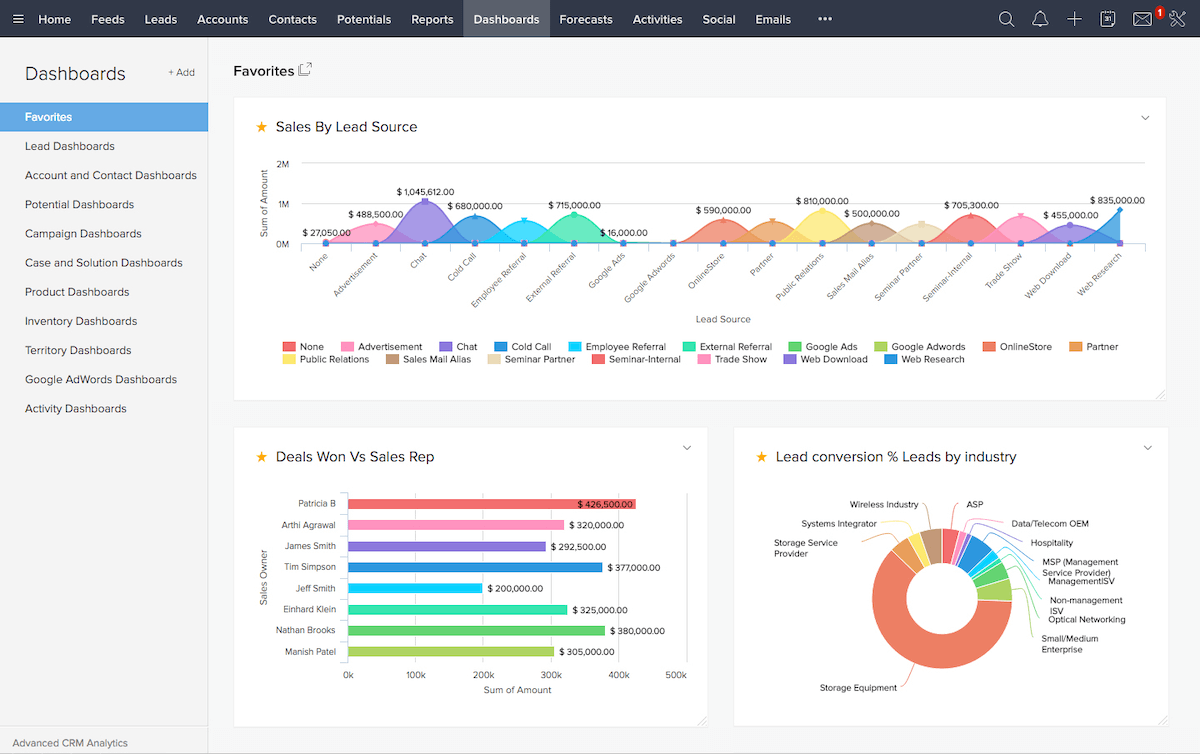

4. Zoho CRM

Image credit: Discover CRM

Zoho CRM is a cost-effective solution tailored for small to medium-sized businesses. Its flexibility positions it as one of the best Salesforce alternatives for businesses looking for an affordable CRM solution.

Zoho features

- Easy-to-use interface with several integrations.

- Customizable dashboards and reports.

- Automation tools to reduce manual admin tasks.

- An AI-driven assistant, Zia, for predictive analytics and lead scoring.

- Collaboration features for team coordination and project management.

- Mobile access for on-the-go management of customer relationships.

Zoho limitations

- Lacks depth in analytics, customization, and automation compared to some competitors.

- Customer support can be inconsistent, leading to varying user experiences.

- May require additional training for users to fully utilize its capabilities.

- Some integrations may incur additional costs or require separate licenses.

- Performance can be affected when handling large volumes of data.

Zoho pricing

Zoho CRM offers a limited free version for up to 3 users, and offers four paid plans:

- Standard: $20 per user per month.

- Professional: $35 per user per month.

- Enterprise: $50 per user per month.

- Ultimate: $65 per user per month.

If you decide to purchase an annual subscription, Zoho also offers a 20-30% discount depending on your plan.

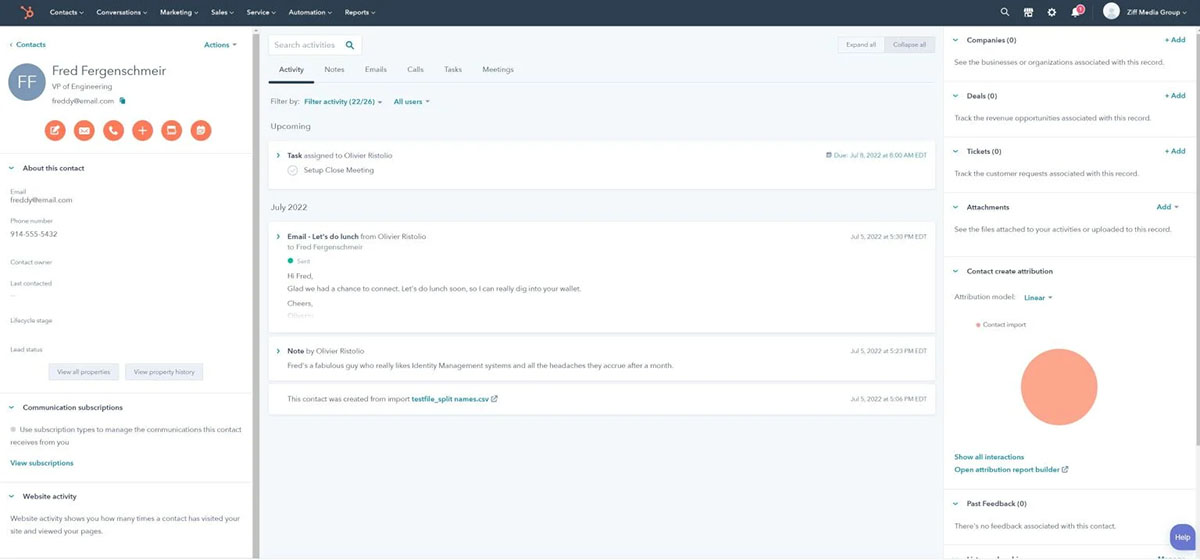

5. HubSpot CRM

Image credit: PCMag

HubSpot CRM is a user-friendly powerful system with an integrated content management system. Users appreciate HubSpot for its various “hubs” that give them the flexibility to select only the hubs they need, ensuring they pay solely for the services they use.

HubSpot CRM features:

- Free plan to start that allows up to 1,000,000 contacts.

- Easy document uploading and access.

- Email tracking and alerts.

- Strong integration capabilities.

- Contact task management.

- Performance metrics and reporting.

HubSpot CRM limitations:

- Free version has very limited features, especially for customization.

- Costs rise quickly as you add more features and “hubs.”

- The pricing model gets confusing for new users.

- Customer support response times can be lengthy.

- Pricing is based on the number of contacts, which is costly for businesses with large contact lists that only need basic features.

HubSpot CRM pricing:

Hubspot offers a free, limited plan for up to 2 users and three core paid plans:

- Starter Customer Platform: $20 per user per month. There is a 25% discount for annual subscriptions.

- Professional Customer Platform: $1,300 per month for up to 5 users. Additional seats start at $45 per month each. There is a slight discount for annual subscriptions.

- Enterprise Customer Platform: Starts at $4,300 per month for up to 7 users. Additional seats start at $75 per month each.

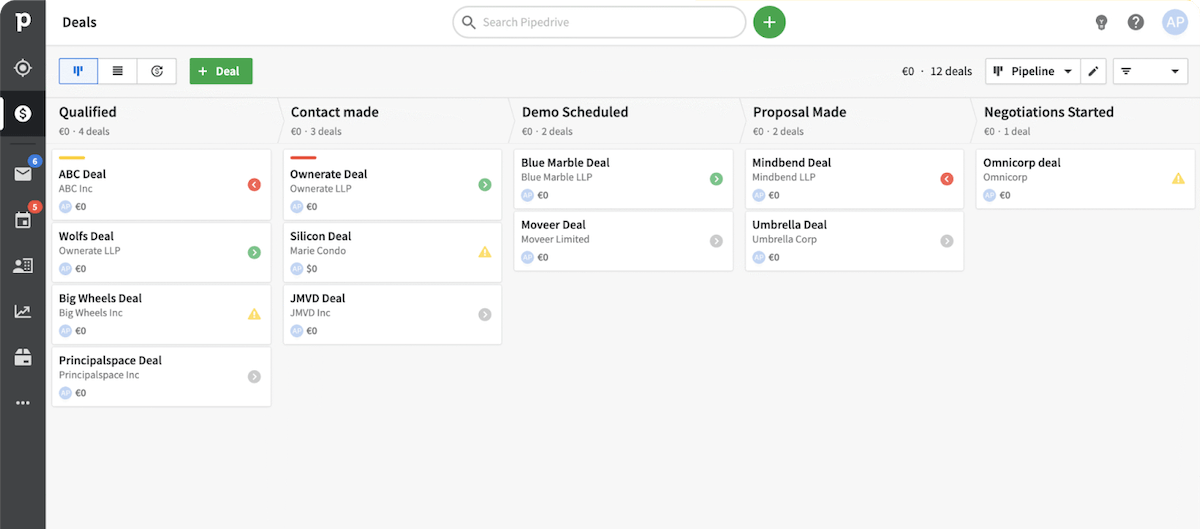

6. Pipedrive

Image credit: Pipedrive

Known for its intuitive interface, Pipedrive offers a sales-focused CRM that helps teams manage leads and deals effectively, cementing its place among the best Salesforce alternatives for smaller businesses.

Pipedrive features

- Visual dashboards for tracking progress.

- Customizable sales pipelines tailored to unique processes.

- Activity-based selling approach to drive deals towards completion.

- Integrations with over 500 applications for enhanced functionality.

- Smart Contact Data for your leads.

- Lead generation tools, including the LeadBooster add-on.

- Mobile app.

Pipedrive limitations:

- Limited customer support tools.

- Basic features may not meet the needs of complex sales processes.

- Pricing escalates quickly with advanced features.

- Some users report that Pipedrive’s customer service is lacking.

- Limited customization options in lower-tier plans.

- Performance issues when handling large volumes of data.

Pipedrive pricing:

Pipedrive offers five pricing plans:

- Essential: $24 per seat per month.

- Advanced: $44 per seat per month.

- Professional: $64 per seat per month.

- Power: $79 per seat per month.

- Enterprise: $129 per seat per month.

Pipedrive offers an annual discount of 18-42% depending on your chosen plan. There is also a free 14-day trial available.

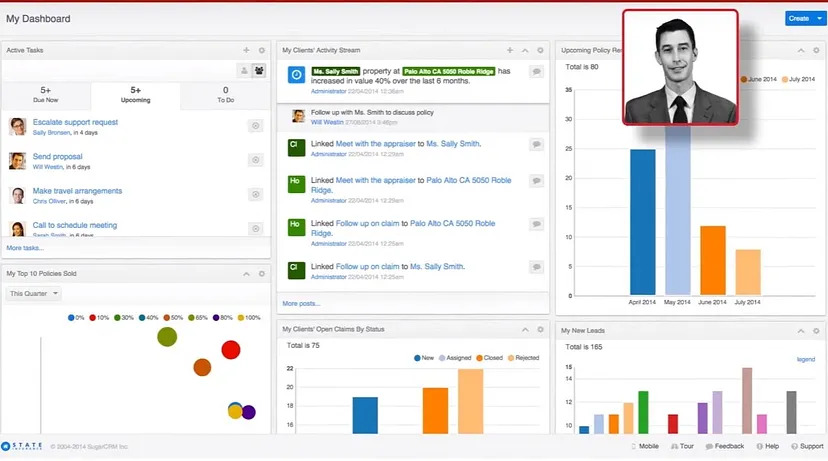

7. SugarCRM

Image credit: Medium

SugarCRM is known for being a flexible platform with extensive customization and integration options. As one of the best Salesforce alternatives, it helps users manage customer relationships while adapting to their specific processes.

SugarCRM features:

- High level of customization.

- Strong focus on sales and marketing automation.

- AI-driven analytics and insights with extensive reports and dashboards.

- Mobile CRM app for on-the-go access.

- Multilingual and multicurrency support.

- Integration with popular third-party applications.

- Some project management features for team collaboration.

SugarCRM limitations:

- User interface and basic functionality can feel outdated.

- High cost and steep learning curve compared to competitors.

- Limited out-of-the-box customer support tools.

- Occasional performance issues with large datasets.

- Inconsistent customer support experiences reported.

- Customization is complex and time-consuming.

SugarCRM pricing:

SugarCRM offers four pricing models:

- Essentials: $19 per user per month, billed annually, with a 3-user minimum and 9-user maximum.

- Standard: $59 per user per month, billed annually, with a 10-user minimum.

- Advanced: $85 per user per month, billed annually, with a 10-user minimum.

- Premier: $135 per user per month, billed annually, with a 10-user minimum.

SugarCRM also offers a 7-day free trial.

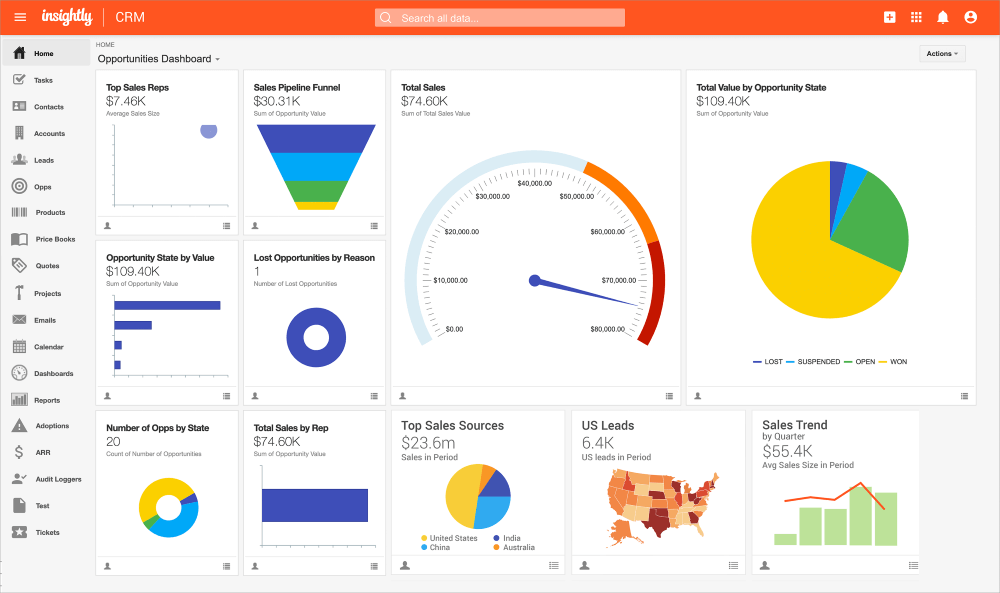

8. Insightly CRM

Image credit: Insightly

Combining project management with CRM capabilities, Insightly is ideal for small-to-midsized businesses that need both customer relationship management and project tracking in one central, user-friendly platform.

Insightly features:

- Project and task management tools built directly into the CRM.

- Customizable fields and layouts for tailored data entry.

- Smooth integration with popular third-party applications.

- Email tracking and communication history for contacts.

- Reporting and analytics tools for performance insights.

- Mobile app for managing projects and contacts on the go.

- Workflow automation for repetitive tasks.

Insightly limitations:

- Lacks more advanced features for complex project management needs.

- Limited customer support options.

- Performance issues when handling extensive data sets.

- Customization options are limited in lower-tier plans.

- Inconsistent user experiences with the mobile app.

- Reporting capabilities are not as robust as those in other CRMs.

Insightly pricing:

Insightly CRM offers three pricing plans:

- Plus: $29 per user per month.

- Professional: $49 per user per month.

- Enterprise: $99 per user per month.

Insightly’s plans are all billed annually. For the Plus and Professional packages, a free 14-day trial is available.

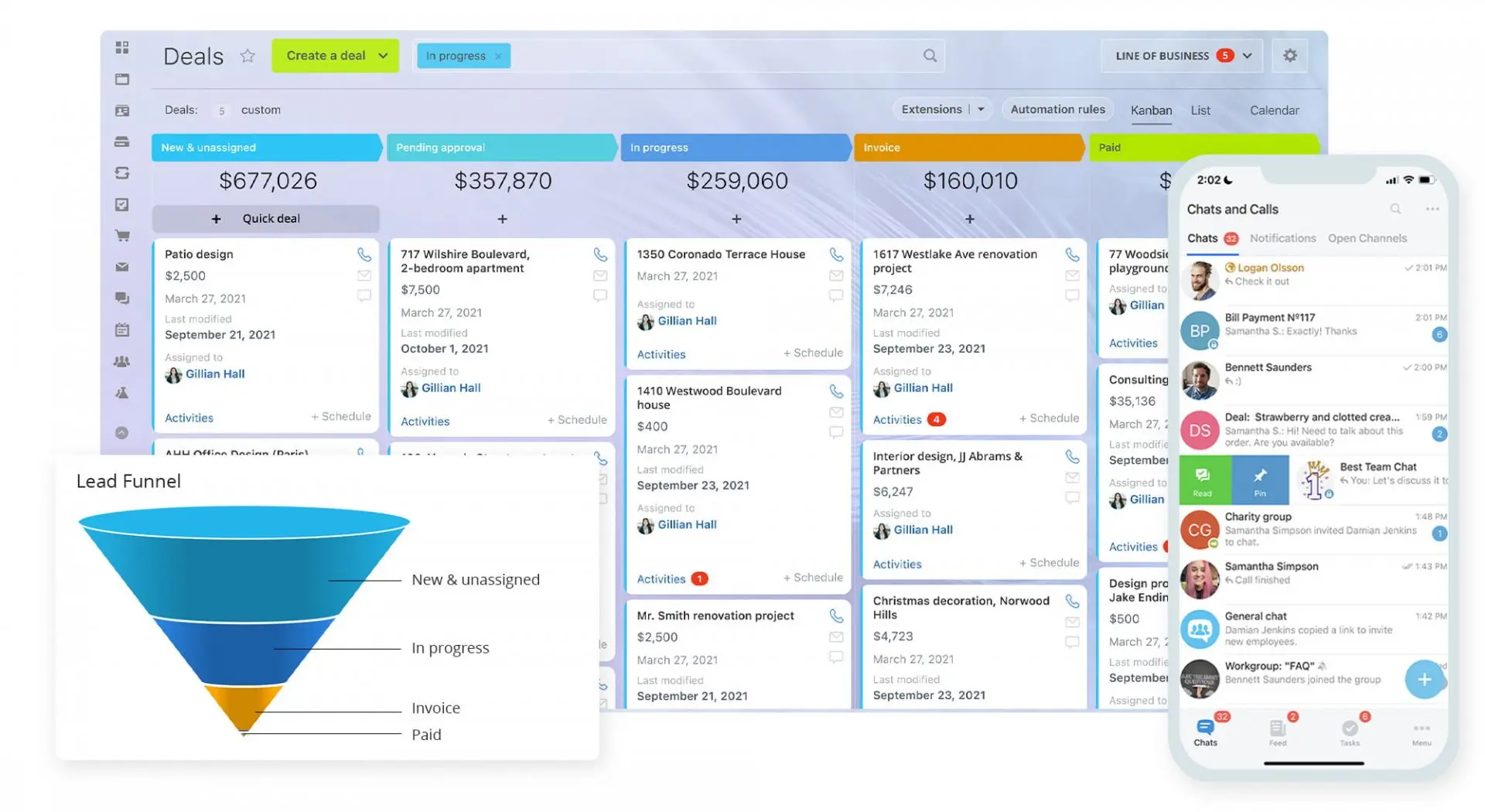

9. Bitrix24

Image credit: Bitrix24

Bitrix24 offers a free or low-cost solution that integrates CRM with collaboration tools. Its affordability and versatility make it one of the best Salesforce alternatives for small businesses looking to drive team productivity.

Bitrix24 features:

- Free version with solid features.

- Built-in collaboration tools like chats and file sharing.

- Strong project and task management capabilities.

- Document management system for storing and sharing files.

- Mobile app.

- Email marketing tools for reaching customers.

- Customizable workflows to automate processes.

Bitrix24 limitations:

- User interface and customization options can be overwhelming.

- Limited integrations with third-party apps.

- Performance issues reported with large teams or data sets.

- Customer support can be slow or inconsistent.

- Limited reporting capabilities.

- Basic functionality may not address your unique business processes.

- Customization options can be complex and time-consuming.

Bitrix24 pricing:

Bitrix24 offers a free basic plan with unlimited users and 5GB of storage. There are four paid plans available:

- Basic: $61 per organization per month, which includes 24GB of storage and 5 users.

- Standard: $124 per organization per month, which includes 100GB of storage and 50 users.

- Professional: $249 per organization per month, which includes 1,024GB of storage and 100 users.

- Enterprise: $499 per organization per month, which includes 3TB of storage and 250 users.

Bitrix24 also offers an annual subscription discount of up to 20%, depending on your chosen plan. A 15-day free trial is available.

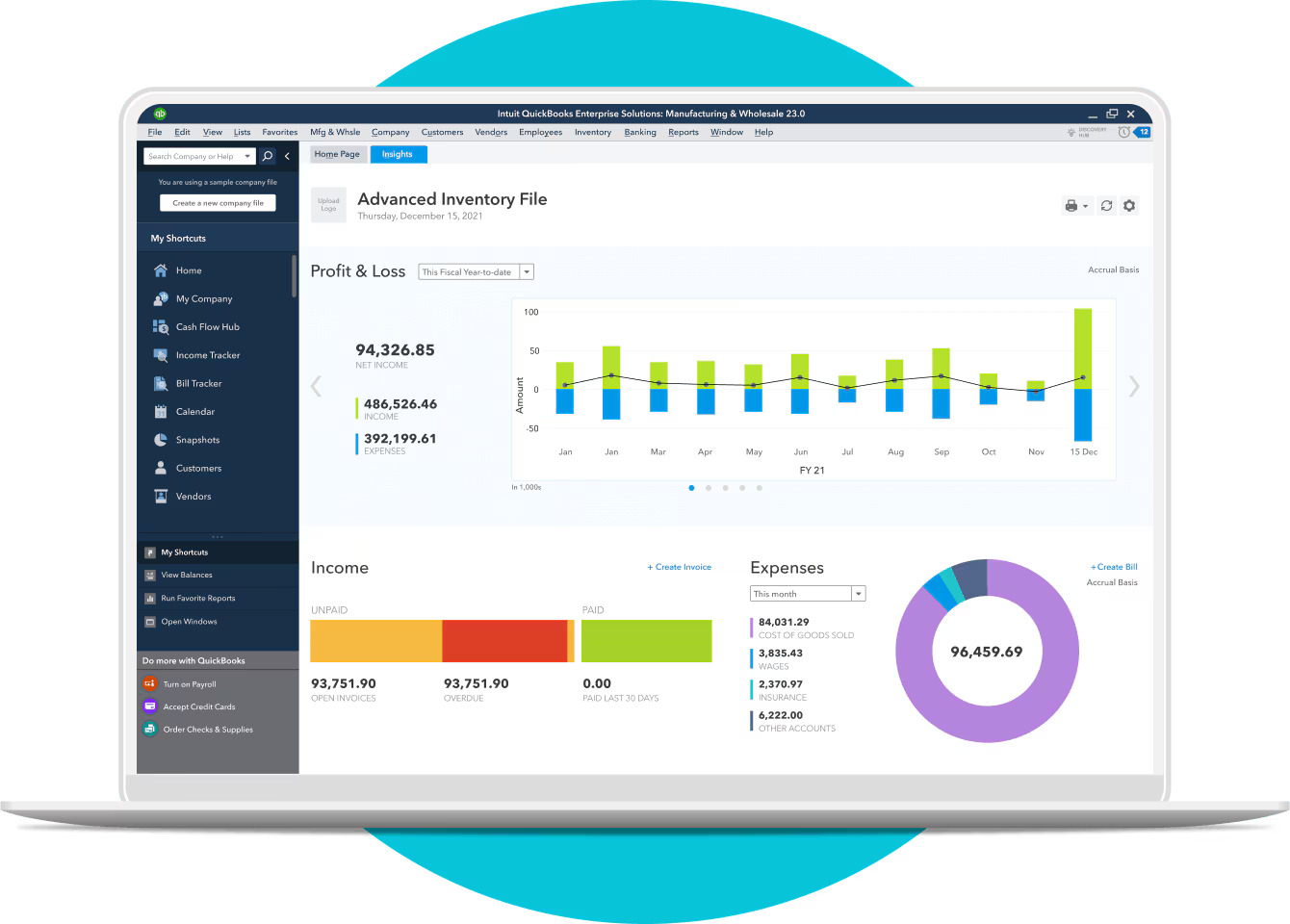

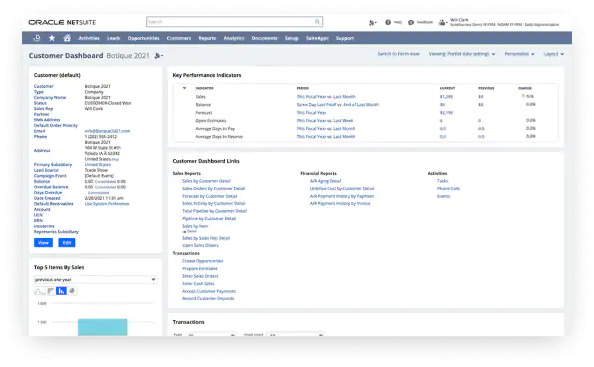

10. Oracle NetSuite CRM

Image credit: NetSuite

Part of the comprehensive NetSuite cloud suite, this CRM solution provides a 360-degree view of customers with integrated ERP functionalities, making it one of the best Salesforce alternatives for larger organizations seeking robust financial and operational management.

Oracle NetSuite features:

- Deep reporting and analytics capabilities.

- Fully integrated with Oracle’s ERP.

- Sales force and marketing automation.

- Customer service management tools for handling support requests.

- Partner relationship management for managing partner interactions.

- Customizable dashboards for personalized insights.

Oracle NetSuite limitations:

- Expensive and complex.

- Requires a dedicated IT team for management.

- Steep learning curve for new users.

- Limited flexibility in lower-tier plans.

- Some features may require additional licensing costs.

- Integration challenges with certain third-party applications.

- User interface can feel cluttered or overwhelming at times.

Oracle NetSuite pricing:

Oracle NetSuite CRM does not have pricing information available on their website. You must contact their sales team to get a quote for your business.

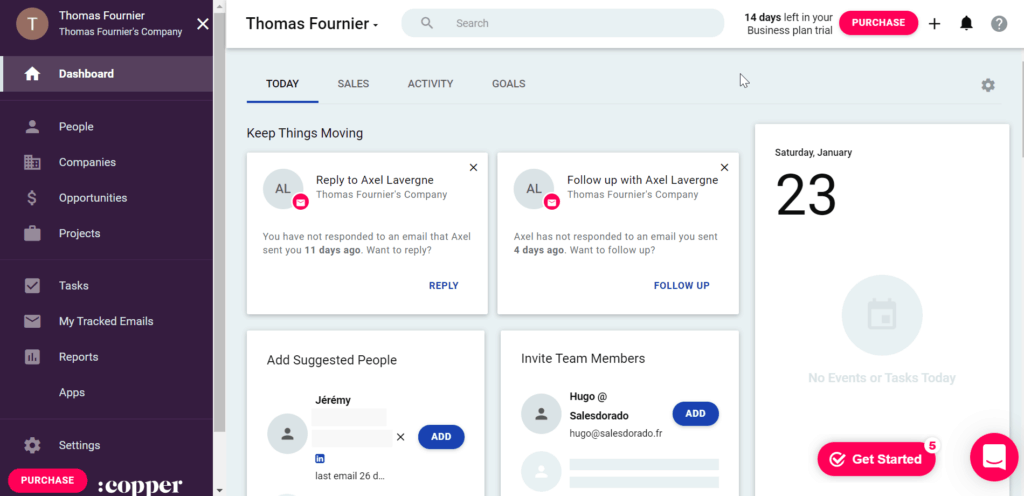

11. Copper

Image credit: Salesdorado

Built specifically for Google Workspace users, Copper is an easy-to-use Salesforce alternative that integrates with Gmail and other Google apps for teams to be able to manage customer relationships directly within their existing workflows.

Copper features:

- Natively integrated with Google Workspace.

- Email tracking for monitoring communications with leads.

- Customizable reporting for tailored insights.

- Mobile app to manage tasks and communications.

- Automatic data capture to reduce manual entry efforts.

- Collaboration and communication tools.

Copper limitations:

- Fewer features compared to larger CRMs.

- Customer support isn’t always responsive.

- Copper is best for Gmail users.

- Learning curve with the user interface and advanced functionalities.

- Limited customization options in lower-tier plans.

- Integration challenges with some non-Google applications.

- Pricing can escalate quickly with additional features or users.

Copper pricing:

Copper offers four pricing plans:

- Starter: $12 per seat per month.

- Basic: $29 per seat per month.

- Professional: $69 per seat per month.

- Business: $134 per seat per month.

If you pay for an annual subscription, you can also get up to 26% off depending on your chosen plan. Copper also offers a 14-day free trial.

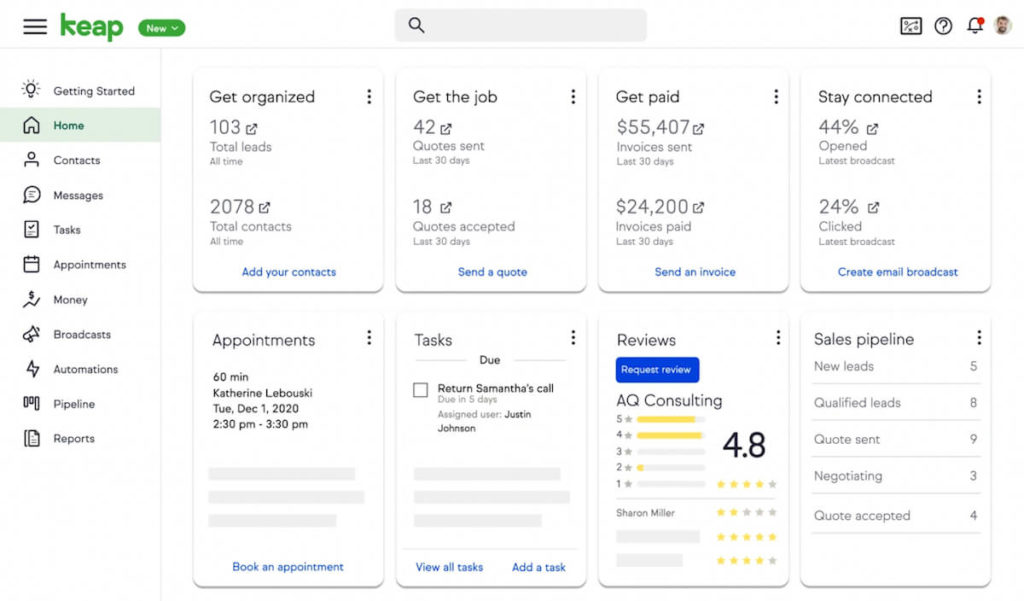

12. Keap

Image credit: Keap

Formerly known as Infusionsoft, Keap combines CRM with marketing automation features tailored for small businesses, helping them manage their sales processes while nurturing leads through targeted campaigns.

Keap features:

- Simple, drag-and-drop workflows.

- Sales pipeline management for tracking deals.

- Automated follow-ups to nurture leads.

- Integration with popular third-party applications.

- Reporting tools for analyzing business performance.

- Mobile app for managing tasks and communications on the go.

- E-commerce capabilities for managing online sales.

Keap limitations:

- Limited customization options.

- Costly if you have many required contacts or users.

- Customer support can be inconsistent or slow to respond.

- Performance issues reported with larger data sets.

- Fewer automation features compared to larger CRMs.

- Integration challenges with certain specialized tools.

Keap pricing:

Keap charges based on your number of required contacts and users. Plans have a minimum of 2 users and 1,500 contacts — pricing starts at $299 per month with a 17% discount if you pay annually.

How to choose the right CRM for you

Out of all these best Salesforce alternatives, here’s how to find the perfect CRM solution for your unique business needs:

- Assess your goals and software requirements.

- Compare features, functionality, and pricing.

- Review customer feedback and case studies.

- Test with free trials or demos.

- Plan for implementation and training.

Wrap-up: Best Salesforce alternatives

No matter your business size or needs, there’s a CRM out there that can work for you. The key is finding one that aligns with your goals, is easy to use, and doesn’t break the bank. Overall, your twelve best Salesforce alternatives are:

- Method CRM.

- Zendesk.

- Microsoft Dynamics 365.

- Zoho CRM.

- HubSpot CRM.

- Pipedrive.

- SugarCRM.

- Insightly.

- Bitrix24.

- Oracle NetSuite CRM.

- Copper.

- Keap.

If you use QuickBooks or Xero, your choice is a no-brainer. Method syncs with your accounting software both ways to keep your financial data secure and your lead and customer data available to everyone who needs it.

Best Salesforce alternatives FAQs

Is CRM software only for large businesses?

No, businesses of all sizes can benefit from a CRM. Many options cater directly to small businesses to help them grow while staying organized.

Is there a better CRM than Salesforce?

“Better” depends on your needs. For some businesses, Method CRM’s customizability or HubSpot’s free plan may be a better fit than Salesforce.

Can small businesses use CRM?

Yes, small businesses benefit greatly from a CRM, especially as they begin to scale. CRM software helps even the smallest organizations manage customer relationships efficiently.

What are the benefits of a CRM?

A CRM system provides several benefits, including better customer service, increased sales, greater customer retention, detailed analytics, and enhanced team productivity and efficiency.