Ever wondered, ‘How much does CRM cost?’ You’re not alone. In the quest to enhance customer relationships and boost sales efficiency, businesses of all sizes turn to Customer Relationship Management (CRM) systems.

But with varying features, features and functionalities, the cost of CRM solutions is diverse. This guide breaks down different CRM pricing, revealing the factors that influence cost. Whether you’re a small business or a multinational corporation, understanding CRM costs is crucial for making an investment that aligns with your goals and budget.

What is a CRM?

Before answering the question “How much does CRM cost?” it’s important to define what a CRM is. A CRM (customer relationship management) system is a tool that helps you manage, analyze, and improve your interactions with:

- Leads.

- New customers.

- Loyal clients.

By consolidating customer information and documenting interactions, a CRM system simplifies sales, marketing, and customer service efforts to make it an essential component for modern business operations.

How much does CRM cost?

A common question among business owners is “How much does CRM cost?” The answer is it depends. CRM costs vary significantly based on several factors, including:

- Features.

- Functionality.

- Deployment.

From subscription models to licensing models, the pricing of CRM solutions is diverse. It caters to a wide range of budgets and business sizes. One-time vs. recurring fees also play a crucial role in determining your overall cost.

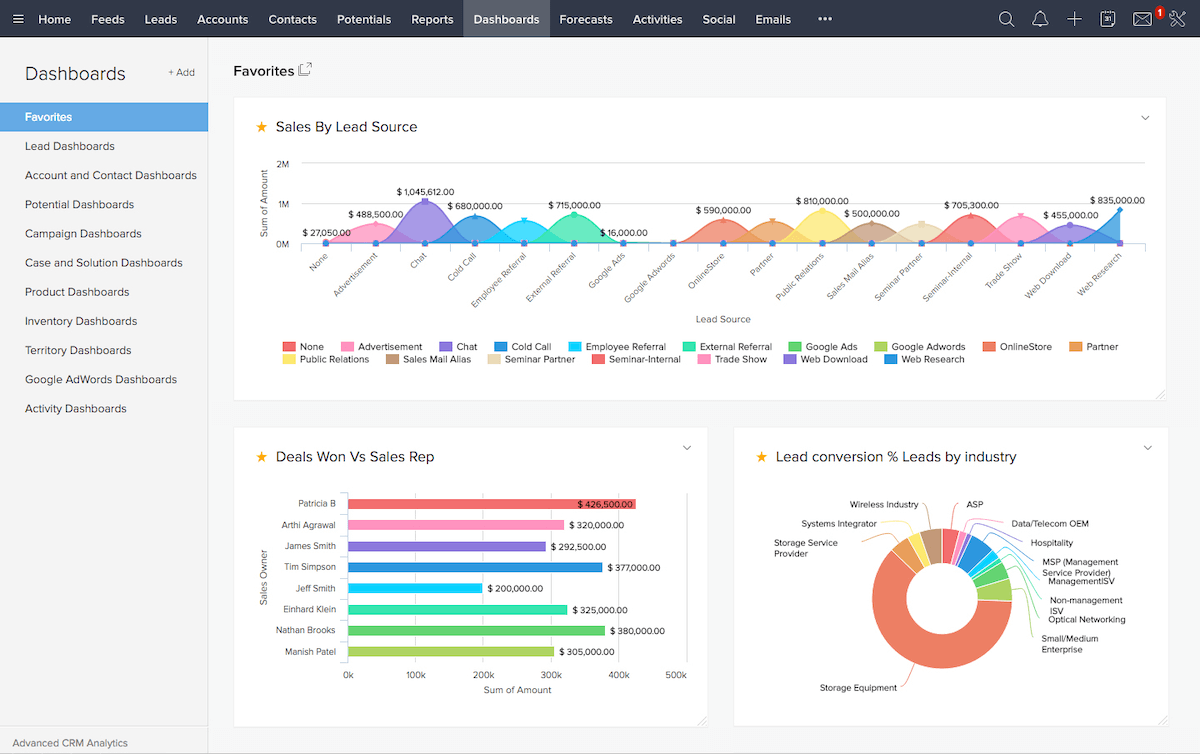

Why use a CRM?

Using a CRM saves companies money in the long run by helping you:

- Enhance customer relationships.

- Improve sales efficiency.

- Provide valuable insights through analytics and dashboards.

It’s a strategic investment that helps you better understand and serve your customers. Despite the upfront costs, CRMs offer a clear return on investment (ROI) over time.

CRM pricing plans for different needs

Team size and usage volume

A CRM provider often calculates costs based on active users. Plans range from basic options for small teams of people to comprehensive enterprise solutions for larger organizations. Bigger companies typically require a higher number of features and a large number of contacts.

Note that some providers choose a pricing model that affords small businesses a discounted rate, so keep an eye out for deals like that.

Basic functionality vs. advanced features

CRM systems offer a range of features, from basic contact management to advanced AI and analytics. A CRM provider typically increases its cost with added functionalities and values its premium features at a higher rate. For example, a typical CRM provider includes certain features in the base price and excludes advanced analytics from the basic plan.

Some companies provide personalized quotes that factor in everything from customization costs to mobile access charges. A quote also assesses additional fees for premium support. This way, the CRM company effectively negotiates pricing for large enterprises to account for the money it spends on R&D to enhance features and more. After all, covering overhead costs is the only way to stay profitable.

Wide range of plans with varying price points

CRM solutions like Salesforce, HubSpot, Freshsales, SugarCRM, and Microsoft Dynamics offer a variety of plans, each with different price points and features, to ensure there’s an option for every business need. They generally follow a subscription plan model, which either costs a specific amount monthly or charges annually based on features.

It’s also common that a CRM includes custom plans for on-premise vs. cloud-based pricing. Finally, you may come across a company that quotes different prices for different regions. Make sure to look into every factor when making your decision.

Hidden costs and additional fees to watch out for

It’s common for companies to make a budget for their CRM expenses that excludes additional fees. However, it’s important to be aware of all the hidden costs, such as:

- Storage costs.

- Customization costs.

- Data migration fees.

Before choosing a CRM, you may want to check whether it requires additional fees for extra integrations, as these significantly impact your overall budget.

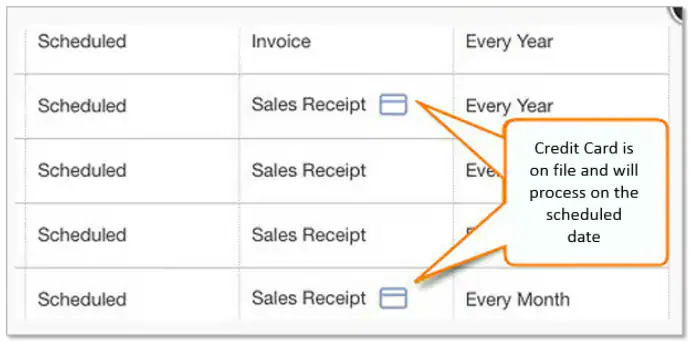

Some CRMs also offer a free trial, but watch out for the end of the trial date, as you may incur an unexpected charge. Not to mention, there may be cancellation fees if you try a software and decide not to continue using it.

Lastly, you may come across a CRM that updates its pricing model periodically or evaluates its pricing annually. If the charges are unreasonable, then it’s worth informing the company, as it’s common that a provider sets its price based on customer feedback. Make sure you look at the most up-to-date pricing information when making your decision.

Software costs vs. other expenses associated with using a CRM

So, how much does CRM cost when factoring in additional expenses? Apart from the software cost, you should also consider:

- Training and support fees.

- Setup and implementation costs.

- Ongoing maintenance expenses.

Average cost of a CRM plan per user per month

The average cost of a CRM plan per user per month ranges based on the complexity and scope of the solution.

Basic plans start as low as $10 per user (or even free), while some systems with extensive features exceed $100 per user. It’s important to consider both the immediate and long-term financial implications of the plan you choose to ensure it aligns with your budget and business growth plans.

What other costs will you pay when implementing a CRM?

CRM training

Ensure that your company allocates funds for training and onboarding so your team can effectively use the CRM. This cost varies depending on the size of the company and complexity of the system.

Overall, quality training reduces the risk of implementation failure and enhances efficiency. So, it’s essential to maximize the return on your CRM investment.

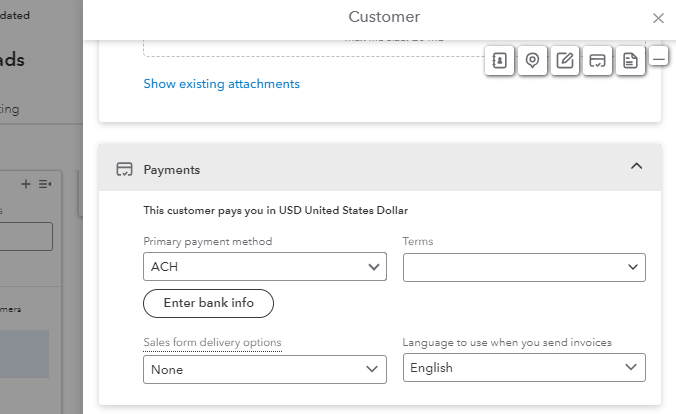

CRM data migration

You incur data migration fees when transferring existing customer data into a new CRM software. This process can be complex depending on the volume and format of the existing data. So, make sure you account for this expense when asking how much does CRM cost for your business.

Consider the costs for technical expertise and the tools you’ll need to ensure a smooth and secure transfer of sensitive customer information.

CRM configuration and set-up costs

Initial setup and configuration costs are significant, especially for complex systems that need extensive customization. These costs cover the initial implementation, including:

- System configuration to match your business processes.

- User setup and permissions.

- Integrating your CRM with your existing infrastructure.

CRM add-ons

Add-on modules enhance the functionality of your CRM, but come at an additional cost. Some examples include:

- Advanced analytics.

- Marketing automation tools.

- Enhanced customer service features.

Carefully assess which add-ons you need to avoid unnecessary expenses.

CRM customizations

Customization costs are associated with tailoring your CRM to meet specific business needs. This might involve:

- Developing unique features.

- Modifying existing functionalities.

- Designing and automating workflows.

As always, remember that customizations increase your CRM’s effectiveness, but also add to your overall cost.

CRM integrations

If your company invests in other tools to supplement your system, third-party app integration charges may apply. So, when connecting the CRM with other software products or systems within your business, make sure you stay within your budget.

These integrations are essential for creating a cohesive technological ecosystem, but they often involve additional costs for:

- Development.

- Testing.

- Maintenance.

What factors impact CRM costs

The cost of a CRM system often varies depending on the types of features required and the compatibility with existing software.

Existing software and required CRM features

If your current systems require extensive modification to work with the new CRM, or if you need advanced features like AI-based analytics, the price will be higher.

It’s crucial to conduct a thorough analysis of your current technology stack and identify the must-have features to ensure you choose a CRM that aligns with both your technical requirements and budget.

Number of users

User-based pricing means the prices vary based on user count and the cost increases with the number of users accessing the system. This pricing model is common in CRM solutions, making it crucial to accurately assess how many of your team members will need access to the system.

Consider your current staff size and potential future growth, as expanding your user base later can increase costs.

CRM integrations and customizations

Integrations and customizations can significantly increase the overall cost of a CRM solution. The more you need your CRM to integrate with other tools (like email marketing software or customer support platforms), the higher the cost may be.

Similarly, customizations that tailor the CRM to your unique requirements can add to the expense. It’s important to weigh the benefits of these customizations and integrations against their cost to ensure they contribute to a tangible ROI.

How to choose the right CRM

Define your CRM requirements

Understanding your business needs and customer management requirements is the first step in selecting the right CRM. For example, is your focus on generating leads? Or do you need a powerful mobile app for access on the go? It’s important to drill down your exact requirements so that you get the best value for your money.

Consider things like:

- Your team’s size.

- The scale of your customer base.

- The complexity of your sales processes.

Considering these factors is the first step in figuring out how much does CRM cost.

Make a list of essential features you will need

Next, identify and make lists of the tools and functions that your business requires, such as contact management, automation, analytics and reliable customer support.

Don’t forget to factor in scalability, integration capabilities with existing systems, and the ease of adding new features or modules in the future. This step ensures that the CRM can grow and adapt with your business.

Consider hidden costs

Ever wondered how much does CRM cost when you take hidden costs into account? Make sure to think about potential costs like integration fees and customization costs when choosing a CRM.

Other areas include additional licenses, data migration, and any other unforeseen expenses that could arise. Being aware of these costs upfront can help prevent budget overruns.

Factor in support and maintenance costs

It’s essential that your CRM budgets for regular updates and support. These maintenance costs are vital for the long-term success of your CRM deployment. Ensure that the vendor offers comprehensive support and maintenance plans that cover:

- Software updates.

- Technical support.

- Security enhancements.

Try demos and free trials

Some CRM providers offer a risk-free way to evaluate a CRM’s usability and functionality. This lets you:

- Test the software in real-world scenarios.

- Understand how it integrates with your existing workflows.

- Identify any potential issues or limitations before making a purchase decision.

Prioritize user experience

A CRM with an intuitive user interface ensures higher adoption rates and user satisfaction. So look for one that offers a user-friendly design, easy navigation, and customizable dashboards. A positive user experience also ensures you don’t need to invest in extensive training.

CRM pricing comparison guide

This section of the blog compares and evaluates the top CRM options. Here you’ll be able to answer the question “how much does CRM cost” when it comes to specific software.

Method CRM pricing

Method CRM offers three subscription plans:

- Contact Management: $25 per user per month.

- CRM Pro: $44 per user per month.

- CRM Enterprise: $74 per user per month.

Each plan offers varying functionalities and capabilities, depending on the stage your business is in and its unique needs. Method also offers a free trial with no credit card required.

Salesforce pricing

Image credit: Salesforce

Salesforce determines its price based on market demand, which reflects their position as a high-value provider.

It’s available in three different plans:

- Essentials: $25 per user per month.

- Professional: $80 per user per month.

- Lightning Enterprise: $165 per user per month.

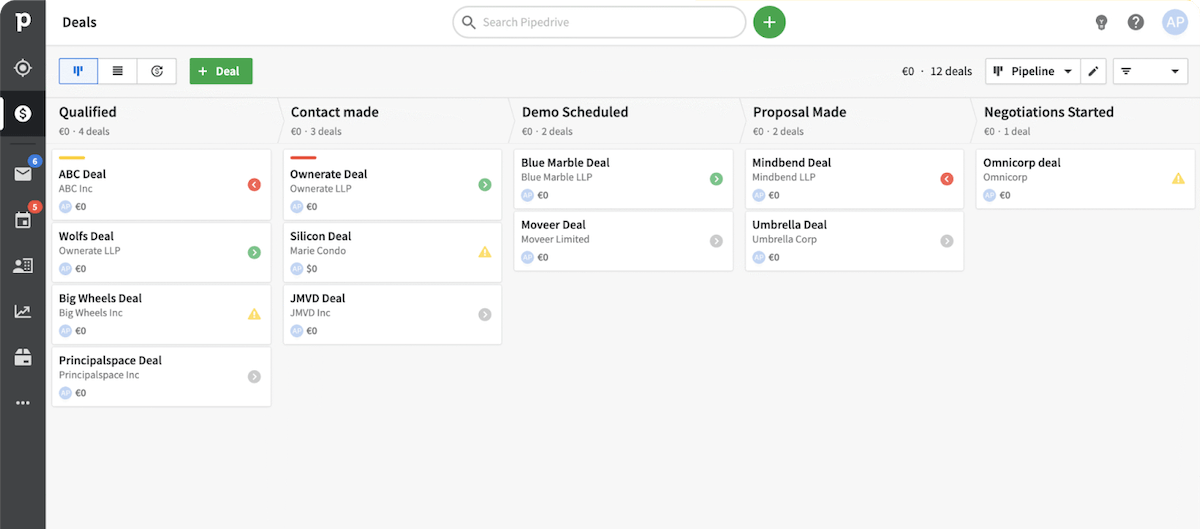

Pipedrive pricing

Image credit: Pipedrive

Pipedrive offers a range of pricing plans that all emphasize sales-focused features, but have varying levels of functionality. Pipedrive has five pricing plans available:

- Essential: $14.90 per user per month.

- Advanced: $24.90 per user per month.

- Professional: $49.90 per user per month.

- Power: $64.00 per user per month.

Enterprise: $99.00 per user per month.

Nutshell pricing

Image credit: Nutshell

Nutshell also compares favorably with other CRM solutions and lists its pricing transparently on its website. Its pricing structure caters to businesses seeking advanced features, with each plan designed to meet diverse business needs and scalability requirements.

Here are its pricing plans:

- Foundation: $19 per user per month.

- Pro: $49 per user per month.

- Power AI: $59 per user per month.

- Enterprise: $79 per user per month.

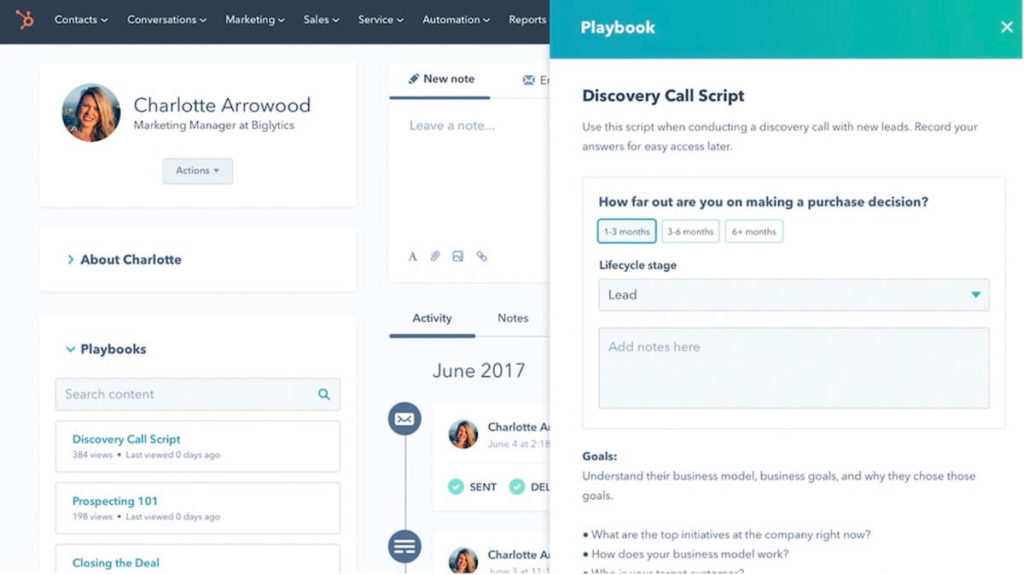

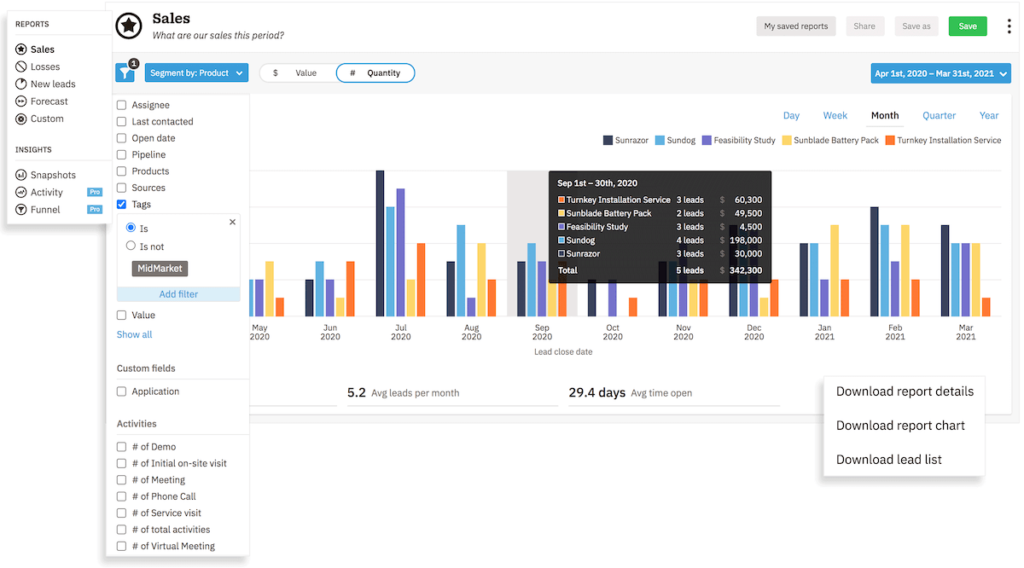

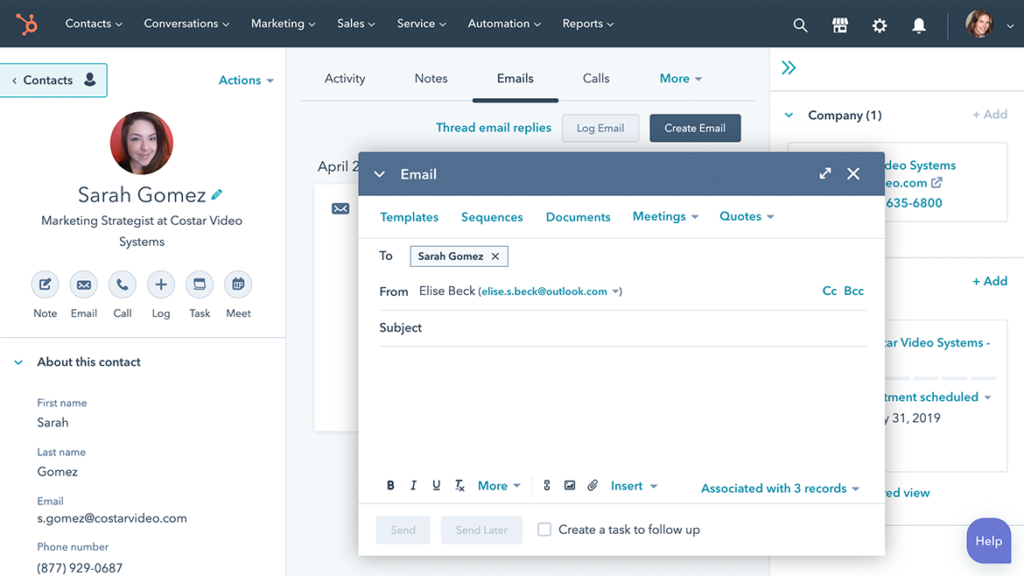

HubSpot CRM pricing

Image credit: HubSpot

HubSpot determines your cost based on individual bundles or “hubs” you purchase. This depends on how many business tools you need. Remember to ask, “How much does CRM cost, including the add-on modules cost?” before you invest, as the final cost quickly adds up.

HubSpot’s Starter plan begins at $20 per month, but its Professional plan jumps to $1600 per month. If you’re looking for an Enterprise plan, costs start at $5,000 a month.

Individual hubs include:

- CRM.

- Sales.

- Marketing.

Note that HubSpot CRM is recognized for its versatility and discounts its services for non-profits. This discount lets non-profits leverage advanced CRM tools for better stakeholder engagement and operational efficiency, which is often challenging with limited budgets.

Wrap-up

In conclusion, navigating CRM pricing can be daunting, but understanding the nuances is key to making an informed decision. While options like Salesforce, Pipedrive, Nutshell, and HubSpot cater to various needs and budgets, Method stands out as a compelling choice. Its flexible subscription plans, ranging from essential contact management to comprehensive enterprise solutions, are designed to grow with your business. Coupled with its user-friendly interface and customizable features, Method offers a perfect blend of functionality and affordability.

Frequently Asked Questions

How much should I budget for CRM?

CRM pricing ranges from basic to enterprise pricing and varies widely depending on other factors. So, there is not one answer to, “How much does CRM cost?”

You want your budgeting estimates to be within a certain range that assesses:

- Software costs.

- Additional fees.

- Ongoing expenses like support and updates.

Also, look for potential CRM deals or discounts. It’s not unusual that a company decreases its price during promotional periods, so you’ll want to watch out for that as well.

Is CRM free to use?

You may come across a CRM provider that offers free web versions with limited features, which is suitable for small businesses or those just starting with CRM. You may also come across a company that offers discounts for longer commitments.

However, note that with CRM software, you get what you pay for. The best solutions come with a cost, but save you time and money in the long run.

How much do companies spend on CRM?

How much a company allocates to CRM depends on various factors. When asking, “How much does CRM cost a company?” it’s important to consider aspects like:

- Company size.

- Needs.

- Values.

- The solution’s complexity.

Ready to find your confidence in the chaos? Start your free trial with Method.

Image credit: goodluz via Adobe Stock