Simplifying your payment processes is crucial to maintaining your company’s financial health and a stable cash flow. To do this, you need to be able to process as many payment types as possible, including:

- Debit card payments.

- Credit card payments.

- Direct deposit.

- ACH transactions.

In this blog article, you’ll learn all about how the QuickBooks software processes online ACH payments, from dealing with individual sales receipts and online invoices to setting up recurring payments.

Follow these quick steps to learn how to set up ACH payments in QuickBooks Online and enhance your business’s financial operations.

Let’s get started!

What is an ACH (Automated Clearing House) payment?

ACH payments are electronic payments made directly between banks through the Automated Clearing House network. It’s a popular form of payment to transfer money without using:

- Paper checks.

- Wire transfers.

- Cash.

This method works for business-to-business (B2B) and business-to-consumer (B2C) transactions, such as vendor payments.

How to process ACH payments in QuickBooks Online

Here’s how to process ACH payments in QuickBooks Online:

Process a sales receipt or invoice

Image credit: Intuit QuickBooks

You can process payments using bank transfer for new invoices or sales receipts and for recurring sales receipts.

Here’s how:

- Click on “+ New.”

- Choose either “Receive Payment” (for an invoice) or “Sales Receipt” (for a sales receipt).

- In the “Customer” drop-down menu, pick the customer’s name.

- In the “Payment method” drop-down menu, choose either “Check” or “QuickBooks Payment – Bank.”

How to set up recurring ACH payments in QuickBooks

You can also set up recurring ACH payments in case you need to schedule payment or automate transactions by following these steps:

- In your settings (gear icon), select “Recurring Transactions.”

- Go to “New” and choose “Sales Receipt” for the “Transaction Type.”

- Enter a name in the “Template Name” field and choose “Scheduled” as the “Type.”

- Select “ACH” for the “Payment Method.”

- Fill out the other required details following the onscreen steps and click “Save Template.”

Make sure you’ve set up members as customers.

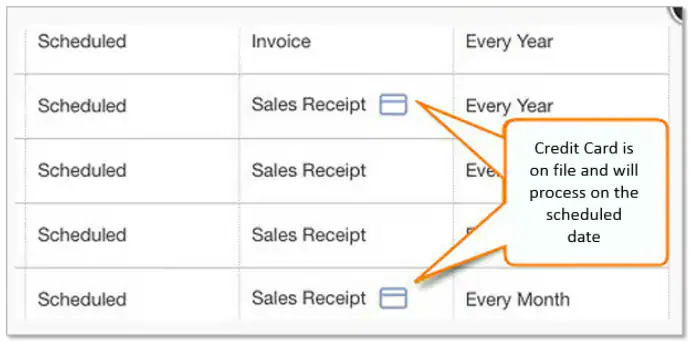

How to process recurring sales receipts in QuickBooks

Image credit: Intuit QuickBooks

Once you schedule ongoing ACH payments, you’ll receive the funds every period, provided your customer has sufficient funds in their bank account.

Here’s how you set them up:

- Navigate to “Settings” or click the gear icon, then select “Recurring Transactions”.

- Locate the recurring sales receipt for your customer and click “Edit.”

- In the “Payment method” drop-down list, select “Check” or “Credit card type”

If you need to update a recurring sales receipt, click “Save template” to keep the customer’s payment details.

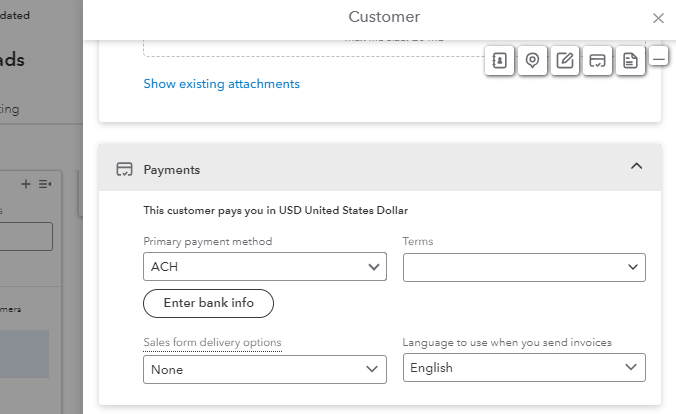

Enter customer’s banking details

- Click on “Enter Bank info.”

- Input your customer’s:

- Name

- Account type

- Account number

- Routing number

- Choose “Use this account information in the future,” and you’re done! You’ll automatically receive your customer payments when they’re due.

Get authorization from the customer

Before saving any details, ensure you have your customer’s consent. Print an ACH authorization form and have the customer complete and sign it.

QuickBooks automatically generates this form based on the details you just entered. You can easily download and reupload it once your customer has signed.

Process the payment

- On the transaction form, tick the checkbox beside “I have authorization and would like to process this transaction.”

- Review the transaction, then click “Save and send.”

- Modify the email message to your customer if necessary, then select “Send and close.”

That’s it! Now you know how to set up ACH payments in QuickBooks Online.

What are the types of ACH payments?

There are two types of ACH payments — you can think of them as “pulls” and “pushes.”

ACH debit (pull)

An ACH debit is a type of ACH payment that pulls funds electronically from a bank account. In QuickBooks Online, businesses commonly use this method to collect bank payment from clients.

ACH credit (push)

An ACH credit is the opposite of an ACH debit. Here, you push funds from your bank account to another account. You can use this method to:

An ACH credit is the opposite of an ACH debit. Here, you push funds from your bank account to another account. You can use this method to:

- Make refunds.

- Pay employees.

- Settle vendor invoices.

How long does it take to process ACH payments in QuickBooks Online?

ACH deposits take between two and seven business days. Recurrent ACH payments take less time after the first transaction with an account.

Save time with the best QuickBooks payment processing integration

QuickBooks helps you with online payments and accounting processes. Method CRM helps you grow your business and get new customers. Together, they make an unstoppable team.

Method’s powerful integration with QuickBooks ensures you manage your business from end to end. It makes it easier to convert prospects into clients and make the most of every sales opportunity. Method offers:

- A reliable, two-way sync with QuickBooks to keep your customers’ payment info up to date and accessible.

- Invoice automation and direct payment collection across several channels.

- Customer management to track all client interactions and improve communication.

Process ACH payments QuickBooks Online: FAQs

Are there fees associated with the QuickBooks Online ACH payment process?

QuickBooks charges a 1% processing fee for every ACH transaction. QuickBooks deducts this transaction fee immediately after funds reach your account. You may also get a notification to your email address about other fees, which QuickBooks deducts on the fifth business day of next month.

What is the difference between EFT vs. ACH?

EFT stands for electronic funds transfer and is a broader term for all digital payments. ACH is a specific type of EFT that is run between financial institutions through the Automated Clearing House network.

Does QuickBooks Online allow split ACH payments?

Yes, QuickBooks Online can handle split ACH payments, which lets you divide payment between different accounts. You can see your split payments under “Transaction List with Splits” in the “Reports” tab.

See how you can extend the limits of QuickBooks with Method.

Image credit: Credit Commerce via Pixabay