Running a small business comes with challenges for business owners. Whether it’s finding clients, structuring processes, or analyzing the market, these responsibilities can take up all your time.

This is why automating your day-to-day business processes is key to lowering additional costs and mastering your accounting functions.

When considering implementing an accounting software solution, NetSuite and QuickBooks are two popular choices. They let you:

- Automate your workflows.

- Handle vendor management.

- Keep inventory levels high.

- Boost supply chain management.

- Manage complex accounting processes.

- Create accurate financial statements.

In this blog, you’ll break down the NetSuite pricing vs. QuickBooks pricing models to make an informed choice.

QuickBooks vs. NetSuite cost

Your NetSuite vs. QuickBooks cost is defined by the functionalities you use. More features come at a price, so using software that suits your needs without exceeding or underserving them is important.

Thankfully, QuickBooks has several versions, including QuickBooks Online Advanced, QuickBooks Desktop Enterprise, and several more. Keep reading for a detailed pricing breakdown with a few of your options when looking at NetSuite pricing vs. QuickBooks cost.

Overview of QuickBooks

This is one of the most popular options for accounting software. It’s renowned for its user-friendly interface and handy set of features. It offers two main options: QuickBooks Online and QuickBooks Enterprise.

Who is QuickBooks best for?

QuickBooks is best for growing businesses that need an easy-to-implement system that will simplify and speed up their processes. It’s a budget-friendly option that lets you expand its capabilities with accessible, third-party apps, such as Method CRM.

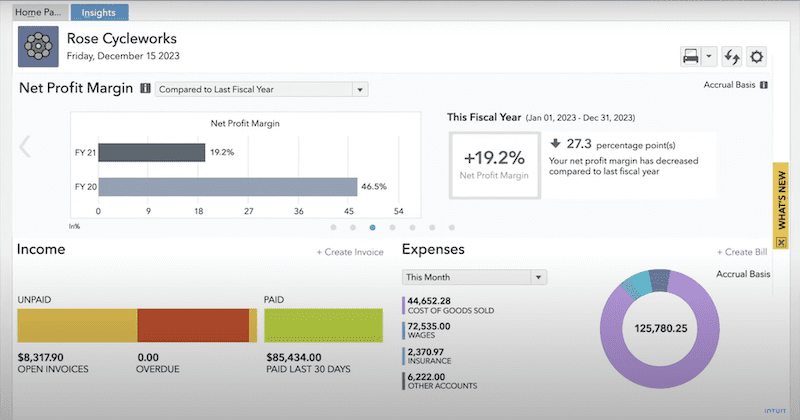

QuickBooks Online

Image credit: Intuit QuickBooks

QuickBooks Online is a cloud-based solution, which means it’s accessible from anywhere with an internet connection. This convenience is a game-changer for businesses that need flexibility and to collaborate with remote teams. Its key features include:

- Tax management.

- Customizable dashboards, financial reports, and analytics.

- Income and expense tracking.

- Multiple payment methods.

- Payroll automation.

QuickBooks Enterprise

Image credit: Intuit QuickBooks

QuickBooks Enterprise is designed for larger businesses with more established processes. Its pricing is tiered and includes a wide range of features, such as:

- Advanced inventory management capabilities.

- Specific user permissions.

- Multi-factor product cost calculations.

- Automated payment reminders.

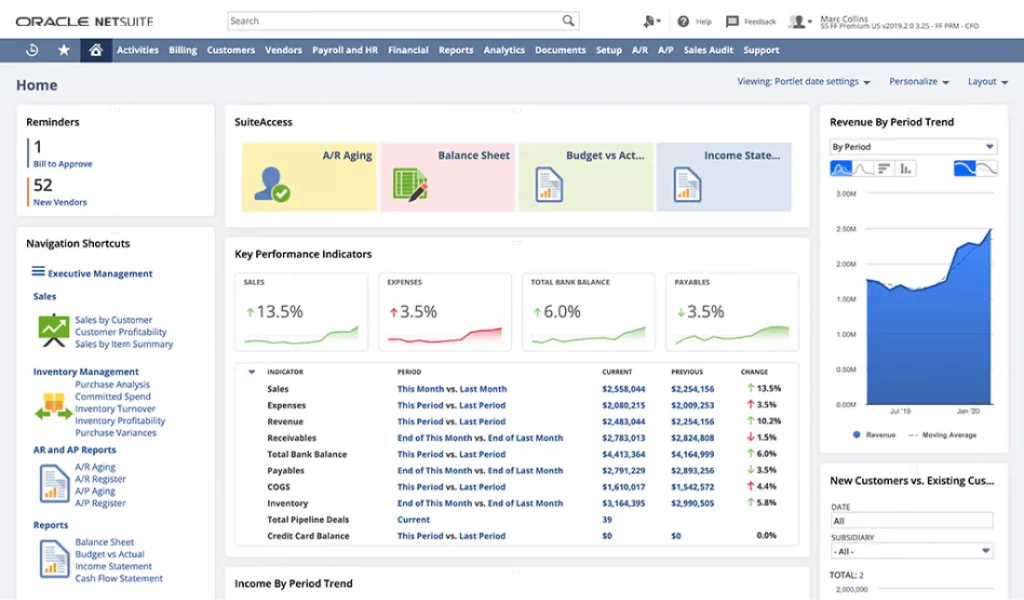

Overview of Oracle NetSuite

Image credit: Oracle NetSuite

NetSuite is a robust, cloud-based enterprise resource planning (ERP) system with advanced features. The platform offers:

- Advanced reporting.

- Cash flow management.

- Balance sheets.

- Asset management.

- Cost tracking.

- Time tracking.

Who is NetSuite best for?

NetSuite is best for large businesses with multi-step processes. Along with SAP, NetSuite is one of the most important business software providers for enterprises. It’s most convenient when a company plans on managing all its processes through one system.

Which is cheaper, NetSuite or QuickBooks?

Let’s explore NetSuite pricing vs. QuickBooks a little bit deeper. In most cases, QuickBooks is more affordable than NetSuite, since it’s made for growing businesses.

NetSuite vs. QuickBooks cost

Both systems’ prices are calculated based on the modules and the amount of users included. Each version suits different needs and budgets:

| QuickBooks Enterprise | QuickBooks Online Advanced | NetSuite | |

|---|---|---|---|

| Price | Starts at $480 monthly | Starts at $160 monthly | Starts at $999 monthly |

| Free Trial | Yes | Yes | No |

| Online or On-premise | On-Premise | Online | Online |

| Integration capabilities | A wide range of third-party apps | A wide range of third-party apps | Other Netsuite solutions |

| Scalable | Yes | Yes | Yes |

NetSuite pricing

NetSuite pricing involves a customized quote based on your business’ specific needs. This flexibility ensures you only pay for the features you require. However, it’s essential to note that NetSuite is more expensive than QuickBooks.

When subscribing to NetSuite’s accounting software, you pay an annual license and a one-time implementation fee. After that, your price per month depends on the:

- Core platform you buy.

- Optional modules.

- Number of users.

NetSuite trial

NetSuite doesn’t offer a trial period for new users. But you can take a product tour to get an idea of how it works before you decide.

QuickBooks Online pricing

QuickBooks Online pricing is subscription-based, with various plans available depending on your needs. The cost ranges from $35 per month to $235 per month for more advanced services. This price includes a fixed number of users, but you can increase it if needed.

QuickBooks Online trial

QuickBooks also offers a 30-day free trial period for its Online version. This lets you test the platform before you make a financial commitment.

Get started with QuickBooks Online here.

QuickBooks Enterprise pricing

QuickBooks Enterprise’s pricing is higher than the Online version due to its more extensive feature set. The cost starts at around $1,992.50 per year and increases based on your number of users and the required features.

QuickBooks Enterprise trial

Like QuickBooks Online, QuickBooks Enterprise provides a 30-day trial period to help you evaluate if it fits your business correctly.

Feature comparison: NetSuite vs. QuickBooks cost

Now that we’ve touched on pricing details, let’s look at NetSuite’s and QuickBooks’ features.

QuickBooks is known for its affordability, user-friendly interface, and excellent support, which makes it an attractive option for small businesses. It offers essential accounting tools such as:

- Invoicing.

- Expense tracking.

- Financial reporting.

NetSuite, on the other hand, includes features for larger businesses. While QuickBooks focuses primarily on accounting, NetSuite’s functionality extends beyond finance.

The good news for QuickBooks users is that integrated point solutions exist to increase QuickBooks’ functionality to that of an ERP. Below is an example of how just one integrated tool lets QuickBooks users overcome growing pains.

Get affordable ERP functionality with QuickBooks Method integration

Method is the #1 lead-to-cash automation tool for small to medium-sized businesses that use QuickBooks Online or Desktop. It’s one of the best business apps to expand QuickBooks’ capabilities for business growth.

Method’s real-time, two-way sync with QuickBooks builds upon the strong foundation QuickBooks sets to give you the power of an ERP at a fraction of the cost.

In addition to supporting financial planning, this integrated solution supports your financial management capabilities by automating your customer communications. It:

- Integrates with third-party apps such as MailChimp.

- Creates custom dashboards.

- Lets you customize quotes and invoices.

- Provides real-time visibility to create an integrated solution with QuickBooks.

Whether you need to convert website visitors into leads or obtain customer approval on quotes via e-signature, Method grows your business, not your stress. Start your free trial here.

How to choose between NetSuite pricing vs. QuickBooks pricing

Deciding factors to consider

Setting key performance indicators (KPIs) for your accounting processes and monitoring your financial performance are crucial to understanding new software’s impact on your business.

To make the right choice between NetSuite vs. QuickBooks pricing, you should conduct a cost analysis. Consider the factors that influence how long it takes to get a return on your investment:

- Degree of business complexity and size: For small businesses with straightforward financial needs, QuickBooks is an affordable option. Especially when you consider that NetSuite users often pay for capabilities they don’t take advantage of.

- Industry-specific needs: Some industries require specialized features to manage daily business operations. Software customization options and third-party integrations can satisfy your needs. Keep these options in mind when considering the NetSuite vs. QuickBooks price.

- Budget constraints: QuickBooks is more budget-friendly for your business. This is the right choice if you’re looking to save on costs.

Pro-tip: Don’t take the decision between NetSuite and QuickBooks lightly, as system migration is often a long, stressful process.

Your financial health and strategy

Ultimately, your budget and financial management significantly influence your decision. It’s crucial to balance the cost of any software with the value it provides to your business. Remember to account for potential future growth and the need for additional features and business tools over time.

Recap: NetSuite pricing vs. QuickBooks

When evaluating NetSuite pricing vs. QuickBooks pricing, consider not only the cost per user, but:

- Data migration fees.

- Set up time and cost.

- Staff training expenses and impact on productivity.

Remember that the right choice between NetSuite pricing vs. QuickBooks pricing for you depends on your:

- Business requirements.

- Budget.

- Industry.

- Long-term goals.

QuickBooks is a cost-effective and user-friendly choice for small businesses with straightforward financial needs. On the other hand, NetSuite is a pricier option for more complex enterprises.

By weighing these factors, you’ll make an informed decision that ensures your business’ financial health and success.

NetSuite vs. QuickBooks cost: FAQs

How much does NetSuite cost per year?

NetSuite starts at $999 monthly, plus the amount of each user fee.

Is QuickBooks Online the same as QuickBooks Desktop?

QuickBooks Online and QuickBooks Desktop are different QuickBooks versions. Both of them offer free trials and are scalable solutions, but QuickBooks Online is cloud-based, while QuickBooks Desktop is hosted on-premise.

Drive your business forward with Method. Start free trial.

Image credit: Vlada Karpovich via Pexels