What is a sales receipt?

Every business owner knows that once a sale is successfully negotiated, payments are received and the product or service has been delivered to the customer, one final step still remains.

A sales receipt lets your customers keep track of their own purchases. They serve as a trail of breadcrumbs not only for tax purposes, but also to keep track of their own workflow processes.

Businesses build trust with their customers by providing these records, so it’s important to understand how to create a receipt in QuickBooks.

Why does a business need sales receipts?

Sales receipts are the cornerstone of a business’s finances and operations. Here are some key reasons you need sales receipts:

1. Proof of transaction: Sales receipts provide concrete evidence of the exchange of goods or services for money. They also facilitate returns, exchanges, and warranty claims.

2. Financial record keeping: Sales receipts help track revenue, understand sales trends, and manage inventory. They are indispensable during financial audits, tax preparation, and financial analysis.

3. Legal compliance: Issuing sales receipts is often a legal requirement for businesses. They help ensure transparency in transactions and are critical for tax reporting.

4. Customer trust and satisfaction: Providing a sales receipt is a standard business practice that builds customer trust. It also enhances customer satisfaction and confidence.

5. Operational efficiency: Sales receipts inform your business strategy, inventory management, and marketing efforts. They help you identify best-selling products, peak sales periods, and customer preferences for informed decision-making.

Invoice vs. sales receipt QuickBooks

The main difference between an invoice and a sales receipt is that you send an invoice to a customer before they make a payment, while you give them a receipt after they make the payment. In other words, invoices are a request for money and receipts are proof the money was paid.

Before sending a customer an invoice, you should also consider creating an estimate so they can agree on how much your products or services will cost.

Keep reading this article to find out how to create a receipt in QuickBooks.

How do I create a sales receipt in QuickBooks Desktop?

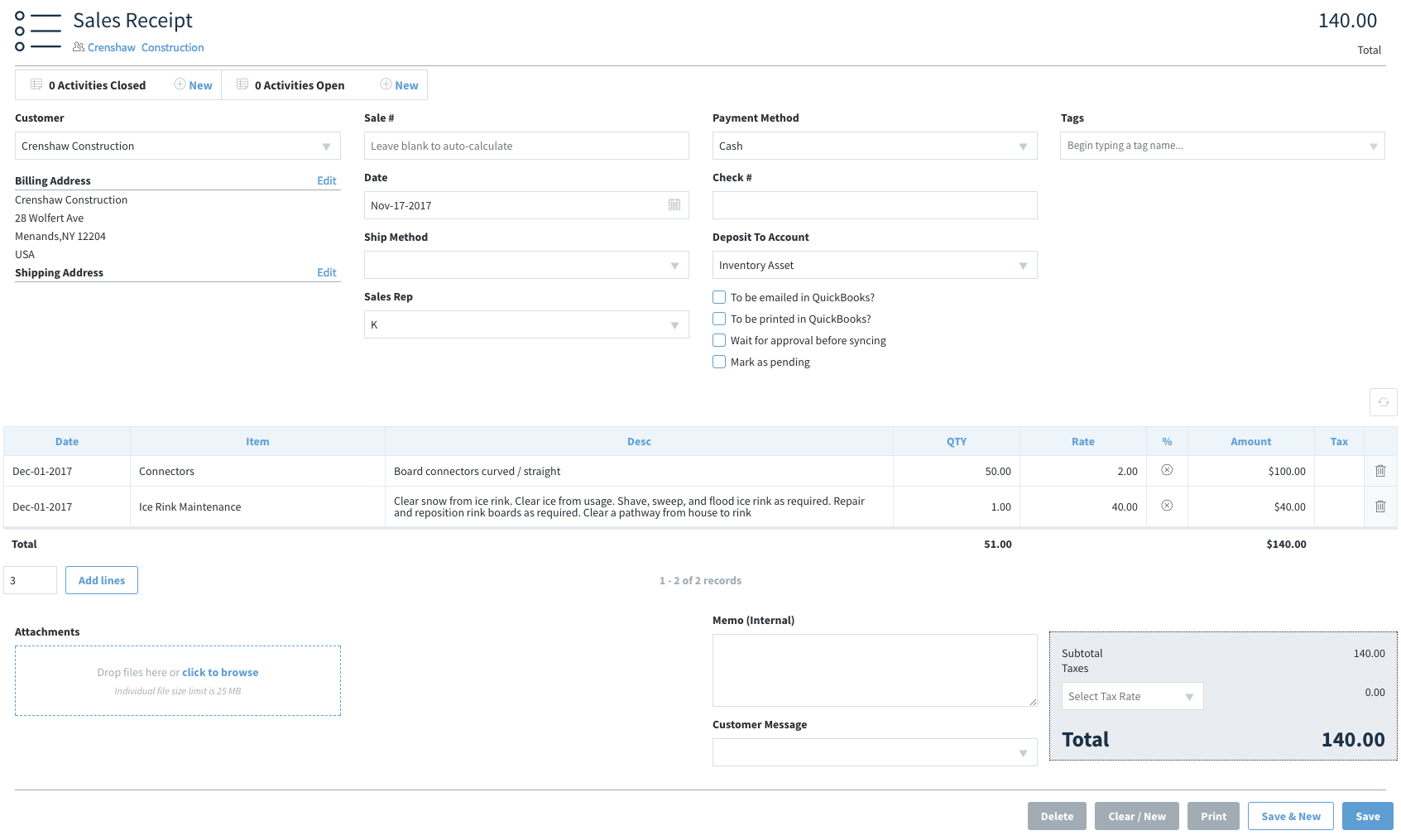

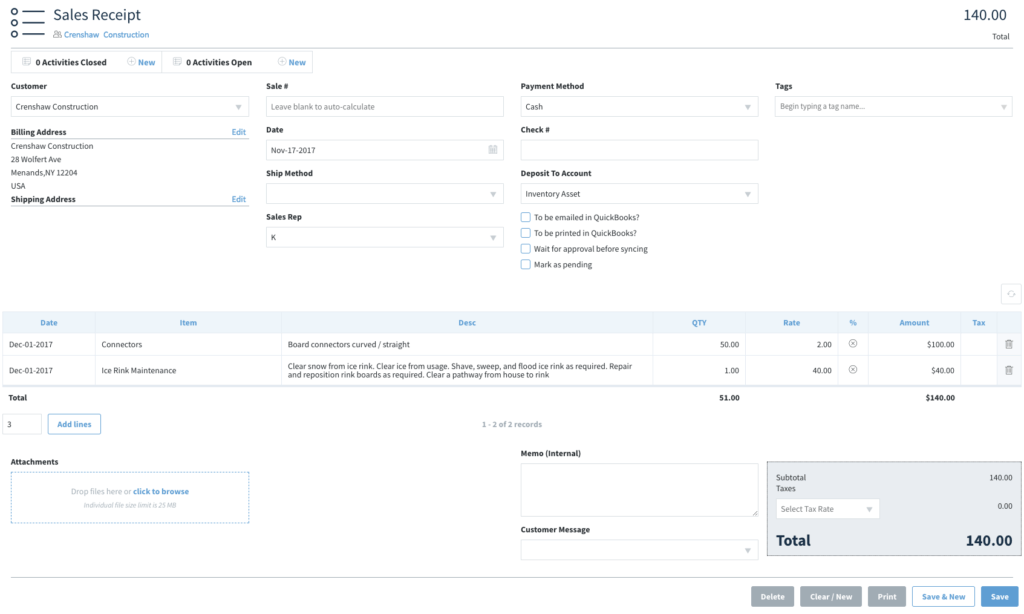

Image credit: Intuit.

Follow these steps if you’re wondering how to create a receipt in QuickBooks accounting software:

1. From the QuickBooks navigation menu, go to “+New” at the top left corner of the screen. Click “Sales Receipt” under the “Customers” column.

2. You should now be seeing a blank sales receipt screen. Select customer name you are issuing the business receipt to from the “Customer” drop-down menu. The customer’s address & contact details will already be filled out if it’s an existing customer.

3. The date of the sale will automatically be set to the current date. If you are issuing a sales receipt from a previous day, adjust the input date to the correct one.

4. Under the “Payment Method” field, choose the customer payment type. You can set an optional “Reference no.” if the customer paid by check.

5. Select where the payment is going under the “Deposit to (account selection)” section (bank deposit, cash deposits).

6. Under the “Product/Service” fields, enter what you sold to the customer. If the item/product selection or service is already set up in QuickBooks, the description and price of the items will already be filled out. If you sold several product types, make sure to add them in as well.

7. Under “Message displayed on sales receipt,” you can add any relevant memo/notes.

8. When you’re finished, navigate to the bottom right of the window and click “Save” to save a draft, or “Save and send” if you’re ready to send the receipt to the customer. This offers a preview before finalizing.

Alternatively, select the drop-down icon on the right side and choose “Save and new” to save the draft and create another receipt, or “Save & close” to save the draft and close the current receipt window.

9. Input any changes to the subject line and email message before you finalize the receipt. You now have a print or email option. Your receipt can be printed or emailed directly to the customer depending on if you select “Print” or “Send and close.”

You now know how to create a receipt in QuickBooks Online!

Receipt number assignment

QuickBooks will automatically assign a receipt number to all your receipts. This keeps you financially organized, which is especially helpful for your accountants come tax season.

View receipts for a customer

To find sales receipts for a customer, it is a straightforward process in the ‘Sales’ menu in the QuickBooks dashboard.

You also know how to create a receipt in QuickBooks from this menu. It requires selecting the ‘Create Receipt’ option. Not to mention, you have the option of linking to invoices from here.

What to include on a sales receipt

If you send out a receipt that only has the transaction amount, you’re missing out on building critical details with your customers.

Each receipt should also contain the following:

- Whether the customer paid by check, cash transaction, or credit card payments.

- Products or services you provided and their quantity & rate.

- Sales tax application.

- Information on discounts and the percentage subtracted from the total.

When you generate your receipts with this information, your customers will be able to track you down for repeat business. In QuickBooks, your receipt template can be saved for future reference or modifications, which ensures accurate recording of sales transactions and consistency in your sales documents.

Benefits of creating a QuickBooks Online sales receipt

While you now know how to create a receipt in QuickBooks, you might be wondering how your business benefits when you issue receipts.

Creating your sales receipts in QuickBooks Online:

- Allows for itemized listing of products or services.

- Provides options for different payment methods.

- Offers templates to simplify the creation process.

- Integrates with the accounting and inventory modules.

A QuickBooks sales receipt can be customized with the company’s branding by using a custom sales receipt template in Method. Customization of receipt template options gives you more flexibility over the fields shown on your receipt, such as payment terms.

If you’re wondering if QuickBooks supports multiple currencies and tax rates, it does not offer this feature at this time. Consider integrating with Method to add currency selection features.

Instant recording

QuickBooks automatically records transactions to show you how many products or services you’ve sold. This reduces the chance of human error and results in more accurate financial records.

Proof of purchase

Creating a copy of your sales history is useful for both you and your customers to verify purchase records. Plus, sales receipts can be linked to specific customer profiles that then can be duplicated for recurring sales. QuickBooks offers a recurring receipts setup to speed up this process.

Also, an emailed receipt serves as another communication touchpoint where customers can reply to and engage with your business further.

Accurate financial statements

Simplifying these features helps you save time and avoid errors, especially because QuickBooks updates the financial records automatically upon creation. This helps you publish your receipts with design and content consistency.

Simplified tax reporting

QuickBooks users that keep a record of their transaction history save a lot of time come tax season. This data is easily accessible and can be viewed or exported at any time or reported directly.

Inventory management

Knowing exactly how many of each product sold is a huge help when it comes to managing your inventory. This lets you know when you need to restock and shows you what your customers are interested in.

Easy reconciliation

Your bookkeeping will never be easier when you have accurate inventory records. You can rely on QuickBooks’ easy reconciliation process to expose errors in the process or confirm that everything lines up at the end of the fiscal period.

Method automates your reconciliation tasks by seamlessly integrating with QuickBooks. See how in one of our videos below.

Can I create a sales receipt in Method that will sync with QuickBooks?

You sure can! Method’s Sales Receipts App lets you create receipts that help your customers keep track of their own purchases — not only for tax purposes, but also to keep track of workflow processes.

Perks of creating sales receipts in your QuickBooks-integrated CRM

Because Method integrates seamlessly with QuickBooks, you can keep track of your revenue, expenses, and customer information in one centralized location.

Other benefits of integrating Method with QuickBooks are that you can:

- Keep a comprehensive list of sales receipts.

- Stop filing handwritten receipts and maintain digital copies forever.

- Link sales receipts with customers.

- Keep a full picture of sales history with a customer throughout your business relationship.

How to import receipts in QuickBooks Online

Now that you know how to create a receipt in QuickBooks, you might be wondering how to save one.

Upload a receipt from your computer

1. Scan and import sales receipt images to your computer. If you don’t have a scanner, you can also take a picture on your phone and use the attachments option to email them to yourself. You can only have one receipt per image file.

2. Sign in to your QuickBooks Online account and navigate to “Transactions.” Select “Receipts.”

3. Click “Upload from computer.” Ensure the image is one of the following file types: PDF, JPEG, GIF, or PNG.

Upload a receipt from the QuickBooks iOS or Android app

1. Select the drop-down menu icon (three horizontal lines).

2. Tap “Receipt snap” and then the camera icon.

3. Take a photo of your receipt under good lighting.

4. Select “Use this photo” and tap “Done.”

What challenges might businesses face in managing sales receipts?

Managing sales receipts presents several challenges for businesses, especially as they scale. These include:

1. Volume of transactions: High transaction volumes make sales receipt management daunting. This leads to disorganization and inefficiency.

2. Data accuracy and integrity: Ensuring the accuracy and integrity of sales receipts is crucial. Manual entry errors, lost receipts, and data corruption lead to financial discrepancies and affect your financial health.

3. Storage and accessibility: Storing physical receipts consumes significant space and resources. Digital receipts also require adequate storage and backup solutions.

4. Compliance and security: Adhering to legal requirements for sales receipt management can be complex. Protecting sensitive customer information on receipts also poses a challenge.

5. Integration with other systems: To optimize efficiency, your business should seamlessly integrate sales receipt data with other systems. Integrating with legacy systems and standalone software solutions also presents challenges.

Addressing these challenges requires:

- Strategic planning.

- Investment in technology.

- A shift towards digital receipt management systems.

How to create a receipt in QuickBooks: Frequently asked questions (FAQs)

Can I email sales receipts to customers in QuickBooks?

Yes, you can email sales receipts to customers in QuickBooks. When you click “Send and close” in the final receipt preview, QuickBooks will email the receipt to your customer.

Can I apply a discount to a sales receipt in QuickBooks?

Yes, you can add discounts to QuickBooks sales receipts. To do so, enter the discount percentage under the “Discount percent” field, or a specific number under the “Discount value” field. To issue a refund in QuickBooks, follow these steps.

How can I organize expenses in QuickBooks?

Your sales forms and expenses all live in QuickBooks, but you can free yourself from manual organization tasks using Method.

You and your customers can sign receipts directly on-screen, instead of scanning the signature from a piece of paper. Then, it’s easy to log the expense in your business platform. You can also confirm a sales receipt form instantly, instead of jumping through hoops.

Method seamlessly integrates with QuickBooks to automatically update your business’ sales and accounting data across every platform. You can automate your workflows so your records are consistent and free from errors, opening up your time to focus on value-adding tasks.

Get started with Method with a free trial. No credit card required!