As a contractor, you need to track your expenses and income. Enter QuickBooks and Xero — two of the most popular accounting software.

The two software offer similar features, including:

- Tax management.

- File storage.

- Financial reports.

That said, these accounting systems have key differences.

In this article, you’ll weigh the pros and cons of each and compare and contrast their features to find out: Is Xero better than QuickBooks for your business, or vice versa?

Let’s get started!

Xero vs. QuickBooks: At-a-glance comparison

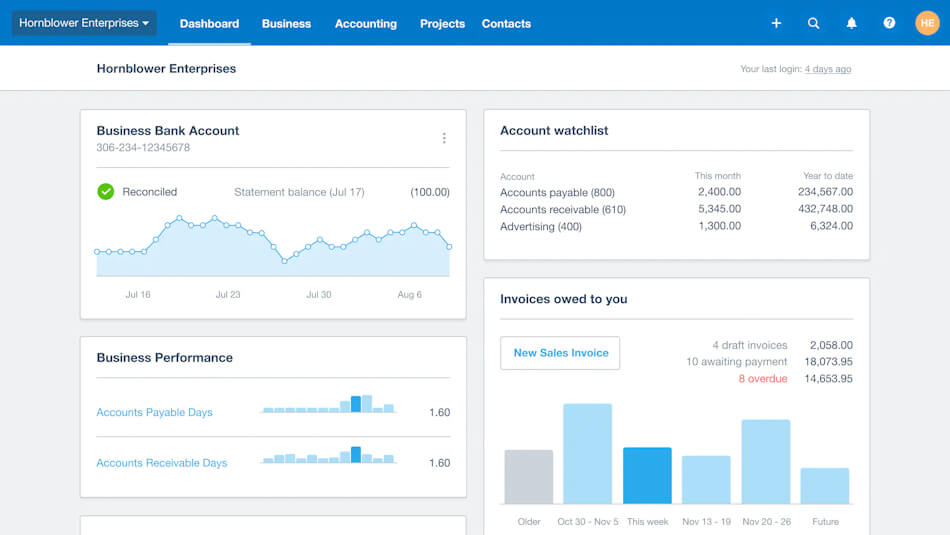

QuickBooks offers both online and desktop versions, whereas Xero only has cloud-based accessibility. So, consider how and where your team usually completes accounting or bookkeeping tasks when debating between the software.

Xero features a clean, user-friendly interface and has a more intuitive design than QuickBooks for accountants. That said, QuickBooks is designed to accommodate multi-user collaboration that will still align with users who don’t understand every accounting term.

Next, think about how many people need QuickBooks or Xero access at your company.

This is a key answer to the question “How is Xero better than QuickBooks?” Xero allows for unlimited users. QuickBooks Online has a cap of 25, while Desktop’s highest tier caps at 40. This makes Xero an ideal solution if you plan to have a large team of bookkeepers and other employees using your accounting tool.

However, 25 users is plenty for most contractors’ accounting needs. Generally speaking, you don’t want too many cooks in the kitchen when it comes to your accounting software.

Now, think about who will be using the tool.

If you need to track project profitability, Xero provides clearer reporting tools than QuickBooks. It lets you monitor project costs in real time and compare them to estimated profits.

Both Xero and QuickBooks offer these features for your business:

- Payroll processing, bank reconciliation, and tax compliance.

- E-commerce integration (if applicable) with data migration functionality.

- Mobile app availability.

- Data export options to analyze performance easier.

- Security and data protection with frequent updates and maintenance.

- A trial period or free version availability.

Xero

Users who review Xero recommend that this accounting software is more user-friendly than QuickBooks. They rank it highly for its minimal training and learning curve.

Xero has a smoother interface than QuickBooks and is preferred by more accountants than QuickBooks internationally. Not to mention, it offers international accounting support (if needed).

Xero’s ability to integrate with third-party apps like Method lets it offer good scalability to growing businesses.

Key features

Let’s go over some of Xero’s best features to determine: Is Xero better than QuickBooks for your business?

With Xero, leverage fixed asset management tools to stay organized and keep your work in one place. Xero also automatically calculates the depreciation of your assets. The best part is that you can run reports to see the value of your fixed assets at any time.

Plus, Xero Projects lets you get started quickly and easily.

Here’s how it works:

- Create as many projects as needed.

- Estimate your time and materials.

- Send off a quote to your potential customer.

It’s that easy. From there, record your time on the job and turn that into an invoice.

To keep up with project costs, you can also add bills and deposits to a job. The best part: your invoices match any changes to stay up to date.

Next, let’s investigate Xero’s reporting capabilities. Utilize reports to manage your projects and see which jobs are making money and which aren’t. This way, you’ll apply more accurate quotes for future projects.

Finally, let’s explore Xero Expenses. Use this tool to instantly record mileage and capture costs by taking photos of receipts.

Xero then pulls all the key information into a claim to keep you informed on every expense.

Pros

- Runs smoothly online, as it was built for the web.

- Strong integrations with many applications.

- Offers more features than QuickBooks for paying vendors.

Cons

- The reporting function is complex.

- Limited in graphic and visual charts.

- Weak customer support without live chat.

Pricing

The following pricing plans are offered by Xero:

- Early: $15 per month.

- Growing: $42 per month.

- Established: $78 per month.

Is Xero suitable for large businesses?

Xero is designed for businesses of all sizes, including large companies. Xero is able to serve the complex financial requirements of larger organizations, with:

- Advanced project management features.

- Inventory functionality.

- Contact management tools.

However, Xero is not fully equipped to handle enterprise-level operations that need to:

- Examine nuanced reporting and analytics.

- Execute highly advanced industry-specific solutions (if needed).

- Evaluate transparency across all levels of the company.

Enterprises generally prefer to adopt ERP (enterprise resource planning) services.

Is there a good alternative to Xero accounting software?

While Xero can perform many advanced functions, QuickBooks Online is still a favorite for business owners. It’s a powerful accounting system with strong user reviews and ratings.

You’d be hard-pressed to find accounting software that outperforms QuickBooks in usability. It is the most popular accounting software to operate in the US, with a strong vendor reputation and reliability.

Because of its popularity, QuickBooks has a large user community and forums. Users report that this resource frequently has a faster response time and provides better customer support than QuickBooks’ standard help channels.

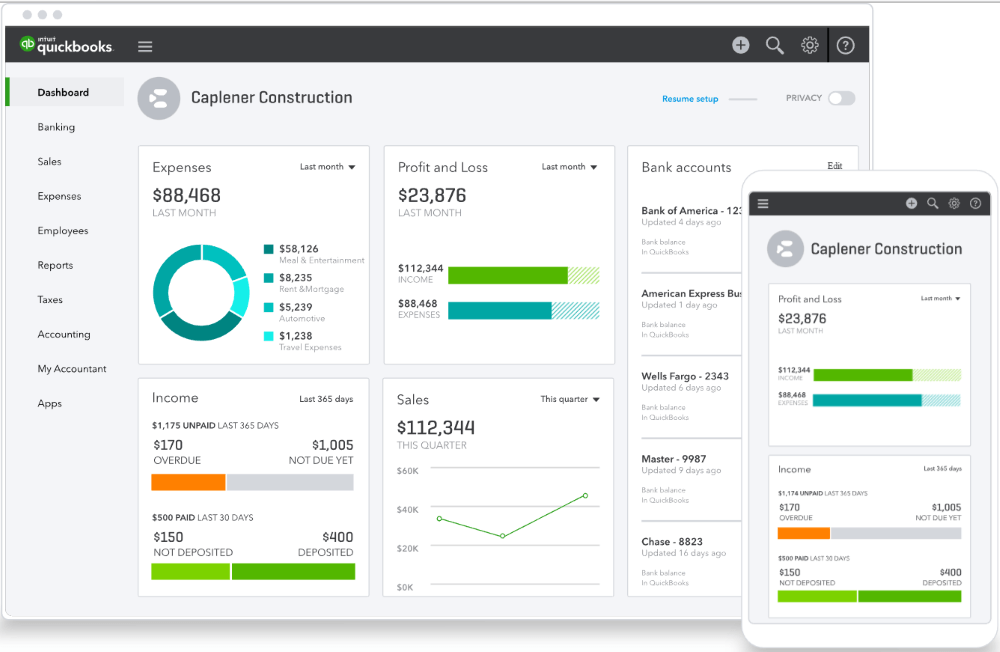

QuickBooks Online

QuickBooks Online offers a cloud-based system that lets you simplify repetitive accounting tasks and processes. Its features and functionality are among the most powerful in the market.

Like Xero, QuickBooks features an impressive app marketplace with powerful integrations that enhance your workflows. Note that QuickBooks Online integrates with more apps than QuickBooks Desktop.

It’s an ideal choice for contractors, as you can:

- Manage bills and invoices.

- Track projects and miles on the go.

- Monitor your financial health.

Get started with your free trial of QuickBooks Online here.

Key features

QuickBooks Online offers an impressive range of features to businesses of all shapes and sizes.

For one, it features advanced financial reports to give you snapshots of various areas of your business. For example, you can run reports on project profitability to see how much you’re making or losing.

Other reports include:

- Budgeting overview.

- Profit and loss by location.

- Invoice and received payments.

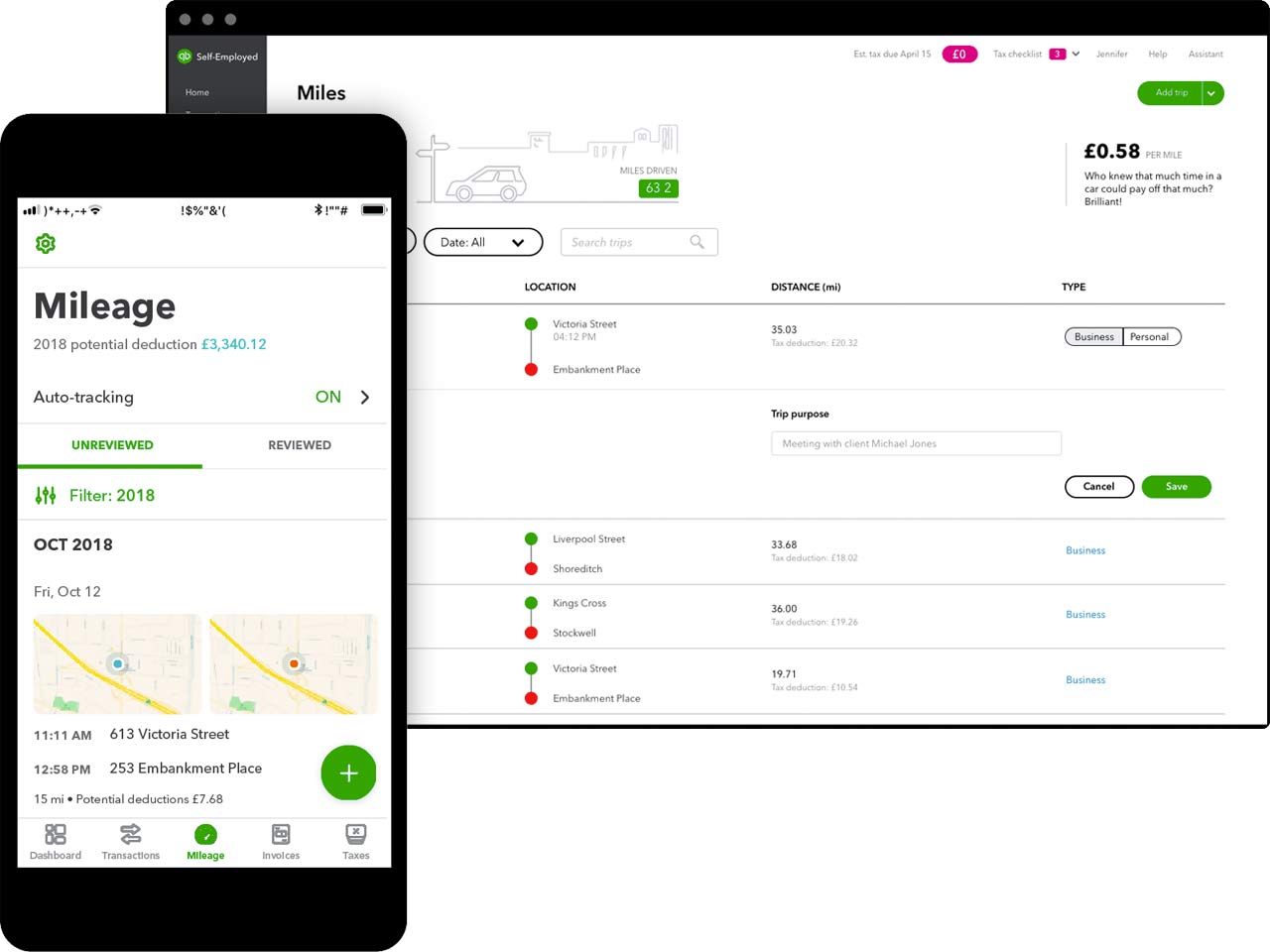

Also, with the QuickBooks Online app, you can enable mileage tracking to record every drive. Your phone automatically detects that you’re driving and uses GPS to measure the distance.

Image credit: QuickBooks

It then stores your trips in one location for you to see your mileage details and tax savings estimates at any time.

You can also post your time and project records every day with the QuickBooks Time app. Whether you’re a contractor, handyman, plumber, or painter, the app lets you track time from any location using devices you already have.

This manages your employee time data for:

- Payroll.

- Invoicing.

- Scheduling.

QuickBooks also lets you effortlessly capture signatures for project sign-offs using the app.Plus, all your QuickBooks Time data syncs to your account in real time, so your data is always accurate.

Pros

- Easy to use and set up with many training videos.

- The reporting feature is informative and easy to navigate.

- The software is regularly updated with new features.

Cons

- Difficult to navigate through past transactions for previous years.

- The e-commerce plugin isn’t fully functional.

Pricing

QuickBooks Online offers the following plans:

- Simple Start: $30 per month.

- Essentials: $60 per month.

- Plus: $90 per month.

- Advanced: $200 per month.

QuickBooks also offers flexible plans for freelancers and independent contractors:

- Self-employed: $20 per month.

- Self-employed tax bundle: $30 per month.

- Self-employed live tax bundle: $40 per month.

Who should use Xero?

So, is Xero better than QuickBooks for you? It’s ideal for contractors with fixed assets who need a lot of users at a low cost.

Its functionality as a fixed asset manager helps it differentiate itself as a top contender. Xero calculates the depreciation of your machinery, which lets you claim the proper gain or loss when you dispose of the asset.

If you’re on a budget, Xero offers many of the advanced features that QuickBooks Online does at a lower price. And if you’re working in a team, you can add all your in-house accountants or company partners to Xero for free.

Who should use QuickBooks Online?

QuickBooks Online is best for those in need of advanced reporting capabilities to drive performance. If you want live customer service, QuickBooks Online is also the right choice. For example, while Xero is easier to set up than QuickBooks, you need to email customer service or look to online resources to solve problems. QuickBooks makes it easy to talk to actual representatives.

If you want other QuickBooks products or a product suite such as QuickBooks Payroll, QuickBooks Payments or QuickBooks Time, this is also a good reason to choose QuickBooks.

If ongoing customer support is something you rely on, then QuickBooks is actually the better choice when asking, “Is Xero better than QuickBooks?”

Is Xero better than QuickBooks?

How you assess the question, “Is Xero better than QuickBooks?” depends largely on how you weigh your business’ specific needs.

Xero’s strengths lie in its:

- Unlimited user access.

- International currency support.

- Dashboard tailor-built for bookkeepers.

It has a smoother interface design and slightly receives more positive reviews than QuickBooks.

After reviewing user feedback, our analysis has shown that users find Xero also updates more frequently than QuickBooks. It has a better mobile experience than QuickBooks’ app functionalities and is more cost-effective than QuickBooks.

However, Xero is only available online and does not offer a desktop option like QuickBooks. And both versions of QuickBooks have more integrations for you to implement additional features that you may be missing.

Despite the greater learning curve, QuickBooks is also designed for users who may not have an accounting background. Because of its popularity, QuickBooks has countless users who comment on online forums to answer difficult questions and create free online tutorials that you can study.

When you integrate Xero or QuickBooks with a third-party platform like Method, neither option:

- Is more customizable.

- Provides clearer reporting tools.

- Is easier to set up.

- Is more secure.

You can compare and critique these pros and cons to answer: Is Xero better than QuickBooks, or is QuickBooks the better fit for my company?

Xero vs. QuickBooks for contractors: What to look for

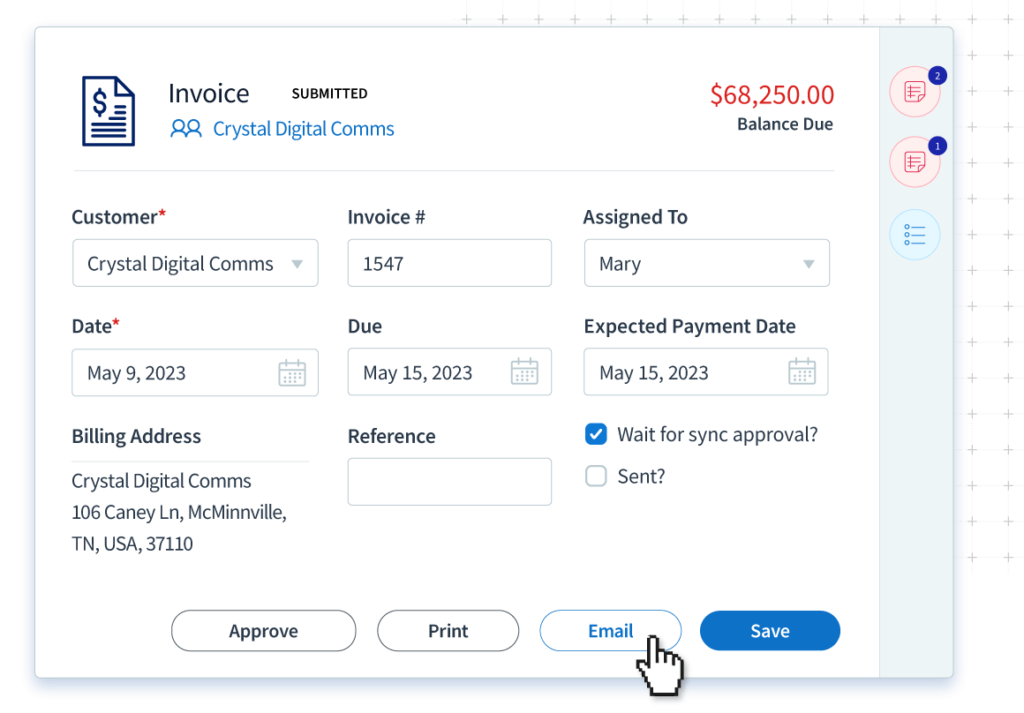

Invoicing

As a contractor, reliable invoicing features are crucial.

Whether you choose Xero vs. Quickbooks Online, you get reliable features to process invoices and quotes.

With Xero, you can easily create an invoice and preview it before sending it via email. That email also includes online payment options to keep your cash flow strong.

With QuickBooks Online, you can update details about the client directly in the invoice, instead of navigating to their contact record. It’s simple and offers the option to add a card or bank account number to a customer’s account so you can immediately process the payment.

Inventory

Having inventory management (if applicable) for your company is important for profitability, as delayed or misplaced materials incur delays and unnecessary costs.

However, when evaluating Xero vs. QuickBooks Online, it’s important to note that QuickBooks Online’s lower-tier plans don’t come with inventory management. So, is Xero better than QuickBooks for inventory management? It depends on your budget.

If you’re unwilling to go for the QuickBooks Online Plus plan to get the feature, then you’ll be glad to know that all of Xero’s plans come with inventory management.

However, note that unlike QuickBooks Online’s inventory feature, you can’t set up reorder points when stock is running low.

Job scheduling

When making the Xero vs. QuickBooks comparison, consider the job scheduling features.

After all, the success of your projects — from allocating resources to managing finances efficiently — lies in proper scheduling.

QuickBooks Time’s job scheduling is a game-changer when it comes to planning and setting multiple schedules on the go. From your phone, you can add:

- Clients.

- Dates.

- Times.

- Alerts.

With Xero, you can view start and end times of your jobs, as well as project milestones in an interactive Gantt chart.

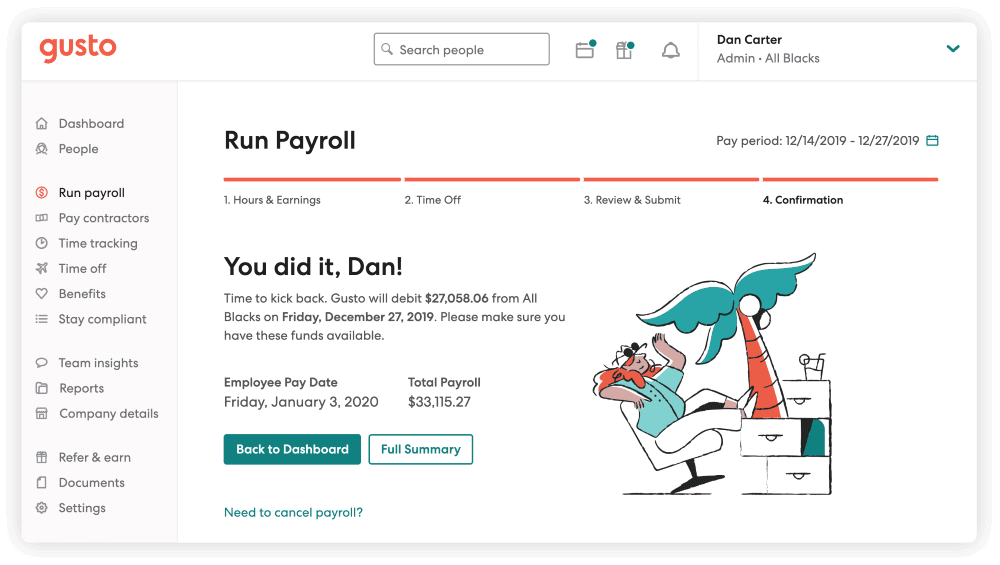

Payroll

As a small business contractor, you need payroll that’s accurate, automatic, and easy to use.

Gusto is Xero’s preferred payroll partner that’s integrated with Xero accounting. It automates:

- Payroll taxes.

- Deductions.

- Filings.

Another benefit is that it handles payroll emails and pay stubs.

QuickBooks Payroll for contractors processes payments quickly and easily. It lets you:

- Manage payroll.

- Calculate taxes.

- Make direct deposits directly.

It also includes employee self-service portals and direct deposit capabilities so you have more time to focus on your day-to-day, instead of on paying your subcontractors.

Integrations

When it comes to answering, “Is Xero better than QuickBooks?” be sure not to overlook the importance of integration.

As your accounting software is one of your core tools, it should integrate with all your other systems, including:

- Your CRM system.

- Your email applications.

- Your project and time-tracking tools.

When debating Xero vs. QuickBooks for contractors, make sure you select the one that offers integrations with the tools you need.

How Method helps small business contractors using QuickBooks and Xero

Method CRM is a robust solution that manages your:

- Accounting.

- Sales.

- Job details.

Its cloud technology and mobile access make it an ideal software for contractors on and off the job site.

The best part is that Method boasts a two-way sync with both QuickBooks Online and Xero. Here’s a breakdown of how it works:

- You only enter data once.

- It gets carried through the workflow.

- Information syncs appropriately to your QuickBooks or Xero account.

As a result, you save yourself from hours of double-data entry and tedious tasks.

Plus, you can turn your estimates into work orders and invoices in just a few clicks.

Overall, Method empowers you to focus on delivering great service to your customers, rather than managing paperwork. It has advanced customization capabilities and offers more automation features than QuickBooks and Xero do on their own.

Bottom line: Xero vs. QuickBooks for contractors

QuickBooks and Xero are both great options when looking at accounting software for contractors. They both provide attractive features at affordable pricing plans.

But is Xero better than QuickBooks? Your best choice really depends on your unique needs.

If you’re a contractor on a budget who’s looking to add a lot of users, then Xero is a better fit.

But if you need features such as advanced reporting or live customer service, then QuickBooks Online is the right pick for you.

Whatever you decide, expanding your accounting software’s potential with integrations like Method is always a good idea.

Xero vs. QuickBooks FAQs

Is Xero or QuickBooks better for small businesses?

Answering, “Is Xero better than QuickBooks or vice versa for small businesses?” largely depends on your industry and if you need to handle multiple companies. Both have advantages and disadvantages, so it’s important to consider which features suit your small business best.

For example, QuickBooks Online offers more detailed reports and analytics than Xero does. This makes it better for businesses with complex financial tracking needs.

But how is Xero better than QuickBooks? It’s much more effective when you only need basic data to monitor your cash flow and profitability.

Another difference between Xero vs. QuickBooks Online is platform flexibility. Contractors who deal with multiple currencies will find Xero better in this scenario.

So, when deciding, “is Xero better than QuickBooks?” it really depends on your small business needs and budget.

Is Xero easier to use than QuickBooks?

Xero is generally easier to use than QuickBooks.

It has been praised for its intuitive user interface and ease of use, while QuickBooks Online offers more robust features suited for larger businesses. That said, both systems are accessible and learnable.

Ultimately, when deciding between Xero vs. QuickBooks, it depends on the complexity and size of your business. With either solution, you can access your accounts anytime and anywhere.

What is the difference between Xero and QBO?

When it comes to Xero vs. QuickBooks Online (QBO), one of the biggest differences is pricing. With Xero, you pay a flat monthly fee with three pricing packages to choose from.

However, with QBO you have several subscription tiers with varying features and add-ons.

For contractors dealing with complex financials, another key difference between Xero and QBO is the availability of industry-specific features.For example, Xero offers an extensive suite of features specifically designed for contractors, such as job costing tools and time tracking, whereas QBO’s offerings are not as robust in this area. That said, QBO offers more integrations and general accounting tools.

See how Method extends the limits of your accounting system!

Image credit: Shutter B via Adobe Stock