The QuickBooks approval process is a key part of the software’s functionality. It allows businesses to track and approve expenditures and manage their budget.

In this article, you will answer questions such as:

- Does QuickBooks have an approval process?

- What is the QuickBooks approval process for Online and Desktop users?

Keep reading to learn about the limitations of the QuickBooks approval process and how you can overcome them.

Does QuickBooks Online have an approval process?

Yes, QuickBooks Online Advanced has an approval process for invoices. However, the same can’t be said for other versions of QuickBooks Online.

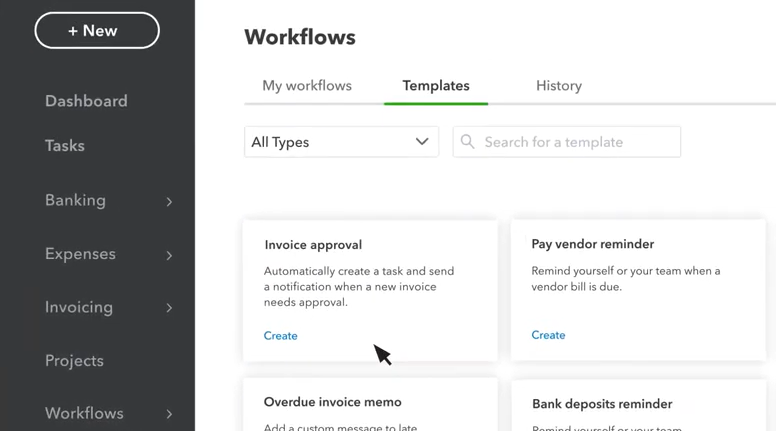

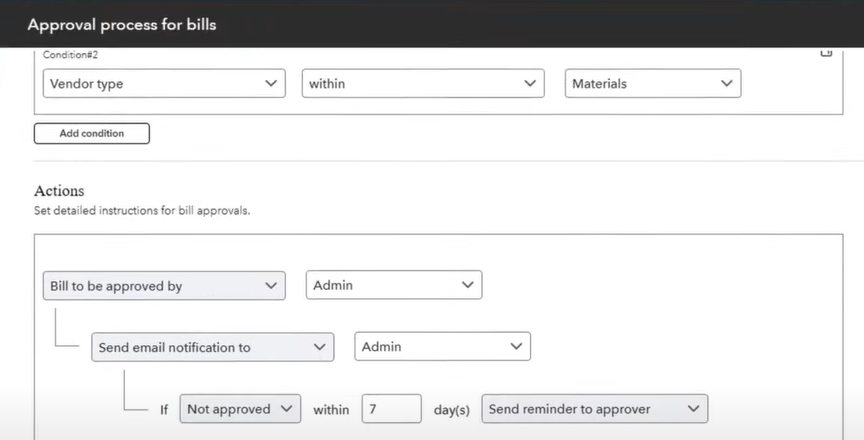

You can set an approval workflow up for each vendor in QuickBooks Online Advanced through the “Workflows” feature.

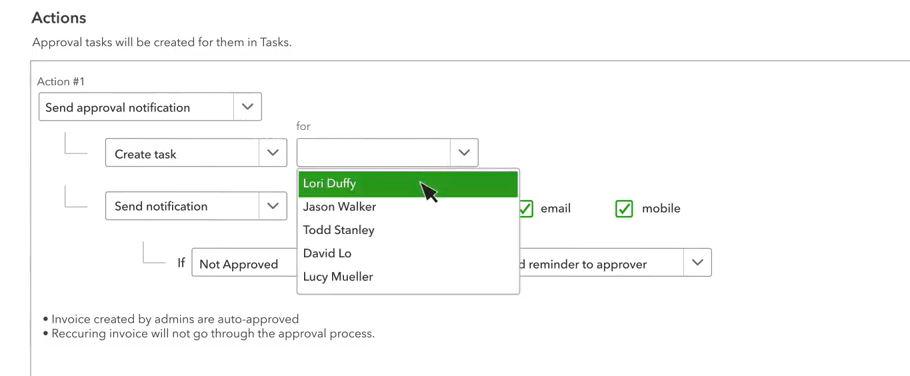

First, you’ll need to create a vendor profile and assign an approver.

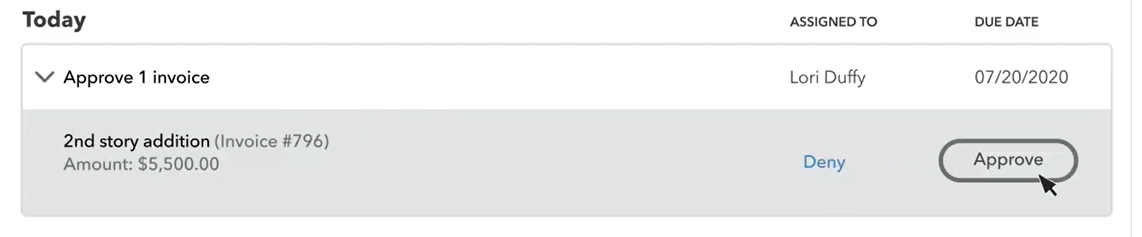

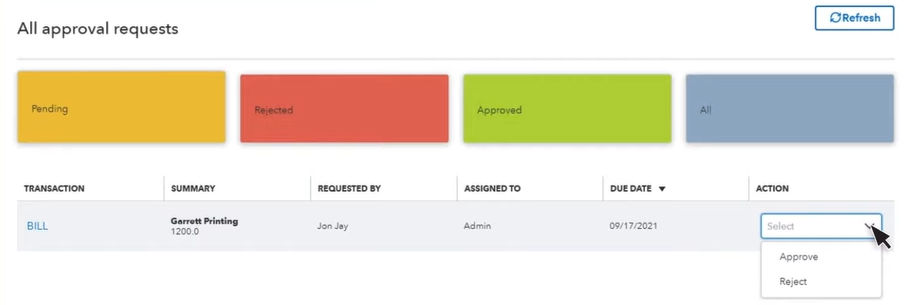

Once the approver is assigned, they will receive a notification when an invoice is ready for approval. They can then approve or reject the invoice in the “Tasks” tab.

The way this process happens is through triggered notifications and manual approvals.

As a result, your automation options are minimal — especially, if you need an approval workflow that goes beyond invoices.

What is the QuickBooks approval process for Desktop users?

The approval process for QuickBooks Desktop Enterprise is similar to the Online Advanced version.

But if you use a different version of QuickBooks than the above two, you will not be able to set up any type of approval.

As a QuickBooks Desktop Enterprise user, you can set up custom bill approvals. You need to create a vendor profile and assign an approver to it.

The approver will be notified when an invoice is ready for approval and can approve or reject it.

As with QuickBooks Online, you can set a dollar limit for bills that require approval in the Enterprise Desktop version. You can also choose a condition based on a vendor or specific customer.

Shortcomings of the QuickBooks approval process

Does QuickBooks have an approval process? Yes, but not without limitations.

For one, custom workflows are only available to QuickBooks Online Advanced and QuickBooks Desktop Enterprise users.

Then, even though you can choose conditions to trigger the approval workflow (such as a dollar limit), this isn’t always enough.

QuickBooks’ approval process only allows for one level of approval. So if you require multiple levels or steps, you’ll need to use a different software solution.

Let’s take a look at the main shortcoming of the QuickBooks’ approval process.

It is limited in scope

The QuickBooks approval process only applies to invoices. This means you can’t use it to approve other expenditures, such as time off requests or purchase orders.

If you need to track and approve more than just invoices, you’ll need to look for more comprehensive approval software.

It lacks customization

When it comes to automation, the software you choose should be customizable to your specific business processes.

QuickBooks’ approval process is inflexible and doesn’t allow for much tailoring. It might not be able to meet your specific needs.

It may cause delays

Another limitation of the QuickBooks approval process is that it can cause delays.

If an approver is out of the office, it can take longer for invoices to be approved. This can also cause a delay in the payment of invoices and disrupt cash flow.

Instead, you may consider using software that allows approvals through a mobile app. This way, even if you’re not in the workplace, approvals can still go through without delays.

How can I overcome QuickBooks’ approval limitations?

While QuickBooks’ approval process has its limitations, there are ways to overcome them. One option is to use approval software to supplement QuickBooks.

Approval software is designed to make your approval process more efficient.

Some features that you might want to look for in approval software include:

- The ability to track and approve all expenditures, not just invoices.

- Flexibility to adapt to your specific business processes.

- Real-time approvals through a mobile app.

- The ability to set up multiple approvers.

With the right approval software in place, you can save time and avoid delays.

Enhance your QuickBooks approval process with Method

Method CRM is a powerful tool that simplifies your approval process. It integrates with QuickBooks and allows you to track and approve all types of expenditures.

With Method, you can create custom workflows that fit your business needs. You can also set up multiple approvers and real-time approvals through the mobile app.

If you need more customization and flexibility than QuickBooks’ approval process allows, you need a CRM like Method.

See how you can automate approvals for invoices or estimates online with electronic signature capture.

Final thoughts: Does QuickBooks have an approval process?

Although QuickBooks does have an approval process, it is limited in scope and customization.

If you need a more comprehensive solution, you can use integrated software like Method CRM to complement those shortcomings.

Get started with a free trial today!

Photo credit: Anna Shvets via Pexels