QuickBooks electronic signature capture is crucial when providing approvals for estimates, invoices, and other financial documents.

There are several ways to sign documents electronically using QuickBooks. But all of these require an external integration.

In this blog, you will learn the benefits of how to capture signatures for QuickBooks Online using a trusted, third-party application like Method!

Does QuickBooks have electronic signature capture?

QuickBooks has become a very popular accounting software program. Its popularity has grown tremendously over the last decade.

It offers a wide variety of features, such as:

- Payroll management.

- Inventory tracking.

- Sales reporting.

- Customer relationship management.

However, QuickBooks does not have an electronic signature capture option. It does let you add a custom field for a physical signature to invoices, but that’s it.

The only way to achieve QuickBooks signature capture is by using a trusted, third-party integration such as Method.

That said, here’s how to make e-signatures possible for each QuickBooks version.

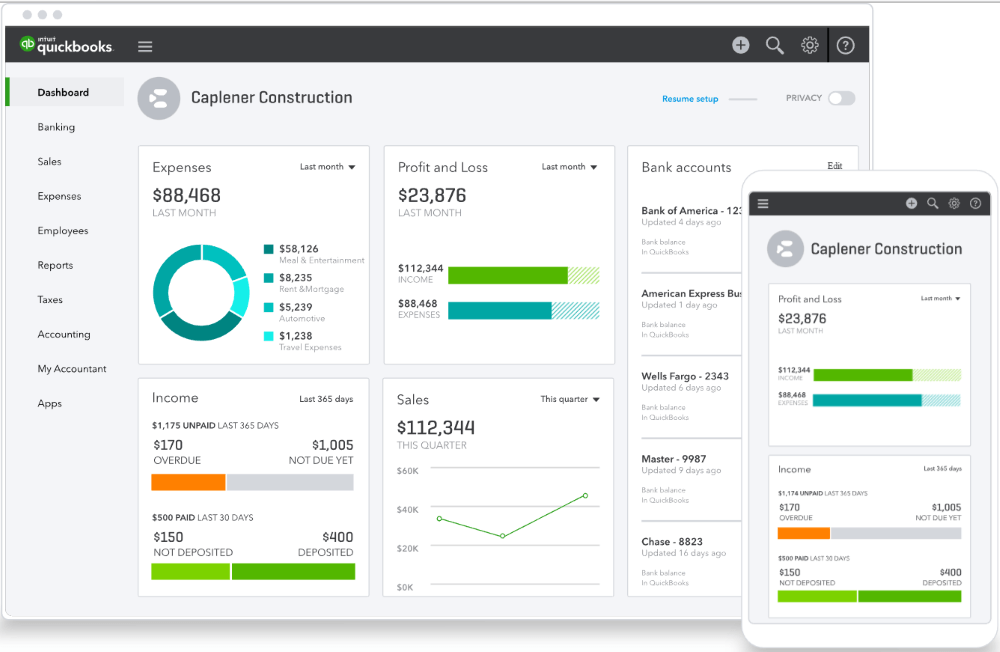

QuickBooks Online

Image credit: QuickBooks.

QuickBooks Online is a cloud-based accounting software that lets you connect remotely from anywhere with an internet connection. This gives you the freedom to manage your business finances on the go. Without third-party integrations, e-signatures in QuickBooks Online EasyStart, Essentials, and Plus are unfortunately not possible.

QuickBooks Online Advanced

Image credit: QuickBooks

QuickBooks Online Advanced is a cloud-based program for growing businesses with more complex processes. However, that also means it has additional costs. At a regular price of $200 a month, it gets expensive for small business owners.

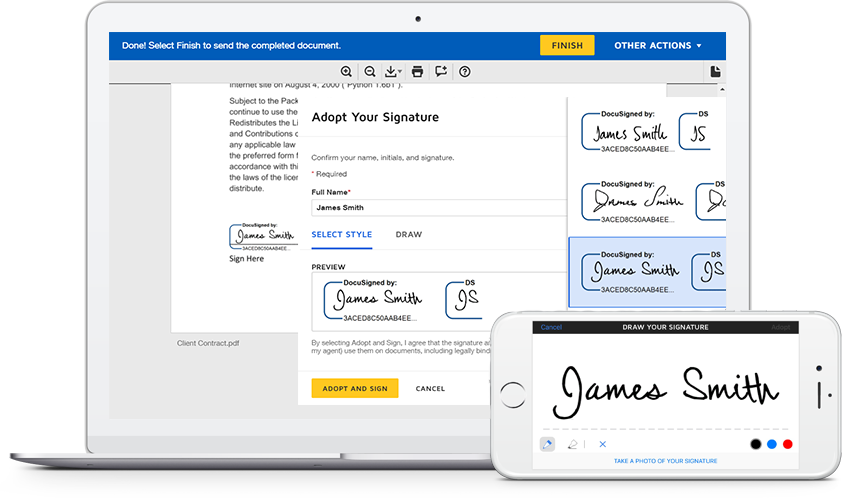

Many businesses choose QuickBooks Online Advanced because it gives them access to premium apps such as DocuSign E-Signature Connector.

Image credit: TitanFile

DocuSign integrates with QuickBooks Online Advanced to offer online signature capabilities. However, it is only available through the Advanced plan. You’ll also need to purchase DocuSign separately at a minimum of $10 per month, which adds up quickly.

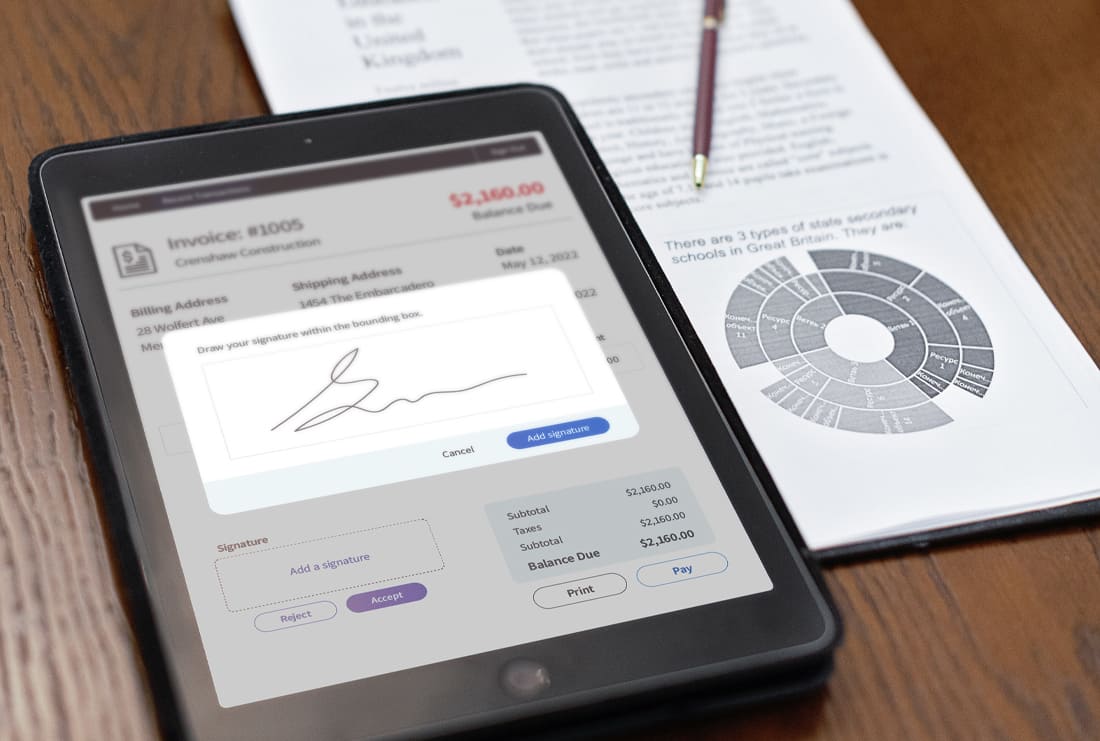

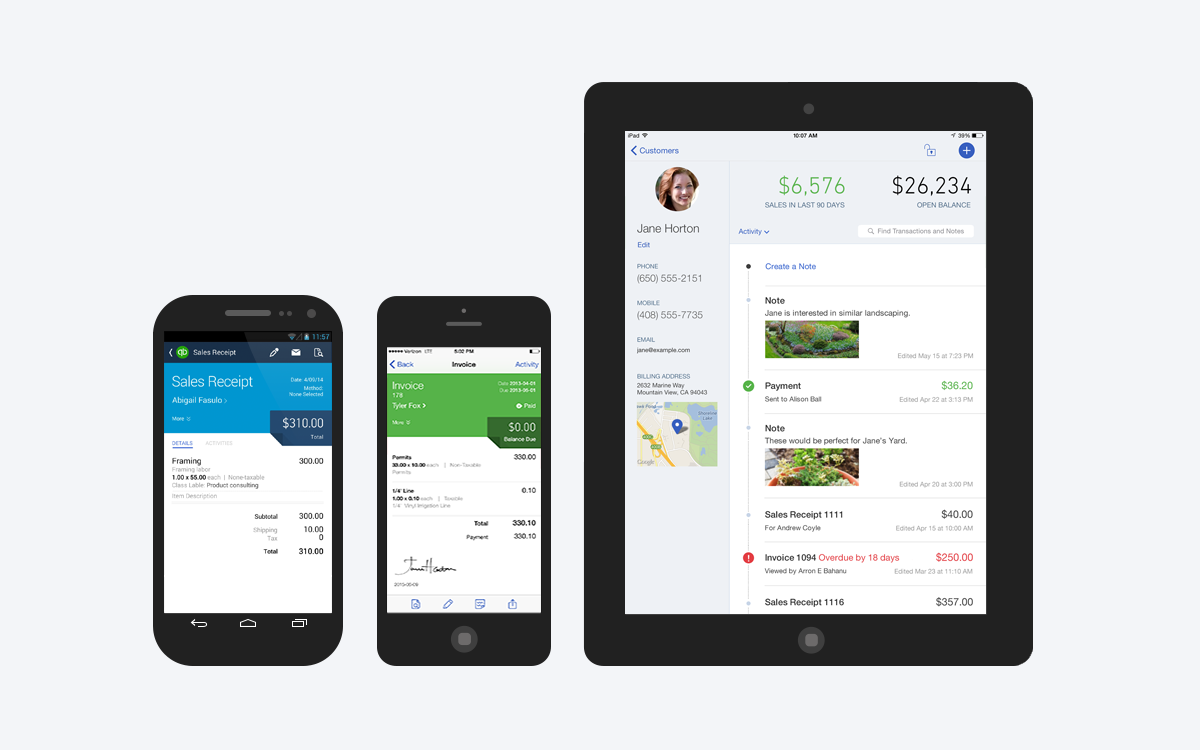

QuickBooks Online mobile app for iOS and Android

Image credit: Intuit QuickBooks

QuickBooks Online offers a mobile app for iOS and Android that lets you capture signatures on estimates on the go.

This user-friendly app means that you don’t need to wait at the printers or carry physical forms with you.

However, you can only capture an online signature with this app from your mobile device. That means if you want your customer to sign an estimate, invoice, or sales receipt, you’ll need to physically be present with them to collect the authorized signature.

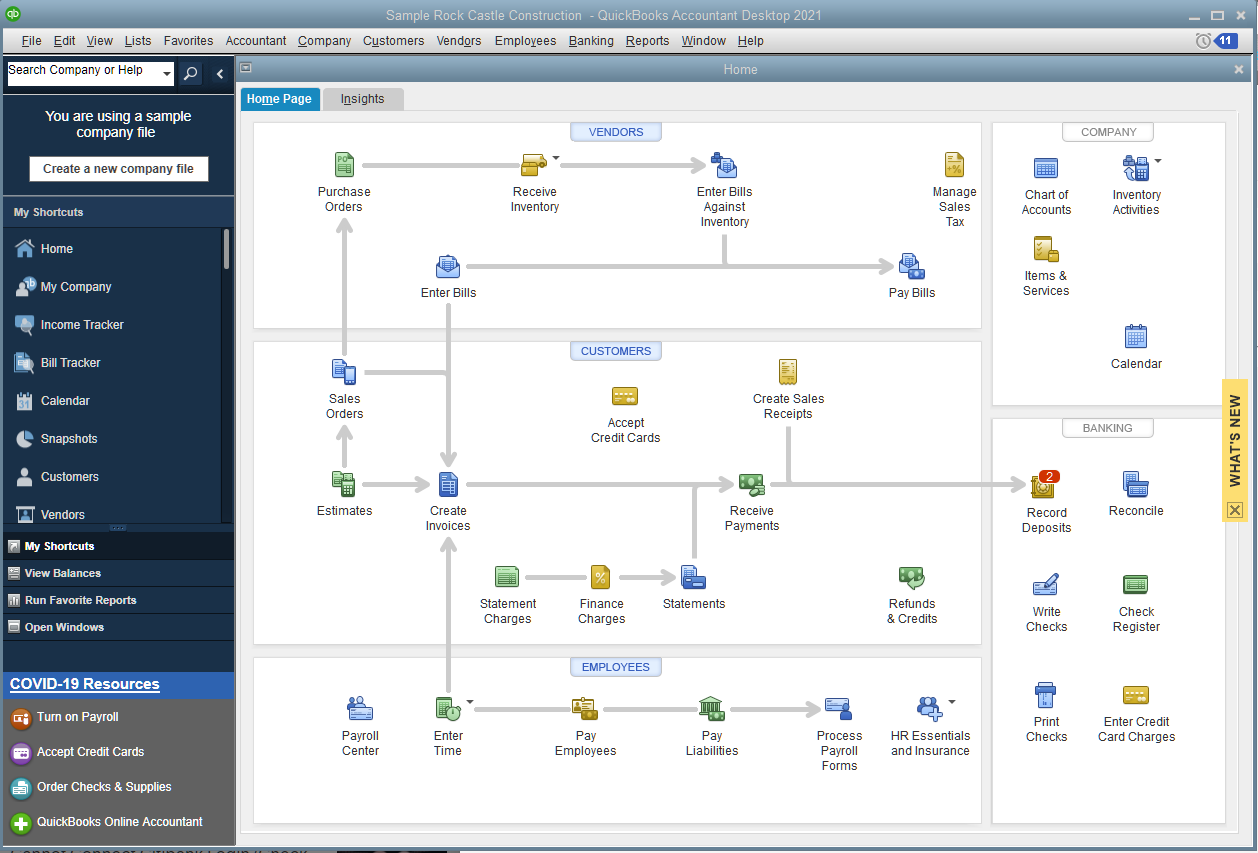

QuickBooks Desktop

Image credit: Go Get Geek.

Like QuickBooks Online, QuickBooks Desktop is an accounting software. However, this version is only accessible from your office computer. Making it near-impossible to work on the go.

QuickBooks Desktop is now only available as a comprehensive accounting software solution. It comes with all the bells and whistles — and the price tag to match. At $1,830 per year, it isn’t affordable for all small-to-midsized business owners.

QuickBooks Desktop for Windows

QuickBooks Desktop version for Windows offers several advanced features including:

- Up to 40 users.

- Payroll.

- Invoices and estimates.

- Reporting.

- Access to over 200 third-party apps (additional costs may apply).

You’ll also gain access to a mobile app, however without the online functionality, it is best used for uploading receipts.

QuickBooks Desktop for Mac

Apple Mac computers are becoming increasingly popular for businesses. Intuit has developed a Mac version of QuickBooks Desktop, however it still lacks the same functionality that the Windows version holds.

In comparison to QuickBooks Desktop for Windows there are:

- Fewer options for reporting and payroll

- Limited inventory features.

- Integration with third party applications is not as frequently supported.

That isn’t to say QuickBooks Desktop for Mac is not usable. It’s still a great accounting option for Mac users. However, it does take a backseat to the Windows version.

At this time, e-signature capture is not possible on QuickBooks Desktop without using an integration like Method.

How to capture signatures using the QuickBooks app ecosystem

Use applications in the QuickBooks ecosystem to implement e-signature capture for your digital format documents.

Apps in the QuickBooks ecosystem include any software in the QuickBooks app store. With these vetted integrations, you can extend the power of QuickBooks to include capabilities like digital signature capture, email marketing, inventory management, and more.

Benefits of integrating e-signature software with QuickBooks

The ability to sign a document anywhere, anytime, is only one of the many benefits of integrating a QuickBooks electronic signature solution.

Below are some of the other ways you can benefit from a QuickBooks signature capture integration:

- Save time: Since you don’t waste time scanning or sending documents, you can focus on other essential tasks. In addition, you won’t have to wait for documents to arrive or be returned before you work on them.

- Reduce costs: Since you don’t pay for printing costs, you can save money on ink cartridges, toner, and paper. You can also reduce shipping costs since you won’t have to mail physical copies of documents.

- Improve organization: If you use e-signing, you can store all your signed documents online. This makes it much easier to manage all of the documents — anywhere, anytime.

- Get paid faster: On average, e-signatures shorten your sales cycle from eight days to three hours. All of which means you get paid sooner.

How QuickBooks e-signature capture helps your business

Keep your cash flow healthy

Most small to midsized business owners have experienced the pain point of outstanding customer payments.

In using e-signature capture, you can shorten sales cycles from days to only a few hours. Digital signatures allow for a faster, smoother, and simplified experience.

Making it easier for customers to pay you keeps your cash flow healthy!

Automate your contract workflow to increase efficiency

Save time on manual tasks like hard-copy signage and delivery with QuickBooks digital signature capture. When you implement e-signature capture into your workflows, your clients get contracts signed and sent to you faster. As a result, your employees can get straight to work and generate more revenue for your business.

This automation saves precious time that your team can now dedicate to your customers.

Improved security

E-signature capture is more secure than hard copy manual signage because it’s more difficult to replicate.

Moreover, you can ease any worries about using QuickBooks digital signature solutions on apps.com as Intuit regularly audits these tools for security.

For example, Method hosts its services through Amazon Web Services and uses insured standard encryption and security practices to keep your client data safe.

Easier document organization

Digital documents are much harder to misplace than paper copies because you can store these in a drive.

Keeping all of your digitally-signed documents online reduces the risk of confusing information between clients or misplacing signed agreements.

Quick and easy approvals

E-signature functionality lets your customers approve estimates and pay deposits with the click of a button.

You and your customers can sign off on approvals at any place, any time. That means no more fiddling with printers and scanners during your approval process.

Better customer experience

The expectation from your customers is that they should be able to perform business interactions with you online.

So, it’s important to deliver a digital, self-serve experience to your customers — especially for signature capture and approvals.

Plus, your customers will enjoy a more positive customer experience as a QuickBooks digital signature capture is easier and stress-free.

With a QuickBooks electronic signature, your customers can sign and review documents from virtually anywhere.

Where you can use QuickBooks e-signatures

With QuickBooks e-signatures, you can capture a customer signature to approve a digital payment securely. You can use signature files in several ways:

- Estimates.

- Invoices.

- Proposals.

That said, uploading a QuickBooks electronic signature file is a convoluted process that involves signing a piece of paper and scanning it to your computer. Consider integrating QuickBooks with a trusted, third-party app such as Method, which authorizes signature functionality on-screen.

Find out more about how that works below.

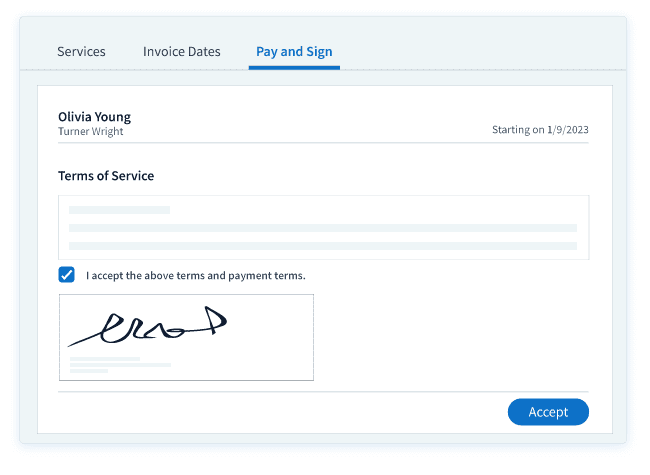

Achieve QuickBooks signature capture with Method

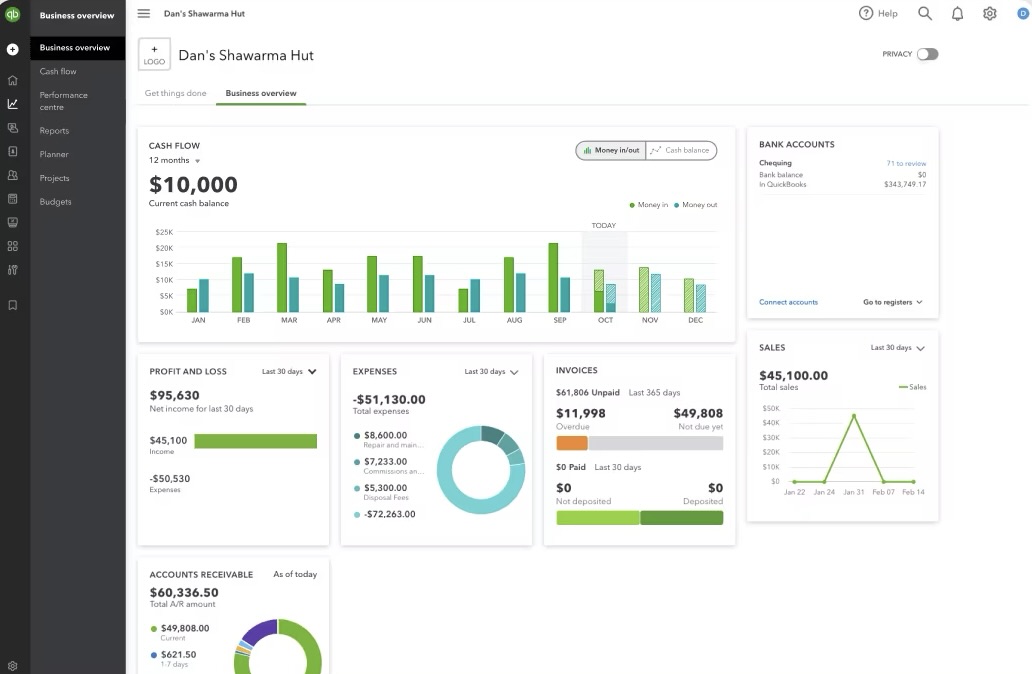

With Method, you can add signature capture to any document that can use it. Here’s a peak at what QuickBooks signature capture looks like in the Proposals App.

Method’s two-way sync with QuickBooks Online and Desktop ensures optimal QuickBooks digital signature capture. Just send a link to the document so your customers can digitally sign instantly.

Better yet, e-signatures in Method have no signature limits (unlike other QuickBooks digital signature solutions).

QuickBooks signature capture: Get started with Method

The benefits of using QuickBooks with Method are abundant. Watch the video below to see why QuickBooks users love using Method.

Aside from helping you capture signatures for estimates and proposals, you can also:

- Manage your sales pipeline.

- Create personalized templates for invoices, estimates, and other financial documents.

- Offer your clients a self-serve customer payment portal.

- Build detailed analytics reports using automation.

QuickBooks signature capture FAQs

How do I use electronic signatures for checks and paychecks?

QuickBooks does not let you add an electronic signature to checks and paychecks, but you can attach an image of your signature to checks and paychecks. In this case, your signature must be handwritten and scanned to your computer.

To enable this feature, select your digital signature from the signature preferences menu and drop it into the signature field on-screen. This lets you sign once and have it printed on all your future checks and paychecks (Instead of handwriting it each time).

Is an electronic signature legally binding?

Electronic signatures can be legally binding. The validity of an electronic signature depends on local legislation and the means by which the signature is captured. Electronic signatures are typically more secure than handwritten signatures, as those are easier to tamper with.

How much do QuickBooks electronic signatures cost?

Electronic signature capture is included free with QuickBooks, but comes with limitations. It needs to be handwritten and scanned to your computer, which is an issue when dealing with multiple customers.

Consider integrating your QuickBooks software with an affordable, trusted, third-party app like Method. You’ll speed up your approval process by capturing digital signatures on-screen, so your customers don’t need to jump through hoops to do business with you.

Get started with Method with a free trial. No credit card required!

Image credit: Mikhail Nilov via Pexels