Drawing from our experience, customer relationship management (CRM) software offers small businesses crucial tools to compete with bigger competitors. For example, a CRM helps boost your customer’s experience and improve sales by automatically organizing your current customers and capturing new leads.

And this is only the beginning of how this solution helps your business!

When choosing the right small business CRM Australia solution, it’s vital to understand what CRM software is and how it benefits your business. Read on to find out your top 10 small business CRM Australia options.

What is a CRM software?

As per our expertise, CRM software fuels your growing business with tools that track your contacts, capture leads automatically, and build the long-lasting relationships you want with your customers.

When looking for a CRM software, make sure to keep an eye out for one that has:

- Native integrations with your everyday tools like Gmail, Outlook, etc.

- Automation tools for sales and marketing.

- Two-way sync with your accounting software like QuickBooks or Xero.

- Automatic follow-ups with leads and appointment reminders.

- Online customer portals for a better customer experience.

- A commissions calculator for your sales team.

The growth of CRM software in Australia

CRM software is one of the fasted-growing software markets worldwide. Our research indicates that it has an estimated growth of reaching $80 billion by 2025.

The small business CRM Australia segment is key as the growth CRM enables for Australian businesses is created through a snowball effect.

When companies implement CRM software, they see exceptional revenue growth, making it crucial for other businesses to invest in a quality CRM system to compete.

Australian businesses spent more than $2 billion on CRM software in 2018, and that number has grown exceptionally over the past few years.

Why is the CRM market growing so fast?

Based on our firsthand experience, today, customer experience is vital to any small business’s growth. What’s more, internet use has migrated to mobile devices, which has boosted the use of CRM’s on-the-go.

Our findings show that more small businesses use CRM software to stay competitive against larger companies. Automation tools for sales and marketing drive growth and allow business owners to have more time to dedicate to new product lines or services.

What does CRM software do?

Through our practical knowledge, small business CRM software is more than just a contact management solution. A strong CRM solution helps fill the gaps that slow down your sales process.

Over time, we found that a CRM enhances your sales experience from lead capture to closing a sale.

The best small business CRM Australia contenders:

- Connect your entire business in one software.

- Keep your team up-to-date with real-time sync with your accounting software.

- Automate your daily repetitive tasks.

- Simplify your workdays and get more time back to focus on growth.

Why consider CRM implementation or upgrade?

When it comes to implementing or upgrading your CRM system, it’s time to evaluate what keeps your small business from reaching your growth goals.

Here are a few areas in which a CRM benefits your business:

- Overview of customer data, interactions, and transactions shared company-wide.

- Data collection, analytics, and reporting specific to your business.

- On-the-go access to your lead and customer data through a mobile app.

- Integrations that power your operations.

How does a CRM help?

A CRM helps your business by never letting you miss a sales opportunity. With automatic lead capture and follow-up reminders, you’re on track to close more sales.

Based on our observations, almost every aspect of your business benefits from CRM tools, as automation is possible for your daily, weekly, and monthly tasks.

Best CRM software in Australia

While it might be easy to search for the most popular, cheapest, or all-in-one small business CRM Australia software solution, it’s worth considering a few key areas before deciding.

Below are the top 10 best CRM software for small businesses. They each list their key features, pros, cons, and pricing.

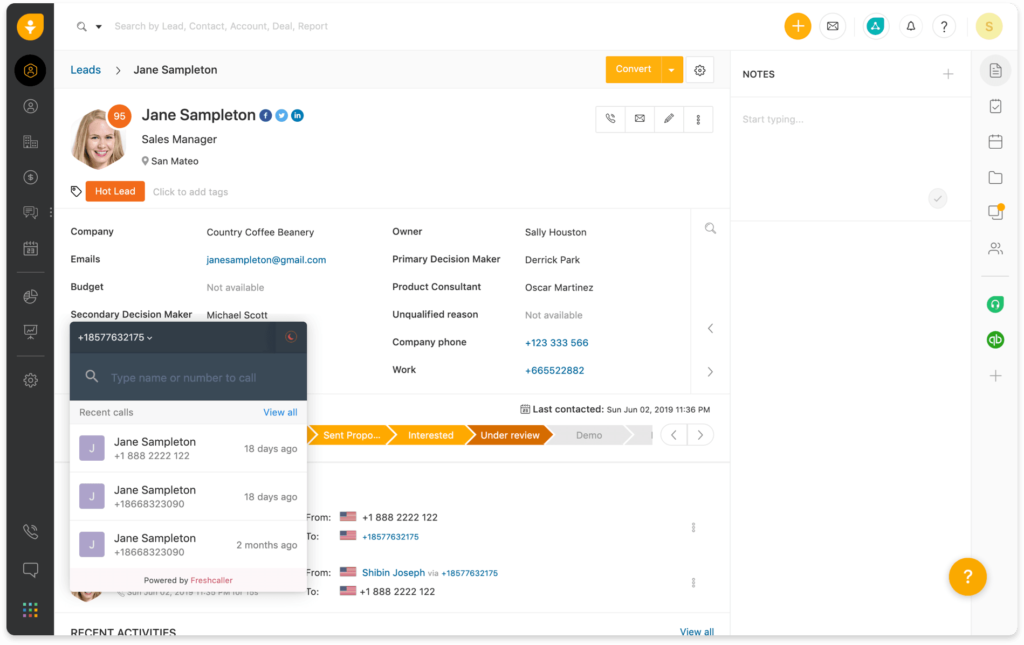

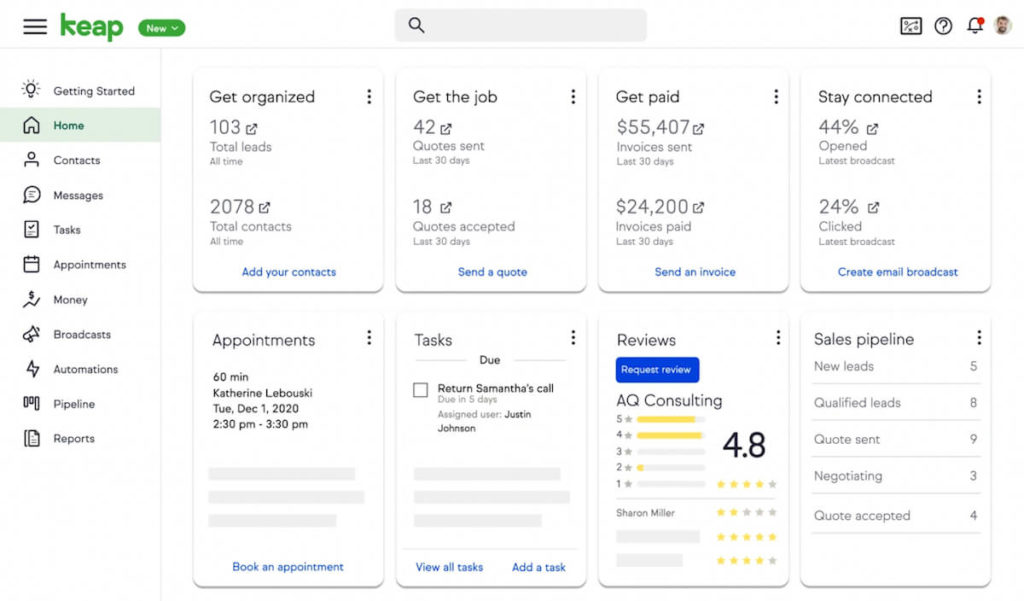

1. Method CRM

Customizable software that automates your processes and saves you hours in your workday is what you get with this small business CRM Australia solution.

Tracks your sales process at every stage and never miss a sales opportunity again with Method CRM’s leading automation.

Key features

Method CRM offers features including:

- Two-way sync for QuickBooks and Xero users.

- 24/7 online customer portals to empower your customers with self-service.

- Integrations with Gmail, Outlook, Google Calendar, and more.

- Manage customers and leads with a 360-degree view of their history and all interactions.

- Lead capture from your inbox, website, etc.

Pros

- Easily stay up-to-date and connected with their mobile app.

- Improve your customer service with Method’s online self-serve customer portals.

- Use their customizable, drag-and-drop tools to create your perfect CRM experience.

- free trial with full access to all features and an unlimited amount of users.

Take advantage of a free hour of customization services with an in-house expert alongside your free trial.

Cons

- Method is only available in English currently.

- To take advantage of all that Method CRM offers, you must be a QuickBooks or Xero user.

Pricing

Method CRM offers three pricing plans. All plans are billed in USD:

- Contact management plan at $28 per month.

- CRM pro plan at $49 per month.

- CRM enterprise plan at $85 per month.

These plans are available monthly or annually with no contract necessary.

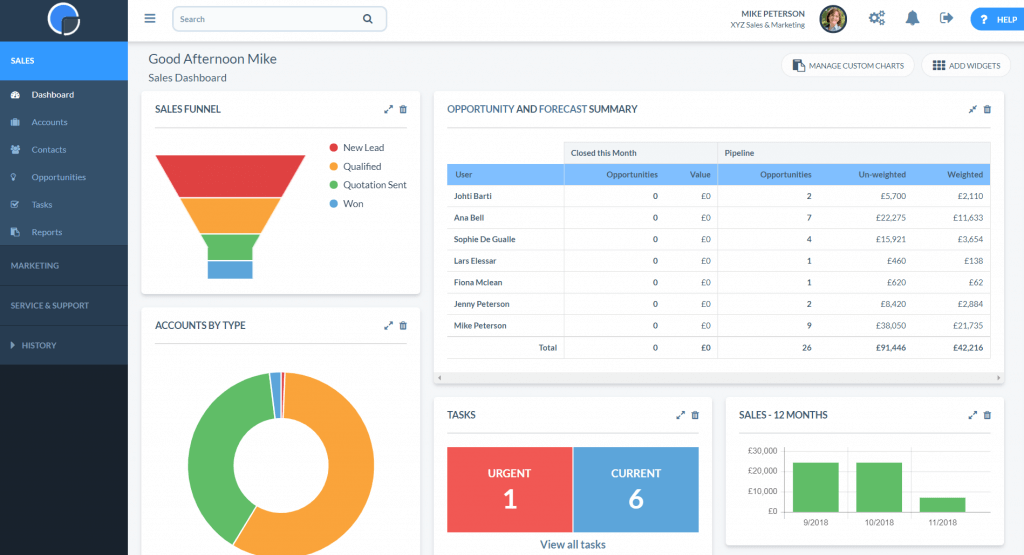

2. Really Simple Systems

Image credit: Really Simple Systems

Our analysis of this product revealed that Really Simple Systems helps your small business create lasting relationships and close more sales. It’s an easy-to-use small business CRM Australia solution that manages your sales, marketing, and customer support processes.

Key features

Some of their key features include:

- Customer history and interaction tracking.

- Marketing and email campaign tools built-in.

Pros

- Stellar and free customer support.

- Simple to use and navigate.

Cons

- Times you out of the software often.

- Limited custom reporting.

- Only offers a free trial for the Professional plan.

Pricing

Really Simple Systems offers a limited free version of their software and three paid pricing plans billed annually. All of their packages are billed in AUD:

- Starter plan: $16 per month.

- Professional plan: $35 per month.

- Enterprise plan: $55 per month.

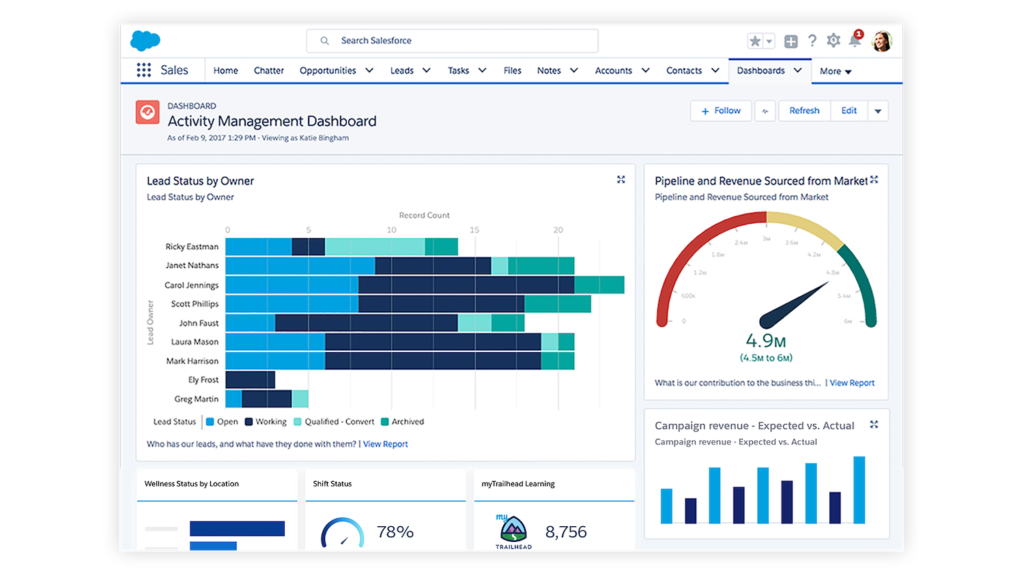

3. Salesforce CRM

Image credit: Salesforce

Salesforce offers a lot of choices for the right small business CRM Australia solution for your business. They offer tools to help you customize and automate your sales, marketing, and support processes.

Key Features

Salesforce’s key features include:

- A seamless user experience.

- Automation tools for repetitive tasks.

- Tools for a variety of industries.

Pros

- Flexible cloud solution.

- Customizable options.

- Marketing automation.

Cons

- Customer support is difficult to reach.

- A Salesforce specialist or consultant is usually needed (at a high price point).

- Offers a limited 14-day free trial.

Pricing

Salesforce offers small business pricing plans billed in AUD:

- Essentials plan: $35 per month.

- Professional plan: $105 per month.

- Enterprise plan: $210 per month.

- Unlimited plan: $420 per month.

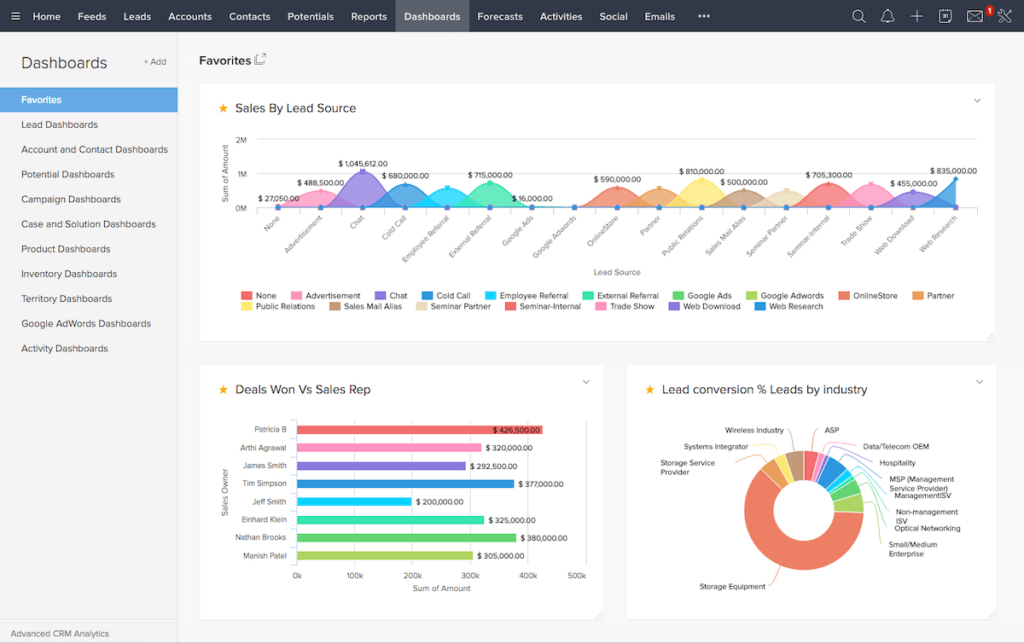

4. Zoho CRM

Image credit: Discover CRM

Zoho CRM offers customer management tools covering all aspects of running your small business. From marketing to finances. They also offer a free version for up to 10 users and with limited software features.

Key Features

- 360-view of customers.

- Easy and fast lead capture.

- Integration with other applications.

Pros

- Customer support is highly accessible.

- Form creation is highly customizable.

Cons

- Vague reporting capabilities.

- Their mobile CRM lacks tools available on their web version.

- Unfriendly user interface.

Pricing

Zoho CRM has a 15-day free trial and four pricing packages billed in AUD. They include:

- Free plan: $0 per month.

- Basic plan: $75.90 per month.

- Standard plan: $152.90 per month.

- Professional plan: $383.90 per month.

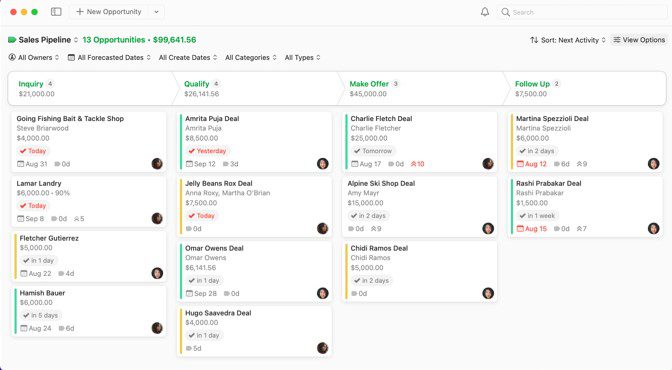

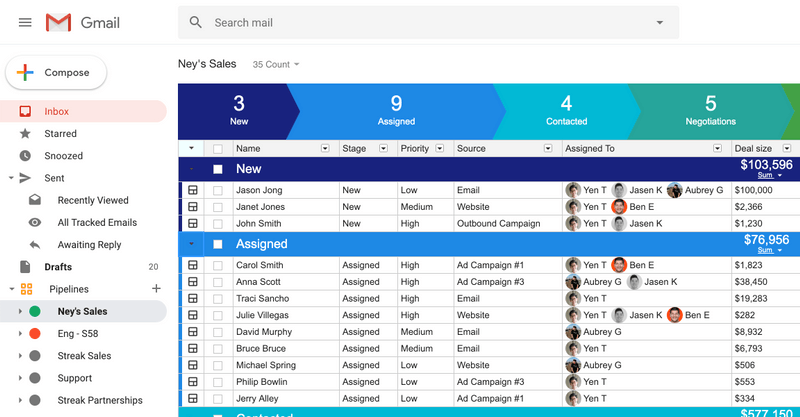

5. Streak

Image credit: Streak

Our team discovered through using this product that if you’re looking for a small business CRM Australia option that has great integration with Gmail, Streak is an excellent choice. Streak offers great tools for various industries and covers many departments within your business, including sales and customer service.

Key features

Here are a few of Streak’s key features:

- Sales pipeline templates.

- Contact info from email is captured and put into your CRM.

- Email marketing and sales follow-up automation.

- The ability to share data easily across your business.

Pros

- Easily customizable fields and forms.

- User-friendly interface.

- Offers a limited free version of their software.

Cons

- Their lower-cost plans only offer email support.

- Must use Gmail to benefit from this software.

- Only offer a 14-day free trial on their Pro plan.

Pricing

Streak offers a free version of their software and three paid pricing packages. All of their packages are billed in USD. They include:

- Solo plan: $15 per month.

- Pro plan: $49 per month.

- Enterprise plan: $129 per month.

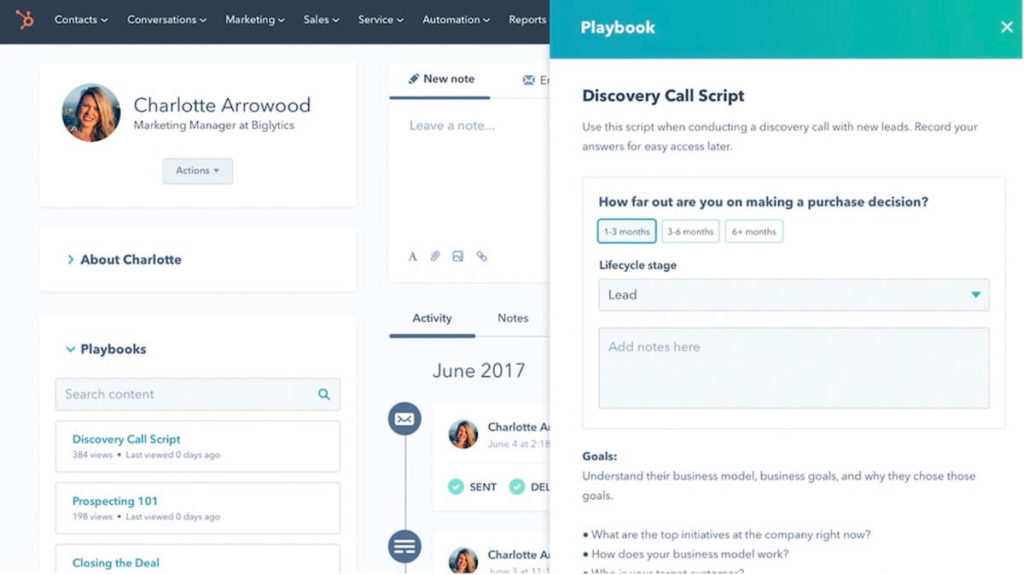

6. HubSpot CRM

Image credit: HubSpot

If you’re looking for basic CRM tools for small businesses, HubSpot has you covered. This software looks to follow your leads through the sales funnel from awareness to close.

They offer tools for marketing, customer support, sales, and CMS hubs.

Key features

Some of HubSpot CRM’s best features include:

- Lead nurture through email marketing.

- Contact management.

- Integration with more than 300 applications.

- Live chat and chatbot support.

Pros

- Provides data on which pages your customers view.

- User-friendly interface and dashboard.

- Web design software with internal content management.

Cons

- Expensive depending on the tools you need.

- Little flexibility with contract-based pricing plans.

- HubSpot CRM templates are difficult to modify.

- Transitioning from a WordPress website to HubSpot’s CMS can be complex.

Pricing

HubSpot CRM has a free version with upgrades for purchase as you scale. Their pricing plans are split into various hubs, including marketing, sales, customer service, and more.

Hubspot offers a Starter plan, Professional plan, and Enterprise plan billed in USD. Their Starter plan starts at $50 per month billed monthly or $540 billed annually, and you can request pricing for their other two plans.

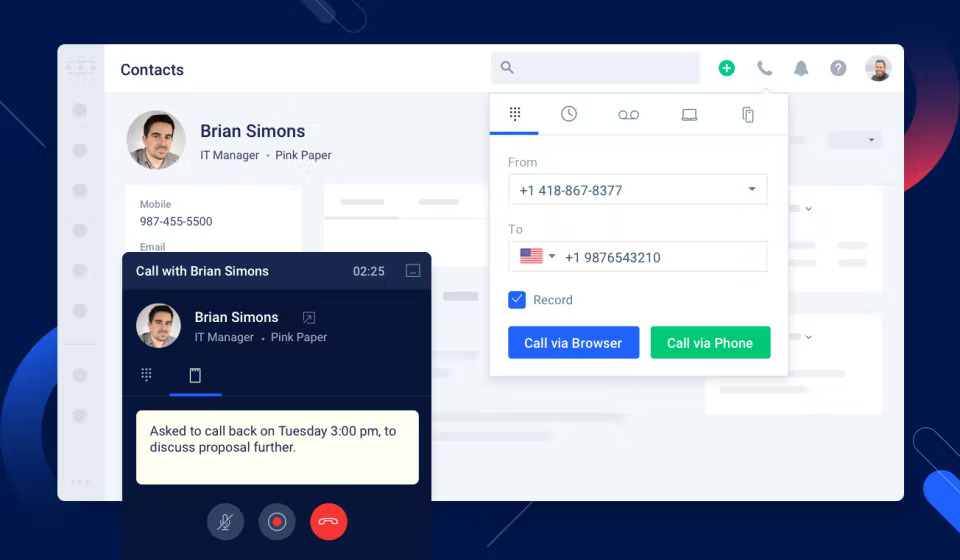

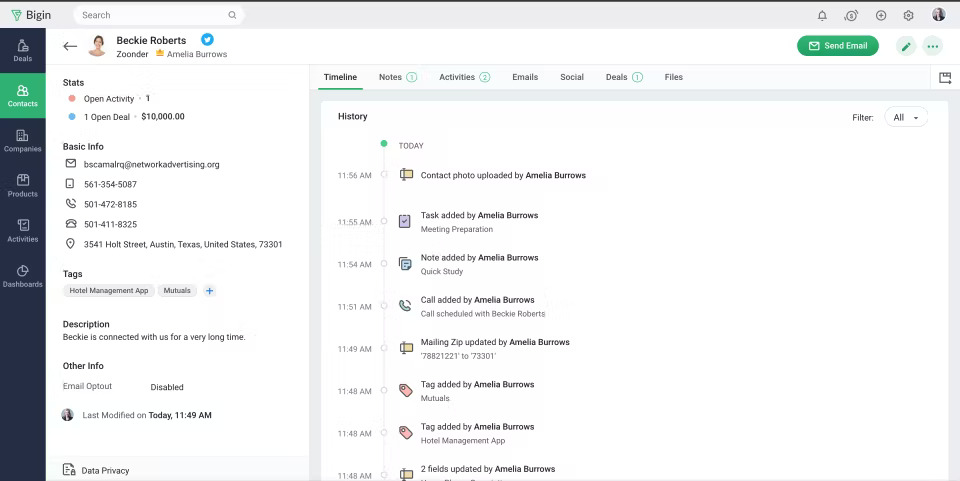

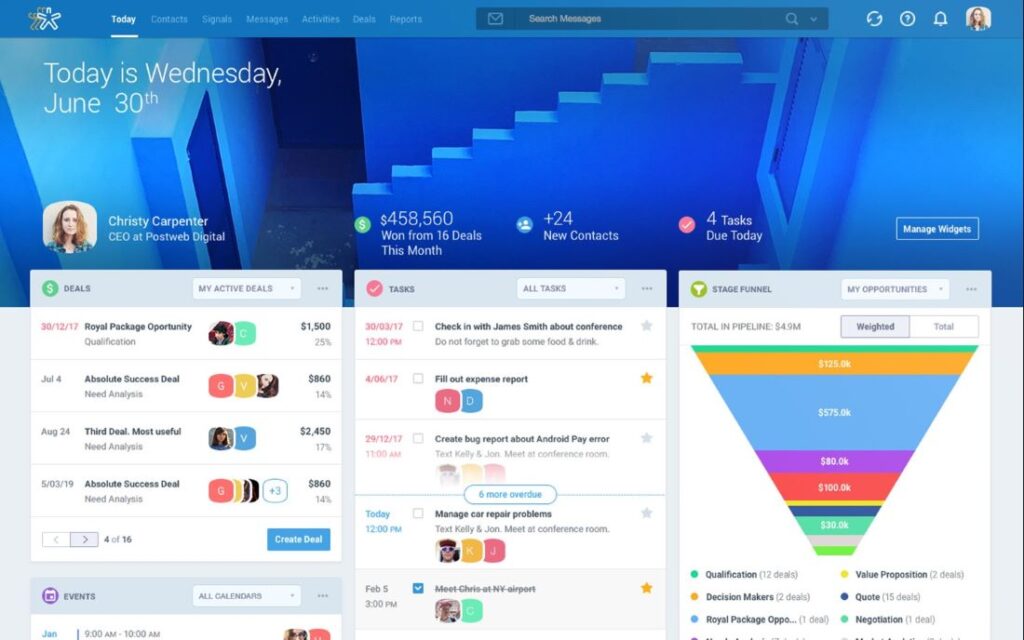

7. Nimble

Image credit: G2

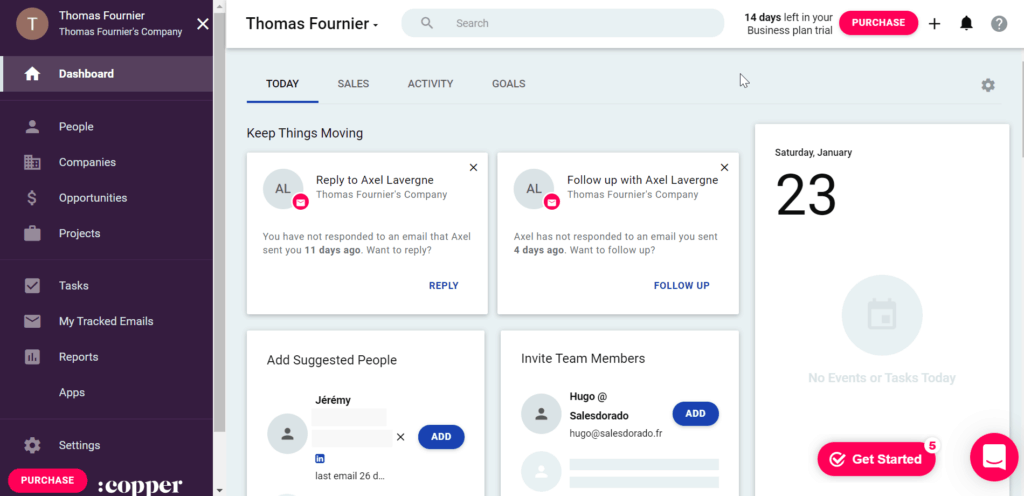

Nimble is a CRM that focuses on communication and makes it simple to stay in touch with leads and customers.

After using Nimble, we have found that the platform provides a user-friendly way to manage messages, segment customers, and keep on top of social media marketing. It’s a small business CRM Australia option at an affordable price.

Key features

Some of Nimble’s key features include:

- Different methods to capture leads.

- Easy segmenting of customers and leads.

- Mobile app is available for iOS and Android.

Pros

- Get emails, social media messages, Microsoft teams notifications, and more all in one place.

- Easy to navigate interface.

- Not very expensive compared to other CRMs.

Cons

- Only offers a 14-day free trial.

- Limited customer support.

- Lacks many tools that other CRMs provide small businesses.

Pricing

Nimble’s pricing is straightforward, with a single plan costing $19 (USD) per user per month if paid annually or $25 (USD) per user per month if paid monthly.

All Nimble features are included, up to 25,000 contacts, 1,000 custom fields, and 2 GB of storage space per user. If you require more contacts or storage, upgrades are available.

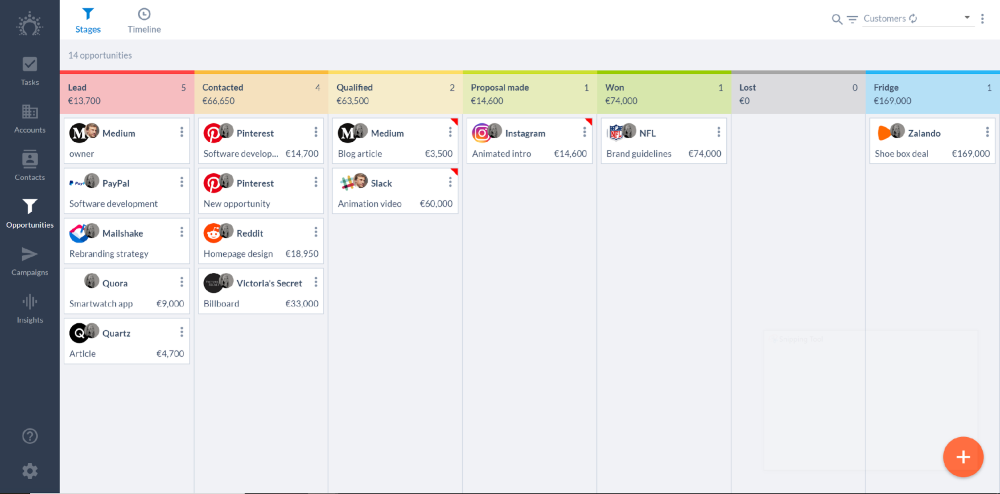

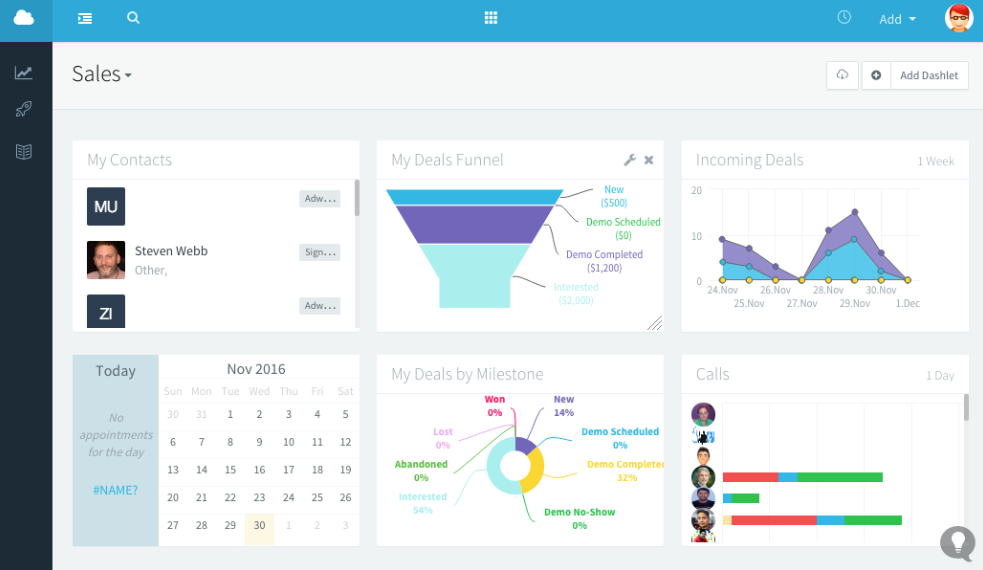

8. Agile

Image credit: Outils Webmarketing

Many businesses use Agile CRM to automate their sales, marketing, and customer service processes. When we trialed this product, we found it offers the basic tools small businesses need to thrive.

Key features

Here are some of Agile’s key features:

- Easy to sync contact information to their platform.

- Customizable contact and company fields.

- Sorting, segmenting, and targeting tools.

Pros

- Affordable software solution.

- Contact management is simple.

- Easy-to-use interface set up for those new to CRMs.

- Automated sales processes making it easier to close deals.

Cons

- Only offers one integration feature for their Starter package.

- Email capabilities lack consistency and have bugs.

- Limited third-party integrations.

- Lack of tailored reporting capabilities.

Pricing

Agile offers a free version of their CRM software with three paid plans. All of their plans are billed in USD. They include:

- Starter plan: $8.99 per month.

- Regular plan: $29.99 per month.

- Enterprise plan: $47.99 per month.

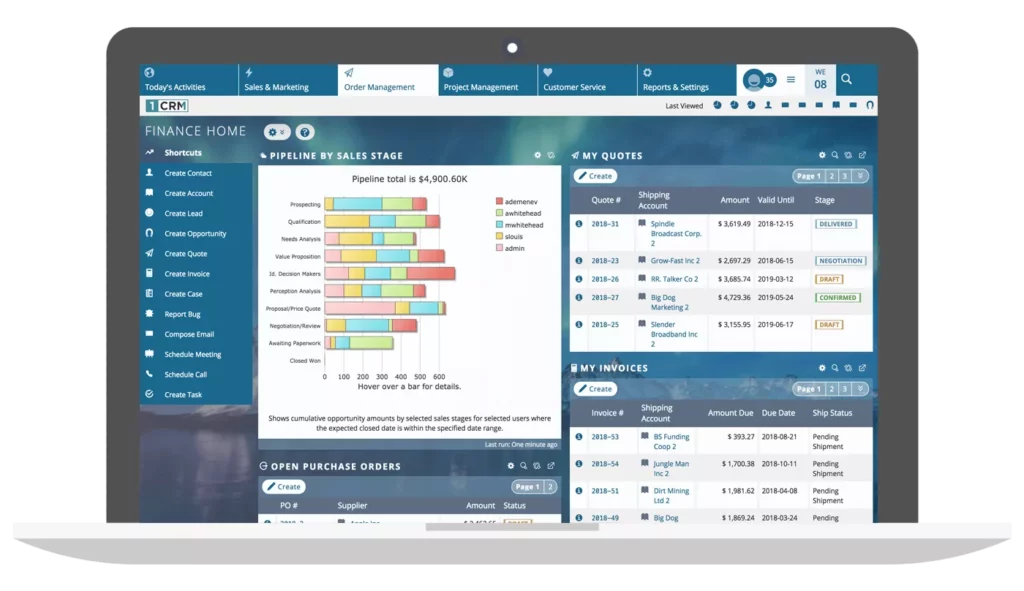

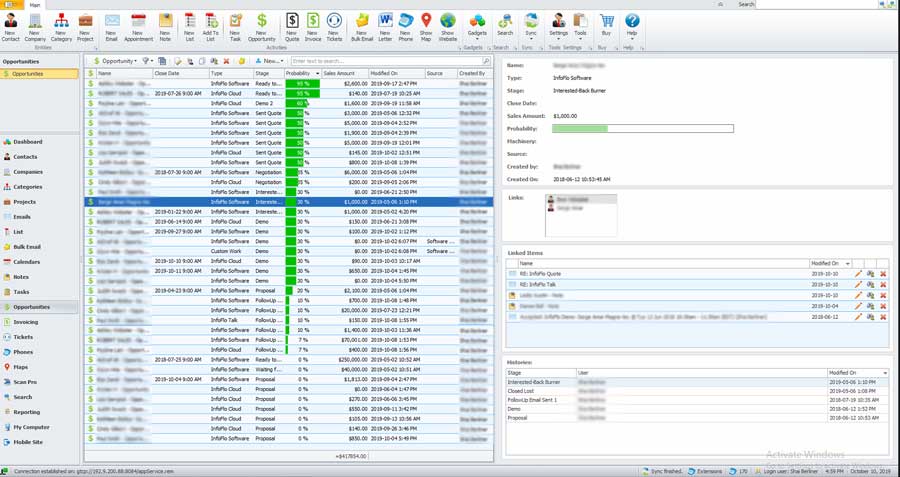

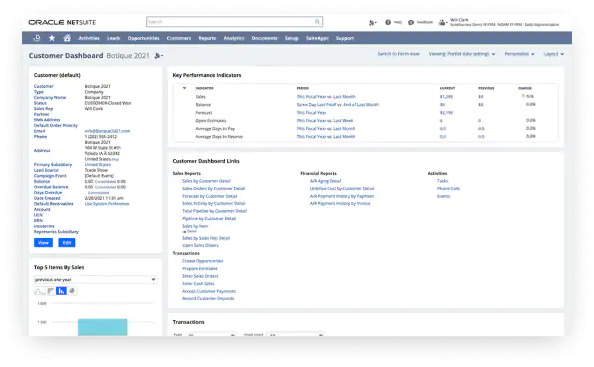

9. NetSuite CRM

Image credit: Oracle NetSuite CRM

NetSuite is a popular and extensive customer management software system. We have found from using this product that accounting, finance, payment gateways, inventory management, and other services are among its specialties.

Key features

- Cash flow management.

- Tools for monitoring expenses and assigning expenses for certain projects.

- Comprehensive dashboard with GANTT charts, profits, losses, tasks, and KPIs.

Pros

- Open API for integrations with other software systems.

- Offers dashboards specific to each employee.

- Estimates are easily turned into invoices.

Cons

- It can be a costly small business CRM Australia solution.

- Works best for mid-sized to larger companies.

Pricing

NetSuite CRM starts at around $129 per month per user. All their pricing is billed in USD.

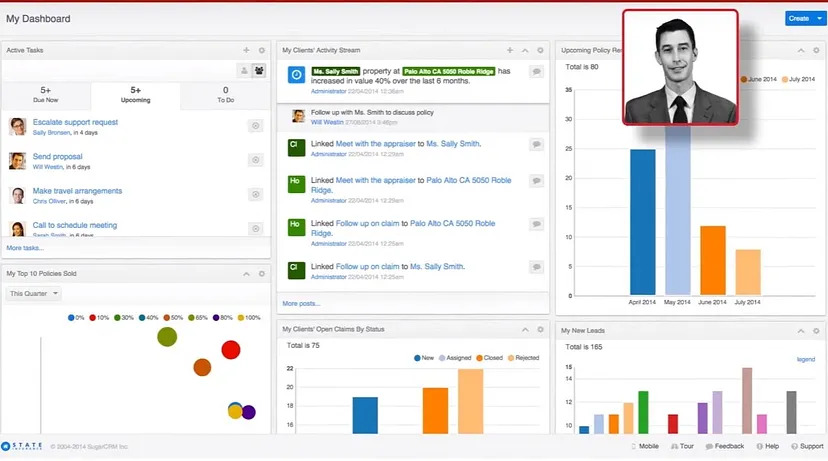

10. SugarCRM

Image credit: Medium

SugarCRM is a CRM for small businesses and offers marketing, sales, and customer service automation.

Key features

Some of SugarCRM’s key features include:

- Flexible customization.

- Intuitive campaign builders.

- Marketing and sales automation.

Pros

- Support services for tech issues.

- Enhanced marketing automation tools.

- 360-view of every customer’s journey through the sales funnel.

Cons

- Integrations with third-party apps are limited.

- Dashboards are not user-friendly.

Pricing

SugarCRM offers these pricing plans billed in AUD:

- Sell plan: Starting at $69 per month.

- Serve plan: Starting at $112 per month.

- Enterprise plan: Starting at $119 per month.

- Market plan: Starting at $1400 per month.

So, which one should I get?

Choosing a small business CRM Australia solution requires considering features, pricing, and overall fit with your industry. Now that you know your top options, keep the following points top of mind:

- Your small business budget for software implementation.

- Areas where your business needs additional tools to operate best.

- Where automation will benefit your business.

- Current growth goals and how to achieve them.

After putting it to the test, Method CRM offers the best features and integrations for small businesses using QuickBooks and Xero.

All the tools you need at an affordable price. Method CRM grows with you, and upgrades are available as you need them.

Reach your next business growth goals with a free trial of Method CRM!

Image credit: Pressmaster via Adobe Stock