QuickBooks is one of the best accounting systems for small businesses. If you’re a construction contractor struggling with disorganized spreadsheets and unpaid invoices, QuickBooks is a great place to simpilfy your accounting.

This article highlights all you need to know about QuickBooks for construction contractors. You’ll learn about QuickBooks Contractor Edition including:

- The type of business it’s best suited for.

- Some of its limitations.

Let’s jump right in!

What is the best version of QuickBooks for construction contractors?

With the various options available, you may wonder which is the best version of QuickBooks for construction contractors. The answer: QuickBooks Contractor Edition.

It was designed with the specific needs of construction contractors in mind, including:

- Job costing.

- Project tracking.

- Specialized reporting tools.

This is the best QuickBooks for small construction for small construction business as it’s easy to manage your entire business from one place.

Whether you struggle with invoicing clients and tracking expenses, or monitoring cash flow and creating customized reports, this is an excellent solution.

QuickBooks for construction contractors streamlines your tedious tasks for you so you can free your hands and focus on growing your business.

Key features of QuickBooks Contractor Edition

When it comes to QuickBooks for construction contractors, very specific features are needed to meet your business needs. QuickBooks Contractor Edition simplifies your construction workflows with the following capabilities.

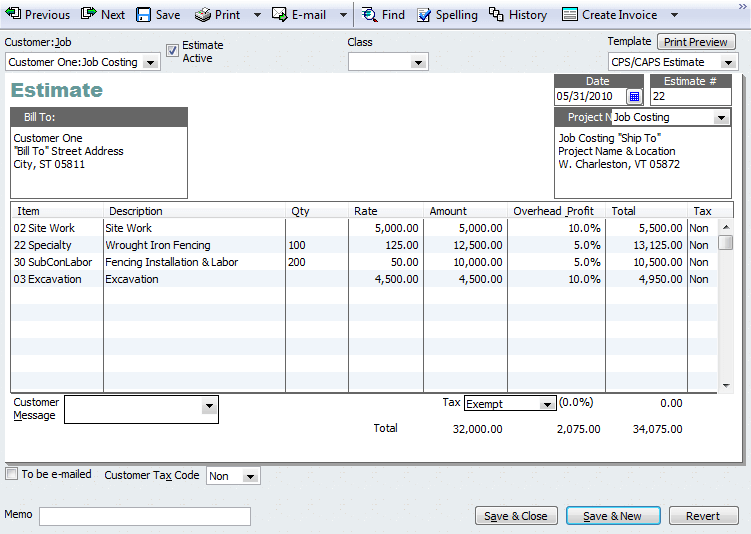

Estimates

As a construction contractor, estimates are important for you to provide your customers with quotes, as well as for your job costing reports.

When creating an estimate, include key data since it will make up the foundation of your next change orders, invoices and profit analysis.

When you need to make a change to estimate orders (which happens with larger projects), QuickBooks makes a change order immediately to deliver to your customer.

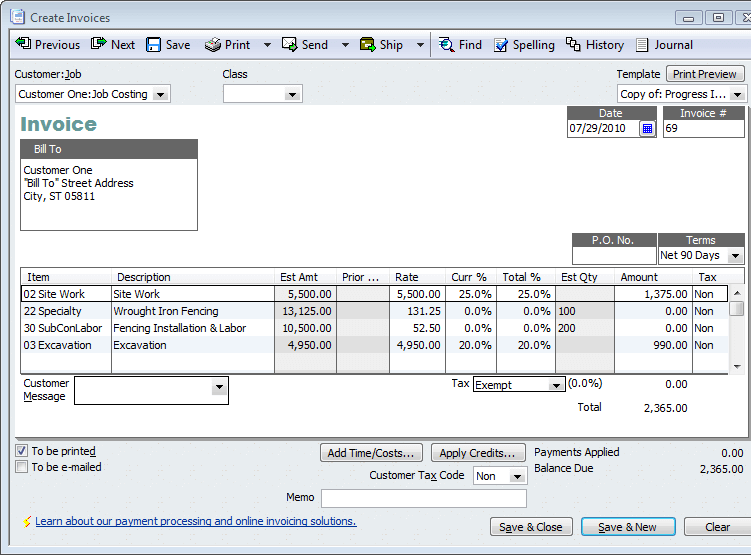

Invoicing

Generate invoices from your estimates in two easy ways. Make an in-progress invoice by selecting a predetermined percentage to bill for each item on the estimate or invoice specific items on the estimate.

When you’re ready to invoice the outstanding estimate:

- Return to the estimate.

- Click Create an Invoice.

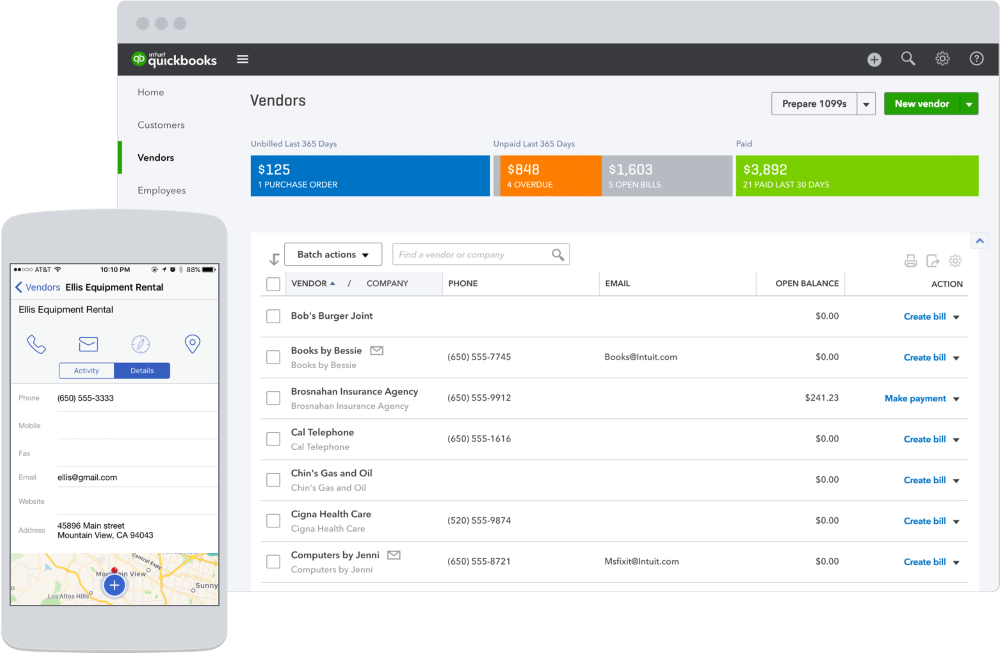

Purchase order management

Create purchase orders from scratch or from the estimate screen. This way you avoid forgetting to order materials.

Use purchase orders to identify the materials you need that aren’t included in the estimate as well.

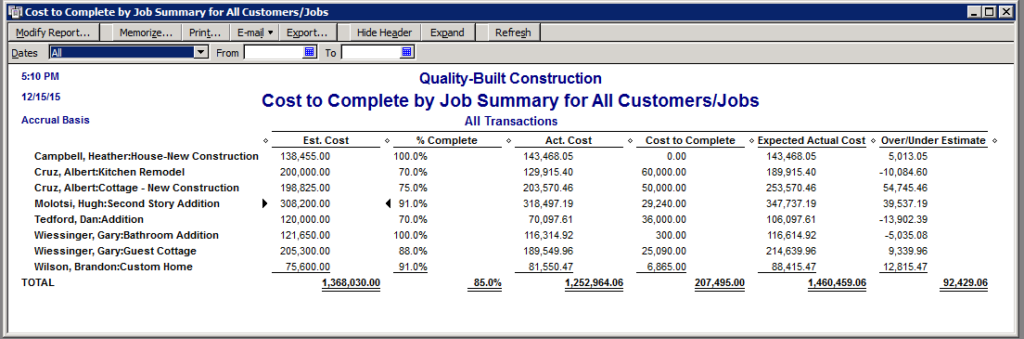

Job and project costing

As a construction contractor, you know how critical it is to track costs on a job. That’s why the Contractor Edition is the ideal QuickBooks for construction contractors.

Similar to QuickBooks Online construction job costing, the Contractor Edition job costing center includes powerful tools and reports. It allows you to get an overview of the top and bottom three profitable jobs during the past three months.

It also provides you with highlights of your performance. In addition, the various reports are customizable to fit your business needs.

QuickBooks allow you to keep track of labour costs, time and expenses for efficient job costing. Here are a few notable features:

- Dashboards and reports to see if your income exceeds your costs.

- Visual charts to show where profit is trending in projects.

- Cost-tracking calculator to check if you’re on track with budget.

Job scheduling

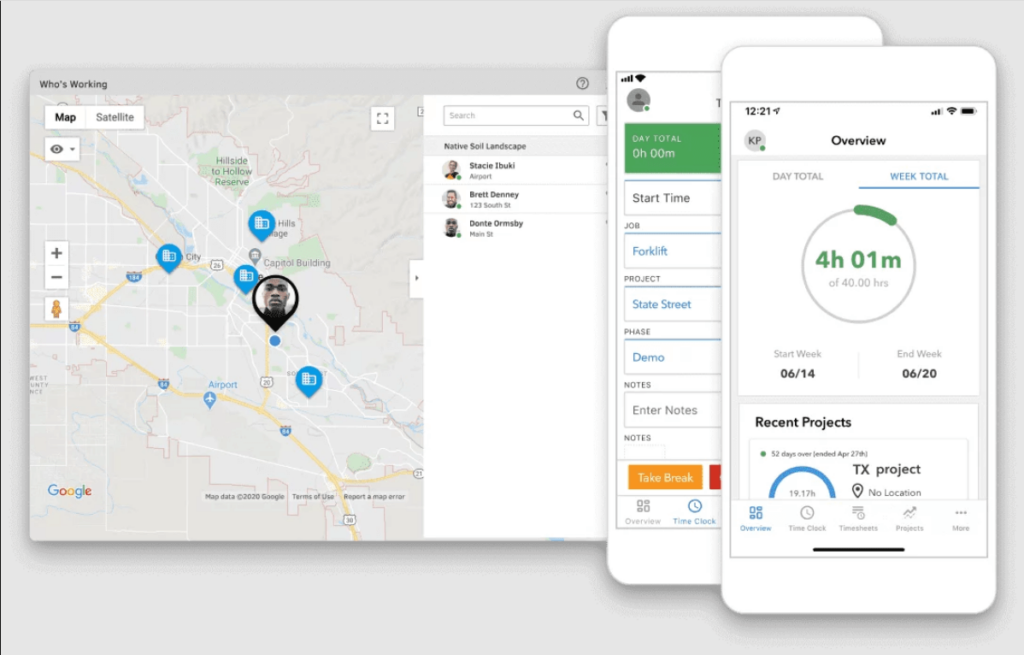

QuickBooks for construction contractors is excellent for staying on top of the endless dates and times. With the QuickBooks Time app, set multiple schedules on the go to stay on track at all times.

Create jobs and assign your crew to specific jobs in minutes, while altering them in real-time. Need your own reminders about your jobs? Set up notifications for yourself.

QuickBooks Time takes stress off your plate by storing everything in the cloud so that you can focus on the job, rather than trying to manage your subcontractors.

What makes QuickBooks for construction contractors even more ideal is the ability to view GPS points for clocked-in employees. Simply open the Who’s Working windows, add a new job to the schedule and assign it to an employee who’s working.

Reporting and forecasting

QuickBooks Contractor Edition is packed with reports for the construction contractor industry.

Your reports are always customizable to make sure you get the data you want to see. With these reporting features, you’re always on top of your cash flow and job costs.

QuickBooks Contractor Edition is best for

With its tailored tools and features, QuickBooks Contractor Edition is considered one of the best QuickBooks for small construction business. The software is suited for contractors with:

- Job costs that are separate from accounting: You save time and reduce errors when you merge your job costing and basic bookkeeping activities.

- Several crews: Make it easy to estimate job profitability as you grow and control costs for multiple crews.

- Tight budgets: With the same inventory functionality as QuickBooks Premier’s base edition, it’s easy to reuse materials on the next job. This saves you time and money as you don’t order unnecessary materials.

QuickBooks Contractor Edition pricing

A QuickBooks Enterprise annual subscription is a total of $380.00 billed monthly with the ability to customize your package for additional features here.

Main limitations of QuickBooks Contractor Edition

Although QuickBooks for construction contractors is a great solution, the Contractor Edition of the software does not come without its limitations.

The first is that cloud accounting isn’t fully supported. From unexpected expenditures that need invoices to needing to hire a technician for a last-minute job, there are some operations and accounting tasks you need to carry out on-site.

QuickBooks Contractor Edition lacks the ability to perform these tasks while on the job.

The next setback involves the user limit. QuickBooks Contractor Edition does not support more than five users working simultaneously.

If you have a construction company with an accounting department, then you want to compare other QuickBooks versions and software options.

Additionally, unlike other software, your accountants and bookkeepers can’t view your computer with QuickBooks Contractors Edition. Instead, you create an Accountant’s copy and send it by email manually.

Go beyond QuickBooks for construction contractors with Method CRM

Construction contractors are turning to CRM (Customer relationship management) to manage customers and how they interact with their business.

It’s not surprising since an effective CRM solution simplifies your construction workflows.

Fom tracking bids to managing documents, Method CRM streamlines every part of your building process.

It takes things to next level with by offering powerful integration with QuickBooks.

Manage everything in one place with Method CRM including:

- Creating estimates on the fly.

- Converting estimates to a sales order.

- Issuing an invoice without needing to re-enter data.

The best part? The automated workflows make it faster to get paid and service your customers. See how below.

Plus, no need to access QuickBooks once you’re synced. Your customers simply pay invoices online.

Method CRM gives you a 360-degree view of your client history as well, making it easy to deliver exceptional service to customers.

How do you connect Method CRM to QuickBooks?

Syncing Method CRM with your QuickBooks Desktop or Online account is a simple process. Follow the detailed steps in this article or watch the video below to learn how.

Bottom line: How to make the most of QuickBooks for construction

Using QuickBooks for construction contractors simplifies workflows so that you can focus on growing your business.

One of the best QuickBooks for construction business is QuickBooks Contractor Edition, as it’s tailored to meet the needs of your contracting business.

Connect your QuickBooks to Method CRM to enhance your operations with:

- Powerful workflow automation.

- Two-way, real-time sync with QuickBooks.

- A 360-degree view of every client.

QuickBooks for construction contractors FAQs

Which QuickBooks is best for small construction business?

QuickBooks Contractor Edition is the best QuickBooks software for small construction business. It’s tailored for the construction industry with all the features you need to manage your finances efficiently and effectively, while remaining easy to use.

QuickBooks Contractor Edition makes it easy to stay on top of job costs and get paid in full and on time.

Is QuickBooks Online good for construction?

When it comes to QuickBooks for construction contractors, QuickBooks Online is a great solution for managing finances.

QuickBooks Online offers basic accounting functionalities, lien waiver tracking, and bid proposal management. It also allows you to access your financial data from anywhere, making it easy to stay on top of everything while you’re on-site.

What is the best software for a small construction business?

QuickBooks Contractor Edition is the best software for a small construction business. With QuickBooks Online construction job costing as well as other features, it’s designed to meet your accounting needs as a small construction business.

Ultimately, however, your choice of the best QuickBooks for small construction business depends on the needs of your business.

For example, if you have an extensive accounting department, then you’ll need to consider other versions of the software, as the Contractor Edition has a limit of five users working simultaneously.

How do you create a job costing report in QuickBooks Online?

To create a job cost reporting in QuickBooks Online set up your chart of accounts specific to the construction industry.

Then assign each job or project to its own unique account so that all associated costs are tracked separately. You can also set up classes (or categories) to track different aspects of each job, such as labor and materials.

Once you have your accounts and classes set up, head to the “Reports” tab in QuickBooks Online and under the “Jobs & Estimates” section. Here you’ll find a selection of customizable reports to track your costs.

Filter these reports by specific jobs or projects, so that it’s easy to see exactly where all your money is going.

Ready to take QuickBooks Contractor Edition to the next level? Watch our demo to get started with Method CRM!

Image credit: Shutter B via Adobe Stock