In today’s fast-paced business world, efficiency and accuracy are paramount. Whether you’re a freelancer in France or a small business owner in the US, effective financial management is crucial.

Enter invoice and estimate software.

This comprehensive guide delves into its:

- Core functions.

- Key features.

- Immediate and long-term benefits.

From streamlining operations to fostering client trust, discover how this tool transforms your financial processes.

What is invoice and estimate software?

Invoice and estimate software is a system that simplifies creating and managing invoices and estimates. It lets you track payments and monitor expenses efficiently, ensuring accurate record-keeping.

For businesses that deal with vendors and product shipping, this software is indispensable. It ensures every penny of your money is accounted for.

It also stores customer and vendor details, so it’s easier to:

- Review past transactions.

- Track invoices.

- Manage inventory.

Understanding the core functions of invoice and estimate software

At its core, this software serves two primary purposes:

- Estimation.

- Invoicing.

Before finalizing a deal or starting a project, it’s essential to give potential clients an estimate of the costs involved. In this sense, software:

- Generates detailed and professional-looking estimates.

- Converts estimates into invoices or purchase orders after approval.

After rendering a service or delivering a product, businesses create an invoice detailing the costs. The software:

- Automates invoice generation, ensuring accuracy and consistency.

- Enables recurring invoicing.

- Facilitates online payment options, from credit cards to web-based apps like PayPal.

- Enhances customer communication.

Key features of invoice and estimate software

- Customizes invoice and estimate templates to match your brand’s look.

- Sends timely reminders to clients about upcoming or overdue payments.

- Integrates with other business tools, like accounting software and payment gateways.

- Provides comprehensive sales reports on categories like items sold.

- Calculates and applies taxes automatically, sometimes supporting various currencies.

- Ensures regulatory compliance, adjusting tax systems based on location.

It’s clear that there are great benefits to using this software, let’s look at some of the main ones.

The advantages of invoice and estimate software

Invoice and estimate software isn’t just about sending bills. It streamlines payment processes from beginning to end and lets you reap long-term benefits by automating manual tasks.

Let’s look at the main advantages.

Streamlining business operations: The immediate benefits

Automated calculations and pre-filled templates mean fewer mistakes in billing.

Invoice and estimate software reduces manual data entry and boosts productivity in financial tasks. This way, you can dedicate more time to value-adding activities.

By using custom templates, you impress your customers with sleek, branded invoices and estimates that boast professionalism.

It also reduces the quote-to-cash cycle by promptly sending invoices and estimates electronically without postal delays.

Long-term payoffs: Enhanced productivity and revenue

With automated reminders and faster invoicing, this software improves cash flow management. It also assists with financial forecasting through data analytics, helping businesses:

- Spot sales trends and opportunities.

- Make informed decisions about pricing, services, and more.

As your company grows, the software adapts, handling increased volumes without compromising efficiency.

And because it typically offers cloud-based access for remote management, you can oversee your financial processes from anywhere.

Through consistent, timely, and accurate billing, you foster trust among clients, increasing the chances of repeat business.

The software also offers secure data storage, ensuring your financial documents and client details are safe.

The process: From creating estimates to sending invoices

Navigating the financial aspects of your business is intricate. The right approach makes it a seamless journey. From the initial estimate to invoice creation and dispatch, each step is crucial for transparency and efficiency.

Crafting an accurate estimate: The initial steps

Creating an estimate is the foundation of any financial transaction. More than numbers, it’s about setting clear expectations. Invoice and estimate software simplifies quote and proposal drafting, ensuring you cover every aspect.

Start by understanding the client’s needs and the scope of the project. With this clarity, you can itemize services or products.

Remember, an accurate estimate protects your business and builds trust with your clients.

Converting estimates to invoices: The seamless transition

Once an estimate is approved, the transition to an invoice should be smooth. This phase is about formalizing the costs you’ve agreed upon.

Using invoice and estimate software, you can convert an estimate directly into an invoice with a click. Make sure to include any additional costs that came up during the project’s execution.

Communication is key here, so always notify your client about any adjustments. The manages invoice disputes and adjustments, for smoother transactions in the future.

Dispatching and monitoring invoices: Staying in the loop

After creating the invoice, the next step is dispatching it promptly. The software enables digital invoicing, which lets you send the invoice instantly.

Whether it’s keeping an eye on payment deadlines or sending gentle reminders to clients, the software also facilitates timely payment tracking, improving payment times.

It also helps you address any queries or concerns quickly, fostering trust among your clients.

Ensuring a smooth payment process for customers

Providing a hassle-free experience for your customers is a crucial part of a seamless payment process. By understanding their preferences and offering multiple payment options, you build trust and ensure timely transactions.

Available payment options: Catering to different customer preferences

Every customer is unique, and so are their payment preferences. Software supports multiple payment methods like cash, checks, and digital payments.

It’s essential to offer a variety of payment options. This:

- Enhances customer convenience.

- Increases the likelihood of prompt payments.

- Promotes repeat business.

Dealing with credit and debit card payments

Credit and debit card payments are the new standard. They offer both convenience and security. It’s vital that you choose an invoicing solution that manages credit and debit card payments efficiently to ensure a smooth experience.

This includes:

- Having reliable card processing equipment.

- Ensuring secure transactions to protect customer data.

- Being transparent about processing fees.

Facilitating online payments: Offering digital convenience

The digital age has ushered in a multitude of online payment methods, from bank transfers to digital wallets. By integrating these options into your payment system, you cater to a tech-savvy audience that values digital convenience.

Ensure your online payment gateway is

- User-friendly.

- Secure.

- Quick.

Remember, the faster the process, the happier the customer.

Managing overdue invoices and establishing payment terms

In the world of business, regardless of industry, cash flow is king.

By having clear payment terms and a strategy for overdue invoices, you can maintain a healthy financial flow.

While software helps with late fee and overdue invoice management, there are a few steps you can take to prevent cash flow issues. Below are some tips.

Designing payment terms for customers

Setting clear payment terms is the first step in ensuring timely payments.

Start by determining how quickly you need payments to maintain a steady cash flow. Software provides customizable payment terms, helping you set terms like net 30 or net 60.

Clearly state your payment terms on every invoice. Clarity and transparency are your best bet when it comes to:

- Due dates.

- Accepted payment methods.

- Potential late fees.

Some businesses offer annual or early payment discounts to motivate clients to pay upfront or ahead of the deadline.

Addressing overdue invoices and implementing late fees

Even with clear terms, some invoices might go overdue. A few ways to address this include:

- Sending a friendly reminder before implementing penalties.

- Adding a late fee, as long as stated in the initial payment terms.

- Starting a conversation to understand how you can accommodate customers better.

Managing payments is a balance of firmness and flexibility. By addressing overdue invoices with understanding and tact, businesses safeguard their financial health without compromising customer relationships.

Using reports to gain comprehensive insights on sales

Reports are the beacon in the realm of business data, illuminating the path forward. Software allows for real-time financial data updates, giving you an updated picture of your financial standing.

When it comes to sales, you can analyze reports for invaluable insights. This helps you understand your team’s performance and make informed decisions.

Let’s look at some ways you can leverage insights to close more deals.

The importance of reports in invoice and estimate software

Many people underestimate the trove of data that invoice and estimate software holds. Reports give a clear picture of your financial standing, including:

- Revenue streams.

- Outstanding payments.

- Overall profitability.

By analyzing sales over time, sales teams can identify patterns, predict future sales, and adjust strategies accordingly. This software also simplifies financial record management in a single page, so you’re not sifting through paperwork or spreadsheets.

Leveraging complete reports for business decision making

Understanding which products or services are most profitable lets you focus your efforts and resources more effectively. Sales reports also help you:

- Set realistic budgets and forecasts for the future.

- Highlight regular clients or those with outstanding payments.

- Tailor your communications and offers to different customer segments.

Harnessing the power of sales reporting empowers you to navigate the complexities of the market with confidence and clarity.

Top invoice and estimate software choices for 2023

Navigating the world of invoice and estimate software is a challenge, but the right choice streamlines accounting procedures and business operations significantly.

Here’s a closer look at the top contenders for 2023.

Method

Method offers a holistic approach to customer relationship management. It automates your entire quote-to-cash cycle.

It’s the #1 automation tool for QuickBooks and Xero users, helping them store estimates and import leads from accounting systems. Its seamless two-way sync lets you:

- Distinguish potential and secured sales.

- Access the data you need.

- Keep non-accounting staff from your accounting system for accurate and secure books.

Plus, because it is a no-code customizable platform, you can personalize Method to your business’ unique needs. See the power of Method in action by signing up for a free trial.

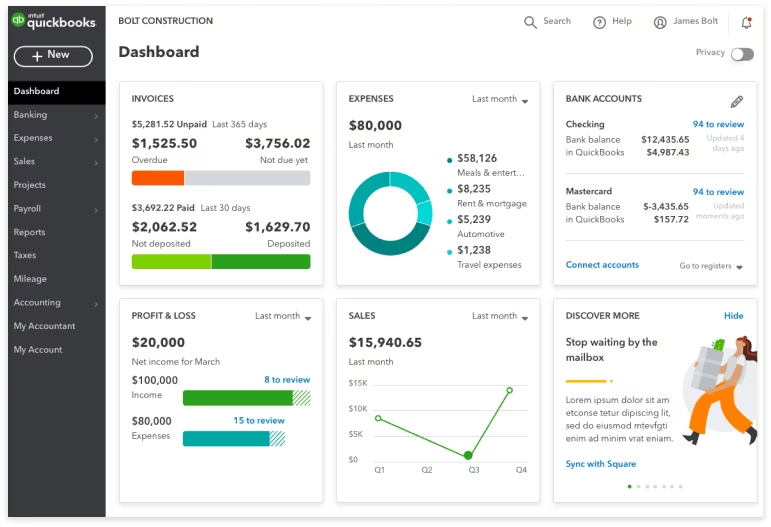

QuickBooks Online

Image credit: Intuit

QuickBooks Online is a comprehensive accounting software that integrates payment processing with business banking. It lets you:

- Pair payments with QuickBooks Checking for instant deposits.

- Integrate a number of apps to supplement functionality beyond accounting.

- Download the mobile app for iOS or Android for a real-time view of your finances.

Its intuitive interface and extensive features make it suitable for businesses of all sizes. If you’re willing to invest a bit more, the premium version of QuickBooks Online offers advanced features.

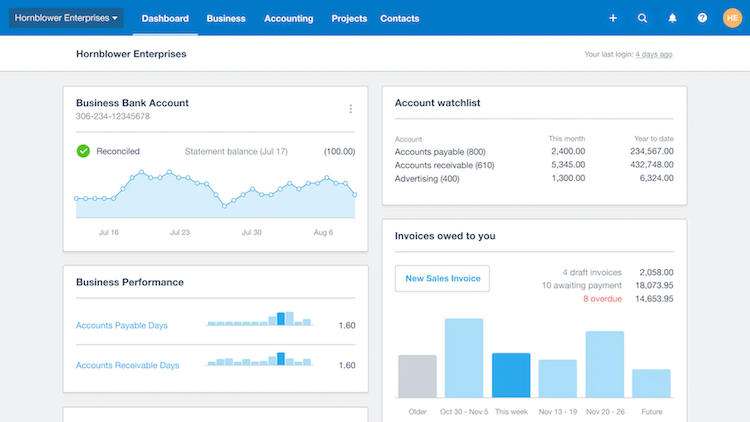

Xero

Image credit: Xero

Xero offers intuitive online invoicing, helping small businesses handle invoice admin efficiently from the desktop app or mobile devices. With its built-in schedule feature, you can plan your invoicing cycle to ensure you never miss a billing date.

Its main features include:

- Invoicing.

- Automated reminders.

- Billing management.

With features that allow you to print or export your invoices, keeping a record of your expenses and receipts is simple. Xero’s user-friendly approach ensures that users new to digital invoicing navigate the system with ease.

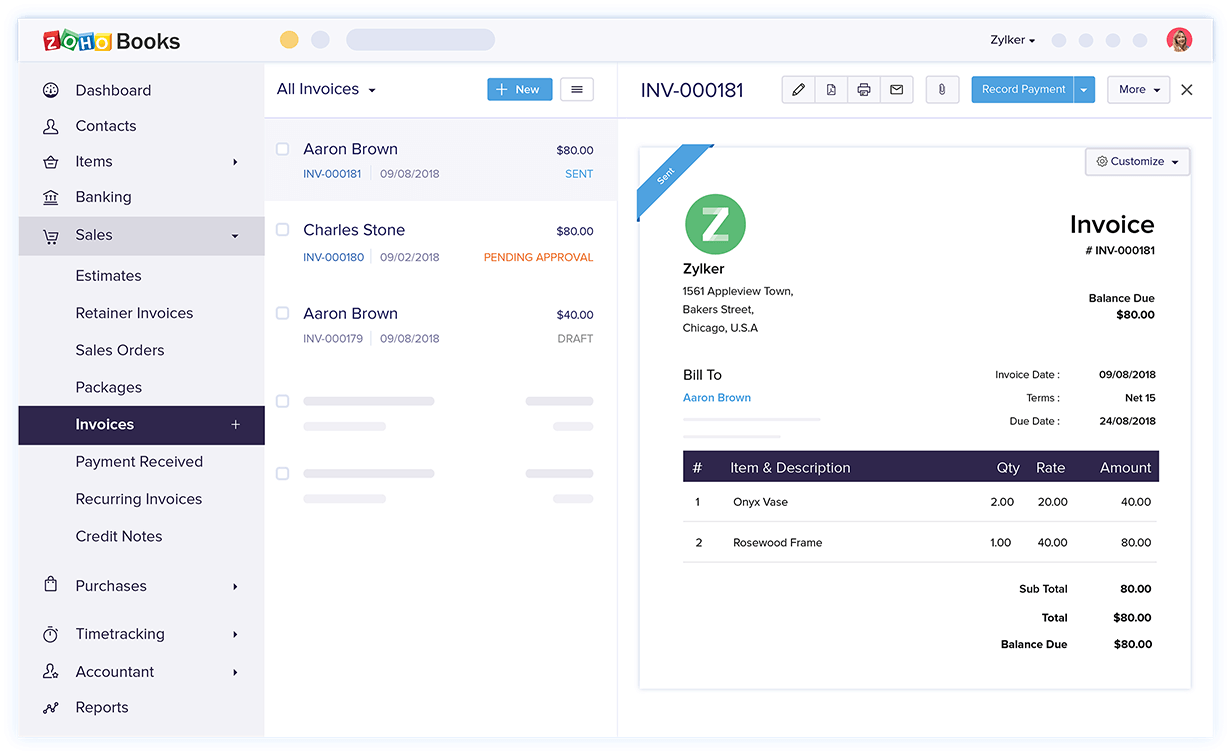

Zoho Invoice

Image credit: Zoho

Part of the broader Zoho ecosystem, Zoho Invoice offers a flexible approach to billing, helping businesses:

- Send quotes, including discounts.

- Convert quotes into invoices or projects.

Its integration capabilities with other Zoho products give businesses a unified platform for various industry-specific operations, from bookkeeping to construction. However, its features are more limited than most standalone invoicing software.

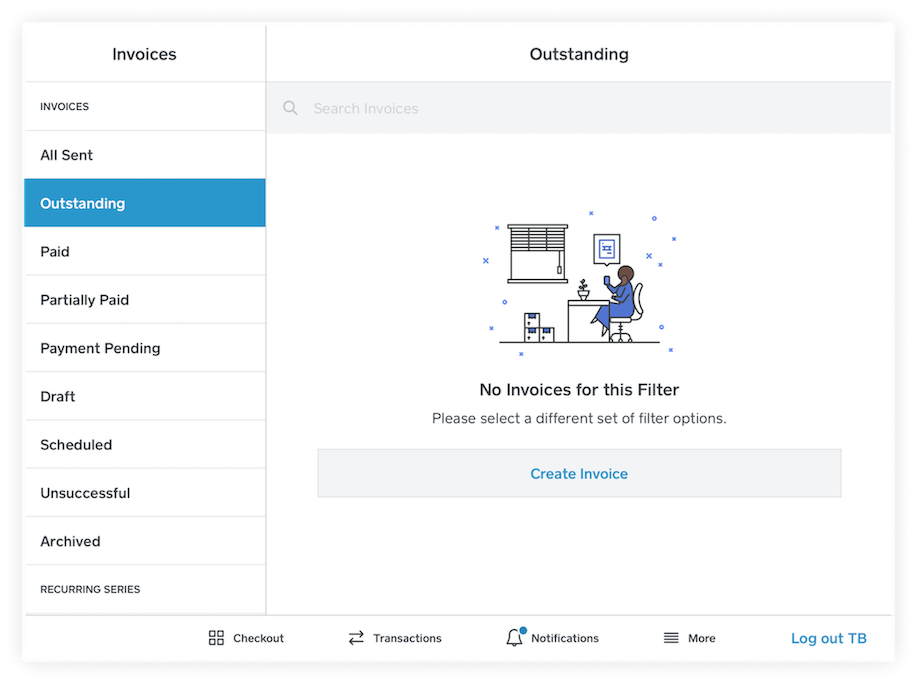

Square Invoice

Image credit: Square

Square Invoices is a part of the Square ecosystem, known for its simplicity and efficiency in payment processing.

With easy integrations and user-friendly interfaces, it’s a solid choice for businesses of all sizes.

Key takeaways

Invoice and estimate software simplifies the creation, dispatch, and management of invoices and estimates, ensuring accurate record-keeping.

Adopting such software:

- Streamlines business operations.

- Reduces errors.

- Enhances cash flow management.

This system covers every financial aspect of a business with comprehensive reports to make more informed decisions.

Consider integrating one of these top software choices, like Method, to optimize your financial processes and ensure efficiency. By comparing the top contenders and checking out reviews, you’ll find the best match for your needs.

Frequently asked questions (FAQs)

What differentiates a good invoice and estimate software from an average one?

A good invoice and estimate software stands out with its ease of use, flexibility, and comprehensive features.

While average software might offer basic invoicing capabilities, superior ones provide:

- An intuitive user interface.

- Integration capabilities with tools in your existing stack.

- Robust reporting features.

Is it possible to customize invoice and estimate templates in these software solutions?

Absolutely! Most leading invoice and estimate software solutions offer customizable templates, helping companies:

- Ensure brand consistency with logo, brand colors, and font incorporation.

- Include custom fields with specific details, terms, or notes.

How do these software solutions facilitate multi-currency transactions?

In today’s global marketplace, dealing with clients across borders is common. Most invoice and estimate software supports multi-currency transactions, letting you:

- Automatically convert invoice amounts based on exchange rates.

- Display invoice and estimate information in the client’s preferred currency.

- Adjust for different tax systems or financial regulations based on the client’s location.

Get out of the weeds and into the driver’s seat.

Automate your quote-to-cash cycle with your free trial of Method.

Image credit: Mikhail Nilov via Pexels