Your business is growing…but so are the cracks.

You’ve expanded to new locations, launched new service lines, maybe even acquired other companies. But what used to be a well-oiled operation is starting to break down.

Sales teams are quoting different prices for the same product. Reports don’t reconcile because every location names items differently. Customer records are trapped in disconnected CRMs. And no one—not finance, not operations, not leadership—can see the full picture of what’s actually happening across the business.

What’s going wrong?

You might think it’s just an accounting problem. But what you’re really seeing is the breakdown that happens when systems, processes, and data are fragmented across multiple entities. There’s no single source of truth, no standardized way of working, and no visibility into what any other team is doing.

Multi-entity accounting isn’t just about balancing the books. It’s about running a connected business: one where teams share data, follow the same playbook, and scale without reinventing the wheel at every location.

That kind of alignment sounds simple, but as businesses grow—adding new locations, divisions, or acquisitions—it gets surprisingly complex. In this article, we’ll explore the hidden challenges of managing multiple entities and how forward-thinking companies are solving them without jumping headfirst into ERP-level complexity.

At Method, we’ve helped thousands of QuickBooks-based businesses navigate this exact transition. From franchises to multi-division operations, we’ve seen firsthand how disjointed systems, siloed data, and inconsistent workflows can hold teams back. That’s why we built one of the only CRMs that truly supports multi-entity QuickBooks environments—and why we’re sharing what we’ve learned along the way.

What is multi-entity accounting, and why does it get so messy?

Multi-entity accounting means managing separate financials for each legal entity within a business, while still needing a clear, consolidated view of how the overall company is performing.

It sounds straightforward on paper. But in practice, it gets complicated fast.

Businesses often split into multiple entities for good reasons. For example:

- A franchise brand might have dozens of independently operated locations, each with its own books.

- A manufacturer might separate its service division from its product sales.

- A growing company might acquire others and keep each one running under its original legal structure.

Multi-entity setups allow you to take advantage of tax benefits, limit liability, and scale. But they can also create serious operational and financial headaches.

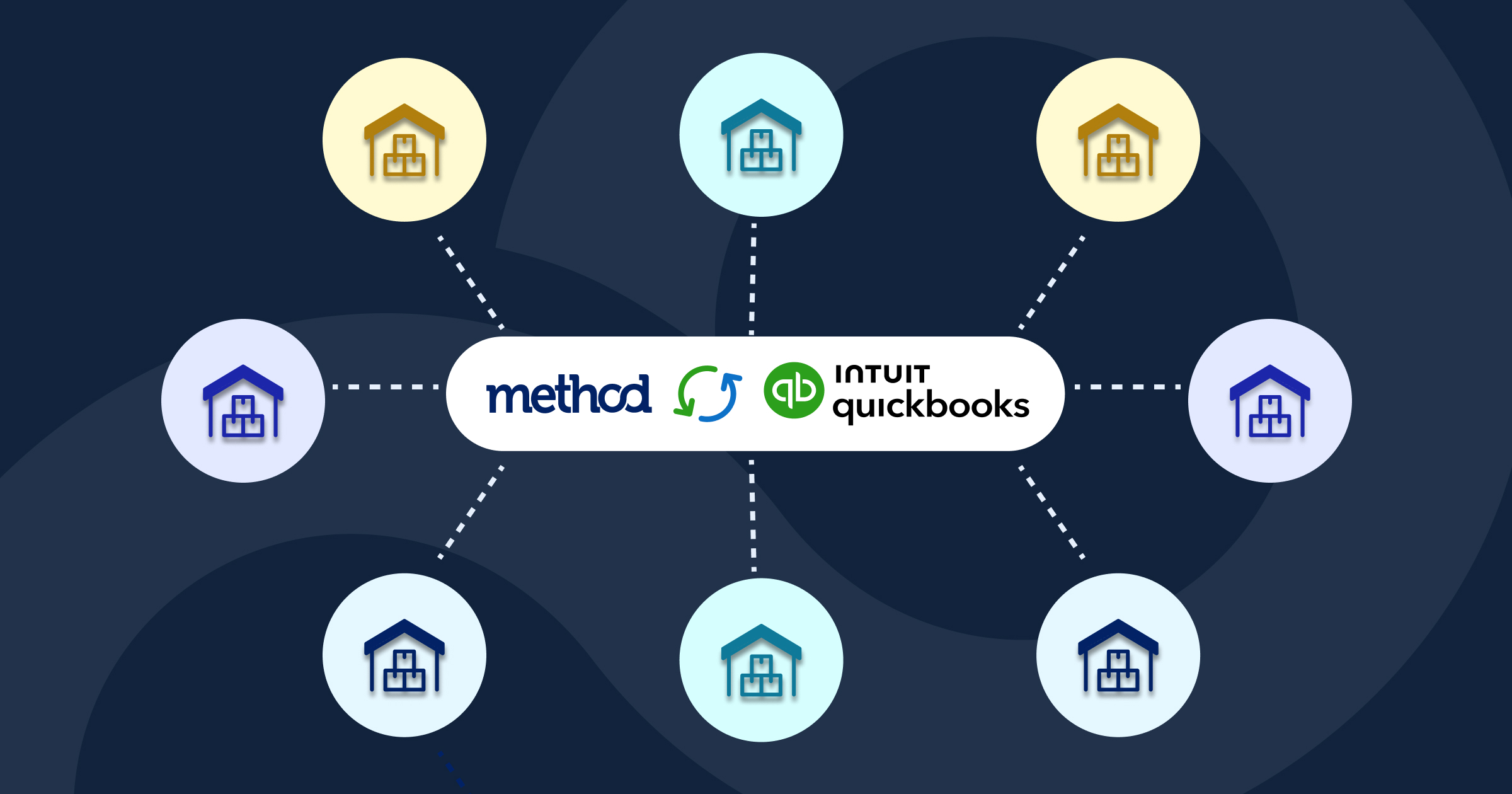

Typically, each entity runs its own QuickBooks file. That means financial data is scattered across systems. Reporting becomes a manual, error-prone process. There’s no reliable way to answer basic questions like:

- How much did we sell last quarter, across all locations?

- Which products are underperforming across the business?

- Are certain locations overspending compared to others?

This might seem like a problem for the finance team. They’re certainly the ones stuck stitching reports together, reconciling data by hand, and chasing down inconsistencies. But the impact runs much deeper.

Without a shared system or set of standards, each location builds its own way of working. Pricing and quoting are inconsistent. Quality checks get skipped. One team uses a CRM—another relies on spreadsheets. There’s no way to enforce processes or ensure teams are following the same playbook.

As a result, leaders lack visibility across the business. Teams waste time duplicating work. Access controls are scattered, with some users seeing too much, others not enough. And customers feel the misalignment, too—getting quoted different prices at different locations, experiencing delays from lost service requests, or having to repeat the same information to multiple teams.

Ultimately, multi-entity accounting isn’t just a back-office function. It’s the foundation for a connected, scalable business. And when it’s fragmented, everything else starts to crack.

The fork in the road: What happens when QuickBooks alone isn’t enough?

As businesses add new locations, spin off divisions, or acquire other companies, their accounting needs become exponentially more complex. What worked fine with one QuickBooks file starts to break down when there are five, ten, or fifty.

At this point, most business owners find themselves at a crossroads.

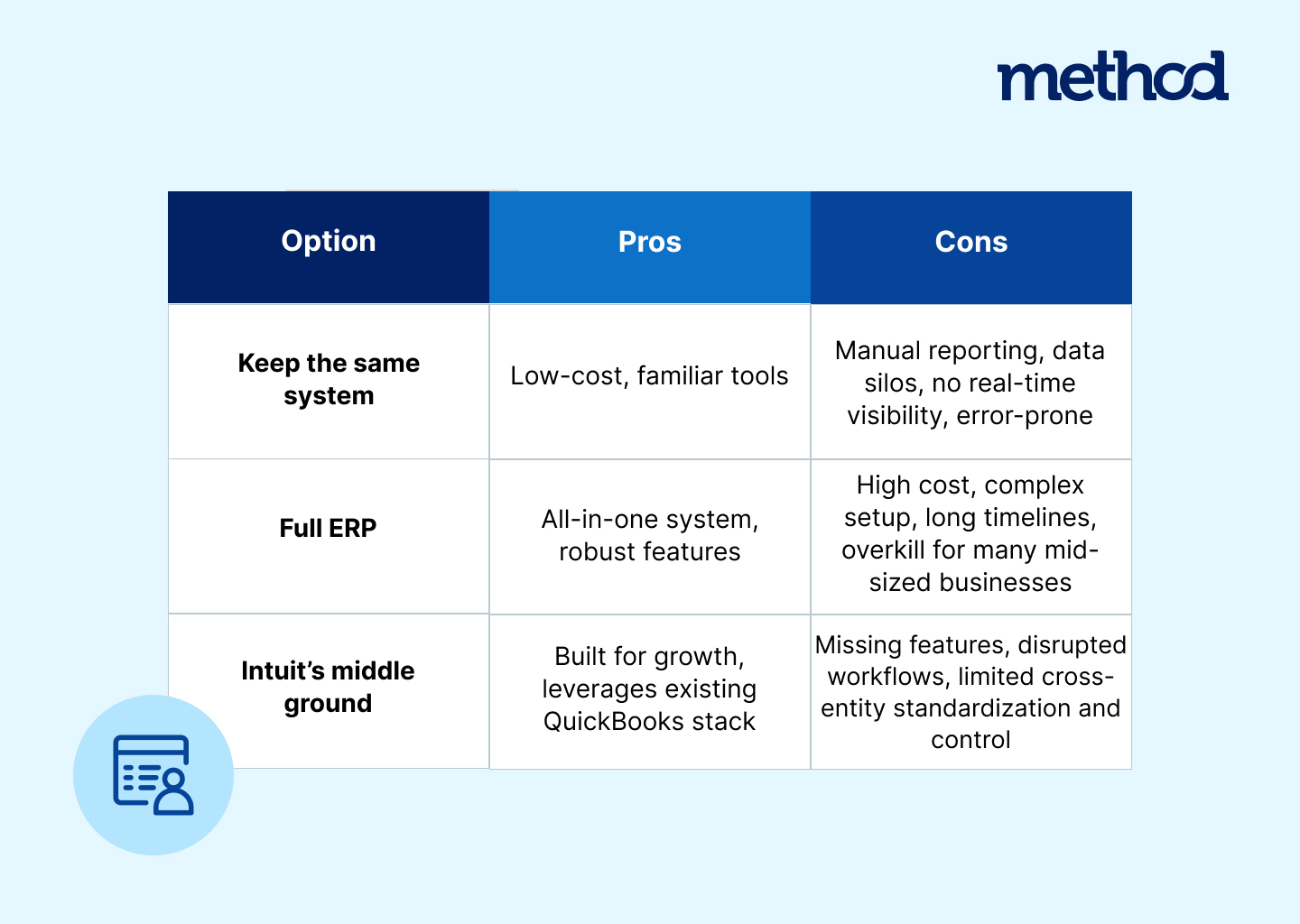

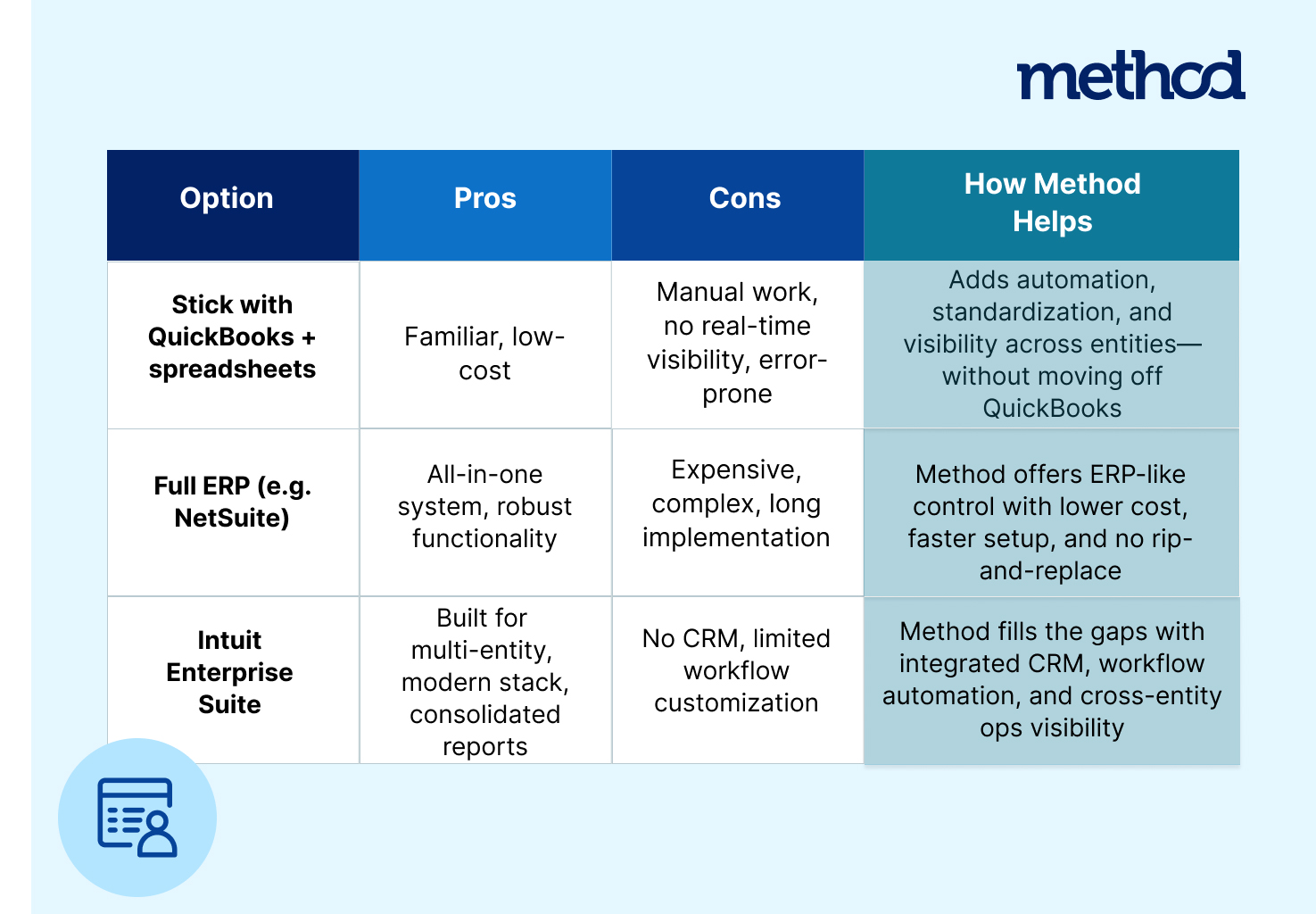

Option 1: Keep the same system and muddle through.

Some try to keep things patched together with multiple QuickBooks files, spreadsheets, and manual processes. They build complex folder structures to track invoices. They export reports from each entity, then spend hours reconciling them in Excel. They rely on one person at HQ who “knows how it all fits together.”

But this approach doesn’t scale. Mistakes creep in. Reports don’t match. Sales and service teams can’t share data across locations. There’s no real-time insight into how the business is performing, only a backward-looking, manual snapshot.

Option 2: Go big and upgrade to an ERP.

Others consider moving to a full enterprise resource planning (ERP) system like NetSuite or Oracle. These systems offer deep functionality and consolidated reporting, but at a cost. Implementation can take months. Licensing fees run high. Customization is complex. And for many mid-sized businesses, ERPs feel like overkill: too rigid, too expensive, and too far removed from how they actually work.

Option 3: Try Intuit’s middle ground.

To address this scaling gap, Intuit has introduced some advanced tools for growing businesses.

To address the needs of growing businesses, Intuit introduced QuickBooks Advanced in 2018, designed for mid-sized companies that have outgrown the basic version. It offers enhanced features like custom reporting and workflow automation, however, it still treats each entity independently. Without a shared data layer or a seamless way to ensure consistency across different locations, many users opted to continue using QuickBooks Desktop, preferring its familiarity.

More recently, Intuit Enterprise Suite (IES) was launched as the latest product aimed at multi-entity businesses. IES is Intuit’s most comprehensive business platform to date. Designed for growing companies with increasing operational complexity, it brings together accounting, payroll, HR, cash flow, and even marketing in one connected environment.

Key features include multi-entity financial management, AI-powered forecasting and budgeting, dimensional chart of accounts, and customizable user permissions. Teams can consolidate financials across entities, automate revenue recognition and fixed asset accounting, and generate rich reports using up to 20 customizable dimensions.

For many companies outgrowing the standard QuickBooks, IES provides a powerful step forward—especially in streamlining back-office processes and giving leadership better financial visibility. But while it adds breadth, there are still limitations in depth, especially when it comes to managing customer relationships and operational workflows.

IES does not include a built-in CRM or advanced workflow engine. It’s not designed to standardize sales and service processes across entities, nor does it offer deep customization for things like quoting, dispatching, or lead management. For businesses that want connected operations across divisions, or a full view of the customer journey, IES solves the accounting side, but often leaves a gap operationally.

The challenge of scaling multiple entities goes beyond accounting

Let’s say a business owner successfully implements a system like IES and starts getting consolidated financial reports. They quickly run into the next problem: the rest of the business is still disconnected.

The sales team is working from one CRM, the service team from another. Each franchise or division has its own way of quoting, invoicing, and managing follow-ups. Customer records are scattered.

IES solves part of the growth problem, but key pain points remain unsolved:

- Sales teams still work in separate CRMs

- Franchises or divisions follow different workflows

- Customer records don’t carry across locations

- Pricing, quoting, and service processes vary from one entity to the next

Financial data is only half the story. The other half is CRM + operations.

Your CRM is where customer relationships actually live. It tracks every quote, service request, phone call, and follow-up across sales and service. Without a shared CRM across entities, teams operate in silos. No one sees the full customer journey. Data gets duplicated, missed, or lost. And the result is confusion for both your team and your customers.

To scale successfully, businesses need more than consolidated numbers. They need connected workflows. Shared customer data. Aligned sales and service teams. Standardized processes—across every entity, division, or location.

Imagine this: one division sells the product, another services it. But they each use their own systems, with no shared view of the customer. So the service team walks in blind, and the customer experience suffers. Internally, your teams are stuck piecing together fragmented data, duplicating effort, and making decisions with half the story.

That’s where connecting your accounting system with your CRM and workflows changes the game.

The connector between financials and operations: Method

Method helps businesses stay with QuickBooks while gaining the operational structure they need to scale. It connects your financials with your front-line processes, so you can unify customer data, standardize workflows, and bring every entity under one roof.

Rather than replacing QuickBooks, Method extends it, filling the operational gaps that accounting software alone can’t:

- With deep, bidirectional integration with QuickBooks, financial data stays in sync across invoices, payments, and estimates—no double entry required. Method works with QuickBooks Desktop, Online, and IES.

- For multi-entity businesses, Method provides consolidated visibility at the head office level while allowing individual franchises, locations, or divisions to maintain autonomy and flexibility.

- Method’s customization capabilities make it easy to standardize where it counts, like reporting, quoting, or payment processing, while still adapting to the specific needs of each location or team.

As we discussed earlier, most growing businesses feel forced to choose between cost, complexity, and control. But Method unlocks a new option: keep the tools you already trust, and layer in operational visibility, CRM functionality, and scalable workflows:

Thousands of QuickBooks-based businesses use Method to align their financials and operations, reduce manual work, and create more consistent customer experiences as they grow. It’s the most practical way to extend what’s already working—without overhauling your entire tech stack.

How Mobility City unified 50+ franchises and scaled with confidence

Mobility City is a national franchise that sells, rents, and repairs mobility equipment through over 50 locally owned locations. On the surface, it looked like a thriving business. But behind the scenes, its rapid growth was exposing serious cracks.

Each franchise operated like its own small business. Some ran on QuickBooks, others still relied on paper. There were no shared processes, no unified data, and no way for headquarters to answer even basic questions like: What’s selling best across the system? Item names varied, reporting was fragmented, and buying power was nonexistent because purchasing data was scattered. As VP of Franchise Operations Craig Kreakie put it, “We needed one system to bring it all together.”

That’s where Method came in.

Mobility City partnered with Method to build a customized multi-entity CRM that integrated with QuickBooks and standardized operations—without sacrificing the flexibility of the franchise model. Working closely with Method’s team, Craig and his team mapped every process, including sales, service, rentals, and repairs. Then, together, Method and the Mobility City team designed workflows that every franchise could follow. The result was a unified system that worked across 50+ locations.

The transformation was remarkable:

- 95% franchise adoption in under a year: Mobility City rolled out Method across nearly all locations, turning scattered operations into a cohesive, scalable system.

- System-wide visibility and benchmarking: HQ can now monitor sales, service, and compliance in real time, comparing performance across franchises and regions.

- Operational consistency: Technicians from Texas to New York follow the same digital work orders, ensuring a consistent customer experience and faster billing.

- Centralized data for supplier leverage: With full visibility into purchasing, Mobility City negotiates better supplier pricing—operating like a national brand, not 50 small shops.

- Streamlined onboarding: Standardized workflows and built-in training have shortened ramp-up time for new hires and new franchisees.

Craig summed it up best: “Technology alone doesn’t fix bad processes. You have to fix the process, then use the tech. Method gave us both.”

Mobility City’s story shows what’s possible when businesses move beyond fragmented systems. By connecting financials with operations, they didn’t just clean up their books—they built a foundation for scalable, sustainable growth.

The new standard for scaling multi-entity businesses

Managing multiple entities doesn’t have to mean juggling disconnected tools, duplicating work, or drowning in manual reporting.

More and more growing businesses are adopting a smarter approach: keep QuickBooks for accounting, and layer on systems that connect customer data, standardize operations, and bring the business together.

It’s a shift from thinking in silos—location by location, division by division—to running the business as a whole. The companies that scale successfully are the ones that don’t just consolidate their books. They consolidate their operations, their workflows, and their customer experience.

That doesn’t require a full ERP. It doesn’t mean you have to reinvent the entire way you do business. You just have to choose tools that work together, support the way your business is structured, and give your teams the visibility they need, without the complexity they don’t.

With the right platforms and tools, growth becomes less reactive and more intentional. You can scale with systems that support the pace of your business, not slow it down.

Bottom line: Growth is complicated, but your systems don’t have to be.

If you’re running a multi-entity business, the complexity is real, but it doesn’t have to be inevitable. With the right approach, you can keep using the tools you trust, connect the pieces that matter, and bring every part of your business into focus.

Whether you’re managing five locations or fifty, you deserve systems that work with you, not against you. If you’re ready to simplify your multi-entity operations, try Method today.