When it comes to construction management, choosing the right software is as critical as laying the first brick for a big building project.

This blog dives into the nuances of three major software systems in the construction management domain: BuilderTrend vs. CoConstruct vs. Method:Field Services. These solutions are renowned for their unique features and functionality that cater to a variety of needs in the construction industry.

Whether you own a construction company with builders, contractors, or remodelers, each platform offers distinct advantages for project management. Comparisons of these platforms reveal similarities as well as unique differences so you can make the best decision for business impact.

Let’s get started.

Overview: BuilderTrend vs. CoConstruct vs. Method:Field Services

First, let’s look at an overview of BuilderTrend vs. CoConstruct vs. Method.

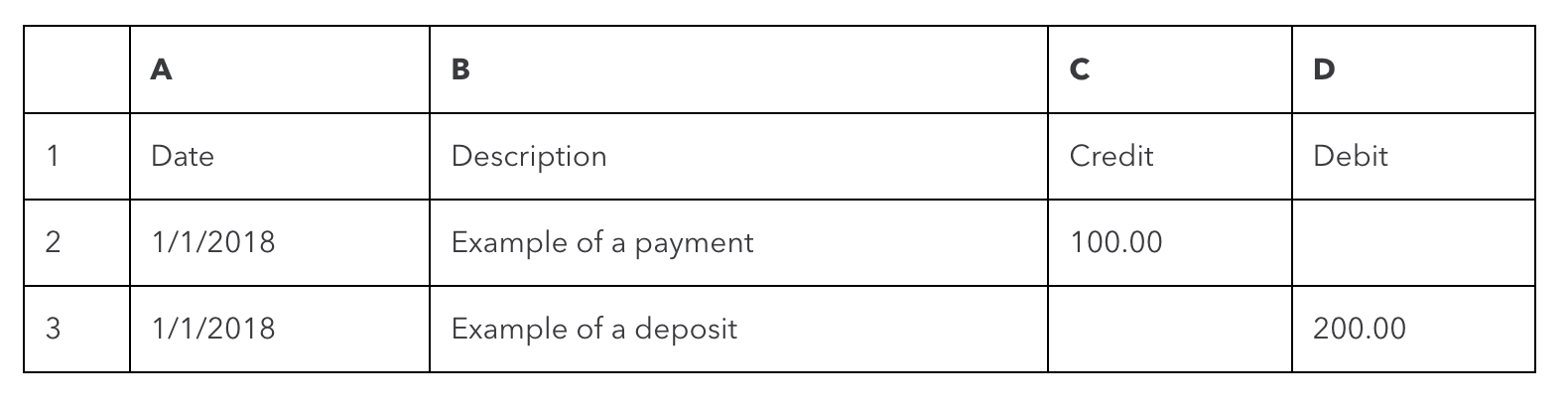

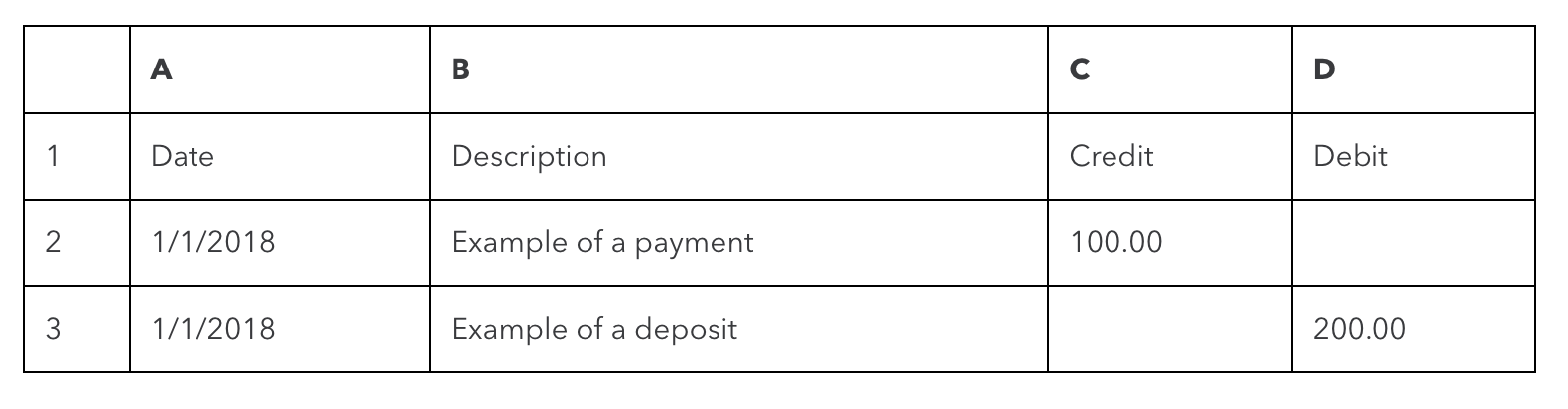

| The offering | Method:Field Services | BuilderTrend | CoConstruct |

| Native, two-way QuickBooks sync | ✅ | ✅ | ✅ |

| Lead management | ✅ | ✅ | ✅ |

| Customer management | ✅ | ✅ | ✅ |

| Opportunity management | ✅ | ✅ | ✅ |

| Self serve customer portals | ✅ | ✅ | ❌ |

| Unlimited workflow automation | ✅ | ✅ | ❌ |

| Custom reporting | ✅ | ✅ | ❌ |

| Unlimited DIY customization | ✅ | ❌ | ❌ |

| Unlimited phone support | ✅ | ✅ | ✅ |

| Mobile app | ✅ | ✅ | ✅ |

| API access | ✅ | ✅ | ❌ |

| Zapier integration | ✅ | ✅ | ❌ |

| Gmail add-on | ✅ | ✅ | ❌ |

| Outlook add-on | ✅ | ✅ | ❌ |

| Mailchimp integration | ✅ | ❌ | ❌ |

| Google Calendar integration | ✅ | ✅ | ✅ |

| 14 day free trial | ✅ | ❌ | ❌ |

Let’s take a deeper dive into the software options.

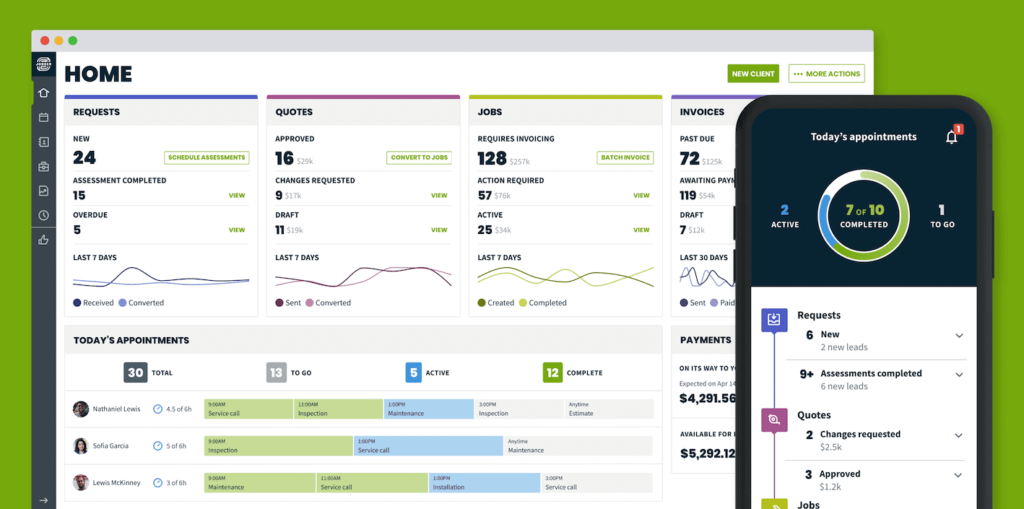

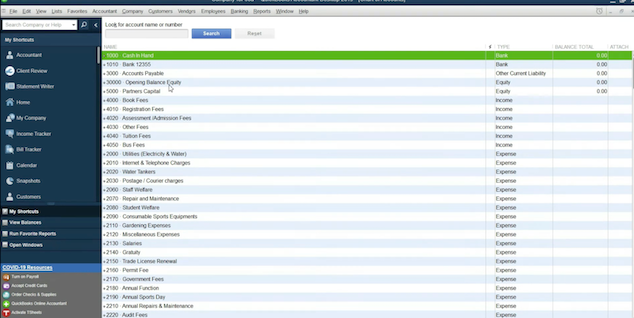

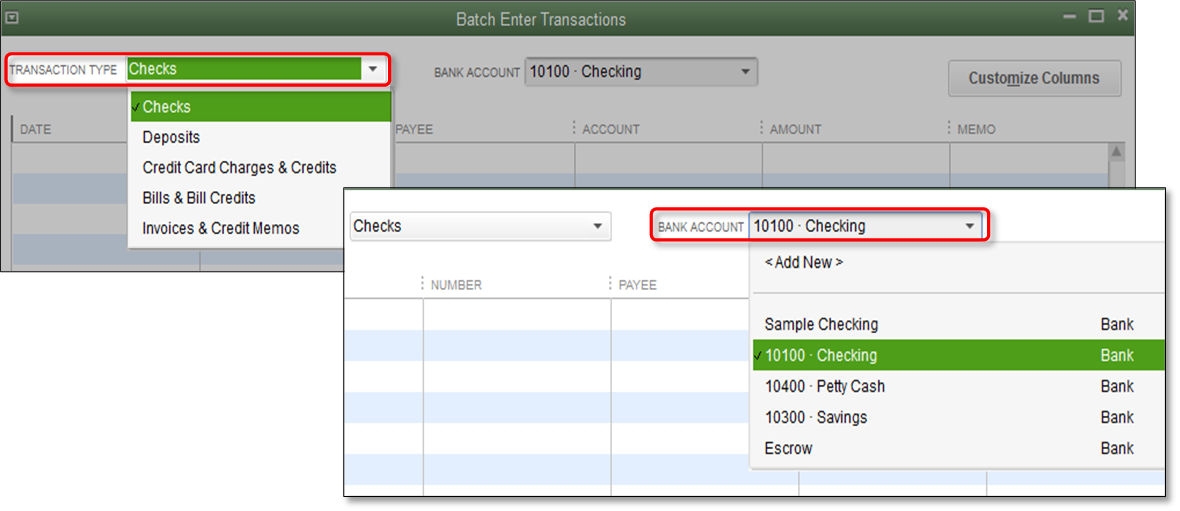

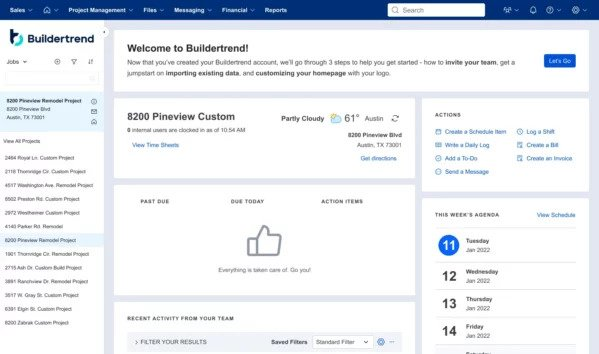

What is BuilderTrend?

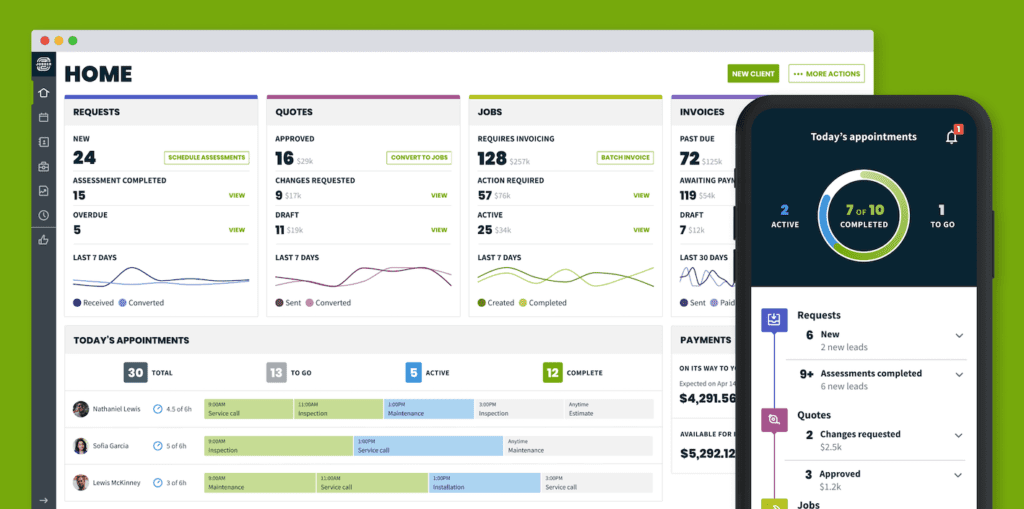

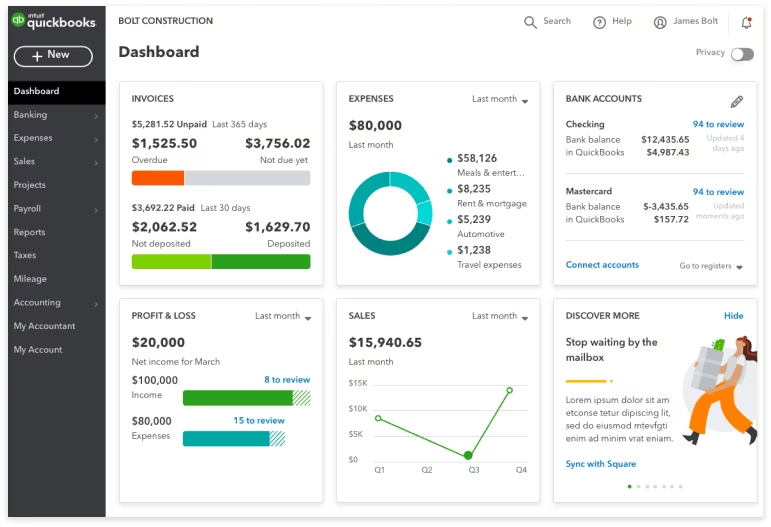

Image credit: Buildertrend

BuilderTrend is a comprehensive project management software in the construction industry known for its powerful features. It simplifies project management by centralizing:

- Communication.

- Scheduling.

- Financial management.

- Documentation.

The platform is particularly noted for these features:

- Project tracking.

- Client collaboration tools.

- Financial tools.

Overview of BuilderTrend functionality

BuilderTrend’s comprehensive functionality encompasses:

- Project tracking.

- Budgeting.

- Document management.

- Customer relationship management (CRM).

As a result, it’s a versatile product that saves you from deadlocks in construction projects.

Unique features of BuilderTrend

- BuilderTrend Wallet simplifies expense management by keeping all things financial in one convenient place.

- Mobile support and offline time tracking to accurately record and manage project hours, even in areas with limited internet connectivity.

- Geofencing to get automatic tracking and verification of worker attendance and hours based on location.

Business management features

The software offers an extensive number of business management tools that are crucial for running a successful construction business, like:

- Sales process tracking.

- Project optimization.

- Lead management.

- Invoice generation.

- Task automation.

Here are some of the capabilities you can expect:

- Simple payment collection and digital signatures.

- Email campaign automation.

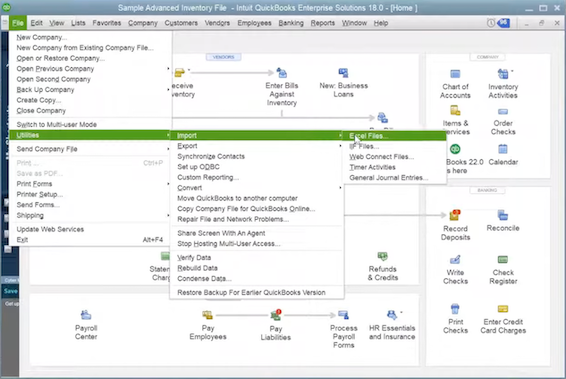

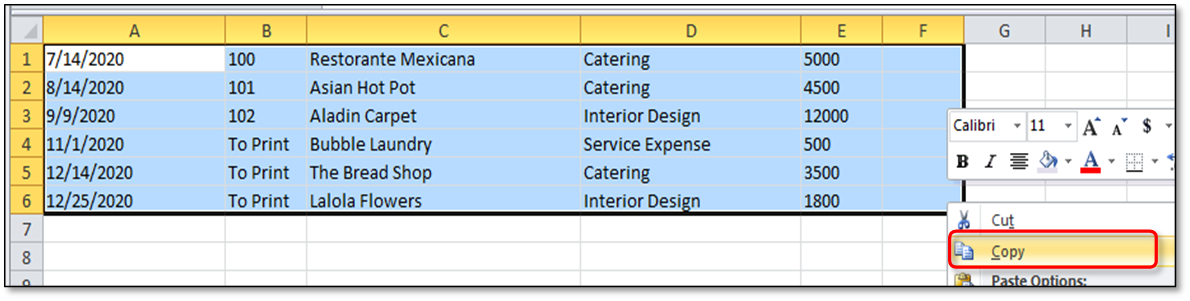

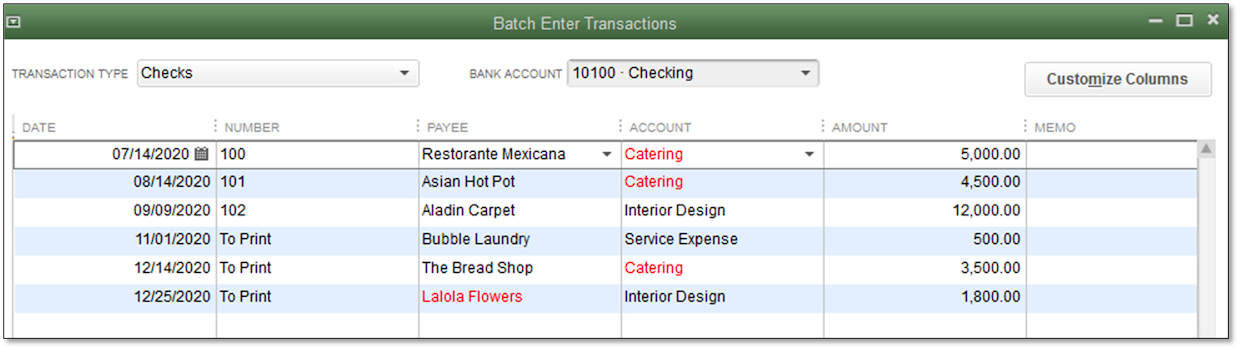

- Import leads, estimates, and customer details from Excel with ease.

- Easily access each document with job-specific folders and storage.

- Mobilize your lead generation process by gathering leads from your website’s contact page.

Field service management features

BuilderTrend’s field service management features include:

- Mobile app access.

- Crew time clock functionalities.

- On-site data capture.

These are essential for managing tasks and team performance in the field. You also get:

- Powerful tracking of your change orders to manage administrative steps — including automated requests and approvals to track changes in real time.

- Centralized purchase orders to keep your team on the same page about budgeting and spending plans.

- Functionality that nables efficient scheduling with shared timelines. This keeps everyone updated on the progress of projects, which helps home builders and remodelers navigate delays.

- A tool to implement “to-do’s” with photos and comments. Use the annotation tool to give more context and direction to clients or subcontractors.

Strengths

- Offers extensive tools for daily logs, punch lists, and change order management.

- Unlimited storage for project-related documents, photos, and videos.

- Includes a unique Homeowner Portal feature that enhances customer service and engagement.

Limitations

- Unintuitive user interface.

- Some users find the software complex due to its depth of features.

- GANTT chart and financial features are difficult to use.

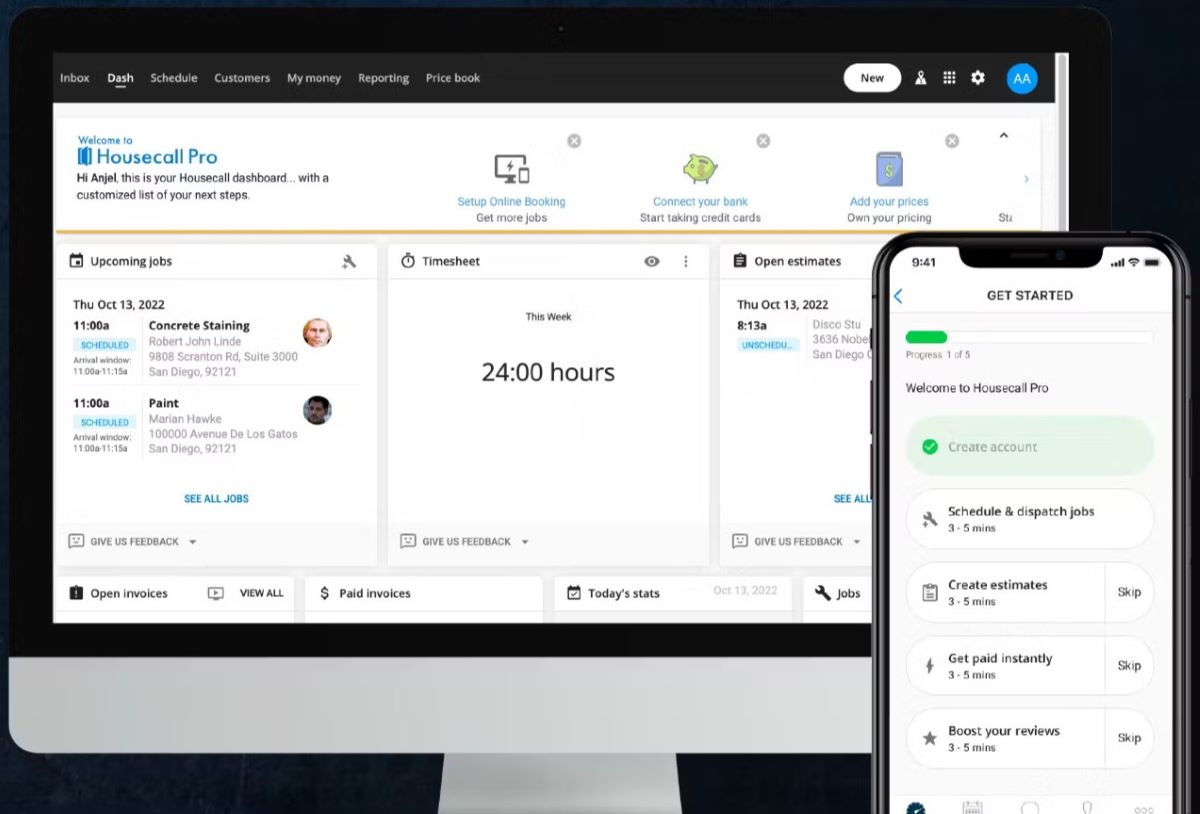

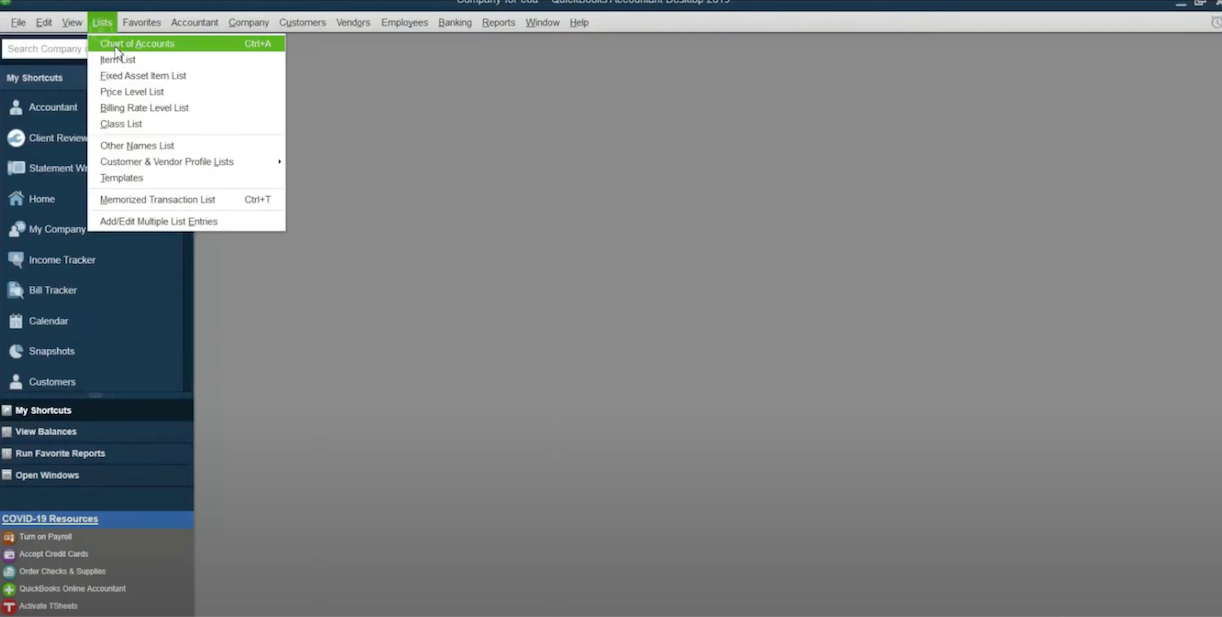

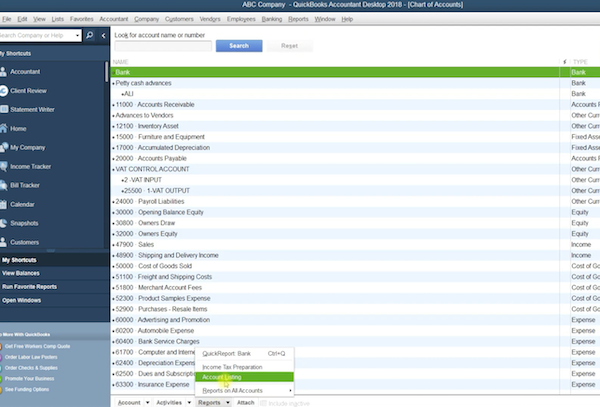

What is CoConstruct?

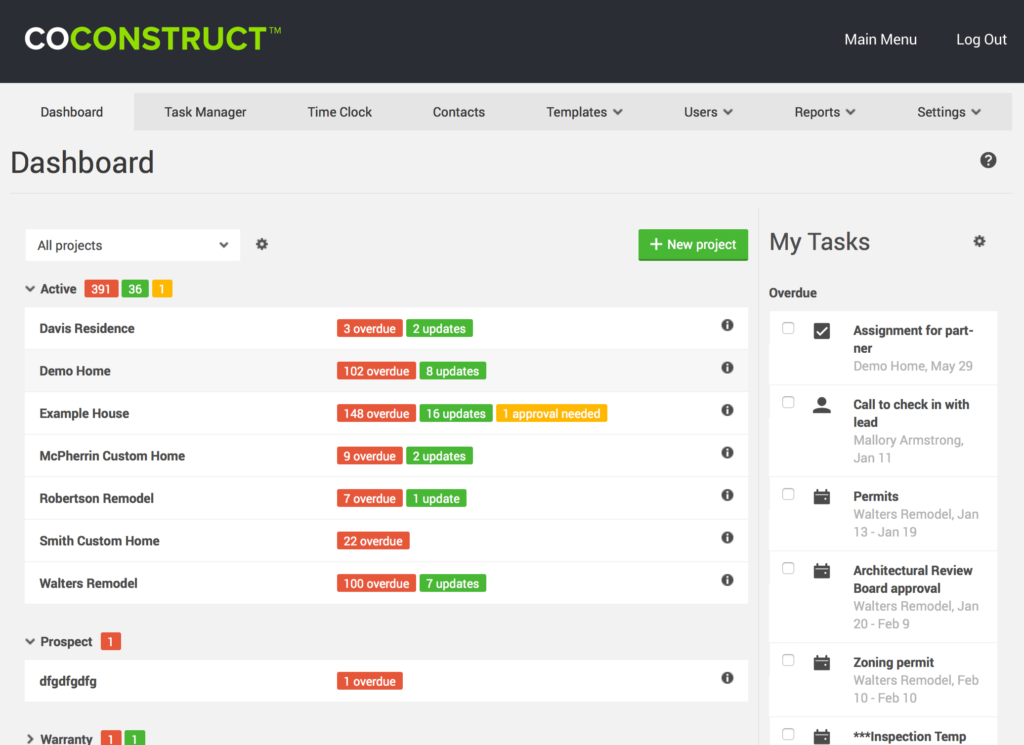

Image credit: GetApp

CoConstruct is a construction project management software specifically for custom home builders and remodelers. It offers a comprehensive set of tools to streamline project, client, and financial management. The software aims to improve:

- Project coordination.

- Communication with clients and subcontractors.

- Budget tracking.

Core aspects of CoConstruct software

CoConstruct fosters centralized communication so that everyone involved in a project can access and share information in one place. It also offers great budgeting and tracking tools to avoid cost overruns.

Additionally, CoConstruct offers tools for client engagement, including:

- Selections.

- Changes.

- Approval processes.

CoConstruct exclusive features

- Single-entry estimating, which lets users enter data once and have it populate across all relevant documents and estimates to reduce errors and save time.

- Specialized warranty tracking for managing post-construction warranties, so you can track, respond to, and resolve warranty issues efficiently.

- Job site activity log to record activities and incidents at the construction site, which is critical for project tracking and accountability.

Business management features

CoConstruct offers comprehensive features to keep your business running smoothly at all times:

- Scheduling features to keep jobs on track at all times.

- Tools to manage emails and leave job-specific comments.

- Customized estimating.

- Cost catalog creation.

- Digital signatures.

- Multiple views including a Gantt chart, and full control over which content is viewable to users and clients.

- Integrations to sync with your Google Calendar, iCal, or Outlook.

Field service management features

- Create, compare, send, and store bid requests in one location.

- Notify crew members via email reminders, texts, and push notifications.

- Accept bids and roll them into contracts with ease.

- Access photo, video files, and documents at any time in our construction app.

- Make quick adjustments by linking your schedule items.

- Build and deliver customized proposals, which leads to more closed deals.

- Utilize project management tools to simplify processes no matter the specs, blueprints, and deadlines you’re dealing with.

Advantages

- The scheduling feature stands out for its ease of use and efficiency — it helps businesses to keep projects on track.

- High ratings for customer support indicate that users find the support team responsive and helpful.

- Users appreciate the abundance of features that BuilderTrend provides.

Disadvantages

- Some users find the software complex initially, according to user reviews.

- For small businesses or individual contractors, the cost of the software is a significant investment.

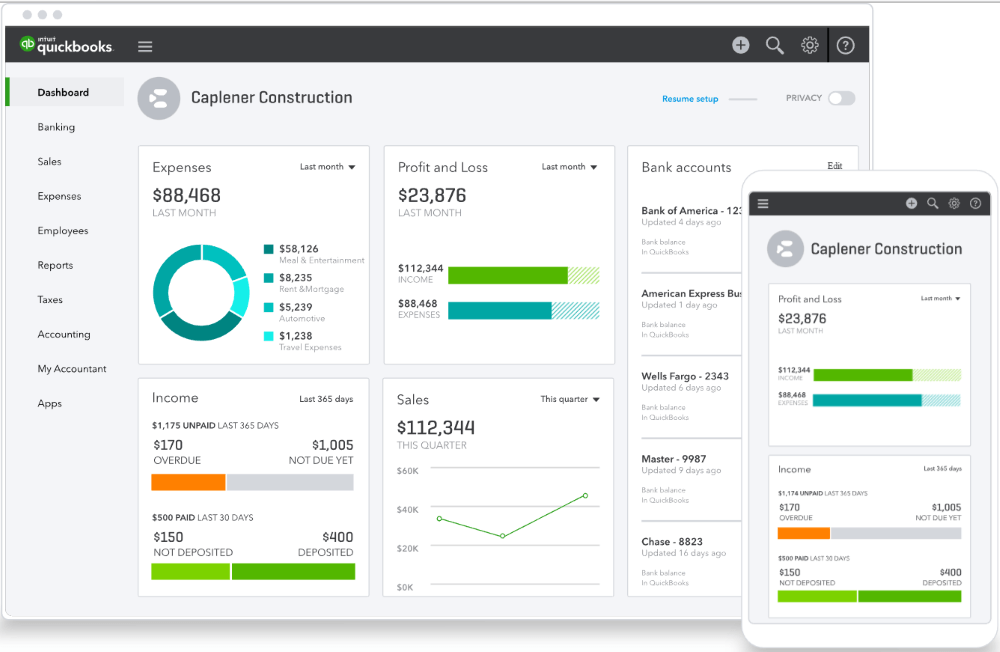

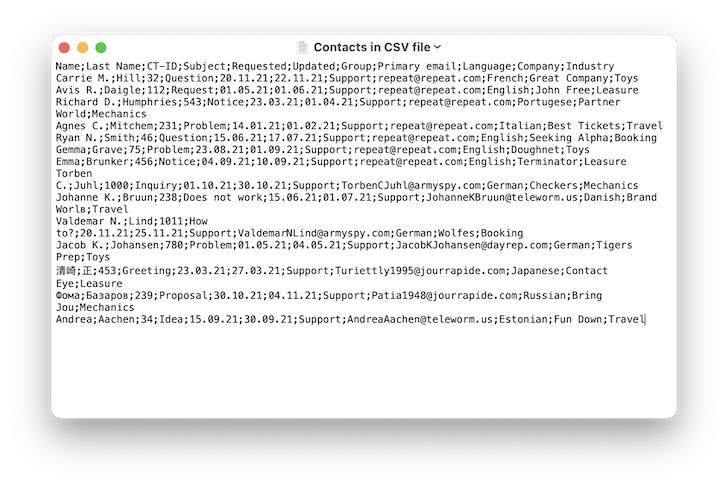

What is Method:Field Services?

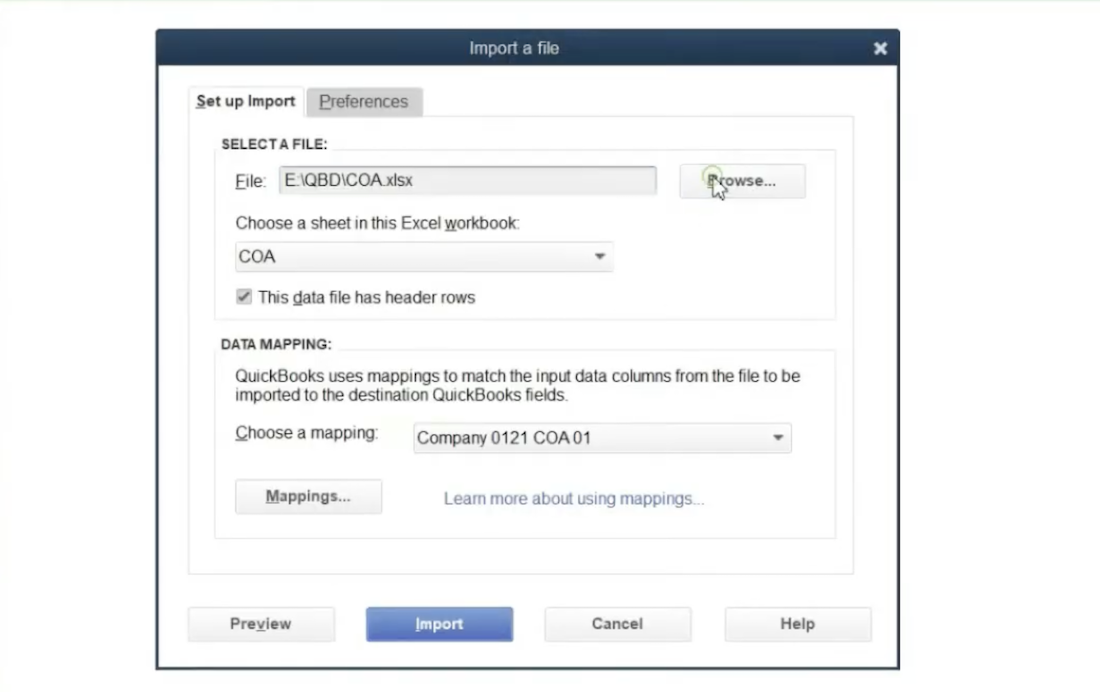

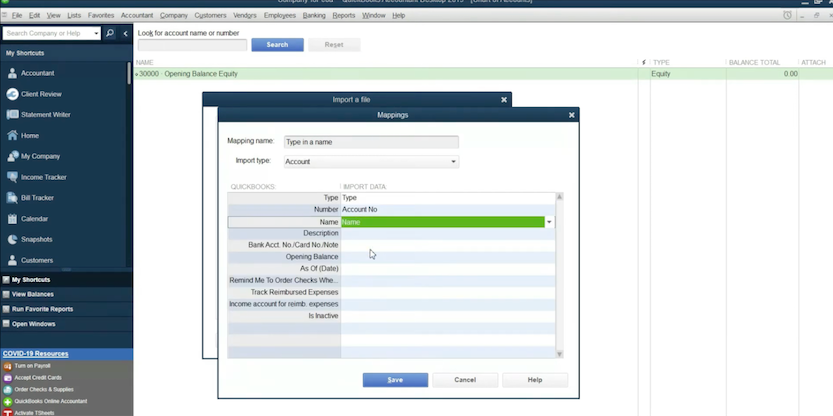

Method:Field Services is the top service management tool for QuickBooks and Xero. The platform is renowned for its unique features and functionality that cater to a variety of needs in the construction industry, including specialty contractors and trades.

This construction management software is versatile and user-friendly. It simplifies lead-to-cash workflows from estimate creation to deposit collection and job scheduling. Method also accommodates various business sizes and offers scalable solutions for construction companies.

Method’s primary functions

As a versatile construction management software, Method:Field Services offers a range of functions. The platform:

- Centralizes all customer data to enable better service delivery and more accurate estimating, particularly for recurring jobs.

- Integrates seamlessly with accounting software QuickBooks and Xero through a powerful, two-way data synchronization.

- Supports cloud-based operations, so your employees can stay connected while on the go.

- Simplifies job creation, scheduling, and dispatching for maximized work order completion and an improved bottom line.

Distinct characteristics of Method:Field Services

What makes Method stand out in particular is that it:

- Features a powerful CRM with comprehensive customer management capabilities.

- Automates all your workflows from invoicing to email campaign management.

- Provides real-time updates to transform your project management.

- Facilitates user-friendly interface that upgrades your software experience.

- Delivers detailed reporting features for you to analyze performance metrics.

- Ensures easy software integration capabilities with all your favorite apps.

- Supports multiple users concurrently.

Business management features

On the business side of things, Method:

- Automates routine administrative tasks to save you from tedious manual effort.

- Provides analytics and insights to evaluate your business performance thoroughly.

- Secures sensitive customer data and ensures data security in general.

- Includes customizable templates and customization support to personalize your entire software down to your logo.

- Prioritizes efficient user experience with an intuitive user interface.

- Facilitates customer management through its CRM.

- Improves overall customer service with simple troubleshooting for issues.

Field service management features

As a field service management platform, Method:

- Supports mobile accessibility with Android and iOS, which connects office and field staff.

- Lets you easily convert an estimate into a work order, then convert that work order into an invoice at any point.

- Tracks work orders effectively so you’re always updated.

- Streamlines dispatching processes and enhances collaboration.

- Aligns with construction strategies and adapts to multiple construction needs

- Enhances client communication through updates you can send while on the go.

- Manages construction projects so you can operate your business with ease.

Pros

- Seamless, two-way sync with QuickBooks and Xero so that software updates in one platform reflect automatically in the other.

- The ability to merge and synchronize contacts, emails, and calendar events for seamless communication.

- Simple interface and dashboards for easy implementation.

- Offers webinars and user training resources for continuous learning and user support.

Cons

- The platform is limited to QuickBooks and Xero users.

- Method is only available in English currently.

BuilderTrend vs. CoConstruct vs. Method: How do they compare?

While BuilderTrend vs. CoConstruct vs. Method operate in similar software categories, they have distinct differences.

Job tracking

BuilderTrend: Offers comprehensive job tracking capabilities that let your team:

- Monitor progress.

- Manage tasks.

- Update schedules in real time.

Its strength lies in providing detailed oversight of every aspect of the job so that you can collaborate and keep projects on track.

CoConstruct: Focuses on simplified job tracking while emphasizing client engagement. It lets users:

- Maintain detailed records of job progress.

- Integrate client feedback directly into the job tracking process.

- Ensures transparency in project development.

Method:Field Services: Integrates job tracking with its CRM functionalities to offer a unique, client-forward approach. It offers the best of both worlds: project management with customer relationship insights. This gives you a more client-centric tracking approach and enhances operational efficiency and overall project management.

Quoting

BuilderTrend: Simplifies the quoting process with its user-friendly interface, allowing for quick generation of accurate quotes. It connects with pricing databases to provide up-to-date material costs, so your quotes are competitive and reflective of current market prices.

CoConstruct: Offers robust quoting features that are highly customizable for detailed and specific quotes. It focuses on client presentation and interaction, which makes it a great tool for personalized customer service.

Method:Field Services: Leverages its CRM capabilities to enhance the quoting process. The platform takes things a step further with targeted and data-driven quotes. This CRM integration ensures that quotes are accurately tailored to specific needs and client history.

Invoicing and payments

BuilderTrend: Provides simplifies invoicing and billing with features like:

- Online payment processing.

- Automated invoice generation

- Integration with accounting software.

CoConstruct: Focuses on a client-friendly invoicing system by offering detailed breakdowns and transparent cost tracking. This approach enhances client trust and satisfaction. CoConstruct also includes features for easy expense tracking and budget management.

Method:Field Services: Offers flexible solutions for invoices integrated with its CRM system for a comprehensive view of financial interactions with clients. This integration lets you personalize your invoicing and track payment history efficiently.

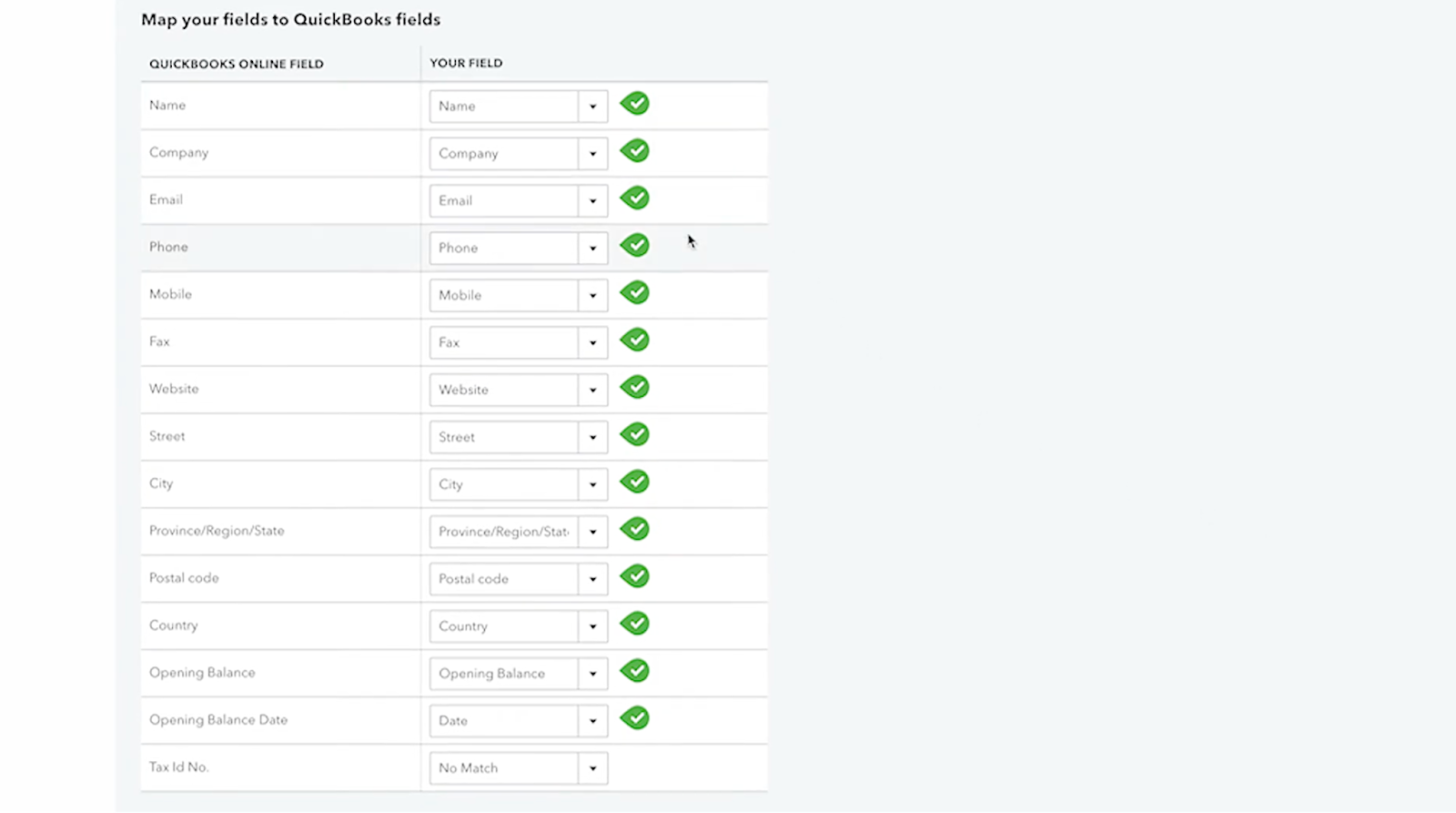

Setup and integrations

BuilderTrend: Known for its ease of setup and integration options, BuilderTrend connects with different accounting, scheduling, and CRM tools. As a result, it’s a versatile choice for many construction businesses.

CoConstruct: While offering a comprehensive set of features, CoConstruct requires a more in-depth setup process. That said, it offers a powerful solution to connect with different applications and optimize your software.

Method:Field Services: Stands out for its customizable setup options and strong emphasis on CRM integrations. This software is ideal for businesses looking to tailor their project management tools to specific workflows and processes. An added bonus is that Method allows for extensive customization options as experts customize your software for you.

Better yet, the platform connects to all your favorite tools and apps to centralize your processes. It shines in its ability to integrate deeply with financial tools like QuickBooks and Xero

Additional features

BuilderTrend: Beyond core functionalities, BuilderTrend offers some additional features like:

- Customer portals.

- Time tracking.

- Warranty management.

- Document and photo storage.

As a result, the platform enhances overall project management and client communication.

CoConstruct: Provides unique additional features like:

- Client communication forums.

- Custom reporting tools.

- Design selections.

These enhance client engagement and promote project transparency.

Method:Field Services: Distinguishes itself with additional features such as:

- Customizable fields.

- Lead management.

- Business process automation.

- Self-serve customer portals.

With these features, Method caters to businesses that need a high degree of flexibility and integration with their existing systems.

BuilderTrend vs. CoConstruct vs. Method:Field Services price comparison

Let’s look at a comparison of prices between BuilderTrend vs. CoConstruct vs. Method.

You can try Method:Field Services free of charge for 14 days, and then choose from three pricing models that start as low as $15 per user per month.

When it comes to Method, the ability to integrate seamlessly with QuickBooks or Xero is also a cost-saving feature if you’re already using either of these accounting software solutions. It centralizes your data and reduces the need for separate financial management tools.

As for BuilderTrend, its pricing is on the steeper side. Here are its pricing plans:

- Essential: $199 per month.

- Advanced: $499 per month.

- Complete: $799 per month.

CoConstruct does not provide pricing information on their website, but you can contact the team for a custom quote.

Who should use CoConstruct?

CoConstruct is ideal for custom home builders and remodelers seeking a comprehensive solution for project management. It’s especially suited for you if you prioritize:

- Engagement with customers.

- Detailed budget tracking.

- Simplified communication between team members, subcontractors, and clients.

Who should use Method:Field Services?

Method:Field Services is the go-to choice for small and medium-sized businesses focusing on field service management. It’s perfect for those who value deep customization and integration with accounting software like QuickBooks and Xero. It’s also a fit for companies seeking a flexible, user-friendly platform that adapts to their unique workflow automation and customer service needs.

Who should use BuilderTrend?

BuilderTrend is ideal for large-scale builders. It offers project management tools that are particularly beneficial for firms that need extensive scheduling functionality, documentation, and client management capabilities.

Which field management software is best?

If you’re on a mission to find the best software for field management, we’ve got you covered. When it comes to BuilderTrend vs. CoConstruct vs. Method, the best choice is clear.

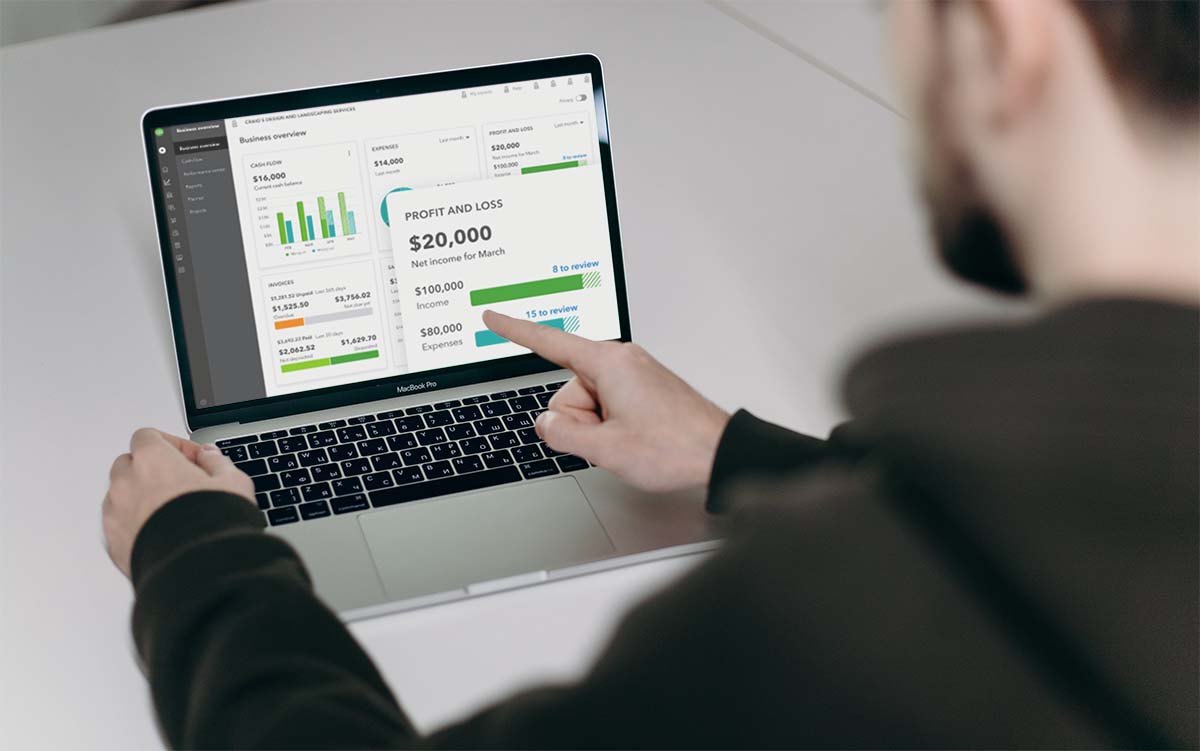

Method simplifies your construction process by offering:

- Unparalleled customization.

- Seamless integration with accounting tools like QuickBooks and Xero.

- A user-friendly interface that adapts to your unique business needs.

The best part is that Method offers scalability so that you don’t have to compromise on efficiency while you grow.

Key takeaways

This blog provides a detailed comparison of BuilderTrend vs. CoConstruct vs. Method. BuilderTrend and CoConstruct are good software products for large-scale and custom home builders. They offer extensive project management tools and client engagement features. However, for smaller businesses, they come with a steeper learning curve and cost.

Method:Field Services shines as the ideal solution for small-to-medium-sized businesses in field service management software category. Some of its standout features include:

- Seamless two-way QuickBooks and Xero integration.

- Customizable platform to tailor the software to specific business needs.

- Real-time updates for project management.

- Detailed reporting tools for performance analysis.

- Strong CRM capabilities that enhance customer management and service.

BuilderTrend vs. CoConstruct vs. Method: Frequently asked questions (FAQs)

How do the mobile app capabilities of BuilderTrend, CoConstruct, and Method:Field Services differ?

Here’s how the mobile app capabilities of BuilderTrend vs. CoConstruct vs. Method differ:

BuilderTrend: Its mobile app offers comprehensive project management tools, including scheduling, time tracking, and document management. It also offers other tools ideal for larger projects.

CoConstruct: Its app is tailored for custom home builders and remodelers. It focuses on client communication, project tracking, and on-site activity documentation.

Method:Field Services: The app excels through a seamless QuickBooks or Xero integration. This makes it ideal for on-the-go field service management, especially for small-to-midsize businesses.

Which is more expensive: BuilderTrend, CoConstruct, or Method:Field Services?

Here’s how the pricing for BuilderTrend vs. CoConstruct vs. Method compares:

BuilderTrend: Tends to be the most expensive, which reflects its extensive feature set for large-scale projects.

CoConstruct: Pricing packages also fall in the higher price range, as they cater to custom builders and remodelers with specialized functionalities.

Method:Field Services: Generally more affordable, especially appealing to small and medium-sized businesses. It offers customizable pricing and an essential feature selection.

Can small businesses benefit equally from using BuilderTrend, CoConstruct, or Method:Field Services?

When it comes to BuilderTrend vs. CoConstruct vs, Method, it’s important to evaluate whether they cater to small businesses. BuilderTrend and CoConstruct offer good features that are beneficial but may be more than what a small business needs — along with costing more money.

Method:Field Services is more suitable for small businesses due to its affordability, customization options, and focus on essential field service management features.

Save hard costs and real time.

Start your free trial of Method.

Image credit: Svitlana via Adobe Stock