Why QuickBooks automation needs to be part of your growth strategy

Discover actionable tips for how to automate your QuickBooks workflows for growth.

In today’s competitive business environment, using technology to streamline operations is no longer optional — it’s essential.

If you’re a QuickBooks Online user, incorporating automation into your strategy helps you compete with bigger fish in your pond.

But how exactly does QuickBooks automation play into your business growth strategy?

Check out this webinar to learn about:

- The advantages of QuickBooks automation.

- Which processes you should automate first.

- Best practices for automating your business.

Webinar snapshot: Essential points summarized

Benefits of QuickBooks automation

From time and cost savings to enhanced productivity and decision-making, automating your QuickBooks processes supports your business growth strategy and sets you up for success.

Save time and money

QuickBooks automation is pivotal for your business operations as it saves precious time and financial resources.

Instead of spending hours on manual tasks, setting up automatic processes lets you focus on other crucial aspects of your business.

Reducing your labor-intensive tasks helps minimize operational costs, freeing up resources for strategic investments.

Reduce human error

Manually inputting data or transferring figures from one program to another leaves room for error, like accidentally entering numbers twice or copying from the wrong source.

These errors lead to significant issues down the line. But automation helps eliminate them, ensuring accuracy and reliability in your financial data.

Enhanced productivity

Automating repetitive tasks in QuickBooks not only saves time but also enhances productivity. This shifts your focus to strategic thinking and creative problem-solving.

Certain tasks are taken off your plate entirely, where you can just “set it and forget it”. Once you test and verify an automation process, it will work independently, relieving you from constantly monitoring it.

Whether you’re overseeing multiple clients or managing different departments, workflow automation simplifies operations, saving mental energy for higher-value activities.

Better decision-making

Accurate, timely, and comprehensive financial data form the bedrock of effective decision-making and a more informed business growth strategy.

With automation, you ensure up-to-date and error-free data, helping you make informed, confident business decisions.

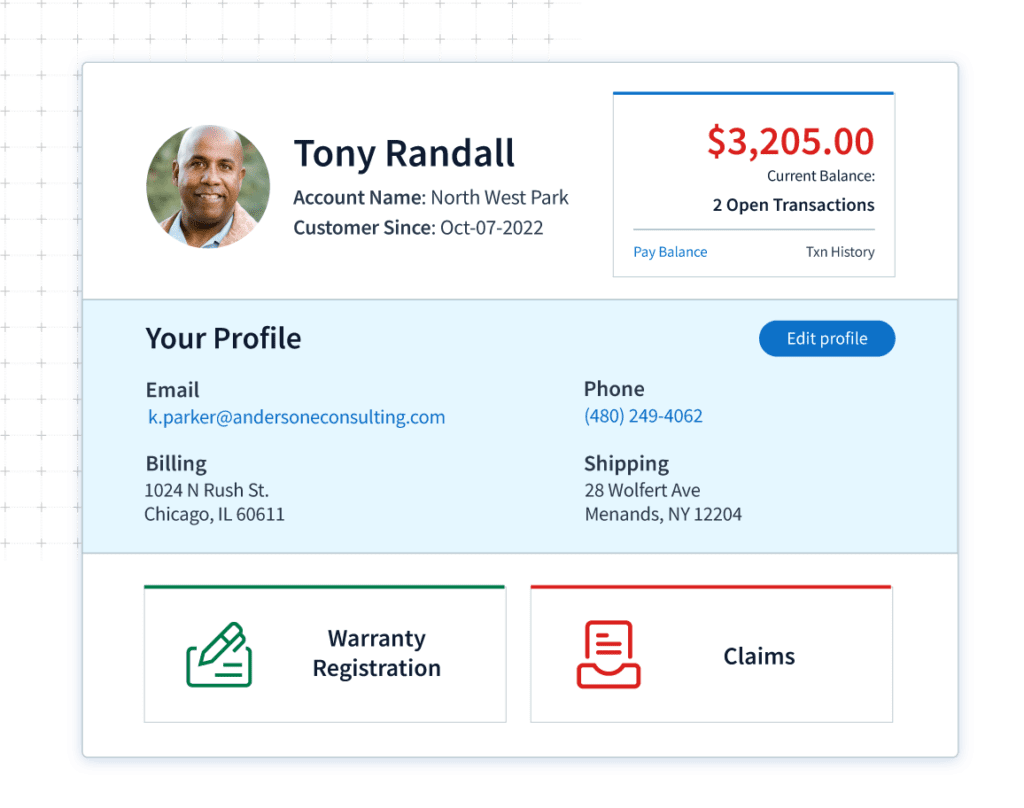

Self-service

You can also automate your customer experience by providing self-service options that let your clients:

- Manage payments.

- Access invoices.

- Get support.

This improves convenience for your clients and reduces your team’s workload.

QuickBooks processes you can automate

Thanks to QuickBooks’ advanced features and growing app ecosystem, there are plenty of processes that you can automate.

Recurring invoices and sales receipts

Automating invoicing and receipt generation in QuickBooks is a game-changer, especially if you run a subscription-based business or bill clients regularly.

QuickBooks lets you set up:

- Automatic invoices and sales receipts.

- Automated payments for recurring clients.

- Interval-based scheduled invoicing for businesses that charge hourly rates.

Accounts receivable

QuickBooks automation lets you handle your accounts receivable more efficiently. You can:

- Set reminders for unpaid invoices.

- Automate follow-ups for past-due payments.

- Create automatic prompts for clients who habitually delay payments.

QuickBooks also integrates with third-party e-commerce apps that handle the details of online sales, fees, and refunds, simplifying your record keeping.

Accounts payable

QuickBooks offers a feature for automated bill payment. You can schedule future payments to vendors or contractors directly from QuickBooks, ensuring you stay within your agreed payment terms and deadlines.

By doing so, you can ensure that your available funds in QuickBooks are always accurate and up-to-date.

Payroll

QuickBooks Payroll automates the payroll process for businesses with salaried employees. It handles deductions and withholdings automatically, reducing manual workload.

If you have regular reimbursements or healthcare-related payments for employees, you can calculate them automatically and include them in your payroll.

Reporting and analytics

Regular reporting is essential for monitoring the health of your business. With QuickBooks automation, you can schedule regular reports such as:

- Profit and loss statements.

- Accounts receivable lists.

QuickBooks can email these reports to you at a specific time, providing a regular snapshot of your business’ financial status without any manual effort.

Bank reconciliation

QuickBooks lets you automate rules in bank feeds, which you can use to identify and organize transactions, such as categorizing specific vendors under office supplies.

You can also match scanned receipts or third-party app data with transactions in your bank feed, saving you the time and energy of manual entry.

QuickBooks automation best practices

1. Assess your needs

The first step is to determine what processes to automate. Ask yourself:

- What tasks take the most time?

- What tasks are tedious or repetitive?

Answering these questions will help you identify areas ripe for automation. Any process that you can schedule or set to repeat is an ideal candidate for automation.

This initial assessment will guide you toward effective and impactful workflow enhancements.

2. Seek expert help

You don’t have to embark on this journey alone. Partnering with a QuickBooks ProAdvisor with experience implementing automation is incredibly valuable.

These automation experts:

- Guide you through the automation process.

- Help you avoid common pitfalls.

- Give you resources tailored to your specific needs.

3. Test automation before deploying

Before fully integrating new automated processes, it’s crucial to test them. Consider creating a separate QuickBooks file for this purpose.

Start by automating one task at a time, testing each thoroughly to ensure it performs as expected.

This slow, methodical approach allows you to troubleshoot issues as they arise and reduces the risk of introducing errors into your live system.

4. Track your progress and observations

As you implement automation, record your observations and track your progress. Noting the challenges and the wins you experience will provide valuable insights for future automation projects.

This will also help you understand the impact of automation on your day-to-day operations. If you can measure how much time you’re saving, you’ll have tangible proof of the benefits of automation.

5. Maximize QuickBooks automation with integrations

You can take QuickBooks automation further by integrating apps in its ecosystem, like Method.

These tools bridge any gaps in your processes. Look at the big picture and consider all aspects of your business, including growth and sales. Integrations help consolidate your operations and manage different pain points more effectively.

Recap: How QuickBooks automation fits into your business growth strategy

QuickBooks automation simplifies your financial management, freeing up time for strategic decisions that drive growth. By reducing manual tasks, your team’s focus can shift from data entry to revenue-generating activities, setting the stage for a sustainable business growth strategy.

Enter Method, a QuickBooks-integrated solution that leverages your accounting data without compromising its security, avoiding confusion and costly mistakes.

Method helps you regain control over your business and improve operational efficiency while increasing your bottom line. It lets you:

- Track opportunities, create estimates, and convert leads to customers.

- Access entire customer histories to provide the best service possible.

- Empower your customers to self-serve, like updating account information, viewing estimates, and paying invoices.

The best part is that because Method is a no-code, customizable platform, you can personalize your apps to match your business needs.