Whether you subcontract production processes in manufacturing or oversee a team of subcontractors in field services, it is essential to have access to flexible reports.

And improving your QuickBooks subcontractor report game is one of the best practices in sales management.

This post breaks down the current subcontract reporting functions in QuickBooks.

If what you’re looking for is a QuickBooks custom reports generator or a QuickBooks custom report writer, you may instead choose an alternative solution.

Keep reading to discover a customizable solution that can automate a subcontractor report in QuickBooks and simplify your workflows.

First, let’s take a look at what a subcontractor report is and how to create one.

What is a subcontractor report?

A subcontractor report is a document that summarizes the work completed and payments made to subcontractors.

The report includes data such as the subcontractor’s name, address, social security number or EIN, total payments made, and payment date.

Managers can use the report to:

- Track spending and budget for future work.

- Ensure record of all contracted work.

- Spot irregularities or missed deadlines.

How do I create a subcontract report in QuickBooks?

There are several ways to create a subcontractor report in QuickBooks.

One option is to use the Subcontractor Summary report, found under the Reports menu.

This report provides an overview of all payments made to subcontractors and the total amount of hours and expenses billed.

Another option is to use the custom report writer to create a more specialized report.

QuickBooks’ custom report writer allows you to create reports that meet your specific needs. This can include information about subcontractor payments, contracts, and more.

If you’re just wondering how to run a quick report in QuickBooks, you simply have to go to the “Reports” menu and select the report you want to generate.

To make things a little more specific, filter your results by date range or account type.

Is a subcontractor a vendor in QuickBooks?

When creating a subcontractor report, QuickBooks Online allows you to create an Expenses by Vendor Summary or a Vendor Balance Summary in a given date period.

In QuickBooks subcontractors are considered vendors. So, you have to register a subcontractor as a Vendor instead of Contractor.

But, is a subcontractor a vendor in QuickBooks? Short answer is: no, not technically. It can be if you decide it makes it easier for you to generate subcontractor reports.

Then what is the difference between a vendor and contractor in QuickBooks? Vendors are paid with invoices, whereas contractors receive payments through paying bills.

You can personalize your reports in some editions of QuickBooks to segment subcontractors from other vendors. This spares you the hassle of digging into long summary reports.

So, if you’re struggling to set up a proper vendor workflow in QuickBooks Online, learn how to create custom reports in QuickBooks Desktop through a few simple steps.

QuickBooks subcontractor report limitations

This level of sales reporting is often not enough to get the big picture.

Most likely, you need more details in your report that are specific to your business needs.

These could include contract type, start and end dates, contract status, contact details, billing options — the list goes on.

The two biggest challenges that users face with QuickBooks subcontractor reports are the following.

1. Incorporating custom data and fields

For subcontractor reports, QuickBooks doesn’t allow you to add custom details. You have only preset templates that are minimally customizable.

This makes the sales reporting process more challenging for you, as relevant data isn’t easily found.

2. Report formatting tailored for your business

QuickBooks’ report templates whip up financial statements in no time.

But if you need a sales report, you’re better off with a customizable solution that simplifies your processes.

While there are some opportunities for customization in QuickBooks, subcontractor reporting is still far too limited.

How can I get customized subcontractor reports?

Method:CRM ties your subcontractor details to your invoices, estimates, and other sales reporting needs.

Bid farewell to QuickBooks’ custom reports generator and quickly generate dynamic reports that filter data based on your specifications.

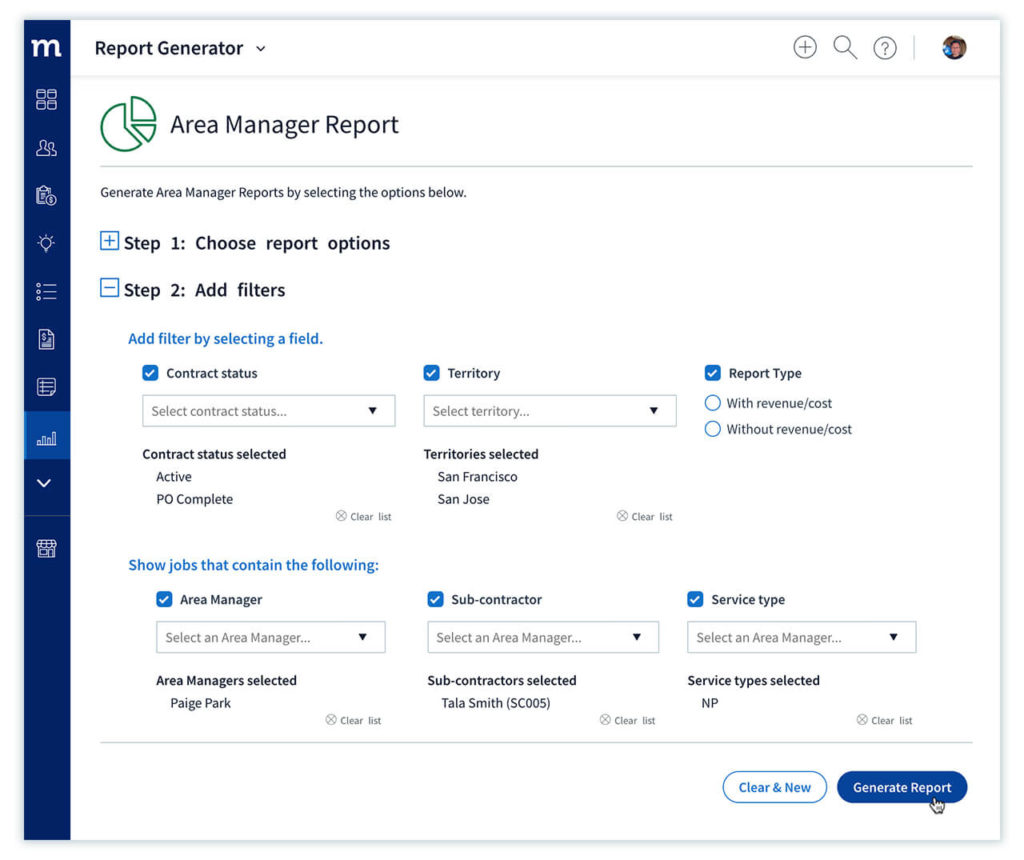

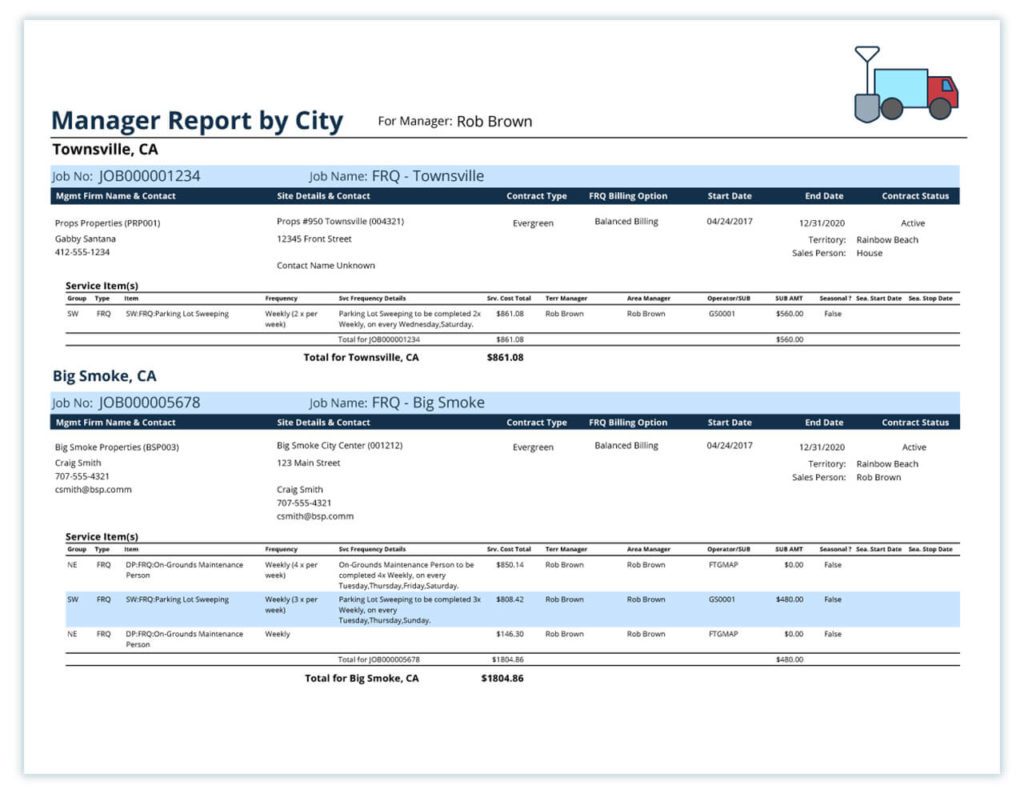

Example: Subcontractor and manager report generator

In this example, Method’s customization services team created a custom report that instantly generates detailed summaries of subcontractors based on manager and territory.

Unlike a QuickBooks subcontractor report, Method’s reporting takes only seconds. Once all conditions are set, a single button click instantly pulls a detailed report with invoice details.

These include the total cost of services and the amount payable to the subcontractor.

You’ll also notice that the report effortlessly merges both QuickBooks and customer information. As a result, contact details, service items, and notes on seasonality will automatically show up.

Subcontractor report: QuickBooks vs. Method

Method:CRM equips your business with reporting tools that provide comprehensive insight for subcontractors and all aspects of your sales pipeline.

Sales reports in Method are fully customizable to reflect any information regarding your subcontractors, customers, employees, and more.

Viewing both QuickBooks and custom sales data in one report saves time piecing analysis together and provides faster insight to your team.

QuickBooks subcontractor reporting FAQs

Can I track time and pay for subcontractors in QuickBooks?

Yes, QuickBooks allows you to track time and pay for subcontractors easily. Use the Expenses by Vendor Summary to show the total payments made to each subcontractor for a specific period.

In terms of tracking time, you can log and manage your subcontractor’s hours in QuickBooks Time. You’re also able to customize different rates for each job to accurately track and report on your subcontractor’s time.

What report in QuickBooks Online will show whether a client was profitable for a specific period?

The profit and loss report in QuickBooks Online shows you your business’ performance for any specific period of time.

It gives you a breakdown of your income and expenses for any period and informs you whether you’re operating at a profit or loss.

To run the report, go to the “Reports” menu, then select “Profit & Loss Standard” from the list of available reports.

How can I account for contract labor in QuickBooks?

How to set up contract labor in QuickBooks:

1. Add your contractor as a Vendor by going to the Vendors menu and clicking New Vendor. Then, enter their personal details.

2. In the Vendor tab, select Contract Labor as your “Vendor Type”.

3. When you make payments to your contractor, make sure you include any taxes that may be due (e.g., Social Security or Medicare).

4. Enter bills for the contractor following the normal bill entry process in QuickBooks – just select Contract Labor instead of Regular Expense when entering the bill data.

5. When it’s time to issue a 1099 to your contractor, you can use the Reports menu to generate all of the necessary forms – just select the 1099 report and follow the instructions.

Following these steps will ensure that you’re properly accounting for your contract labor in QuickBooks.

Ready to improve your sales reporting?

Timing is everything in sales. Method:CRM’s reports identify opportunities and client relationships, so you can close deals faster by empowering your sales team to access the data they need quickly.

Start your free trial of Method:CRM today!

Image credit: Anete Lusina via Pexels